Category: Uncategorized

No Diversification in Mudville – Time To Try Different Risk Premia Styles

Diversification is usually thought of as a longer-term concept. Don’t worry if it seems like you are not receiving diversification in a given month or quarter. Think about diversification across a longer horizon. Diversification also does not guarantee better returns for a portfolio. Negative diversification does mean that your losers will be offset with winners.

Evolution and Adaption: Trend-Followers are Constantly Changing

Hedge funds styles, strategies, and firms evolve over time. The behavior of a hedge fund today is not the same as yesterday. These behavior changes are not because a manager has changed his style but because the environment, the tools, the regulations, and the ideas surrounding finance are different.

Blending Risk Premia and Generating Craftsman Alpha

Alpha generation will fall when it is measured correctly through an appropriate benchmark. Alpha shrinkage over the last ten years is a measurement problem. Returns for hedge funds are a combination of the underlying risk premia styles employed and the skill of the manager.

Alpha Production – As We Get Better at Beta Measurement, Alpha Will Decline

A growing investment management theme over the last few years has been the incredible shrinking alpha. As investors gain more information on risk premia, there seems to be less alpha produced by managers. In reality, alpha production has likely not changed, but our measure of alpha has gotten more sophisticated so the skill associated with any manager seems to have declined or at least changed over the last decade. We can now tie what was previously thought of as alpha to specific risk factors. If alpha is tied to systematic risk factors, then it really is not alpha.

25 Years after Jegadeesh and Titman – The Momentum Revolution

Trend-following and momentum has always been an important part of hedge funds and alternative investing but it would be hard to say that trend-following was mainstream thinking prior to the early 90’s. This was the high water period of the market efficiency, but that thinking started to take a major change with the “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency”, published in the leading Journal of Finance. There were other papers that discussed similar topics and the behavioral finance paradigm shift had already begun, but this was the one paper that many academics started to quote with increasing frequency about momentum effects.

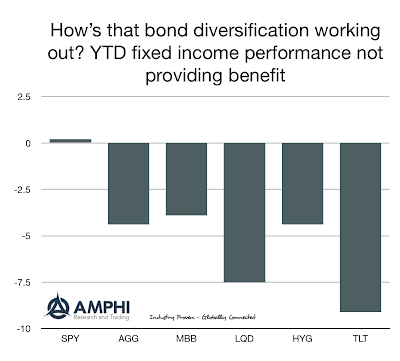

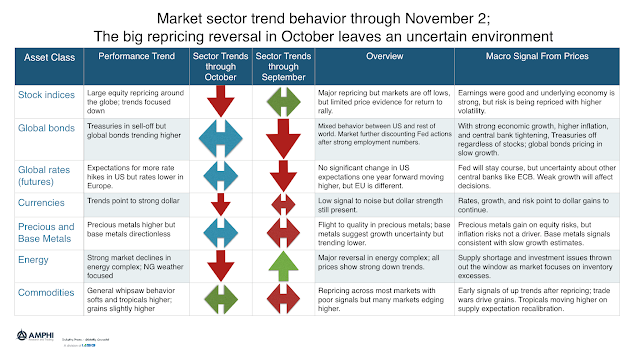

The October Repricing Causes Low Signal to Noise, Limited Trends

When markets reprice risk, it is not fun being a trend-follower. Long equity indices were a crowded trade and few made money when the early October reversal hit the markets. Fast traders were able to exploit the move, but a bounce off the lows hurt intermediate traders. Bonds were hit with the cross-currents of flight to safety against the continued threat of growth and Fed action. Currencies were hit with this repricing and not a place of profit able trends.

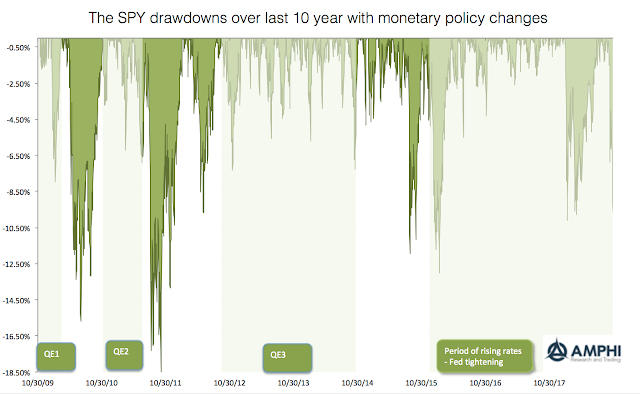

The Price of the Fed Not Providing New Liquidity – Larger Drawdowns

Our graph looks at the drawdowns for the equity benchmark SPY over the last ten years. While the current drawdown has come fast, there are have been a number of drawdowns that have been far worse albeit none that have reached the magic 20 percent market correction level. There is reason to be concerned, but investors need to have perspective.

Rising Interest Rates on Loans Current Numbers Don’t Show a Change in Standards

The channels of monetary policy are more important for any investigation of the macro economy. This is one of the key lessons from the Financial Crisis. Now that short-term rates are finally moving higher, the behavior of banks with respect to their lending activities becomes more critical. It is expected that as rates move higher, the demand for loans will be lower. Additionally, there may be a tightening of lending when rates move higher.

Emerging Markets Is A Place to Be In The Long Run

Emerging markets were talked about in many 2018 forecasts as the place to increase allocations both for bonds and stocks, yet that recommendation has been a performance disaster for many investors. For both the last year and for longer investment periods, EM has not matched the performance of DM equities or bonds. The current causes are many: trade wars scares, low commodity prices, a strong dollar and currency crises, over leverage, slower recent growth, and some strong geopolitical blow-ups. There are strong risks present, yet the arc of economic progress and convergence is still in place for those who think in the long run.

Hedge Funds – Mistakes, Pain, Competition, and Perhaps Not Enough Risk-Taking

“My mom always told me it’s okay to make mistakes, but she never worked at a hedge fund.”

― Turney Duff, The Buy Side: A Wall Street Trader’s Tale of Spectacular Excess

Decision-making will be filled with mistakes and failure. It is part of the process when making bets in an uncertain environment. No one is 100% certain and at your best, your track record will match your estimates for success. The objective of good investment decision-making is to get the process right, so failure or lack of success is not from lack of skill or outright ignorance. Nevertheless, even if the odds are in your favor, you will not get every decision right.

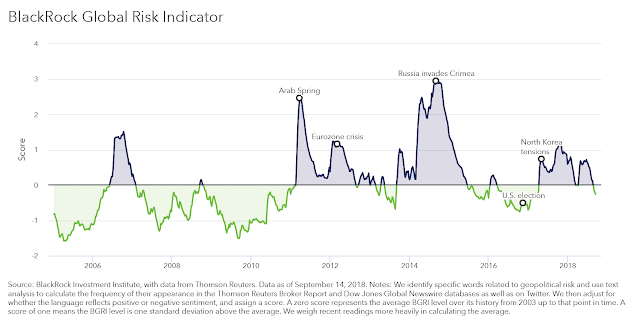

Geopolitical Risk Is Not the Driver of Any Market Decline

The BlackRock Global Risk Indicator is an interesting measure of uncertainty through looking at key work searches across a broad number of market news sources. I cannot say that this is a risk measure. Rather, the indicator is a measure of geopolitical negative news focus. It is a sentiment indicator that may lead to risk, as measured by negative market performance.

The Empirical Process Needs Narrative – Filling In the Space Between Data

The concept of investment narratives has been given a bad reputation especially by quants, yet these stories are often the glue that holds together data. Quants say, “Only look at the data”, yet the data may only be useful through words that extend meaning to the data.

Deglobalization and the Decline of the Liberal Order

The post-WWII period is special in political history. Instead of sovereign conflicts driven by self-interest, the world engaged in a successful experiment in multi-lateralism using world organizations to facilitate cooperation and resolve conflicts. This dominance of classic liberalism, albeit at times imperfect, was led by the United States that showed exceptionalism by furthering this global view and not normal imperialism.