Category: Uncategorized

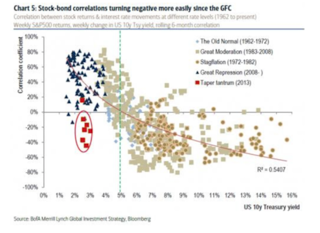

The Stock-Bond Correlation Curve

There has been a strong positive relationship between the correlation between stock and bonds and the level of yields. As rates have declined the stock-bond rate correlation has moved from negative to positive. This is a phenomenon which has been found around the world in all major markets. Many analysts have measured this through equity and bond returns (prices) which will show a strong negative correlation. The secular decline in inflation has pushed down bond yields during a time of long-term equity gains. Similarly, the decline in real yields through a fall in bond risk premiums has also been associated with an increase in stocks.

Disaster Risk – Priced in Risk Reversals

There has been a lot of discussion about crisis alpha with some hedge fund strategies like managed futures and the need for investors to build portfolios which will provide some crisis risk offset. There has been less talk about what is the definition of a crisis or how to measure the chance of a crisis.

Interest Rates, Risk Aversion, and Uncertainty – It’s About Precautionary Savings

What drives real interest rates? The answer seems to be associated with a demand for precautionary savings. That is, the real rate of interest will be driven by changes in uncertainty and risk aversion. If uncertainty or risk increases, there will be an increase in the demand for safety. if there is a increase in the level risk aversion, there will also be an increase in the demand for safety savings. Past research has shown that the real rates are associated with changes in growth volatility, but another recent paper called “Precautionary Savings in Stocks and Bonds” looks more closely at measures of volatility and changing risk aversion or attitudes to risk in the stock market which can be useful at linking change in real rates to market behavior.

Uncertainty and What Drives Interest Rates

One of the leading questions for any investors or asset allocator is what drives interest rates. If you know the factors that will cause rates to rise or fall, you have a significant edge in the market. Any decomposition of rates will fall into three broad categories, the real rate of interest, expected inflation, and a risk premium. What has been a puzzle for many researchers is that while there is an expectation that there should be a positive relationship between growth and interest rates based on inter-temporal smoothing, there has not been found a strong empirical relationship like what has been with expected inflation.

More on Bubbles – Trends Last Longer than Expected

There is the old adage that “trends last longer than expected”, so hang onto your positions. Since you don’t know when trends will end, just stay with those trends as long as possible. Always hold those winners regardless of how long and how far they have run-up. I could place some qualifiers on this adage but it a good base view for anyone who wants to be a trend-follower.

All Bubbles are not Trouble

Without a doubt there has been significant concern about asset price bubbles. Even though there still is not a good working definition of a bubble. Many define bubbles as booms that go bust, but that only means that we will never know we are in a bubble until after the fact. Clearly, there has been vivid descriptions of some famous cases including the technology bubble in the US; nevertheless, a closely look at history suggests there have been many booms that have not been busts. While the chance of a boom leading to a bust is higher than a unconditional forecast, the number and frequency of busts is not so high as to say confidently that all large price moves will turn into crashes.

Market Prediction and Using Dispersion as a Guide

I was having a discussion with friends for where the SPX will end over the next three and six months as well as what could be the ending value for the year. The predictions were all over the map with a mix of investors saying the market will be either higher or lower. I also had some that said it would be both, first higher then lower, and others suggesting the first leg will be lower only to then go higher again.

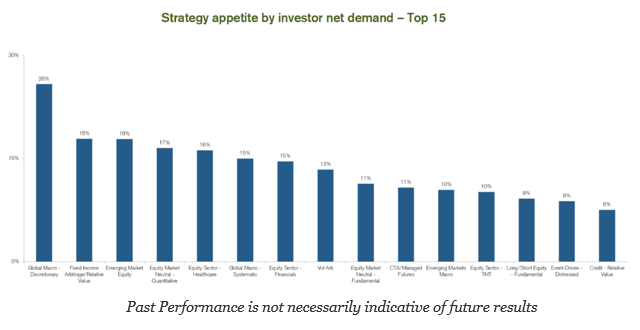

Credit Suisse Survey – Changing the Hedge Fund Mix

The latest Credit Suisse hedge fund survey for 2017 provides a detailed review of where there is the most investor demand for hedge fund strategies. Number one is global macro based on a desire to have greater portfolio diversification. This appetite is followed by fixed income arbitrage. The swing in demand shows a movement away from long-short equity and a movement to credit and sector specific strategies.

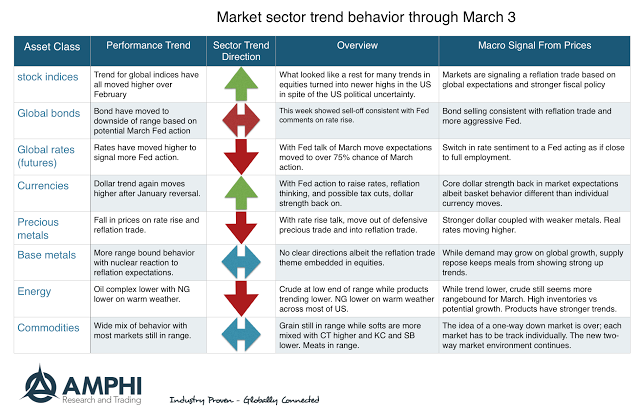

Sector and Style Behavior All Positive

Style returns were all positive for February with the largest gain for the large cap US SPX index. International stocks lagged given the increase in the value of the dollar. Small and mid-cap indices did not gain as much in February after stronger movements over the last few months since the US election.

Narrative Economics – Food for Thought for Quants

Quants focus on data and numbers. Forget any story or narrative and show me the data. Yet, a narrative often drives markets. Investors have to be aware of the current narratives that are in the market place because it can provide either a headwind or tailwind for market moves. The narrative can be consistent with the underlying data or it can be in conflict. The narrative can be driven by good economics or it can be driven by theories that have been popular in the past but have been debunked. Financial journalists look story that fit the facts nicely. Consequently, it is important to read the news to appreciate the current market narrative or storyline.

Trends in Markets – Equities Continue but Bonds in Fed Move Transition

What seemed to be a slight rest at the beginning of the year has turned again to a strong equity bull market. The reflation trade is back as signaled by equity index behavior. Bonds also suggest a reflation trade given the recent talk by Fed Chairman Yellen and other officials concerning the likelihood of Fed action in March. While not a rout, bonds are also signaling a growth trade.

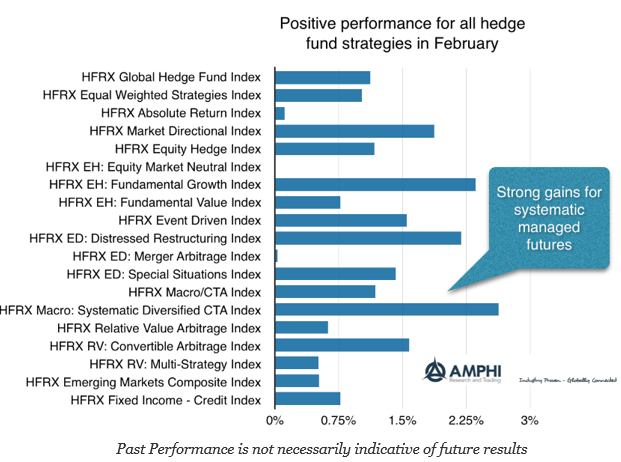

Hedge Funds Gain for February

All hedge fund strategies gained for February with especially strong performance for systematic CTA’s and fundamental growth strategies as measured by the HFR indices. Managed futures showed gains because both equities and fixed income markets trended higher for the month. The fundamental growth strategy seemed to be positioned to take advantage of the global reflation trade. Other winners included market directional and distressed restructuring strategies.

Reign of Errors – The Consequences are Real

The self-fulfilling prophecy is, in the beginning, a false definition of the situation evoking a new behavior which makes the originally false conception come true. The specious validity of the self-fulfilling prophecy perpetuates a reign of error. For the prophet will cite the actual course of events as proof that he was right from the very beginning.

– Robert K. Merton from Raji Sethi blog

Robert K Merton wrote about this issue in 1948 in the Antioch Review

“If men define situations as real, they are real in their consequences”

– W.I. Thomas