Category: Uncategorized

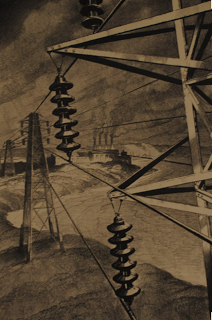

Visualization of Connectedness and Networks – Moving Beyond Correlation

Everyone uses correlation to tell a story, but some cutting edge work takes this to another level when it is connected to concepts on networks and topology of mapping connections. Network research is on the cutting edge of understanding systemic risk and how capital and information flows across the globe. It can also be used to help visualize data. The idea that all markets will react together is a just a simplification that can lead to poor thinking about markets. A network approach can help show how markets interact.

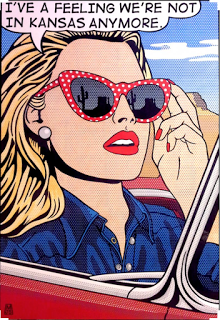

Foreign Exchange Trading – Adding another Dimension to Alpha Creation

The dollar and FX trading is back in hearts and minds of investors. For many, it never went away, but during the Post-Crisis period, there was a fall-out in performance and interest in trading currencies as an alpha source. With limited trends and carry that was squeezed down to zero there were limited opportunities for profit. If all central banks are behaving the same and growth differentials small, there will just be limited trade opportunities except for periodic short-term dislocations. That dearth of opportunities has changed in 2016 and may continue in 2017 for a simple reason. Economic differentials across countries are back.

Fake News, Old News, Wrong News, or Just Plain Old Prices

The world has been abuzz with talk of fake news as if this was a new concept. Fake news has been around as long as newspapers have been printed and before. It has been called gossip, bias, or yellow journalism. Fake news has taken countries to war, ruined reputations, and swindled readers. Like all technological change, it is coming faster and in more forms.

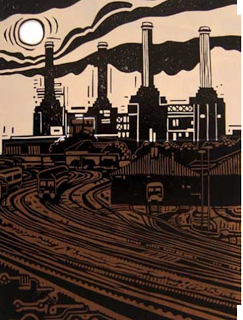

Paid Less for Less Protection – Your Credit Markets for 2017

One of the best performing sectors for 2016 was high yield credit which saw a large reversal in spreads with the improvement in the oil market. Credit funding for shale oil exploration and production was in jeopardy with the low oil prices, but the duel conditions of higher oil prices and an improvement in economic prospects have brought spreads to former tight levels last seen in 2014. Of course, there are other issuers in the high yield market but this move was associated with the risky oil credits.

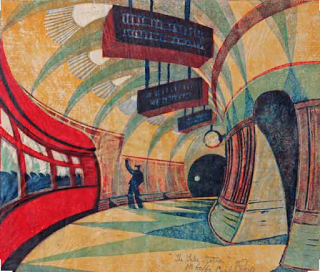

Momentum and Mean-Reversion (divergence/convergence) Research Shows Combo Works

We have often stated that the market move in two modes or regimes, divergence and convergence. Another way to describe this market behavior is through momentum and mean-reversion. Yet, these regimes should not be viewed as independent. They can actually be negatively correlated, but because they have different time horizons, they can co-exist. An older paper looks at combining these two strategies with global equity returns and finds that a combination can lead to excess returns. (See Balvers and Wu in “Momentum and Mean Reversion Across National Equity Markets”.)

The Most Important Chart for 2017 – Embrace the Current Uncertainty

There is the foundational view that increased uncertainty will and should lead to changes in our economic behavior. There should be an increased desire for caution. Investments in the future should be smaller or deferred. There should be an increase in the holding of cash versus any risky investment. Actions may be scaled or averaged to reduce potential regret. Risk aversion will impact the return needed to offset the risks faced. Uncertainty should be avoided or at least approached with caution.

Ideas and Work… Focus on the Details of Doing

Often what passes for an idea is, on closer inspection, really propaganda – someone wants something, wants to promote something. The hard part is finding a form. The most convincing works tends to be those in which the thinking is inseparable from the doing.

The big-idea people will always be among us…. Nothing wrong with big ideas, but they aren’t especially relevant to figuring out how something works – or doesn’t.

– from 2. to 1. How 3. See by David Salle

Risk Factors Change – Do You?

From ETF Trends comes an interesting chart on the relative performance of different risk factors for US large cap equities. Factor analysis and building portfolios based on specific factor risks has become all the rage in investing. We think this is useful and significant advancement to portfolio management, but there is still a lot to learn about the dynamic behavior of factors.

Focus – Study on Diseconomies of Scope Demonstrates the Key to Success

We know the answer to success. If you want to get good at something you have to focus and do the work. Is this focus measurable in money management? Similarly, can we say something about manager focus through time? An interesting piece of new research looks at this problem in the paper, Diseconomies of scope and Mutual Fund Manager Performance.

The Buzz with Pension Clients 50-30-20

The rule of thumb used by many investors as a base portfolio allocation has been a 60%/40% stock/bond mix. When in doubt, investors are supposed to go with a standard 60/40 allocation as a safe base case. If you are going to change the allocation, measure the change against the base 60/40 mix. Investors can perhaps add international equity or international bonds or maybe a dash of commodities, but if there is more uncertainty, the safe action is to move back to 60/40. Many advisors may suggest something different, but then show why it would be better than the baseline 60/40 as the reason for its efficacy.

Where do advisers want active management?

There has been a strong move to passive investing tied to benchmarks by investors. The reasons for this movement are threefold. One, passive benchmark investing is cheaper than active management. Two, active management has often underperformed benchmarks. Three, passive investing provides transparency on what will be in the portfolio. Nevertheless, a survey of defined benefit consultants suggest that the choice between active and passive management is not obvious and actually asset class specific. There are some areas where consultants view that active management is important while other areas the focus is for passive investing.

Fidelity Survey – Expect Asset Allocation Changes

A recently published Fidelity Global Institutional Investor survey suggests that more asset allocation changes will be made in the next one to two years than shown in their last two surveys in 2012 and 2014. This survey anticipates what we are all thinking – it is a new investment world with a Fed becoming more aggressive and the politics of populism sweeping many countries. The post-crisis investment world of boundless liquidity and asset performance catch-up has ended. We are entering a new period of two-way market views. There is more uncertainty on market direction so we are likely to see more divergences in asset allocation.

When asked about the top concerns for investing in their portfolios, the three top answers were all boar performance; what is past performance of an asset class, what is the expected return from an asset class, and where has there been success and failure with investments. Perhaps performance is always the top issue in the minds of managers, but the survey highlights particular focus during this period of transition.

Asset Classes, Styles and Sectors Show Dispersion

A review of all sectors shows some clear themes across asset classes. Bonds are out of favor and US equities are preferred. International equities and bonds reflect repricing of rates and currencies while still showing lower global growth.