Category: Uncategorized

Trendless Markets as We Move into February

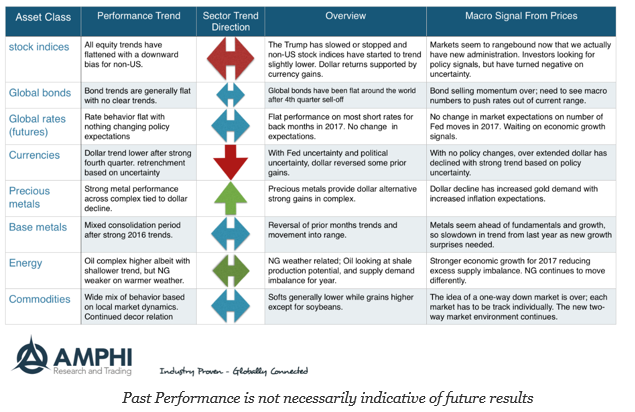

Our sector indicators have all pointed to more trendless behavior for the major asset classes. The only major trend was a decline in the dollar for January and stronger moves higher for precious metals. With higher inflation expectations, and policy uncertainty, there are fundamental reasons for these moves.

Emerging Markets – Bonds Beat Equities Which Beat Commodities – Will this Continue?

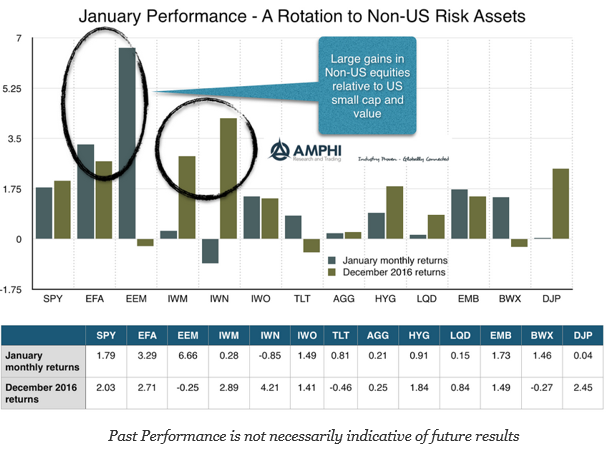

Emerging markets have been a tough place to invest especially in equities during the post Financial Crisis period. We include a stock index (EEM), and bond index (EMB) and a commodity index (DJP) for some simple comparisons of three ways to play emerging markets. After a strong rebound in 2009, emerging market equities have generated no returns for investors. Slower growth, poor commodity markets, and a stronger dollar have left equity holders with nothing to show for seven years. Emerging market bonds have told a different story with strong consistent gains since the Financial Crisis even with the strong dollar move over the last few years.

Sector Behavior Shows Stability After Large Moves at End of the Year

It was a positive month for risky assets, albeit more one of consolidation and than return break-out like what was seen last quester. Global markets outside of the US, especially emerging markets, showed large gains after a weak fourth quarter. The dollar gains post-election were partially reversed which added a tailwind to non-dollar investments of about 2%. After accounting for currency changes, developed non-dollar returns are back in-line with the US.

Banking and Speculation – All a Matter of Opinion?

“When as a young and unknown man I started to be successful I was referred to as a gambler. My operations increased in scope. Then I was a speculator. The sphere of my activities continued to expand and presently I was known as a banker. Actually I had been doing the same thing all the time.”

– attributed to Ernest Cassel by Bernard Baruch

The Switch – An Ascent in Non-US Returns

After the euphoria in small cap, value, and growth stocks post the Trump election, the markets have calmed and moved slightly upwards. Global equities and emerging markets stocks were the big winners for the month. These moves were a degree of catch-up to the outperformance in US stocks. Even with the poor print for fourth quarter GDP, equity investors are discounting better growth in 2017.

Bonds as Diversification Insurance – I Don’t Think So

Would you buy insurance where the value changes every day with market conditions? An “insurance contract” that may provide a hedge against equity risk today only to see the value of the hedge disappear tomorrow? Of course, the value can appear again, but investors may not have any guarantees. This is recent problem of investing in bonds as a diversification tool. The value of this diversification has become more variable.

Regression to the Mean, Luck and Picking Hedge Fund Managers

There are few statistical facts more interesting than regression to the mean for two reasons. First, people encounter it almost every day of their lives. Second, almost nobody understand it. The coupling of these two reasons makes regression to the mean one of the most fundamental sources of error in human judgment.

-Anonymous from What the Luck? The surprising Role of Chance in our Everyday Lives by Gary Smith

If it Works for Poker, it should Work for Investing…

More money is lost by players who know what the right thing to do is, but don’t do it, than for any other reason. Having a strategy, a game plan and the discipline to stick to it are, along with a sufficient bankroll, the four most important thing that a player needs to be a winner.

– Ken Warren poker writer on Texas Hold ‘Em

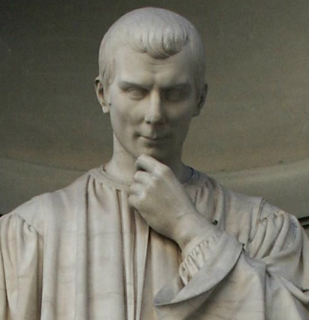

Machiavelli Could Have Been a Trend-Follower

Whoever wishes to foresee the future must consult the past; for human events ever resemble those of preceding times. This arises from the fact that they are produced by men who have been, and ever will be, animated by the same passions. The result is that the same problems always exist in every era.

– Niccolo Machiavelli

Downside Risk – Maybe You Should Be an Insurer?

No investor wants to bear downside risk. Well, perhaps more precisely, no one wants to bear downside risk without extra return compensation. Strong asymmetric risk preferences create the reason for a volatility risk premium – the empirical fact that implied volatility is higher than realized volatility. What the volatility risk premium states is that if you buy an option you will pay more in terms of volatility than what the market will give you in actual volatility. In a very simple but elegant paper in the Journal of Alternative Investments called “Embracing Downside Risk”, some practitioners look at the compensation toward downside risk through a decomposition of returns by strategy.

2017 – Living in a Bimodal World

Most investors like to think of financial market risks as measured through a normal distribution. In reality, we know that it is not the case. However, how we incorporate and discuss fat-tails is not always clear. One thing that is clear is that fat-tails can be created when there is a mixed distribution or a combination of distributions that represent different regimes. A simple example will be the mixing of growth versus recession or good versus bad states of the world. This has been our theme for 2017 with a new year post. The potential for two different economic regimes will create fat tails in the return distribution of financial assets.

Money Management – Is the Amount of Talent Important?

Money management is all about the talent, yet there is little economic analysis of human capital as an input in the creation of returns for the money management industry. That gap in research has changed with the new paper, “On the Role of Human Capital in Investment Management”. This provocative paper studies over 10,000 RIA’s across a number of years and asserts that more human capital may not help return generation. Having more advisory personnel may help with attracting assets. More investment advisor employees creates the appearance of more talent, but having more bodies is more likely to generate behavior like a closet index with less active shares and lower tracking error. They call it – money management – and staff is needed for management and the gathering of assets. Investors just have to be careful understanding why more staff is needed.

FX for 2016 – The Betas Say Carry is Back

The development of FX style betas has changed the way investors think about their foreign exchange trading exposure and risks. The approach is simple – trading risks in FX can be decomposed into four style factors, trend, carry, fundamentals, and volatility. The argument states that an investor can easily manage or decompose FX returns using these beta styles or strategies. It is an effective way to show how returns can be generated in currency markets.