Category: Uncategorized

Risk premia performance generally positive for January

It is a new year and the underperformance of many alternative risk premia strategies in 2018 is now an old memory. Good performance heals past return wounds. While well-constructed alternative risk premia should not be highly correlated to market beta, they will be related to the investment regime. Risk premia are time varying.

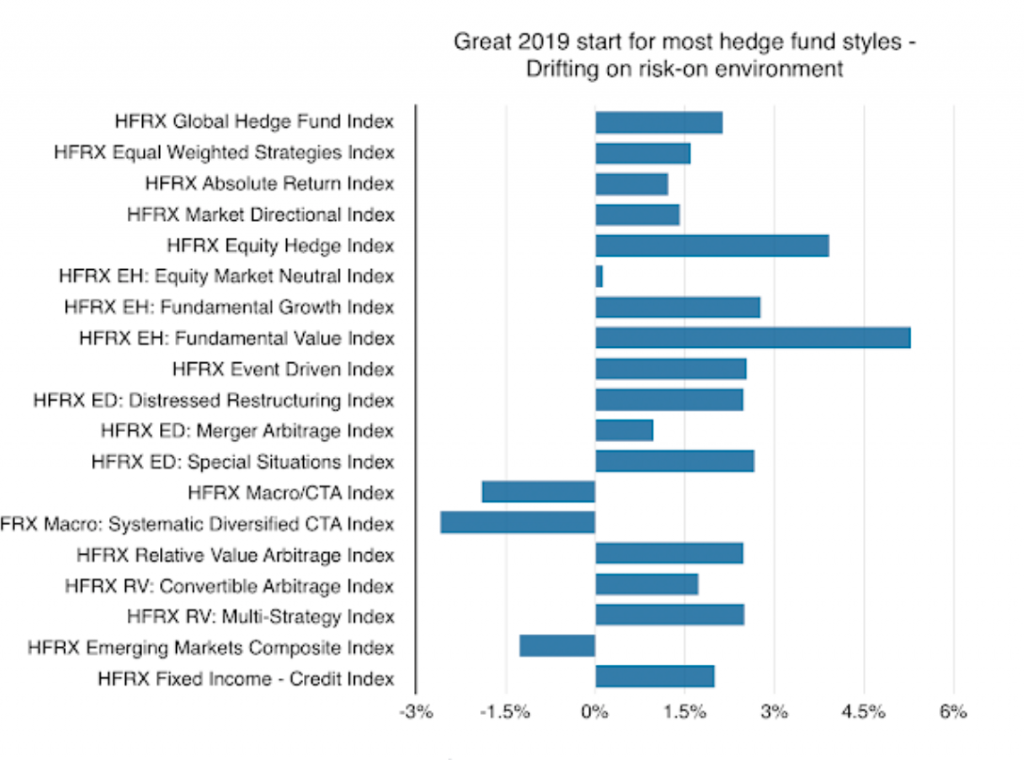

A risk-on environment and the hedge fund world is good

Hedge fund styles as measured by the HFR indices showed strong positive January performance in tandem with the gains in the stock market. When in a risk-on environment many hedge fund styles are winners.

Global stocks – All about avoiding global slowdowns and recessions

Is it that simple? Global equity investing is all about missing the big macro risks – recessions. There are headline risks every year, but it is always about economic growth when you step-back and look at annual performance. If global growth appreciably slows, global stocks are hurt. A simple long-only asset allocation strategy is to stick with long-term trends with the ability to walk-away when a recession or slowdown occurs.

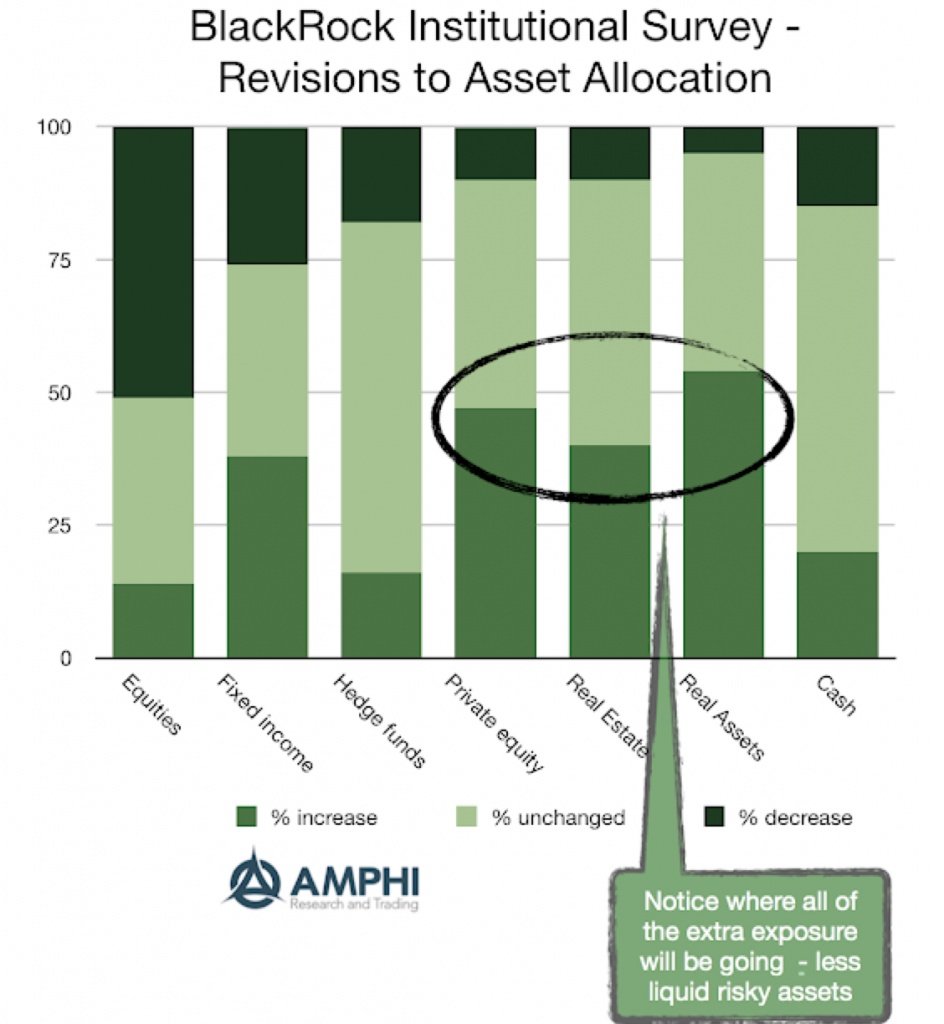

Liquid or Illiquid: Are you getting paid enough for less liquidity?

A key issue with any hedge fund investment is liquidity. How much should you be paid for illiquidity with assets? How much should you be paid for illiquidity with a fund structure? How much liquidity do you need? What are the liquidity terms that are acceptable for a fund?

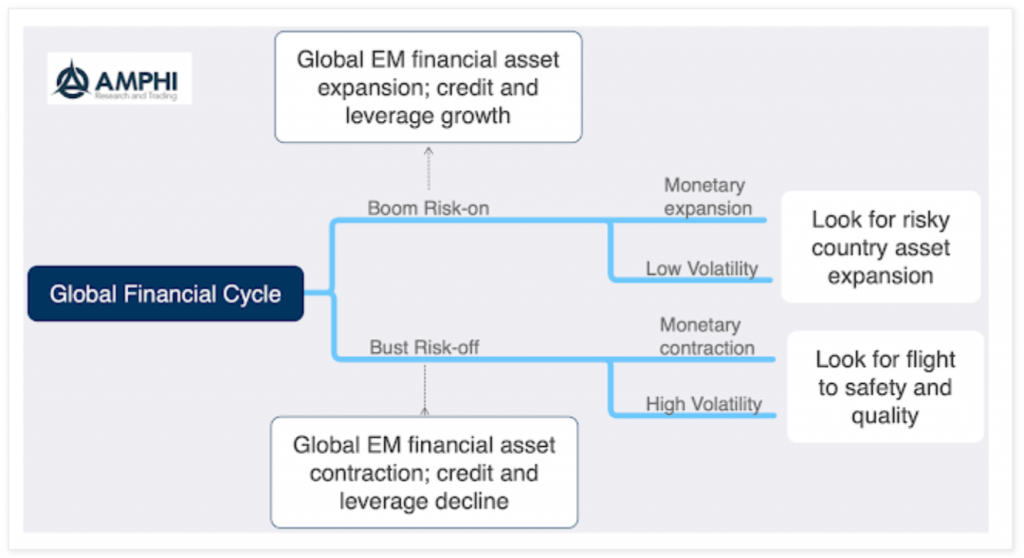

Global Financial Cycle – Look for the risk regimes

A recurring theme for our forecasting model is not predicting the future but just identifying the current regime. It is more important to first know where you are before you determine where you might be going. If you have ever been lost, the best solution is to first figure out your current location.

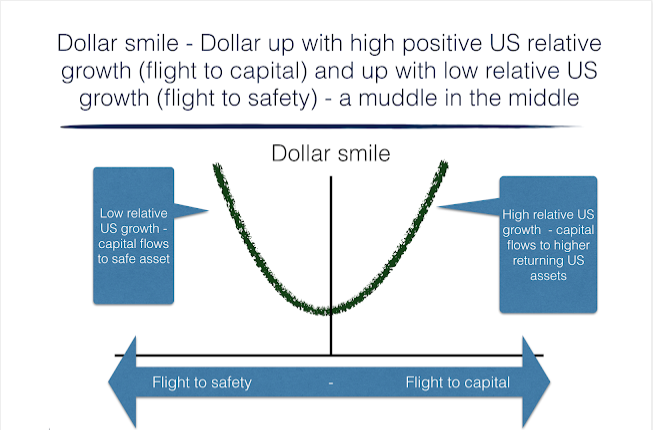

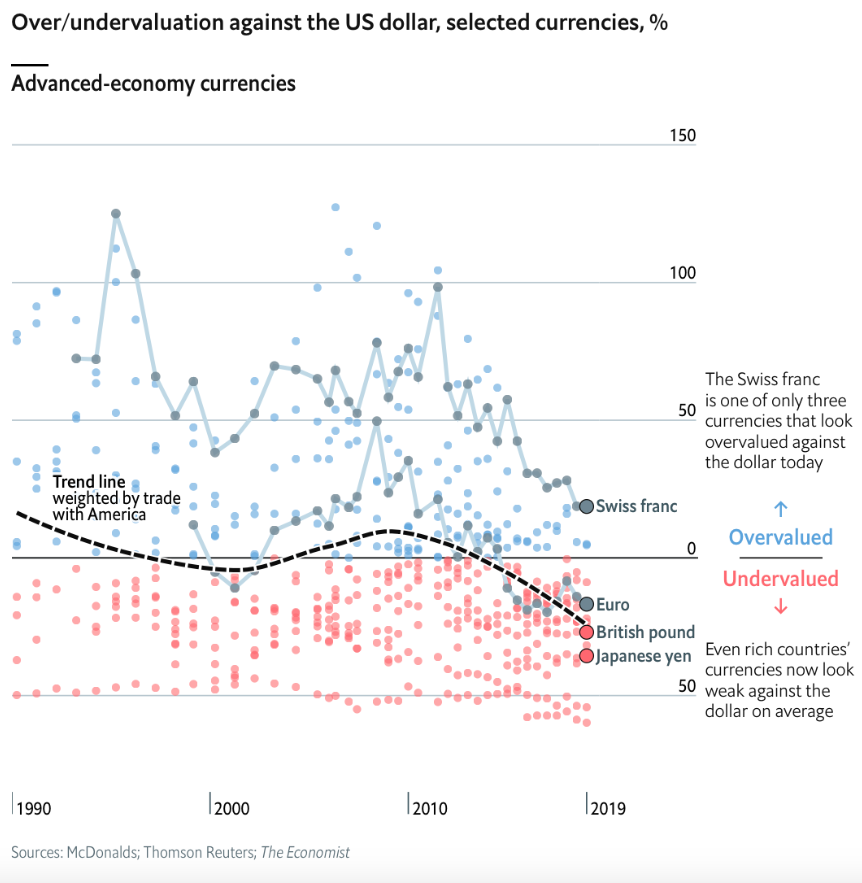

Dollar smile – We are moving to the smile bottom

A good simple approach for framing the longer-term movements in the dollar is through using the narrative of a dollar smile. We have written about this years ago, but think it is relevant today. The dollar smile, first popularized by Stephen Jen, says that currency behavior is driven by two competing regimes. Regime 1 is […]

Concentration, inequality and the status quo – Size matters but not always for the better

A capitalist system is not always competitive environment, but competitive environment is a capitalist system. One key macro issue that is not often discussed is the increasing concentration of businesses in the US and other capitalist countries. While not monopolies, an increasing amount of market share is in the hands of fewer companies and form oligopolies.

In credit do you trust? – This trust may be misplaced

The origin of the word credit, credere, is Latin for believe or trust. So there is a simple question for any credit investor, do you believe that current outstanding credits can be trusted to payback all interest and principal over the next few years? It is a simple question and many who trusted payments a year ago do not have the same trust today.

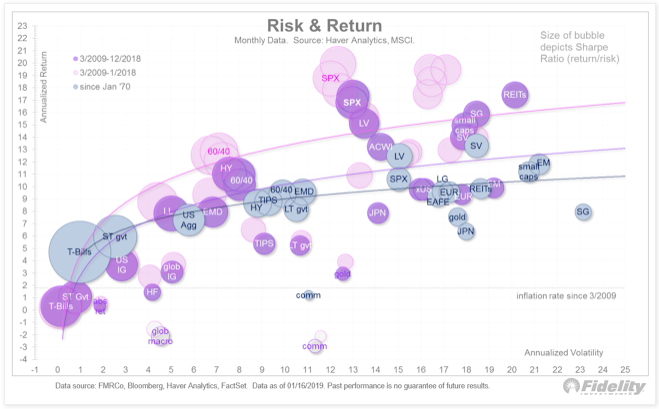

The Efficient Frontier – Not a Line but Cloudy Dream

This is a very interesting chart of the efficient frontier from Fidelity for a number of reasons. On one level the return to risk locations for different asset classes are relatively stable, but there has been a mean reversion of returns during the fourth quarter that is pulling return to risk ratios back to long-term averages. Excess returns by definition cannot last forever. The fourth quarter was a correction to the long run and by the evidence in January perhaps an over-reaction.

Dollar down – A big trade for 2019?

What was keeping the dollar moving higher? A simple difference in monetary policy has been a key driver. With the Fed tightening through raising rates and engaging in QT, the reserve currency provider was out of step with the rest of the world. However, recent comments by Fed Chairman Powell and other Fed bank presidents have changed policy expectations.

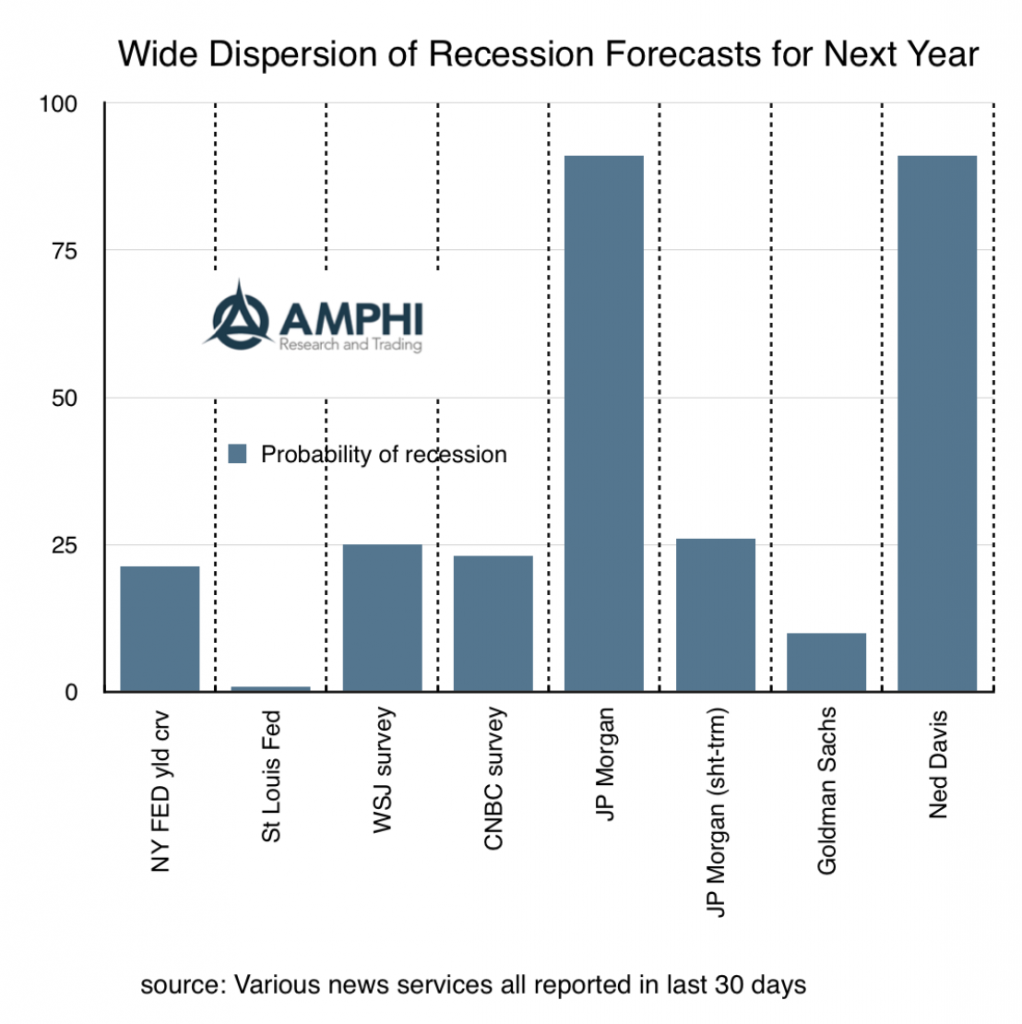

Recession probabilities – There is no consensus

What is the chance of a recession this year? Many have tried to build systematic models to give a probability number. This has been a good advancement in thinking about macro forecasting, but the variability of forecast is unusually wide. Different inputs will give different probabilities and there is no consensus on what should be the right inputs.

Where are institutional investors going to put their money? Not what you think

It was a tough year for money managers. All asset classes underperformed cash and most were negative for the year. Equities were a return disaster for December. Hedge funds did not do well for the year. So what will investors do?

What are shadow interest rates telling us?

We cannot forget that the zero bound on interest rates caused distortions in market price signals. Now in the US rates are above the zero bound so it seems like the concept of a shadow rate is not important; however, it is still relevant for many other central banks and it provides a good measure of where we have come over the last few years. Using the shadow rate as a historic measure of relative tightening, we can say that the Fed has actually been on a tightening policy since the end of quantitative easing.