Category: Uncategorized

CTAs Stung by Low Volatility in August

Following a flat July, CTAs struggled in August. A concomitance of low volatility, range bound markets, lack of follow through on existing trends, as well as an emergence of new trends, resulted in negative performance for several managers. The extremely low volatility environment was challenging for most systematic managers as their strategies had little to work with. This absence of any meaningful follow through resulted in a portion of previously accrued gains being absorbed back into the markets.

Wider Dispersion in Sectors, Styles and Countries in August

We have described August as the dog days of summer given the limited movement in major asset classes; nevertheless, we were seeing more dispersion within equity and bond sectors, styles, and country indices. Moving averages are flattening and there are less clear signals within our sector groupings. It is unclear how long range-bound behavior will last given that the Fall season for financial markets, when trading activity picks-up, starts next week.

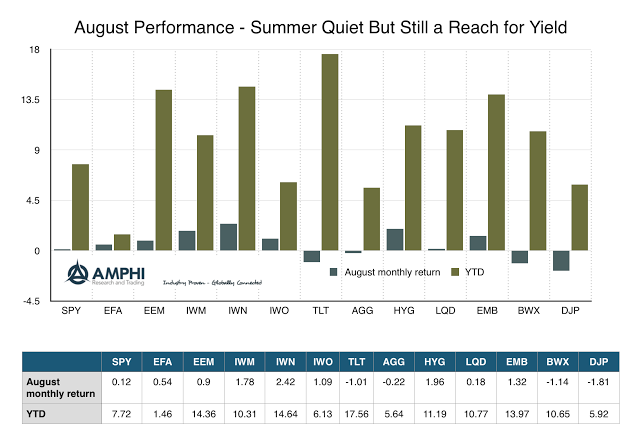

Review of Asset Classes

For many it was a hot August. Time to slowdown, go on holiday, and not worry about financial markets. Of course, there is a lot to worry about, but August performance across most asset classes showed general range-bound behavior with a continued reach for yield within the equity and fixed income asset classes. The tight range was linked to no substantive news to change expectations. After weeks of hype, the comments of Fed Chairman Yellen at the Jackson Hole conference did not serve up anything new. The data driven Fed may raise rates or not based on further confirmation of data that seems stuck in a range.

Beware, Sharpe Ratios are Time-Varying

“What is your Sharpe?” This is one of the first questions that is always asked of managers. The mangers will firmly reply, “My Sharpe ratio is X.” The conversation then moves onto the next question as if this one number serves to address the performance issue, yet the Sharpe ratio is dynamic. In a drawdown, no one wants to even see that number. When things are going well, the Sharpe ratio is king. Investors have to accept that this is a variable number because the underlying assets bought by funds have variable Sharpe ratios.

The Elegance of Simplicity in Investment Management

Some people believe that if you want to show how smart you are, you should tell people how complex your investment process is relative to others. Wow investors with your skill and mental agility, this will win you new money. Be and act like the most intelligent person in the room. The Power of Simplicity […]

Getting Ready for a Liquidity Event Through Using Index Futures

Liquidity is never present when you need it. This truism is especially the case when there is a financial crisis. A crisis become a liquidity event if sellers cannot find buyers at a fair price or at extreme any price. If the security is more specialized or complex, it will be even harder for the seller to find buyers. There will have to be a greater price decline from fair value before a buyer is found.

Looking for a Turn in Both Government Bonds and the Japanese Yen

In quite a few ways, recent weeks have been anything but boring. Trying to filter out important events from random noise in markets today feels like a bit of a mugs game, but that shouldn’t stop us from trying if we think that we can add some value to our investors. We would like to pick up on a couple of areas that are gaining our attention, and we’re certainly not alone, so here goes with our version of events.

IASG Launches Broker Dealer to Serve an Expanding Audience for Managed Futures

IASG Alternatives was founded in 2015 by current IASG team members Perry Jonkheer, JonPaul Jonkheer, and portfolio managers, Tyler Resch and Greg Taunt. This new company adds to the services provided by Institutional Advisory Services Group (IASG) by offering futures fund and managed account platform products designed to fit the risk tolerance, diversification, and transparency needs of our customers. Our free portfolio review process consists of an initial consultation, research and evaluation of managers that fit prospective customer’s risk return profile, portfolio design, and ultimately daily monitoring and reporting once an investment is open. Through education and proper manager selection we believe futures are an option that everyone should be knowledgeable about as a potential diversifier for their traditional investments.

Bank of Japan Surprise Move

Thoughts on today’s Bank of Japan action and Global Equity Markets The Bank of Japan surprised markets overnight by becoming the most recent central bank to move rates into negative territory, albeit only on new excess reserves created by additional QE, and this time with a razor thin 5-4 vote. This comes on the heels of continued weak economic data, and again (their 3rd time in a year) they postponed the deadline for achieving their 2% inflation target an additional 6 months to early 2017. The Yen weakened dramatically (~2%) overnight as the market was surprised by this seemingly aggressive action in light of recent commentary that additional easing wasn’t necessary.

NFA Elections – Position Paper

It is time for another NFA Board of Directors election. If it seems like we just asked you for your

vote, it’s because we did as you elected us to two-year terms less than a year ago. However, due to

changes to the Board’s composition, we currently find ourselves up for election yet again in the only

two contested races on the whole Board. We know that the constant stream of elections may seem

unimportant, but as someone who makes their living subject to ever-increasing regulation, taking the

time to vote for effective Board representation directly benefits your business.

One of the unique things about NFA is that it is chartered as a democratic, Member-run self-regulatory

organization. This carries with it substantial responsibilities for both Members and Management to

balance maintaining the rights of Members with protecting customers and avoiding regulatory capture

whereby the organization could be run for the benefit of a select few. For the organization to be

successful, Members need to take an active role in its governance, by educating themselves on often

complex regulatory issues, speaking out on proposed regulations, and electing Directors who put those

goals above their own personal benefit. We think that we have done the latter to the best of our

abilities and would be honored to continue serving you on the Board.

The “New” IASG

For the past several months, IASG has been in the process of updating the aesthetics of our site. To do this properly, we conducted an IASG user questionnaire to get a better sense of what users liked, disliked, and wanted to see more of…For the most part, feedback was incredibly good. Users loved the functionality […]

Nat Gas: Summer Weather and Hurricane Season Begins

Written by: Bryen Deutsch The time has come for natural gas traders to refocus on US weather outlooks. June 1st marks the official start of hurricane season. While we did see an early season storm on the Atlantic seaboard a few weeks ago, the bulk of cyclone activity occurs during the next 6 months. The […]

Are You Interested in Becoming a Commodity Trading Advisor?

Services for CTAs Grow Your Business With Us You’re busy honing and perfecting your trades and strategies; you don’t have a lot of time for client acquisition or back office management. IASG can help. List your programs FREE on IASG.com and you’ll be introducing yourself to thousands of potential new customers and partnering with an […]