Category: Uncategorized

What do CIO’s Care About? Only Four Things

The comment from Kip McDaniel provides a roadmap for what any hedge fund needs to address when marketing to a pension or any client. It is not about you, the manager, but the investor.

1. How does this investment fit within the asset allocation framework of the pension? Why does it matter?

2. How should this investment be delivered to the client? How does it fit within the overall portfolio construction and use capital efficiently?

3. What is your edge versus other managers and how can you generate confidence that this edge can be achieved?

4. What will be done by your fund to protect the money allocated to you? How will your investment help protect the overall portfolio?

The questions are relatively simple, but the answers require a lot of thought if the manager wants to truly be a top service provider.

On the “Fog of War” – No One gets this Quote Right, but the Concept Stands

Many have used the metaphor “fog of war” to describe the uncertainty faced in risky situations. It is attributed to Carl von Clausewitz from his work On War. It has had a profound effect on military thinking. Unfortunately, many have used the phrase without reading the book. The phrase “nebel des krieges” was never written by Clausewitz. You cannot blame many for this mistake given it is a dense work written in 19th century German and translated into English in the 1870’s.

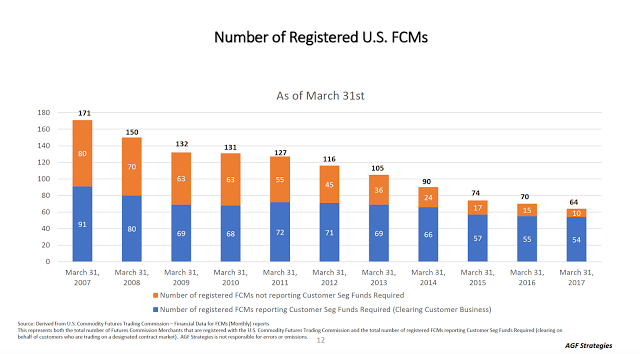

FCM Concentration – Is This Good for Futures? We Don’t Know

Market structure matters regardless of the industry. The interaction of economic agents will impact market behavior and drive pricing. Competition reduces markets frictions and transaction costs. If there is less competition, the cost of execution will be higher, and there will be less liquidity. This applies even to highly regulated markets like futures trading. A simple graph shows the decline in the number of FCM’s operating in the futures markets. The number has been cut in half since 2011.

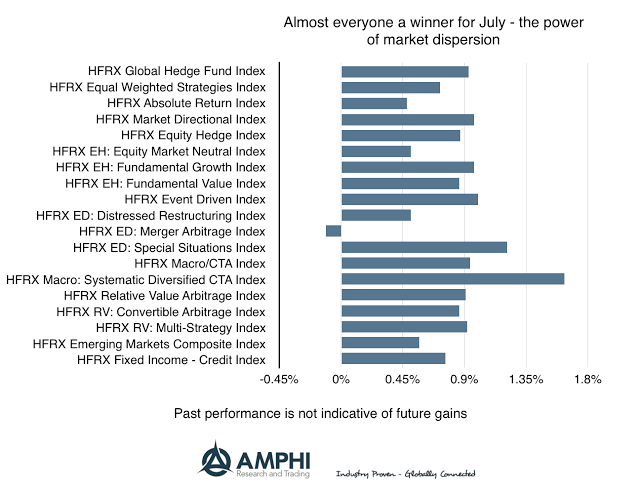

With Asset Return Dispersion Increasing – Hedge Funds Generate Gains

Almost all HFR hedge fund strategy indices were positive for the month of July. In many cases, the strategies beat small cap and value indices for the month. Our take on this good performance is that the increased dispersion in returns, lower average correlation across equity pairs, is a key reason for the gains. Greater dispersion means there are greater opportunities for stock pickers to differentiate themselves.

July was a Currency Trend Month – Likely to Continue

For trend-followers in July, currencies were the big winners. Strong trends with relatively low volatility made for many winning trades. These trends as well as moves in precious metals are likely to continue in August. Currently, this is the place for greatest upside opportunities. The currency moves did see some short-term reversals around central bank and key economic announcements which may have hurt traders with tight stops, but the general direction in 2017 continues.

Stock Market Confidence Off the Charts – But Also Lurking Fear

The Yale International Center for Finance conducts monthly surveys of individual and institutional investor’s confidence in the stock market. While there are other surveys available, the Yale Center provides a long term view of what investors may think about the markets.

Sector Dispersion Continued for July – Value from Picking Winners

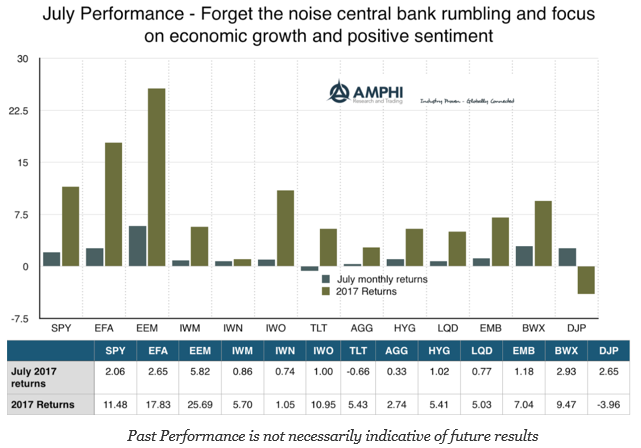

The equity markets again continued to march higher with strong gains in international and emerging markets. However, it should be noted that non-dollar equities were given a nice tailwind from the decline in the dollar, (take off 2-3+ percent). After the currency adjustments, there is less reason for large celebrations. What should be a concern is that the biggest moves were in large cap stocks with more modest returns for small cap and value indices. This should be expected on a dollar decline given the international nature of large-cap earnings, but lower breath is not a positive sign for follow-through with the trend.

Rhetoric versus Reality for July – Watch the Cash Flow and Growth

The drumbeat of over-valuation continued in July, but investors do not seem to be listening to any negative stories as stocks around the world continued to move higher. The view that economic growth will pick-up in the second half of the year coupled with rosier earning forecasts have pushed equities higher. Any worry about valuation will be for tomorrow. Today, the focus is on buying risky assets around the world.

How Many Asset Classes are Necessary for Asset Allocation? No One May Know

Here is a simple question that should have an easy answer. Name a universal set of asset classes that can be employed to categorize the investments for a large university endowment. The answer to this question may astound you. There is no agreement on the number of asset classes an endowment should have in order to make asset allocation decisions. That’s right, the largest university endowments cannot agree on this basic number for how to categorize investments. See the paper, “The evolution of asset classes: Lessons from university endowments”, Journal of Investment Consulting Vol 17, no 2, 2016.

Algorithm Aversion or Just a Desire for Low Cost Optionality?

Investors have had an aversion to using models, but that may be changing rapidly. More money is being managed by systematic managers or focused on some form of smart beta or a set of rules to investing. Nevertheless, there has been documented fear from letting go and having a model make decisions.

The Hazard of Experts – How Do You Avoid This Hazard Effect with Hedge Fund Managers?

There is a well know cognitive bias called the Dunning-Kruger effect whereby individuals who perceive themselves as experts will have the illusion of superiority concerning their cognitive abilities. They believe their own talk. They are experts, right?

A Simple Taxonomy of Diversification – All Diversifiers are not Alike

When I hear about diversification across funds or strategies, I, like most investors, will immediately focus on the correlation matrix versus other alternatives and asset classes. However, investors should be thinking beyond the simple historical numbers and focus on forward expectations for correlations. There should be views of how diversification may change through time or behave under different scenarios. To form diversification or correlation forecasts, investors should have a classification scheme for diversification. All diversification is not alike and a classification scheme may help with determining how correlation may move.

Cost of Liquidity – The Hidden Management Fee that needs to be Calculated

Investors are looking closely at the fees being charged, but the hidden fee of liquidity may be the most significant cost that is often not talked about. Large firms that are charging less may have higher costs associated with liquidity than small firms. As the size of the firm grows, the cost of entering and exiting may be higher. Additionally, some markets that may offer opportunities are avoided because the cost of trading when liquidity is lower is higher.