Category: Uncategorized

Return Rotation to Higher Risk Premium Equities Relative to Bonds

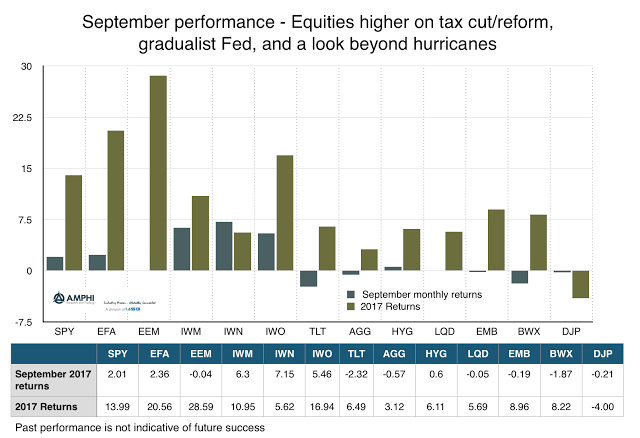

September was a month of transition for many styles, sectors, and class returns. In the style sector, small cap, growth, and value benchmarks generated strong performance under higher expectations for the reflation trade. There was a rotation from safer fixed income to higher risk premium styles. We are a long way from tax reform or a cut, but the fiscal issue is back on the table and in the minds of investors who want to get ahead of any changes.

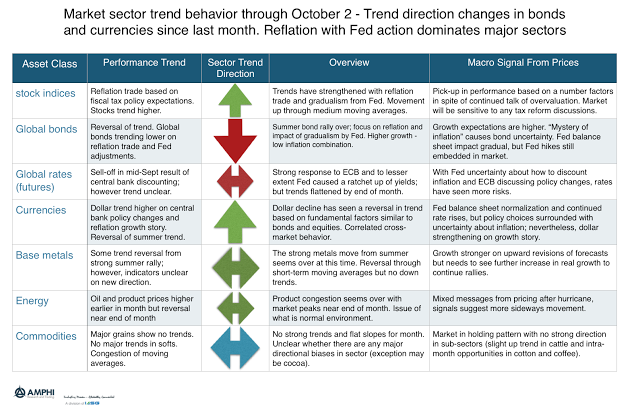

Change in Sector Trend Direction – Problems of September May Be Opportunity for October

The trend story for September was an end to the summer bond rally, a pick-up in equity trends, and a new interest in buying dollars. Without major strong trend opportunities in commodities, the reversal in bonds and currencies hurt many managed futures traders.

No “Inflation Mystery” with Equities but Bonds More Uncertain

Regardless of the speculative warnings or the beware signs in fundamentals equity markets continue to move higher. Who says there isn’t inflation? It is just a matter of definition between real goods and financial goods.

Asset Allocation dispersion Risk – The Cost of Wrong Allocation Picks is Significant, So You Need Macro Gamma

There is no question that research shows that asset allocation matters. It matters more than stock selection and it matter more than manager selection. But, it is sometimes hard to visualize what is the impact of different asset allocation choices. The following table from Fidelity’s Market Snacks is enlightening. The table of average annual return is completely expected. If you increase risk through more aggressive asset allocations, return goes up. The movement from conservative to aggressive over the long-run is linear; nothing new here.

Deloitte CFO Survey – Overvaluation and Less Optimism – Beware

The Deloitte CFO quarterly survey should give any investor pause for concern. The numbers for this quarter show that 83 percent of those surveyed believe the equity market is overvalued. The number is at all time highs but has been around 80% all year, in spite of the market continuing to go up. Perhaps the CFO’s forecasts are wrong; however, I have more concern from the economic sentiment and expectations.

Challenge and Reality for Hedge Funds – Beating the Stock-Bond Blend

The key challenge for many global macro and managed futures managers (or any hedge fund combination) is showing their relevance during the post Financial Crisis period when the simple combination of stocks and bonds seem to have been enough to generate a very effective Sharpe ratio.

Hedge fund managers need to show their value-added in an environment where the negative correlation between stocks and bond has allowed the two-asset class blend to do an effective job of diversification.

Exit Strategies and Quant Trading – Knowing How Firms Deal with Exits Is Critical

A panic only occurs if you are a late follower toward the exit. The panic occurs when you realize that the cost of exiting is higher than expected and liquidation is not moving as fast as expected. A trader can go through a mini-panic on a regular basis if an exit strategy is not planned correctly and there is a liquidity shortfall, Exit strategies are all about not panicking at those critical times, yet there are trade-offs between reducing panic and maximizing return. The control of exits as well as entries is a core issue with model building and drives incremental returns.

The Business of Hedge Funds – Dynamic Choice Beyond 2/20

The lifeblood of hedge funds as businesses is their performance pricing proposition through incentive fees, but the simple business model of 2% management fee and 20% incentive fees is fast becoming extinct. Pricing is coming down as well as becoming more complex with more pricing alternatives as the businesses become more competitive and investors become more sensitive to alpha production.

Tetlock – Political Forecasting is a Loser’s Game… So Follow Trends?

The talking heads in the media spend significant time making political predictions. Even many Wall Street economists fall into the trap of giving political forecasting advice instead of digesting the economic data. The outcomes and impact of elections; pundits usually don’t know. The time of geopolitical risks and wars; pundits don’t know. The cultural changes that will impact markets; pundits don’t know. Unfortunately, the media does like the experts who are doubtful and equivocate. Pundits, however, are not often stupid. They provide significant amounts of information, background, and data. It is just that their ability to make good forecasts is poor. The advice from the forecasting expert Phillip Tetlock, the author of Superforecasters and Expert Political Judgment: How Good is It? How Can We Know? is very simple, “Don’t listen to them”. Their overconfidence will cause investor decisions to go awry. They place too high a probability on their views.

Research and Systematic Investing Can Overcome Motivated Cognition

Motivated cognition – we believe what we want to believe. We will also believe based on who we are and who we want to be. Our goals and needs shape our thinking. Facts do not change our goals when we have motivated cognition. Investors rationalize and filter evidence presented to support their views. Motivated reasoning will generate confirmation biases.

AllianzGI Risk Monitor Survey – Geopolitical Risk on the Rise, Requires Special Thinking

If you tell me I have increased equity risk, I can adjust my asset allocation way from stocks and determine a good hedge strategy. If you tell me there is more interest rate risk, I can adjust my bond exposure and determine a hedge. But, if you tell me I have geopolitical risks, the choices or options become more complex. Geopolitical risks just don’t happen often so we don’t have a lot of countable events. Increased political risks will usually mean risk-off, but how this plays-out through a portfolio is less clear. It calls for more careful portfolio construction and diversification management.

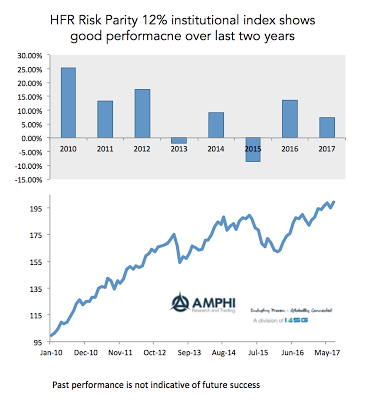

HFR Risk Parity Indices – A Systematic Alternative that is Returning

HFR has announced a new set of risk parity indices. The set of indices includes risk parity strategies at different volatility levels and for both institutional levels and smaller funds. These investable indices represent 25 different products with $110 billion in AUM. The risk parity portfolios are generally comprised of four sectors which are given equal risk weight: equities, credit, interest rates, and commodities.

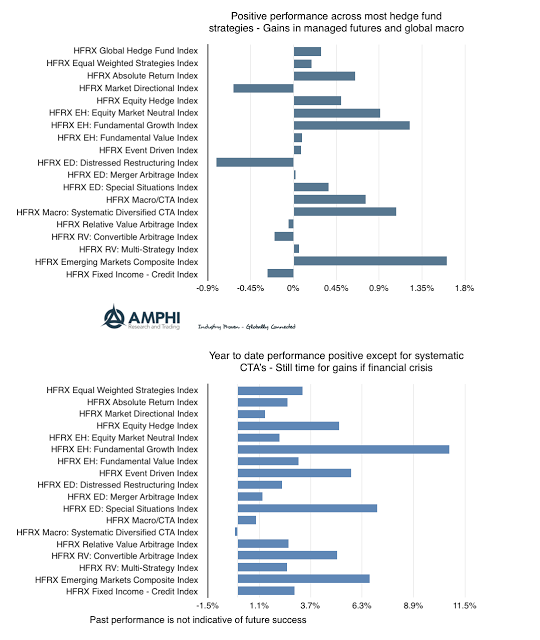

Hedge Fund Performance – Growth, Macro, and EM Best Strategies

While stocks were mixed with performance down for the month in with growth, value, and small cap benchmarks, there was a general increase in hedge fund returns for August. Equity-focused hedge funds gained from the added dispersion in returns across sectors and individual stocks. Evidence suggests that active management relative performance increases when the correlation across stocks decline.