Category: Uncategorized

Pew Charitable Trusts State Pension Review – No Good News Here

State pensions have changed their portfolio composition during the last ten years to increase their allocations to alternative investments, yet this adjustment has not helped them reach their targeted returns. This gloomy story was presented by the Pew Charitable Trusts State Public Pension Funds’ Practices and Performance Report.

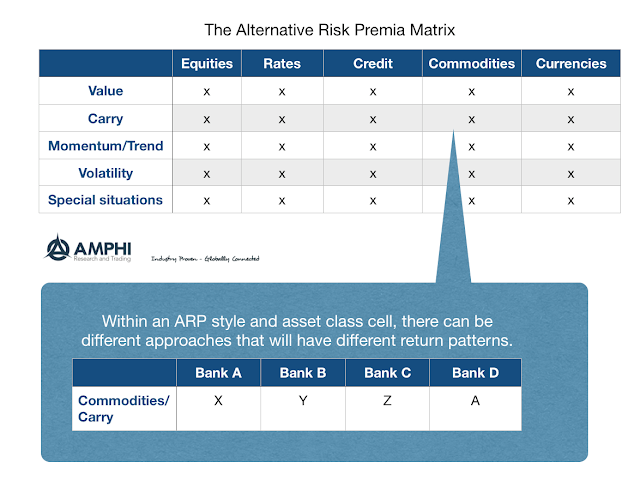

The Alternative Risk Premium Matrix – A Good Way to Jumpstart A Portfolio

An alternative risk premium (ARP) matrix is an effective way to start any portfolio construction exercise. A matrix divides risk premia through two criteria, asset class and style. We think in terms of a 5×5 style/asset class matrix. The asset classes include: equities, rates, credit, commodities and currencies. These asset classes have inherent differences that make them unique even when looking through an alternative risk premia lens. For alternative risk premia we include: value, carry, momentum/trend, volatility, and special situations. These styles are been well-defined and identify risk premia that can be exploited through forming long/short portfolios and are actively traded and structured through the bank swap market.

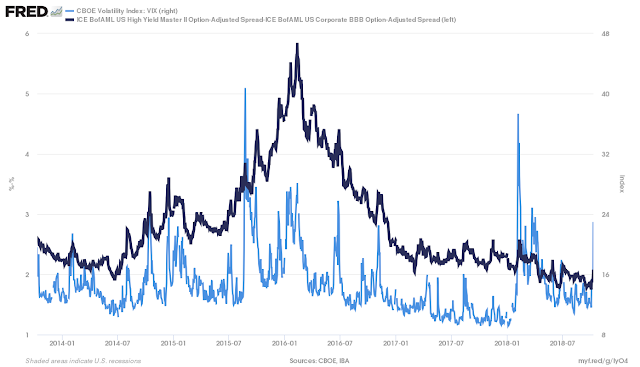

Corporate Debt Growth Has Exploded – The Added Macro Shock Sensitivity Creates Real Risks

There is no question that the explosion of corporate debt has caught the attention of many investors. This debt growth has been especially strong for BBB-rated companies which on the cusp between investment grade and high yield. Yet, like the boy who cries wolf or the doomsayer who is predicting the end of the world, warnings of a credit crisis do not seem to have affected investor activity. Corporate spreads are still tight and the reach for yield has continued almost unabated. Investors have not been given reasons to care about this debt issue today and have pushed any risks into the future.

Cliffwater State Pension Review – There Is Work to Be Done To Reach Expected Returns

There are still significant funding challenges for state pension funds even with the bull market over the last decade. The consulting firm, Cliffwater, analyzed state pension performance over the last decade in the recent review. State pensions have not been able to meet their actuarial return assumptions. This under performance places them further below their funding requirements. These funding shortfalls exist even though most funds beat a 70/30 stock bond benchmark. There is also strong return dispersion across states with the best states generating returns 25 percent over the median state return and the worst states over 30 percent lower than the median.

Forward Guidance – When In Doubt Expect a Cautious Fed

President Trump mused that it would be “crazy” for the Fed to raise rates in December, but his comments miss the point on how the Fed is operating. The continued themes through Fed forward guidance are caution and flexibility. Investors are looking for certainty about the policy path, but the Fed is only going to give fuzzy guidance. Policy will be adjusted slowly so as to not make a mistake. There will be no rules that will bind behavior. When in doubt, do not change from the status quo. We are still living a Yellen Fed world.

Corporate Spreads and Carry versus Volatility Shocks – Risk Potential Higher

Volatility has spiked higher with the decline in equities, but there are also volatility effects on other markets. Using a Merton debt framework, corporate bonds can be thought of as a risk free bond and a short put position on the value of the firm minus its liabilities. Hence, if market volatility increases as measured by the VIX, there should be an increase in corporate spreads. Additionally, the spreads should increase more for highly levered firms or firms that have higher risk such as those represented in the high yield market. This increase in spreads is related to the increase in the volatility of the value of the firm and not the volatility of interest rates or call features which will be incorporated in the option-adjusted spread.

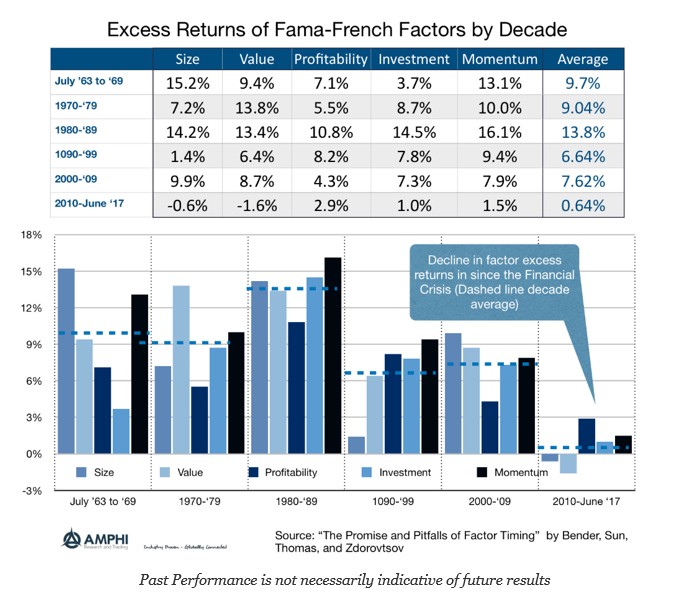

The Post Financial Crisis Decade: Unusually Low Factor Returns and an Investment Drag

The post Financial Crisis has been an unusual periods especially when measured by factor excess returns. Simply put, there were no traditional factor returns as measured by the classic Fama-French factors. A comparison across decades show that factor returns are variable but generally positive and average from 6+ percent to just under 14 percent. The average excess returns for Fama-French factors since 2010 have been less than 1 percent. If you tried to make money playing these risk factors you got paid nothing. Since factor investing is the bread and butter of equity hedge funds, this is a clear indication why hedge fund investing has under-performed or disappointed many investors over the last few years. Forget about alpha decay, there has been limited return from investing in risk factors.

10 Years after the Financial Crisis: What Have We Learned For Asset Management?

Let’s ask a simple question. After a decade, what are special lessons that money managers internalized from the Financial Crisis? If there was no financial crisis, money managers would have learned many of the concepts of behavioral finance. Investors would have learned the value of passive investing and ETFs. Asset manager would still have allocated to hedge funds, and diversification strategies would still be employed. Perhaps the Financial Crisis intensified these trends to alternative diversification strategies, but ten years after the crisis many of the concerns, fears, and behavioral changes may have been lost in a bull market

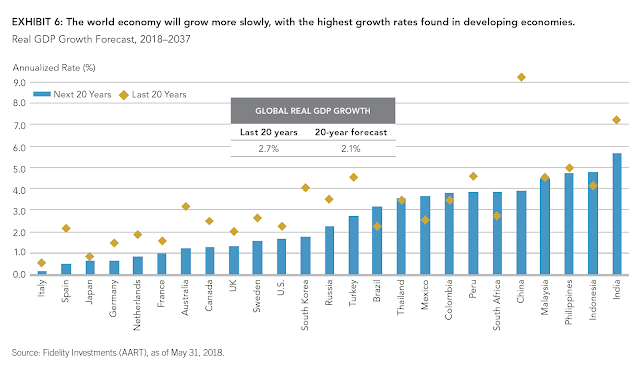

Long-Term Growth Pessimism From Fidelity Investments – What Should You Do?

Fidelity Investments as come out with their long-term secular global growth prospects and it sobering tale of lower growth. (See Secular Outlook for Growth: The Next 20 Years.) With few exceptions, the growth for each of the countries studied will be lower. The exceptions are based on catch-up, the idea that very low productivity countries will increase productivity as they move closer to the rest of the world. These forecasts are not based on any exogenous events that will cause economic growth disruptions. They are only focused on demographics and productivity. Populations will be aging, growth rates will be slowing, and productivity is not expected to see any increases over current trends.

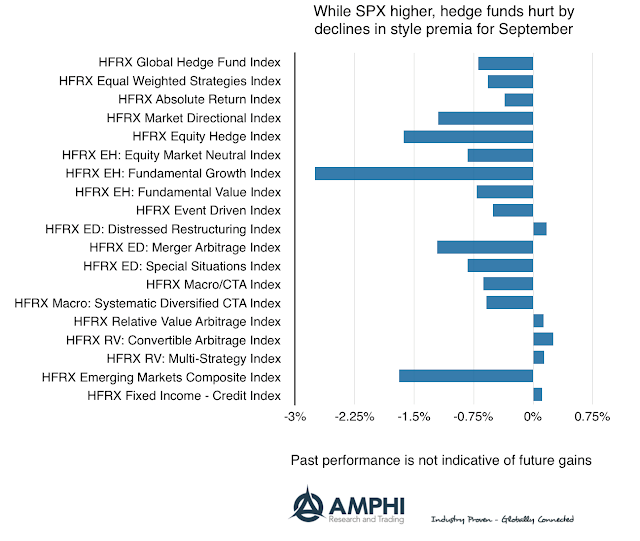

Hedge Fund Styles Underperform – More Risk-Taking Will Be Required To Make Positive Returns

You would not think some hedge funds would be down so significantly for September returns given that the major stock index (SPX) moved higher, but upheaval in small cap, value and growth harmed the average equity hedge fund. There were some positive gains in relative value managers, but it was a generally a tough month for those trying to actively find returns.

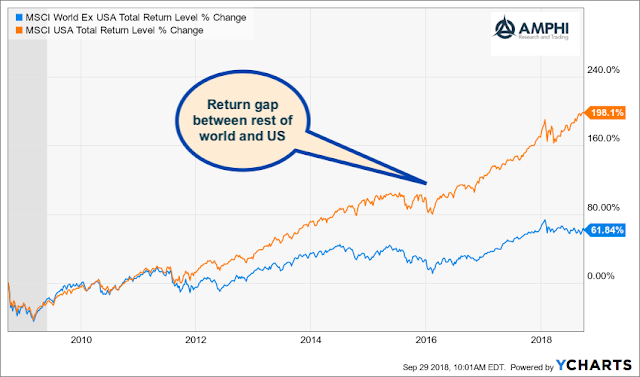

The Big Equity Return Gap – Should We Expect the “Great Convergence Trade”?

There is a large return gap in equities. The US and the rest of the world are living in two parallel equity investment universes. For the US, strong economic growth, loose monetary policy even with the current tightening, and pro-cyclical fiscal policies have proved to be a successful investment elixir. The rest of the world is facing slower growth, debt without gains, and an environment that has been filled with uncertainty. We are not arguing that the differential is unjustified. However, we are surprised by the length and size of the gap given the interconnectedness across markets especially in the developed world. This is not the equity diversification that investors expected or desired.

Strong Directional Trends in Bond, Rates, and Energy Sectors

September was a slightly down return month for many trend-followers as the first half of the month was range bound. Our sector indicators showed most markets not having clear trends with only some slight directional tilts. During the month, the markets became more directional for bonds, rates and energy. The price action in these markets aligned with economic fundamentals. A combination of continued good economic news, higher inflation, and another Fed increase all point to negative fixed income markets not just in the US but across all developed markets. Equity market signals were less clear-cut as the combination of higher rates and strong economic growth generated crosscurrents that were less clear. Cash flows should be higher, but the discount rates are also higher.

10 Years After the Financial Crisis: What Have We Learned?

We spend a great deal of time studying history, which, let’s face it, is mostly the history of stupidity.”

-Stephen Hawking

“We learn from history that we learn nothing from history.”

-George Bernard Shaw

I don’t want to sound pessimistic, but it cannot be helped when reviewing what lessons have been learned since the Financial Crisis. It has been a decade since the Financial Crisis; however, some of the same problems that led to the crisis seems to still exist. Yes, there are differences; subprime loans, mortgage excesses, and bank leverage will not be the problems. Some of the structures have changed and our knowledge of financial channel dynamics on the real economy has improved, but the meta-issues of credit, leverage, and liquidity still seem to exist with limited solutions and discussions.