Category: Uncategorized

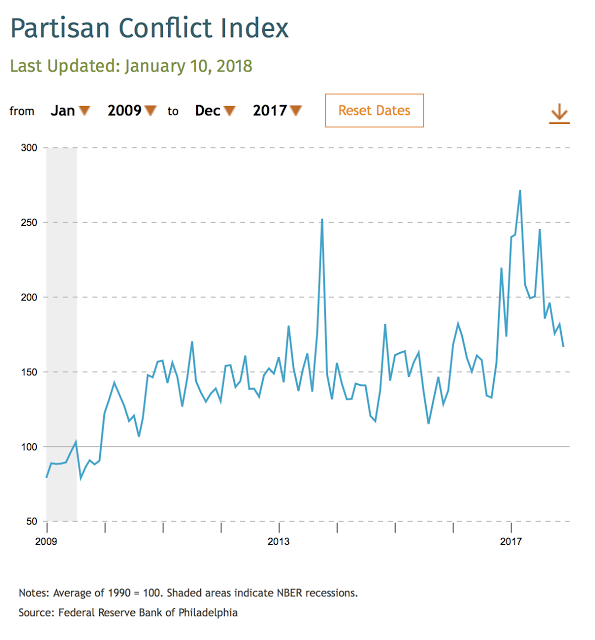

Philly Fed Partisan Conflict Index is Actually Down – Normalization May Be Good for Markets

As someone who is biased toward quantitative work, it has been difficult to judge the impact of political rhetoric and conflict on market behavior. Market uncertainty should increase when there are more partisan conflicts which should translate into higher market risk premiums. Nevertheless, if there is no measure of conflict, this idea cannot be put to a test.

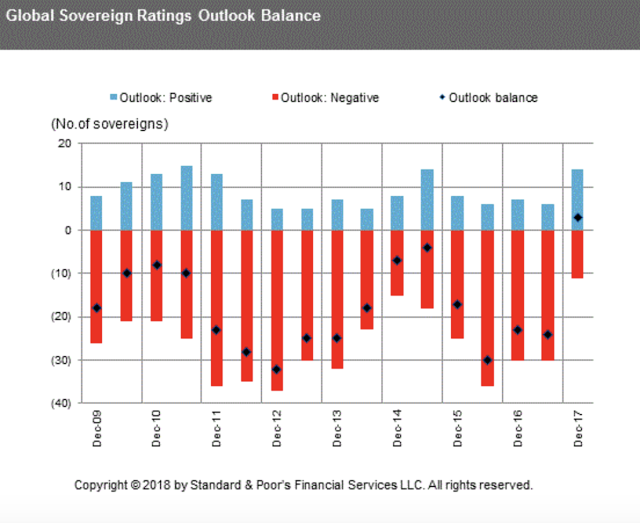

Best Sovereign Credit Period since the Financial Crisis – What a Surprise in Growth Will Do

A year ago the market was concerned about global credit risks. The sovereigns with a negative outlook were high and the number of positive outlooks was low, but that has changed in one year given the improvement in global growth. The number of negative outlooks is at post Financial Crisis lows, the positive outlooks are high and the balanced outlooks are positive for the first time. The balance has improved markedly across regions but especially in Europe and the Middle East. The chance of default risks has fallen given credit quality is improving.

Complexity Bias and Trend-following -We Have a Bias Towards Complexity Yet Simplicity Should Be Preferred.

Faced with two competing hypotheses, we are likely to choose the most complex one. That’s usually the option with the most assumptions and regressions. As a result, when we need to solve a problem, we may ignore simple solutions — thinking “that will never work” — and instead favor complex ones.

-Farnamstreetblog.com Complexity Bias: Why We Prefer Complicated to Simple

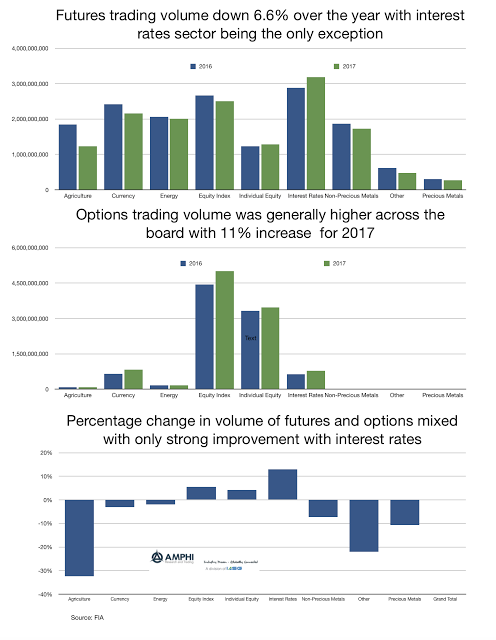

Volume in Futures and Options Flat Based on the Low Volatility in Many Markets – This Will Change in 2018

Global financial markets performed very well but you could not tell by looking at the volume of trading on futures exchanges around the world. The year-end numbers from the Futures Industry Association (FIA) show that futures trading volume was down over 6%. Options volume was up 11% and overall futures and options volume was flat for the year.

The Rate of Return on Everything – Everyone Needs to Save, But the Return on Wealth Over Growth is Volatile

The new paper, The Rate of Return on Everything, 1870-2015, a tremendously informative research piece on long-term rates of return also happens to address one of the key issues concerning the cause of inequality discussed by Thomas Piketty in his book Capital in the Twenty-First Century. Piketty draws the provocative conclusion that inequality grows over time because the rate of return on wealth is higher than the growth of GDP. Wealth accumulates to those that have it and not to those that try and ride the wave of GDP growth. Given the positive discrepancy between “r”, the return on wealth, and “g” the growth in GDP, the gap of inequality will only grow over time.

Understand the Incentive and You Understand the Analyst – Incentives Create Forecast Biases

We didn’t exactly believe your story, Miss O’Shaughnessy. We believed your 200 dollars. I mean, you paid us more than if you had been telling us the truth, and enough more to make it all right.

-The Maltese Falcon

La Nina Weather Pattern Will Bring Some “Fun” to Grain Markets – If Volatility and a Price Shock is Your Idea of Fun

There are seasonal weather patterns that will ebb and flow during the year bringing volatility to agricultural markets at regular times. However, the longer-term impact on supply can at times be limited. There is noise around production numbers but inventory can serve as a cushion.

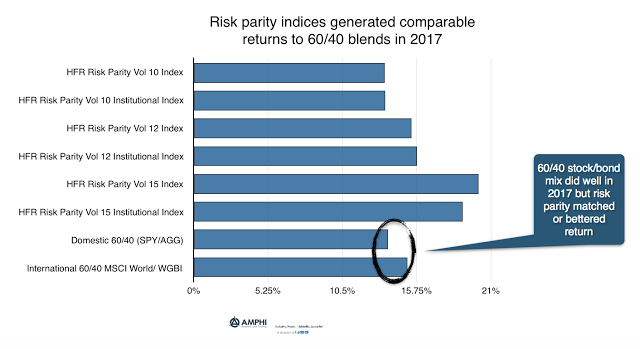

Risk Parity Shows Good Performance – Diversification Plus Volatility Weighting

The 60/40 stock/bond blends both domestic and international generated double-digit returns on strong equity performance. The majority of the risk came from the stock allocation which make them sensitive to any market reversal.

Sector Performance Shows More Year-End Dispersion in Returns – This Should Continue in 2018

A year-end performance review of styles, sectors, and country index ETFs shows the peaks and valleys for 2017 and what may be ahead in 2018. Overall, this was an especially good year for international investing and holding exposure in emerging markets. Large cap US which has strong international earnings also did well in 2017. Mid and small cap US underperformed during the year in spite of the resurgence in economic growth. The worst performing style was defensive dividend focused. Value underperformed growth by a wide margin.

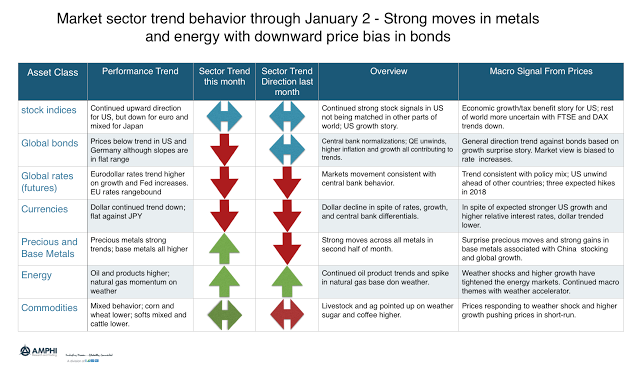

Strong Upward Momentum in Metals with Down Moves in Bonds and Dollar – Good Potential for the Start of the Year

There were some trend surprises in markets near the end of the year; the upward price movement in both precious and base metals and the weather shock in the natural gas market and to a lesser extent oil product markets. The question for the beginning of the year is whether these trends will only be short-term in nature. Strong price spikes, especially weather related, are often reversed.

60/40 Global Blend Tells a Similar Story to US – 2017 Was Exceptional – A Normal Year May be Closer to 1/2 of the Return

The 60/40 stock/bond combination generated an exceptional year for many investors. Although a 60/40 combination is a simplified version for the portfolio that many investors hold, it is a good representation of the general asset class mix without any accounting for alpha and manager selection. For international investors, we ran a similar 60/40 combination of the MSCI World and Citi WBIG index of world sovereign bonds.

A Dollar-Funding Problem? – Cross-Currency Basis Swaps Signal Temporary Dollar Shortage

Global macro traders look for outliers. The good ones have a disciplined approach to review and process lots of cross-market relationships looking for the few that may be out of place. These are the relationships that need capital and for those that can provide the funds, there is a reward.

Do You Really Want to Live With a 60/40 Allocation in 2018? – Follow the Numbers and You Will Likely Underperform

Numbers and statistics are a funny thing. They usually don’t lie and are not fake. You can misinterpret them, but numbers tell a story and it is the job of the investor to either accept the story or come up with an alternative.