Category: Uncategorized

Reign of Errors – The Consequences are Real

The self-fulfilling prophecy is, in the beginning, a false definition of the situation evoking a new behavior which makes the originally false conception come true. The specious validity of the self-fulfilling prophecy perpetuates a reign of error. For the prophet will cite the actual course of events as proof that he was right from the very beginning.

– Robert K. Merton from Raji Sethi blog

Robert K Merton wrote about this issue in 1948 in the Antioch Review

“If men define situations as real, they are real in their consequences”

– W.I. Thomas

Long-Term Worry with Trade

The global macro manager is always worried about a few key issues. Where will country and global growth come from? What will be the flow of liquidity and credit to markets? What will be the desire by investors for risk-taking? The answers to these questions will describe the drivers of future asset returns.

Finance and Political Worlds Continue to Diverge

If I invested based on political rhetoric and news, I would be moving to a safe asset and expect stocks to decline. The uncertainty concerning policy and the animus between political parties and countries would suggest an environment that would not be suitable for the long-term optimism that is needed to see equities march higher. If I read just the financial papers and economic data, I would paint a more optimistic picture with consumer and business surveys both showing a positive environment. If I were a focused policy wonk, I would have a mixed view on market prices with the potential for stimulative policies but still a policy environment where details and specifics are scarce. It is hard to see these differences continuing. As politics, economics, and policy come into focus, there will be a strong reaction in price. Unfortunately, predicting when this alignment will occur is very difficult.

What are the Potential Yield Risks with Bonds?

There is still concern about the potential for large moves in bonds during the next three months. The latest rolling yield changes shows a calming after the large moves late last year. Nevertheless, uncertainty on policy, growth, and the equity markets may all impact Treasury yields, the “safe” asset. If safe means limited moves in yield, investors may be in for a surprise. A flight to safety can easily take the 10-year below 2% while a pick-up in inflation or growth can lead to yields pushing closer to 3%.

Preqin Survey – Investors Frustrated with Performance

Hedge funds are frustrated, as evidenced by the recently published Preqin Investor Interviews. If hedge funds do not perform this year, there will be significant changes in allocations. The number of respondents to the survey who said that returns fell below expectations increased by 50% in one year to the highest levels reported. Only 3% of investors believed that returns exceeded expectations. This was tied for the lowest levels reported.

Preqin Survey – Lower Allocations to Macro and Managed Futures

A close look at the investor intentions for hedge funds suggests that poor managers will see their allocations reduced this year. The proportion of respondents who will reduce their allocations is at the highest levels reported and about 20% higher than last year and more than double from two years ago. Similarly, the survey has lowest level of respondents willing to increase their allocations.

The Willis Towers Watson Global Pension Assets Study 2017

The Willis Towers Watson Global Pension Assets Study 2017 shows that the same pension trends for the last decade continue. First, the march to defined contribution (DC) plans from defined contribution (DB) plans has not abated. Of course, there are some wide variations across countries, but the good old days of getting a managed pension from a company or a state are not coming back. Second, the growth in pension assets from the major countries is slowing but continues to rise in emerging markets. Emerging markets do not have the same developed pension systems and often have pension assets well below the country GDP. There is a catch-up in EM and this is where asset growth will be seen.

News Sentiment – It is Worth Following

Some may feel they are overloaded with news and it is just noise. Well, some new machine learning research suggests that following new is worth a second look. The news can provide a strong measure of sentiment that can improve forecasts versus using traditional fundamental information. This news sentiment is also unique and can add value versus survey sentiment information found in the long-serving Conference Board and University of Michigan work. This new research on sentiment is presented in the paper, “Measuring News Sentiment” from the Federal Reserve Bank of San Francisco.

Bond and Equity Flows -Who is Underwater?

Asset allocation changes are often associated with the pain faced by investors. When there is financial pain through loses, allocations change, so it is important to know where are the pain points. Pain points can be associated with book value loses. Look at when money flowed into an asset class and the price associated with that flow.

BlackRock Survey – Investors Will Pour Into Real Assets

Earlier this month, BlackRock reported their institutional investor survey findings taken from late last year. The results are not that surprising if you believe that inflation may be rising and there is still a need for yield. Cash levels are expected to decline along with fixed income, but real estate will see a large boost. Investors will reduce public equity exposure, but increase their exposure to private equity. There is a bias to less liquid higher risky assets. What may catch some by surprise is the large increase in allocations to real assets which includes timber, commodities, infrastructure, and farmland.

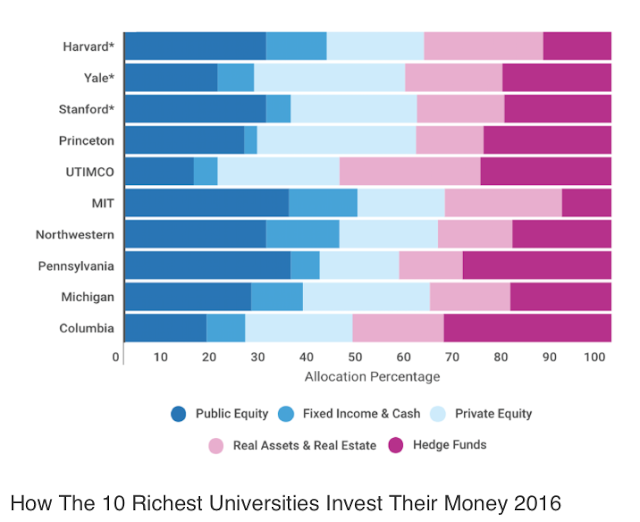

Endowment Models – Bogle Simplicity a Winner

Everyone likes to follow what endowments are doing because there is the assumption that they represent smart money. If universities are where the smart people are, then it stands to reason that their money managers are also smart. The return numbers suggest that endowments don’t have a lock on good performance. In fact, simple allocations have proven to be more effective at generating return. The Bogle model which is a simple variation on the classic 60/40 stock/bond mix is a perfect example. This asset allocation in made up of 40% US equities (total US stock index), 20% international equities (total international stock index) and 40% bonds (total bond index). The Bogle allocation works when compared with endowment allocation which have been tilted to alternatives and away from equities.

Hedge Fund Performance Starts Well for January

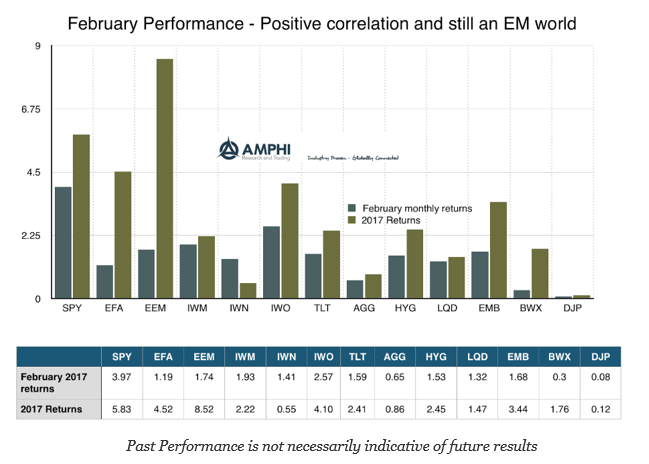

The markets were generally calm for January even with the upheaval and uncertainty from the new Trump Administration. The surprise for many investors is the continued low volatility in the markets which seems inconsistent with the political uncertainty faced. While hedge funds generally did well for the month, there were some negative stand-outs, the macro and CTA strategies.

What are Endowments Doing with Their Allocations?

This above chart from thetrustedinsight.com provides an interesting tale about asset allocation for large endowments. Forgot about the traditional 60/40 stock/bond mix. Forget about the 50/30/20 stock/bond/alternatives mix. If you don’t need liquidity, as is the case for the endowment portfolio allocations, a mix between liquid and illiquid is a better base framework. Hold private equity and real estate as core allocations. This core is for long-term appreciation and cash flow greater than bonds, but is generally illiquid. Take money from fixed income and cash. Take funds from public equities and use hedge funds, which may have mixed liquidity, as an additional return enhancer. The public equity and bond/cash portion of portfolios is between 25 and 50%, while hedge funds are from 7.5 to 32.5% for these key endowments. The majority of their allocations are not with traditional equity and bond beta.