Category: Uncategorized

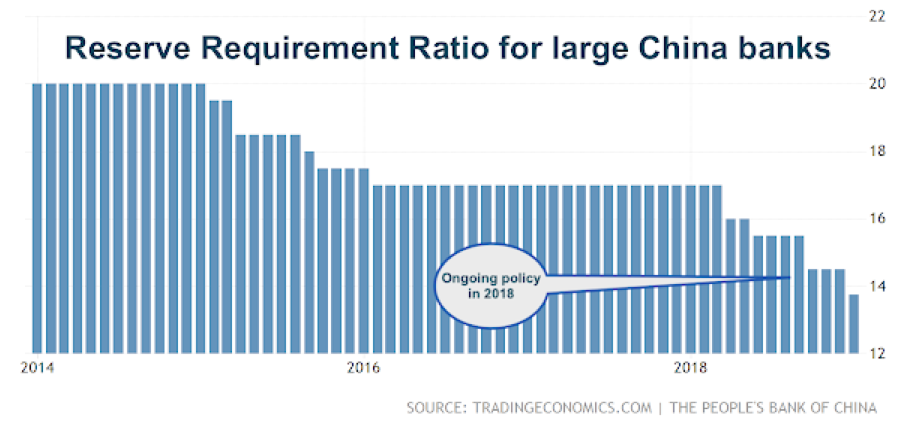

Just as important as Powell Put – China monetary action; PBOC on the move

One of our major themes for 2019 is that investors should more closely track monetary policy developments in China. The reasons are simple: the economy is big, its trade impact is global, and the PBOC at times has followed a monetary policy at odds with the Fed and ECB.

Facts and Stats – Some facts are interesting but not useful

The end of the year is usually filled with reviews and facts about what happened and speculation on what may happen in the future, yet investors can be cluttered with too many facts. Some facts can be very interesting and great for conversations, but that does not mean they are useful for plotting a course for 2019.

Powell Put in place after AEA comments

Every Fed Chairman has their own variation on the market put strategy; Greenspan, Bernanke, Yellen and now Powell. We can call this new one the “everything on the table” put strategy where the guidance of yesterday tells us nothing of what might happen tomorrow. This may be a reluctant put. Powell may have tried to stay the course for tightening, but a bear market can change the mind of many a well-intentioned central banker.

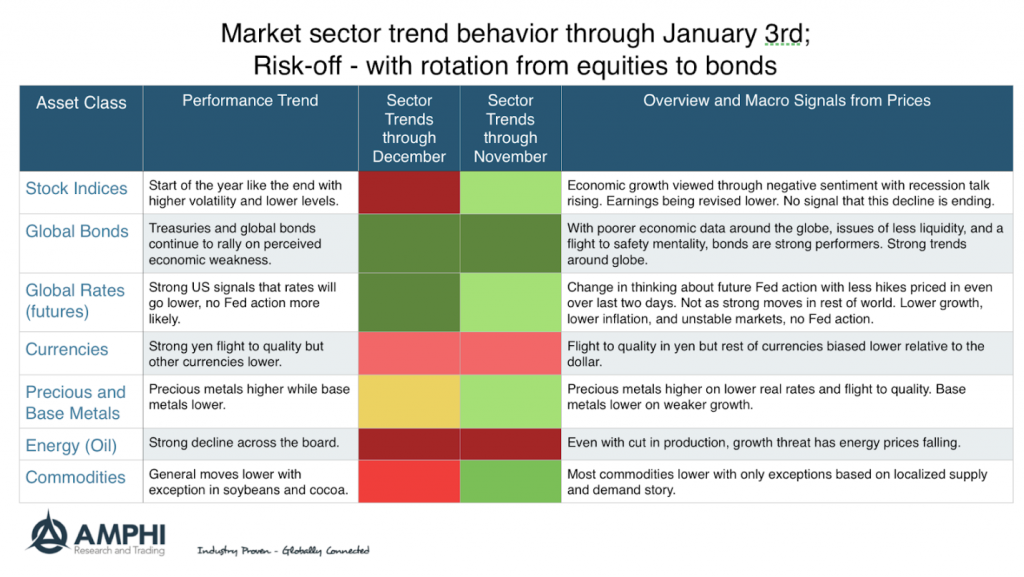

Strong trends across most market sectors

December was a great trend environment for those focused on intermediate to long-term timeframes. There were profitable opportunities in both equity indices and global bonds. Equity index trends flipped early in December and have accelerated albeit with greater intraday volatility. Bond trends continue on slower macroeconomic growth numbers and the perception of a more dovish Fed. Strong signals exist for short, intermediate and long-term timeframes.

Time Varying Alternative Risk Premia – Do You Want To Be Active Or Passive?

A big issue with building an alternative risk premia portfolio is whether you believe that it should be actively managed or whether it should just be a passive diversified portfolio. This is a variation of the old issue of whether there is investment skill with predicting returns. Investment skill is not just isolated to security selection but also can be applied to style rotation just like asset allocation decisions.

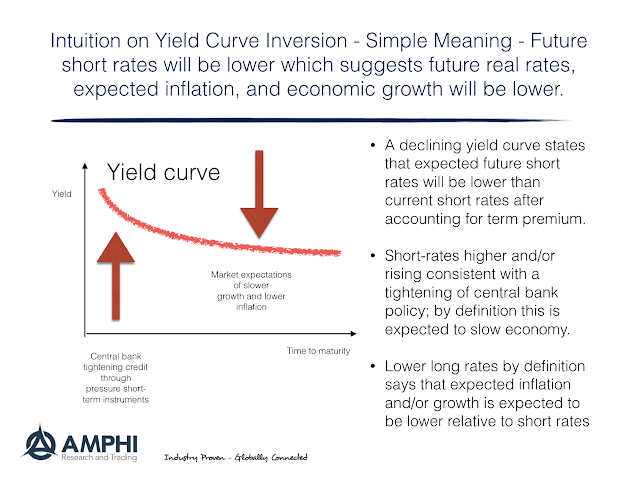

Yield Curve Inversion Hysteria – Give It a Rest

Everything you have heard about yield curve inversion is true; nevertheless, everything that is true may not harm your investments. Yield curve inversion is a good predictor of recession, and there is a link between this inversion, recession prediction, and equity declines. However, being the first to react to flattening or inversion may not win you portfolio success.

Are Risk Factors and Risk Premia the Same Thing?

There is a difference between risk factors and risk premia. This may be viewed as a subtle distinction, but it is important to think about the differences. Factors explain the return attributes of an asset. Those attributes may be either style or macroeconomic factors. Factors provide a description of what drives returns. A risk premium is what an investor receives for taking-on the risk associated with a factor. A risk premium is compensation for non-diversified risk which can come in the form of a style or a macro factor. A factor is a measurement of a characteristic. A premium is compensation for holding a characteristic. Investors want to be paid a premium for a persistent repeatable factor.

Central Bankers as a Tribe of Technocrats – Outside the Mainstream?

Are you a technocrats or a politician? If you listen to central banks, they will say they are just technocrats or experts who do not engage in politics. To discuss political implications of policy or have politicians involved in the discussion is an infringement on a central banker’s cherished independence. Only through independence and limited oversight can central banks do their sacred technical work.

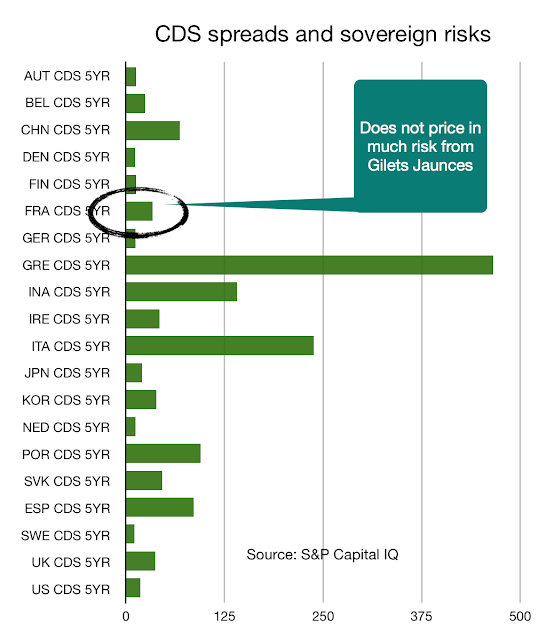

French Political Uncertainty Not Priced Effectively

The cost of being wrong with political uncertainty is significant and the impact will be felt across many markets. The yellow jacket “uprising” has already shifted French economic policy and will also affect the direction of government. We may not be extremists but the fundamental pact between the governed and government is broken which is not good for any investments.

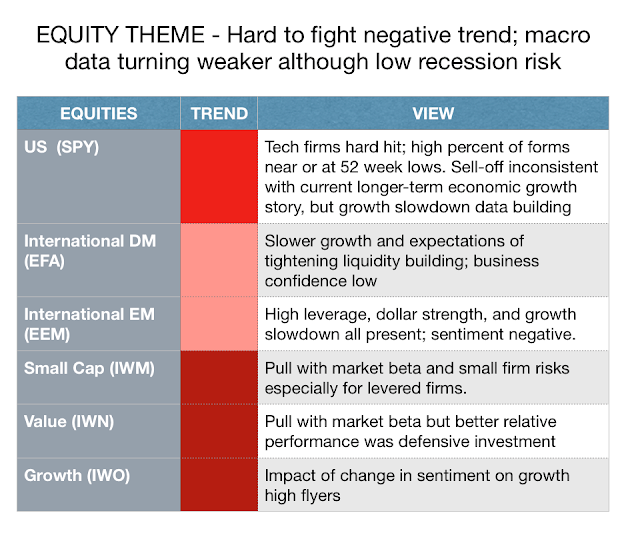

Equity Risk Allocation – No Change in Exposure Reduction View

It not a matter of like or dislike the fundamentals of equities in the current environment. When sentiment changes and volatility increases, reassessment of current exposures is warranted. However, concern about the macro environment should be increasing. Maintaining lower market risk exposure by more than half of core allocation from 60% to 30% or half equity beta exposure is appropriate. (The darker red signifies a stronger trend.)

Categorization and Classification – Fundamental to Finance and Investing

“Categorization is not a matter to be taken lightly. There is nothing more basic than categorization to our thought, perception, action, and speech. Every time we see something as a kind of thing… we are categorizing.”

– Linguist George Lakoff

From The Geometry of Wealth by Brian Portnoy

Most investment work is about forming categories. We divide securities into asset classes. We make subcategories within an asset classes. We make industry classifications. We divide risks into different types of premia. There are value classifications. There are categories and classifications based on macro factors like inflation. Investors like to group. All scientists like to make groups and form clusters of similar things to find commonality.

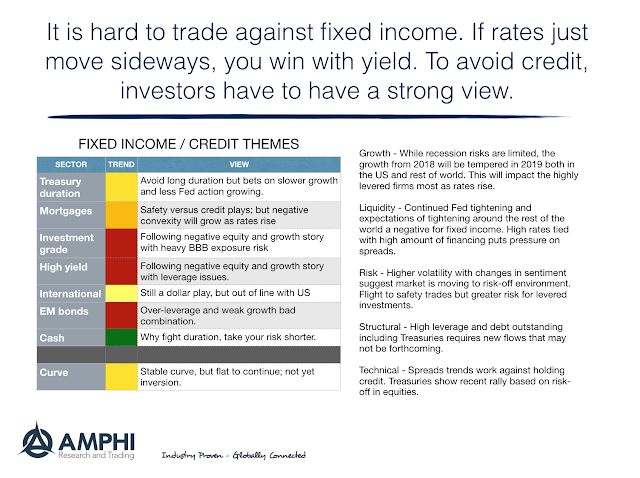

Fixed Income Choices – Move To Further Underweight

Current views on asset allocation in fixed income and credit are generally negative. The focus should be on holding shorter duration and cash investments.

Spread Widening Can Be Costly – All Is Not Well In Credit Land

It does not take much for an investor to have a losing credit trade on long duration bonds. The average duration on a long-term 10-year corporate is around 8 and current OAS spreads for triple-B corporates are 160 over Treasuries up from 120 earlier in the year. Half this move will take investors back to levels seen in 2016 and wipeout all of the spread compensation for a year. This is not an extreme bet if we have any further erosion of equity prices or change in credit risk expectations, (See Corporate debt growth has exploded – The added macro shock sensitivity creates real risks.) Shorter duration corporates will be at less risk given their lower duration but the stocking up of credit for yield reaching can be painful if credit risks increase.