Category: Uncategorized

Hedge Fund Performance Mixed, but some Bright Spots with Fundamental Growth and Systematic Macro

Hedge funds returns were mixed for November, but the fundamental growth and systematic macro strategies generated strong returns of over 1 percent. The fundamental growth strategy is the HFR leader for the year with a return profile at over 17%. The macro systematic strategy again generated a strong positive return. The HFR macro systematic index return was significantly higher than other systematic indices for November which suggest a high dispersion across managers in this category. The macro/ CTA which includes discretionary managers was actually down for the month. The absolute return, special situations, and emerging markets strategies were the biggest down strategies for the month, but all showed declines of less than one percent.

Sector Return Performance for Equities Strong across the Board – Hold Overweight in Equities

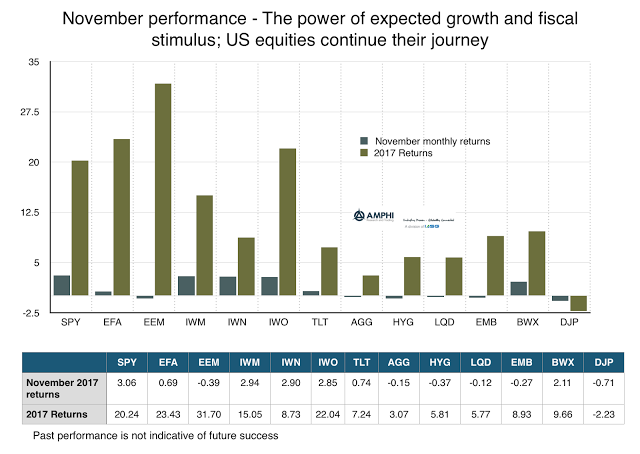

Equity style sectors were strong across the board with only emerging markets posting a negative November return; however, emerging markets have been the best performing sector year to date. The value index showed a strong gain although it still lags the growth index year-to-date. Trend indicators are all positive except for emerging markets and the short-term trend in the small cap index. Price indicators suggest that there is no reason to cut equity exposures.

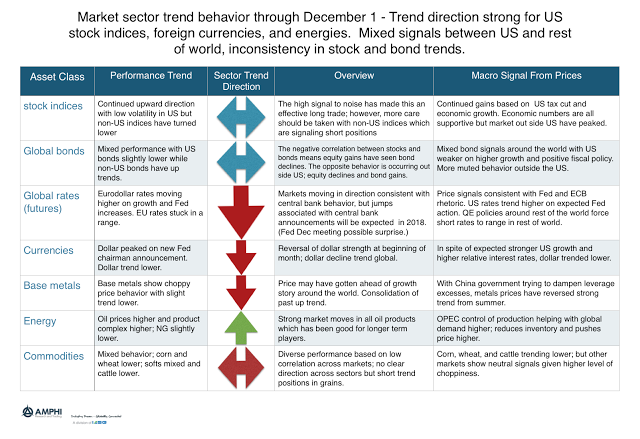

Trends Signals Still Mixed in Many Asset Classes – Long US Equity Indices Still Strongest Signal

Trend behavior last month was mixed for many CTA managers. The allocation weights had a significant impact on November performance. We believe there may again be significant dispersion in performance because trend dispersion is high. For example, US stock indices show strong up trend signals while non-US stock indices are showing clear short signals. The opposite is the case for bonds where US bond signals are for short positions while non-US bonds signals point to long positions.

Stocks Continue Their Strong Performance – Hard to Fight Equity Trends; The Opportunity Cost of not Following Trends is High

A combination of good economic growth news and a fiscal policy tailwind again drove US equity markets. The discounting of a US fiscal accelerant shows up in the positive US-global return differential for the November.

Expected Yields and Returns for Bonds are Still Low – Go Get More Alternatives

The asset allocation decision concerning the addition of alternative investments, especially for diversification strategies, is actually quite straightforward. One, find strategies that have low and stable correlations with stocks and bonds. Two, find strategies that have a minimum acceptable return that will beat a traditional diversifier.

Normalcy for Stock Bond Correlation Says You Need Other Forms of Diversification

The bond diversification story is based on the strong negative correlation between stocks and bonds that has existed for over a decade, yet it is not a given that stocks and bond returns will move in opposite directions. A quick look at a very long history from a Wellington Management chart tells us that the negative correlation is the exception not the rule.

Strategic Asset Allocation – Adding Value in a Low Returns Worlds

Strategic asset allocation as the name implies requires long-term return assumptions. There are often wide variations in the future forecasts. Many forecasts we have surveyed show positive expected returns, but the numbers are significantly lower than what investors have seen historically since the Financial Crisis. In general, Research Affiliates provides a good tool for analyzing the past and expected returns that we find helpful.

Holding Period Diversification – Investing with Hedge Fund Managers that have Different Trading Time-Frames Adds Value

Diversification can come in many forms. One that is not often discussed is holding period diversification or the time- frame used for making a trading decision. Some strategies are successful based on the expected holding period of the investment and not just the trading process employed. For example, there could be two price-based systematic managers who use similar models, yet they will get very different returns based the calibration of the holding period, short-term versus long-term. In the case of trend-followers, there are some trends that last only a short-time and can only be captured through trading a short time-frame versus other trends that can last for weeks, months, or quarters. These are captured differently based on the look-back or speed of the models.

Changing the Risk Profile from Credit to Macro – Take Away Liquidity Risk and Switch Alternative Risk Premiums

Investors should have a growing concern with the reach for yield in the current market. The reach for yield has pushed investors into illiquid issues where the risk profile has changed from credit/carry to credit/carry/illiqudity. Investors will generally receive a higher premium if an asset is illiquid. Unfortunately, illiquidity premiums are hard to measure; consequently, the traditional credit betas will not be properly measured and there could be the mistaken view that there is greater alpha from managers who hold these types of assets.

Ivy League Performance – Competing With Top Tier Endowments Can Be Done

The latest performance numbers for Ivy League endowments have been nicely displayed in the chart below along with the 60/40 stock/bond portfolio. Since the development of the “endowment” model associated with Yale and the attention on Harvard, the largest endowment, there has been an unusual focus on these funds. There is a fair amount of dispersion between the best and worst managers in the group.

Dan Fuss’s 4 “P’s” for Global Fixed Income – Watch Out If You Are a Bond Holder

Dan Fuss, the Loomis Sayles bond guru, has been working in fixed income for decades. He has developed a set of four “P’s” with central bank behavior for looking at the macro fixed income environment and his read is suggesting that caution should be applied to any forecast that believes bonds are safe.

Spider Chart Tells Managed Futures Story Differently

The spider chart is an alternative way of displaying data that may be useful at showing the strong diversification benefits versus different asset classes and alternatives. Correlations are looked at through a matrix form but the spider or radar graph may better display the most relevant information. Each node on the web may represent a different asset class and show the correlation of each to a single strategy.

Will Hedging, Not Speculation Be The Driver of a Financial Disaster? Is VaR Hedging Like Portfolio Insurance?

Unlike earlier financial disasters, this one will emerge not because of too much speculation, but because of the inverse – too much hedging.

-William Silber on stock market in August 1987

Could this be the problem we are facing with the next financial crisis? There has a significant amount of talk about over-valuation in equities and the reach for yield in fixed income, but there has been less focus on how a financial crisis will evolve. It may not be from speculators changing their views on the market although this could be a catalyst. Selling could be driven by investors who are trying to hedge or mitigate their risk exposures.