Category: Uncategorized

Measuring Risks – Working Against the Downside

“I would’ve created CAPM around semi-variance, but no one would have understood the math and I wouldn’t have won Nobel Prize…” H.Markowitz

In a Tough Investment World – Investors Will Need Help Finding Returns

It will be a tough investment world going forward for the simple reason the odds are against you. If you are a blackjack card counter in Vegas, you always know the odds, or the count. You know that on any draw, you can get lucky, but in some environments, the chance of success is just lower. Regardless of how smart you are, if the odds are not with you, your chances of getting good returns are lower. Your job as an investor is to know the odds and deal with the consequences.

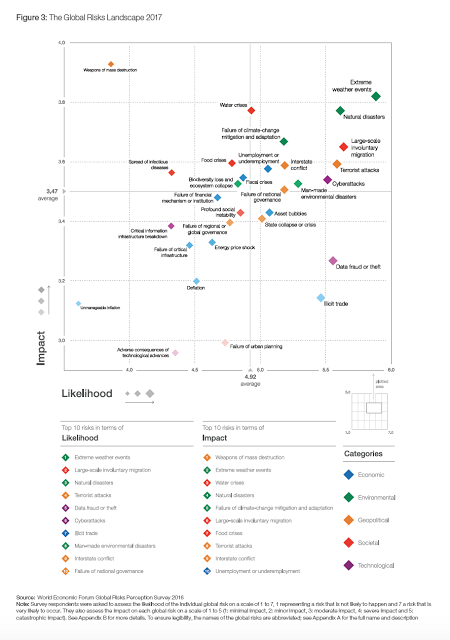

WEF Global Risk Report – What to be Afraid of in 2017

The World Economic Forum (WEF) Global Risk Report serves as a useful guide on the broader set of risks that may impact the world over the next year. This report is important because it moves outside the narrow focus of finance and looks at a broader set of risks. Nowhere are economic issues in the top five for impact or likelihood in 2017. This is a big change from the 2007-2010 period. This is the first time economic issues are neither in the likelihood or impact top five. The dominant category is environmental which suggests that commodities markets are most likely to have the immediate impact if there is a shock. Extreme weather and natural disasters have the highest impact and likelihood combination from WEF analysis

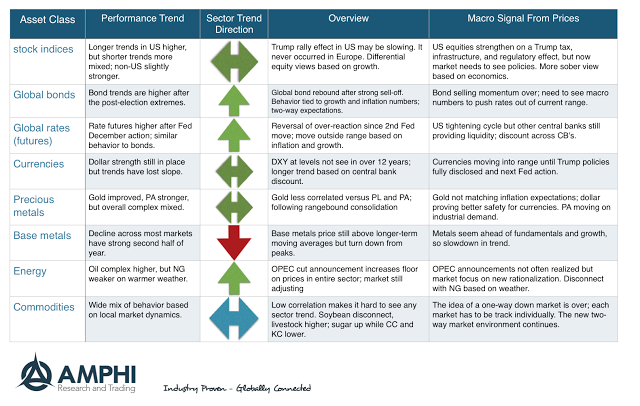

Trends in the Market – The More Cautious Trump Rally

The euphoria of the US presidential election is over. The market jumped under a new wave of optimism associated with an end to fiscal austerity, tax cuts, and regulatory reform, but now the reality has to set in and investors have to see the actual policies and believe they will be effective. This new sense of reality may describe the current price action for asset classes. You can call it mean reversion or a response to an earlier over-reaction.

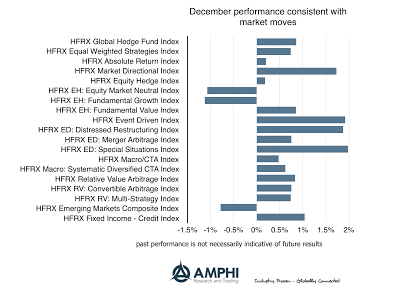

Hedge Fund Performance in 2016 – Was This a Skill-Based Year?

Hedge fund managers are supposed to show skill during periods of higher risk and uncertainty. If there is more uncertainty or ambiguity concerning market, skill-based managers should be able to do better than those who just buy a market index. This is one key reason behind choosing hedge funds. When there is uncertainty and risk, alpha should be generated by skill managers.

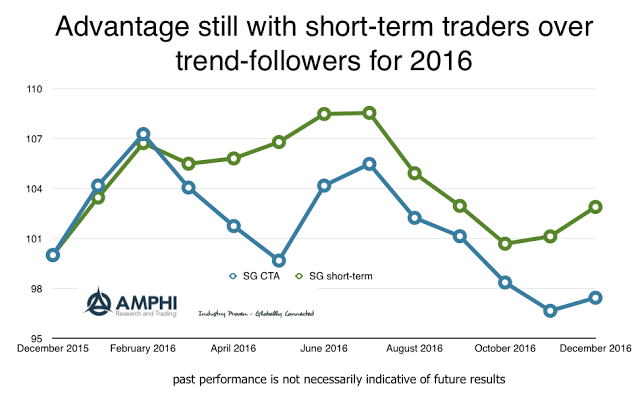

Timing Diversification

All systematic traders are not alike. Investors know that, but the differences become highlighted at the end of the year when returns are reviewed. There are potential diversification gains within a strategy space by choosing a set of managers who behave differently.

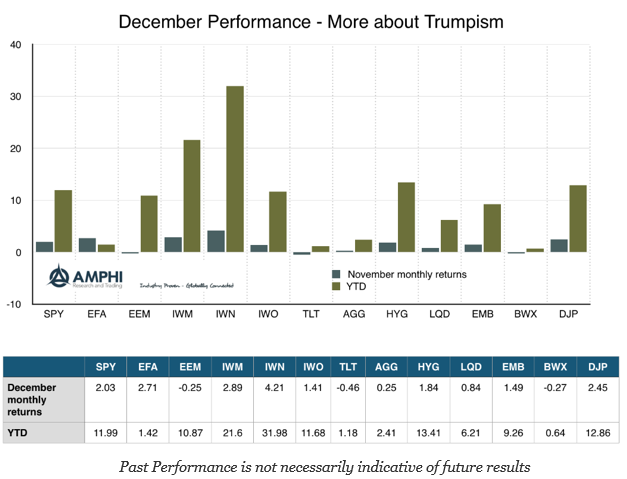

Changing Trends in ETF Market Sectors – Too Much Optimism?

2016 became a great year for small cap, value, and growth indices post the US election. Investors are discounting changes in 2017 that will impact the bottom line for companies, so the new year will be about realizing those optimistic expectations. The recent declines versus short-term moving averages suggest that this euphoria is now being tempered.

Did Asset Class Performance Reflect the Political Upheavals of 2016?

Show me the performance for the year and I should be able to tell you something about the economic and political events for the year. I may not be able to tell you the specifics, but I should tell you whether it was a “good” or “bad” year in terms of economic growth, uncertainty, risk, and confidence. Looking back over 2016, you would not know that it was a year of political upheaval.

Divergence in Bank Performance between US and EU – So What?

The one take-away from the Great Financial Crisis has been the importance of financial intermediation, banking. When banking is disrupted, lending will not happen. There will be a cutback in credit which stalls the economy. Additionally, if capital is not available for banking, there will be a cap on lending especially if there is a constraint on leverage. Funding will become scarce. If bank capital falls, lending will be disrupted. This lending channel is amplified with the swings in the business cycle.

Listen Up Hedge Funds – You Don’t Perform, You Die

The latest hedge fund asset flow report published by EVESTMENT tells a tale of an industry that has become more competitive and is in a period of consolidation. The easy money of being a hedge fund manager is over. Now, you have to earn your AUM through offering a better product. The year to date outflows for 2016 have been $83 billion which is small on a $3 trillion base, but suggests that investors are getting more particular in what they expect from hedge funds. Couple these outflows with the higher level of fund closing and we see a competitive market place which is unforgiving to managers. It does not matter whether you think you have investment skill; poor performance will relegate you to obscurity.

Financial Stress Down, Policy Uncertainty Up

Don’t try and call the direction of the markets with some forecast which will most likely not come true. Decide the environment that we live in and determine what will be the best portfolio to take advantage of it, or as I say often, “You cannot tell where you are going until you know where you are.” A key for knowing your economic location is through determining whether there is financial stress in the economy. Stress leads to change. When stress increases or falls, investors will become more risk averse or risk seeking. It is a driver of volatility.

The Phillips Curve – Isn’t that an Old Relationship that Does Not Apply Anymore?

Anyone with grey hair is likely to remember studying the Philips Curve in his or her macroeconomics class, yet if you started to talk about the unemployment inflation trade-off today, you would be viewed as some “old school” thinker who is out of touch with reality. The Phillips Curve is an artifact of economic history. Is the Phillips Curve dead, another zombie model that walks around with no useful purpose? No

Visualization of Connectedness and Networks – Moving Beyond Correlation

Everyone uses correlation to tell a story, but some cutting edge work takes this to another level when it is connected to concepts on networks and topology of mapping connections. Network research is on the cutting edge of understanding systemic risk and how capital and information flows across the globe. It can also be used to help visualize data. The idea that all markets will react together is a just a simplification that can lead to poor thinking about markets. A network approach can help show how markets interact.