Category: Uncategorized

Northern Trust – EIU Survey – “See” the Risk – “Know” the Risk

The Northern Trust/EIU Transparency in Alternatives Investing Survey 2017 focuses on some important investment considerations from investors around the world. Once again the most important issue seems to be the degree of transparency provided by managers. This applies to both traditional and alternative managers. An investor needs to know what he is buying when he gives money to a manager. Funds are entrusted to others. The purpose for this transparency is very clear – understanding the degree of risk being taken.

Use your Collateral Wisely and Enhance Managed Futures Efficiency

Managed futures investments have the key structural feature that they do not use leverage in the sense of borrowing money to increase notional positions relative to cash. In most cases, margin requirements are a small fraction of the capital invested in a program or fund. A managed futures fund may only use less than 20 cents on the dollar for margin while 80 cents or more may be held in a custody account at close to zero interest rate. Nevertheless, some managers are more aggressive and may hold funds in an enhanced money fund or short-term bond fund to add to return. Of course, some investor will use a separate account and only provide funds for margin with a cushion. This cuts the excess cash held by the manager.

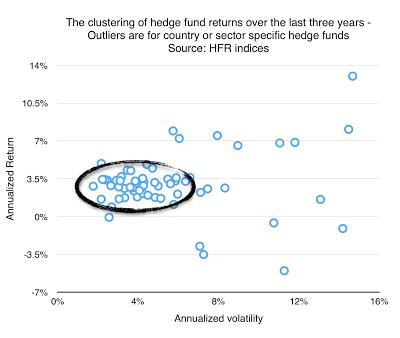

Clustering of Hedge Fund Returns – Where is the Difference?

A close look at all of the HFR hedge fund index returns over the last three years shows a significant amount of clustering of styles with the only outliers associated with country and sector indices. For 60 indices, the average three year (May 2014 – May 2017) annualized return was 3.04 percent and the average annualized volatility was 5.61 percent. Outliers are focused on sector indices like technology and energy and country or regional indices like India or Latin America.

Smart Beta – Why Look at these Investments? Diversification

The FTSE Russell annual survey on smart beta does a good job at describing trends in investor thinking with respect to this growing area of portfolio allocation. Smart beta is extending its breath and reach to other asset classes as well as a wider selection of risk premiums and formats. What is still clear is that investors are looking for smart beta in all forms to help with risk reduction and improve diversification. These are the number one and three reasons for holding exposures. Nevertheless, the fastest growing investment objective is cost savings. It is likely that smart beta is being used as a substitute for more expensive active management.

Two Components of Active Management, Style and Skill – Investors Need to Choose both Wisely

There has been much discussion about benchmarks and beta with hedge funds, but it is important to take a step-back and discuss how active returns are generated. Active management can be divided into two parts, the style used and the skill employed within that style. You can call a style a risk premium as is the case for value or small investing; however, all returns from styles may not be from risk premiums. Style is simply a descriptor or means for generating returns. Skill comes with the method of employing the style. Within a style, some managers are better at it than others.

Quants vs. Discretionary – Numbers vs. Story – Is One Better?

Most of our quants have a computer-science background. They can code in either Python or C++. Whereas on the discretionary side most of them come from a more traditional investment-banking background and are digging into 8-Ks and company fundamentals and being able to look at companies from a bottom-up perspective as compared to trying to use many different data sets to help predict the prices of stocks.

-Ryan Tolkin CIO Schonfeld Strategic Advisors

As the old joke says, “There are only two types of people – those that type others and those who do not.” However, this dichotomy may be applicable for current money management. There are two camps of analysis, the quants who are looking for repeatable behavior in data and the discretionary analysts who are looking for unique or special situations across markets. The quant plays the averages and the probabilities while the other places value on what cannot be counted and handicapped. One focuses on the numbers while the other looks for the firm story as a thesis for investing.

Language, Perception, and Numbers – The Translation Problem

“March Hare: …Then you should say what you mean.

Alice: I do; at least – at least I mean what I say — that’s the same thing, you know.

Hatter: Not the same thing a bit! Why, you might just as well say that, ‘I see what I eat’ is the same as ‘I eat what I see’!

March Hare: You might just as well say, that “I like what I get” is the same thing as “I get what I like”!

The Dormouse: You might just as well say, that “I breathe when I sleep” is the same thing as “I sleep when I breathe”! – Lewis Carroll’s “Alice In Wonderland”

“If you cannot say what you mean, your majesty, you will never mean what you say and a gentleman should always mean what he says.” – Reginald Fleming Johnston (The Last Emperor)

“let your yea be yea; and your nay, nay.” – Matthew 5:37

I meant what I said and I said what I meant. An elephant’s faithful one-hundred percent. – Dr. Seuss book “Horton Hears a Who”.

When managers or investors use language, there can be a significant amount of uncertainty in what meant. There is little precision in language so quantitative analysis provides more details in the highly competitive money management field.

Should I Care if a Managed Futures Fund has a Five-Star Rating?

So you see a manager with a good Morningstar rating. It has five-stars. Should an investor care? Past performance is not indicative of future returns, so should it matter if you had highly rated past risk-adjusted performance?

Certainly, a rating is not definitive, but as a heuristic on a fund’s relative performance, there is positive information to be gleaned from ratings.

A Difference between Theory and Practice

There is difference between theory and practice. The academic research study that identifies an obvious new risk premium may be difficult or impossible to implement in practice. The good firm is able to separate theory and practice and avoid implementing bad ideas. They will have a feel for whether it can be done in practice.

Networks and Plumbing – The Mechanics of Systemic Risk

Behind the backdrop of the vast changes in monetary policy over the post Financial Crisis period has been the movement to improve the regulatory environment for financial markets in order to reduce systemic risk. Significant work has been done to improve monitoring and rules to eliminate excessive speculative behavior, but as more regulations are proposed and more changes to the financial system are made, there is demising marginal benefit and a greater likelihood for unintended consequences. A rule that makes sense for one group may lead to a shift in risk capital and changes in behavior toward unregulated areas. Simply put, risky behavior will shift to the places where the cost of speculative behavior is least.

Sector Behavior Consistent with Economic Story but Wider Dispersion

While large cap and international stocks continued to move higher, the markets are starting to see more dispersion with small cap, growth, and value indices all posting negative returns for the month. The Russell value index has fallen to negative returns for the year. A growing dispersion is also evident in sector and country returns. Bonds have been a safe asset with positive gains for the year across all sectors. The returns are consistent with slow but positive growth around the world with controlled inflation.

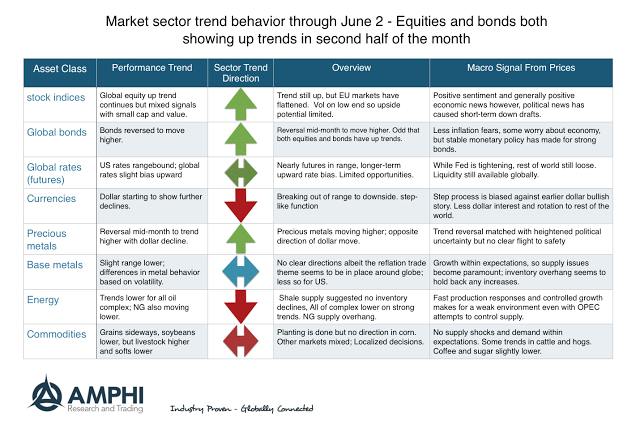

Trends for June – Up for Equities and Bonds

May was a mixed month for many trend-followers. Some did well while others got caught on the wrong side of mid-month reversals. The month saw a mid-month equity sell-off which could have stopped-out a number of key positions in equities and bonds. This sell-off was based on political uncertainty and not macro fundamentals.

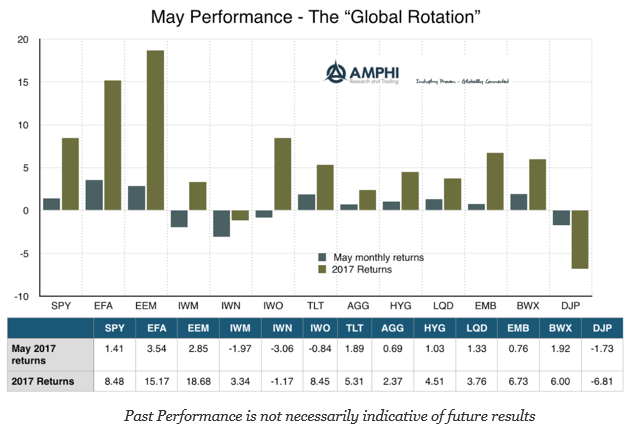

Asset Class Performance – The “Global Rotation”

Call it the “Global Rotation”, but last month was a continuation of what we have seen for the year. There has been a flow of money into international stocks and increasing divergence between the rest of the globe and US risky assets. There is a dollar adjustment component to these returns, but there is no mistake that there is a preference for cheaper opportunities around the world.