Category: Uncategorized

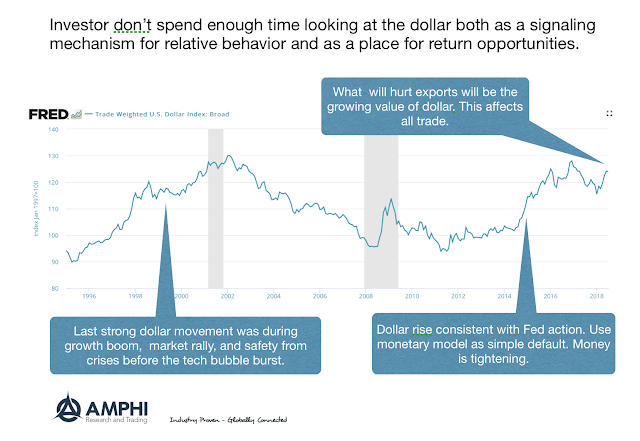

The Dollar is Sending Signals if You Care to Listen

I am concerned about tariffs. They are strong effects on importers and exporters in industries affected by tariffs and we don’t really know how tariffs will impact the supply chain and logistics for many companies. Nevertheless, the strong dollar will have a bigger impact on US exporters across the board.

Fisher on Debt – It is a Cycle and When Optimism Falls, So Will Financial Assets

…the public psychology of going into debt for gain passes through several more or less distinct phases:

(a) the lure of big prospective dividends or gains in income in the remote future;

(b) the hope of selling at a profit, and realizing a capital gain in the immediate future;

(c) the vogue of reckless promotions, taking advantage of the habituation of the public to create expectations;

(d) the development of downright fraud, imposing on a public which has grown credulous and gullible.

“The Debt-Deflation Theory of Great Depressions” Irving Fisher

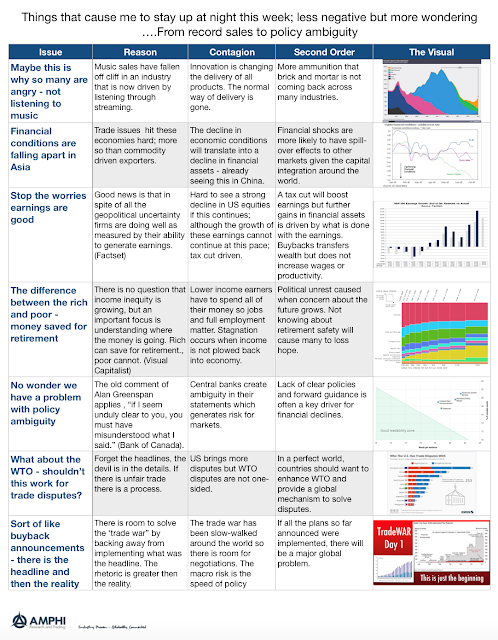

Things That Make Me Stay Up At Night This Weekend – From Music to Ambiguity

I have fewer concerns this week; however, there is significant risk with inflation. Inflation is growing around the world. We are pass 2% in the US by any number of measures. Let the overshoot begin. There is little reason so see the Fed changing their behavior and there is a stronger case for further money reduction around the world. The trade rhetoric is still high and there is general agreement that further trade action will slow growth, yet we continue to move down this path.

Technical and Practical Knowledge – You Need Both for Asset Management

Can anyone who has technical knowledge become a good money manager? This is a fundamental question for the quant revolution.

Manage Investments Like Leonardo da Vinci – Think Out of the Box, Be Curious

I have just finished reading the insightful biography of Leonard da Vinci by Walter Isaacson. Isaacson makes da Vinci accessible as a person. HIs description really struck me. Da V+inci should not be placed on a pedestal of genius. He had a humble beginning. He did not have the schooling that others received during the period. What he did have was relentless curiosity. If you look at his notebooks or his art you will see his incredible power of observation and a mind that was not limited by conventionality.

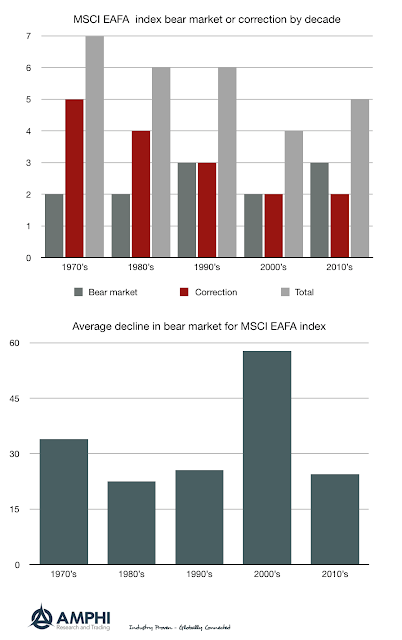

Bear Markets Are Unavoidable – So What Are You Going To Do About It?

How often should you expect equity bear markets? Using the global diversified MSCI EAFA index, we calculated the number of bear markets, moves down greater than 20%, and corrections, move down greater than 10%, since 1970 by decade. (Hat tip to Ben Carlson of “A wealth of Common Sense” for providing the raw data for developing these charts.) The numbers suggest that you will get 2-3 bear markets per decade. The number of corrections or bear markets total 4 to 7. The average decline of the bear markets is variable. The 2000s decade was horrible with two bear markets more than 50%.

Alternative Risk Premia Showed Varied Performance Over The Last Year

The new HFR bank systematic risk premia indices provide a wealth of information on this growing and important investment area. All alternatives risk premia are not created equal. A review of the return performance over the last year shows that there were clear winners and losers.

2/20 Fees – DOA, Dead on Arrival – The Changing Market Structure for Hedge Funds

The film noir, “DOA”, had a great premise – a man staggers into a police station and wants to report a murder – his own. He was poisoned and had a limited time to find his killer and why. The hedge fund industry 2/20 fee schedule is dead. Some managers may not know it yet, some are in denial, but it happened and now it is just a matter of sifting through the suspects to find the killer.

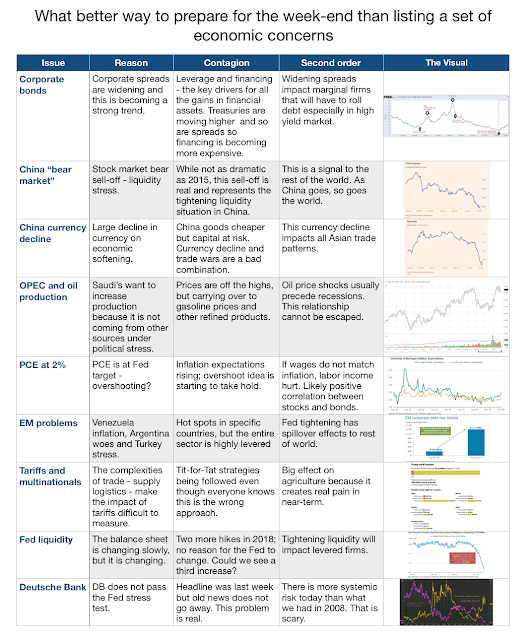

If You Need Something To Give You Financial Worries This Weekend, This List Will Do It.

The employment report for June was positive with both job creation strong and the participation rate higher. This is reflected in the stock market, but there are still growing clouds of economic and financial concern.

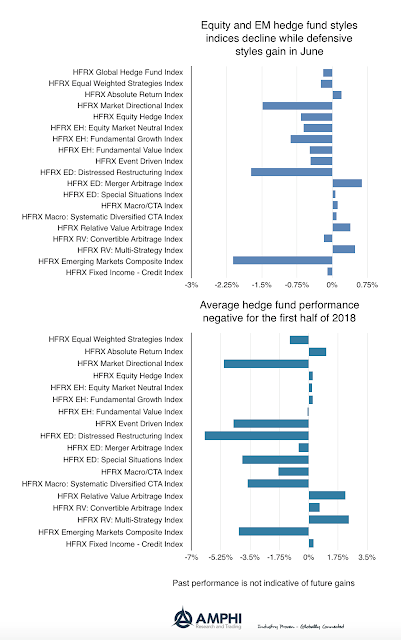

Hedge Fund Performance Poor for 2018 – Limited Alpha Generation

Hedge fund styles as measured by the HFR indices, on average showed negative performance for June. EM strategies were the hardest hit sector. The only bright spots were merger arbitrage, defensive strategies like global macro and relative value. The general decline in equity markets globally and more mixed performance in the US held back returns.

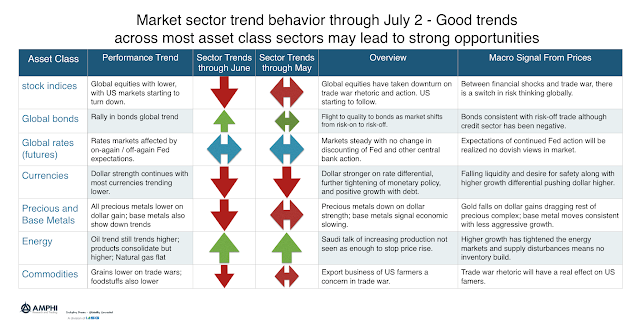

Strong Trends Across Most Asset Class Sectors Point to a Strong Opportunity Month

A review of trends in each of the major asset class sectors shows that there should be a strong return opportunities in July. Global stock indices are declining on trade war rhetoric and action. This growing sense of risk has spilled-over to bond markets through classic risk-on/risk-off behavior. Bonds have gained even with the threat of higher inflation. The dollar looks to continue its up trend as money flows back to the US and away from EM. Precious metal prices have fallen on the dollar strength. In spite of the Saudi’s willing to increase oil production in response to falling inventory, oil prices have continued to trend higher. Grain prices have fallen on fears of a trade war in agricultural exports to China. The general direction in commodity prices has been lower.

Risk Should Not Be Determined by Feelings of a Past Experience – Block the Perceptions and Focus on Some Numbers

Risk perception is often about pain and not probabilities. It is about the experience of risk not the mathematical chance or size of loss. I would like to say that everything about risk management is measurable and can be reviewed dispassionately, but that is not the case. There is often a difference between fear and facts and this is the perception gap which often leads to bad judgment. You may be a dispassionate risk assessor, but the market’s perception of risk may be driven by its weighted perception of the risk.

The Power Law, 80/20 Rule, and Concentration of Returns – What It Means for Money Managers

The power law has been become a strong fascination to me. We have been trained to generally think about the normal distribution. The law of large numbers has been pounded into our psyche since our first class in statistics but as you look more closely, the more relevant the power law becomes. Now, a normal distribution will produce extreme values. However, in a power law the extremes follow certain characteristics such that the “top few” are unbundled or more likely to have an extreme, (as opposed to a normal distribution where the “top few” are exponential and bounded).