Category: Uncategorized

Financial Shocks Can Be Either Endogenous Or Exogenous – What Can We Expect?

There was a clear financial shock to the market with the spike in the VIX index earlier this month, but the market has reversed a significant portion of the earlier losses. From the SPY high in January, the market declined about 10.5%. There has been a reversal of 6% so the stock market is now positive for the year and only down 4.5% from the high and down 2% from month-end.

Psychopaths Are Not Good Hedge Fund Managers, Neither Are Narcissists – Who Would Have Thought?

Wall Street is filled with characters and “personality”. I have met my share, but a key question is whether some of these personality extremes actually lead to better returns. I have written about this in my posting The Wisdom of Psychopaths and Trading. Some have suggested that the characteristics of psychopaths if directed toward good goals may lead to successful outcomes. The core idea is that a lack of empathy or emotion found in psychopaths is actually good for some jobs. Certainly, there is a strong strain of thinking that trading should be without emotion. Hence, personality characteristics such as less emotion or empathy may be good for return generation. You just may not want to have them as your boss.

Generating Tilts Around Core Bonds – Changing The Correlation, Yield, And Risk Exposures To Bond Sectors Offers Opportunities For Portfolio Refinements

Some may say, “A bond is a bond, is a bond”. Investors may place risky assets in one category and then have bonds in a less risky category. This dichotomy does not focus on the important distinctions between bond groups and the roles that different bond categories may play nor does it present the possible trade-offs between return, risk, and correlation within a portfolio from different bonds.

If Dollar Is Down, Investors Want To Look Toward Commodities

The dollar may be trending down, but investors should also look at the second order effects of what will happen to other markets. For example, a declining dollar is good for long commodity exposure. The long commodity argument is twofold, one, a decline in the dollar makes commodities denominated in dollars cheaper to foreign buyers which will increase demand; two, a decline in the dollar associated with global growth will increase global commodity demand. There are both substitution and income effects.

“Bond Vigilantes” – They Were Corralled But Never Disbanded

We have not heard from the “bond vigilantes” in quite some time. The origin of the word vigilante is Spanish for watchman, alert, or guard, and like a watchman they have been out there waiting for the long combination of events. The definition of bond vigilantes is a broad term for bond market participants who impose discipline on the market through focusing on negative fundamentals. Their form of discipline is selling duration or not buying at current levels.

Yes, The Stock-Bond Correlation is Rising, But Let’s Have Some Perspective

Many commentator have talked about the fact that stocks and bonds moved together during the current market sell-off as if this is big news, highly unusual and signal of market change. A positive correlation is not the normal relationship we have seen in the post Financial Crisis period, but it may be a little early to say there is a sea-change in market behavior.

Risk Parity – When volatility goes up across asset classes, the result is painful. But perhaps not as bad as some alternatives.

Risk parity has had good performance over the last two years with double digit returns after stumbling in 2015, yet the diversification strategy of equal weighting of four major asset classes has been painful this year. Diversification based on weighting risks offers some protection but is not cure for a volatility revaluation.

What to Do in a Market Sell-Off – Don’t Sell, Rebalance and Restructure

When asked for money, WC Fields once said, “Sorry good man, all my money is tied up in cash.”

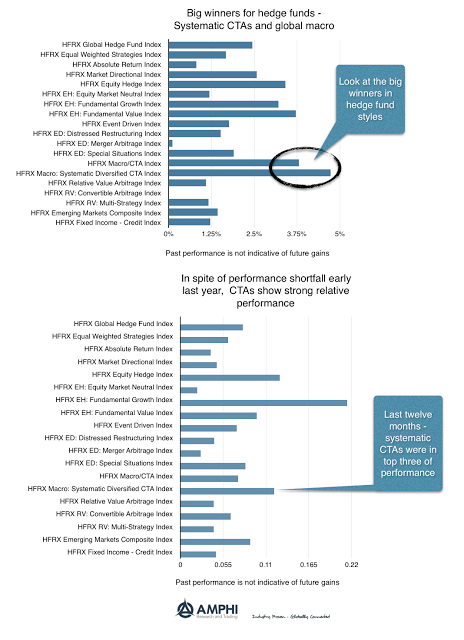

Hedge Fund Performance Strong in January, Especially for CTAs and Global Macro

Hedge fund performance, as measured by the HFR indices, showed strong performance in January especially for global macro and systematic CTAs. Systematic CTAs also generated returns that were in the top three categories for the last twelve months.

January Sector Performance Strong for Style, Sector, and Sovereign ETFs and Poor for Bond ETFs

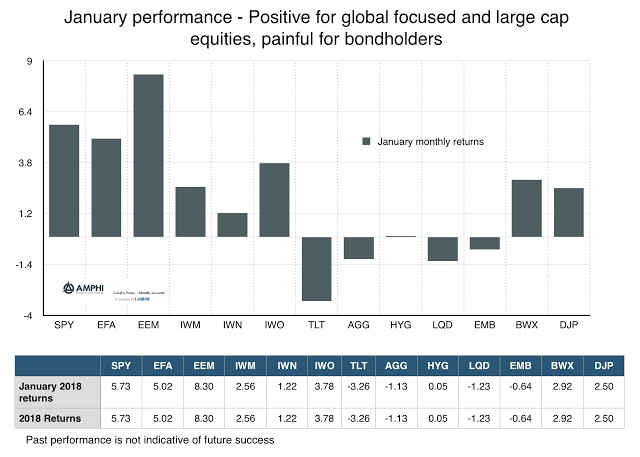

Equities started the year with strong performance across style, sector, and country groupings; however, there were some exceptions to these gains and also some signs of potential for performance declines. Bond ETF returns were all negative except for international bonds which gained from the dollar decline. These returns are consistent the fundamental story of strong growth and expected higher inflation. There will be peak and valley in return even with the clear story, but the general direction is still risk-on for equities and avoidance of duration for bonds.

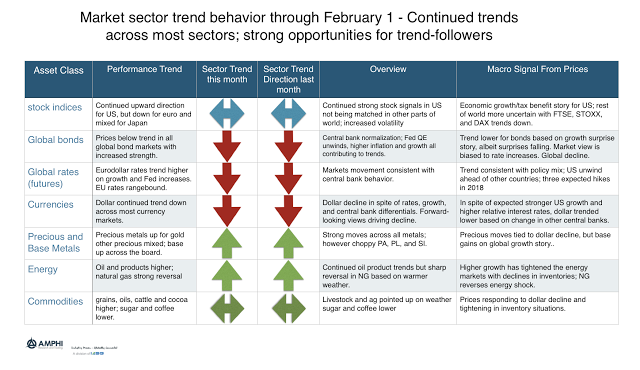

Trend in Markets – Short Bonds and Dollar, Long US Equities – Strength Continues going into New Month

January performance was a good start to the year for many trend-followers. Our sector trend measures suggest a good performance month that looks to continue into February. The fundamental themes concerning growth and inflation at the beginning of the year continue although with different levels of intensity.

January Market Performance – An Extension of Growth and Inflation Themes

With continued euphoria about global growth and growing fears of inflation, the large cap and international stock investors saw strong gains while bondholders were hit with loses. Markets in January saw extremes in what were identified as the core themes for the year, growth plus inflation. Now, there may be stagflation holdouts, but growth indicators are still strongly positive albeit there are signs that the trends in positive economic surprises last quarter will be more tempered.

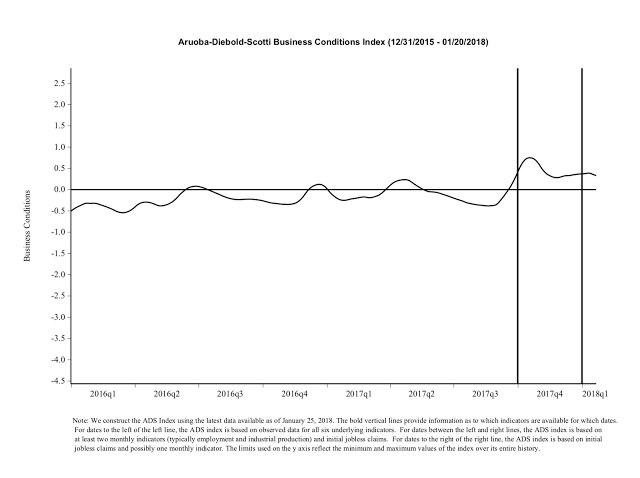

Philly Fed Business Conditions Index – Consistent With a Robust Market

The relationship between growth and equity market returns is not always direct. Equities can move higher because of an increase in earnings growth or from an increase in valuation. Market earnings should increase with economic activity but they may vary across the cycle. Similarly, the relationship between growth and nominal yields also can be variable albeit generally positive. Higher growth may lead to higher real rates, higher expected inflation or a change in monetary policy. The problem is that actual economic growth often has reporting delays so the link with market prices is mixed. The link between prices and fundamentals should focus on leading or forward-looking indicators.