Archives

Gamma Q February 2022 Market Update

Commentary provided by Todd Delay of Gamma Q Our long bias to corn and the soybean complex drove returns for February. Deteriorating weather conditions in South America ratcheted down production estimates, providing support to corn and soybeans; then, as the month came to an end, it was marked with the opening of the Russian invasion […]

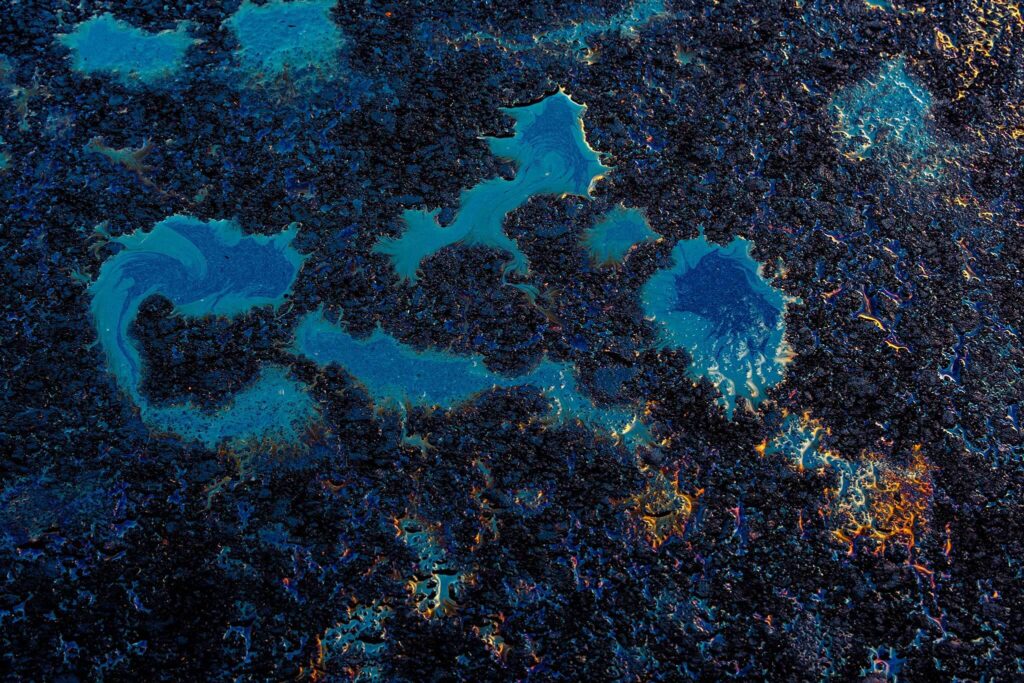

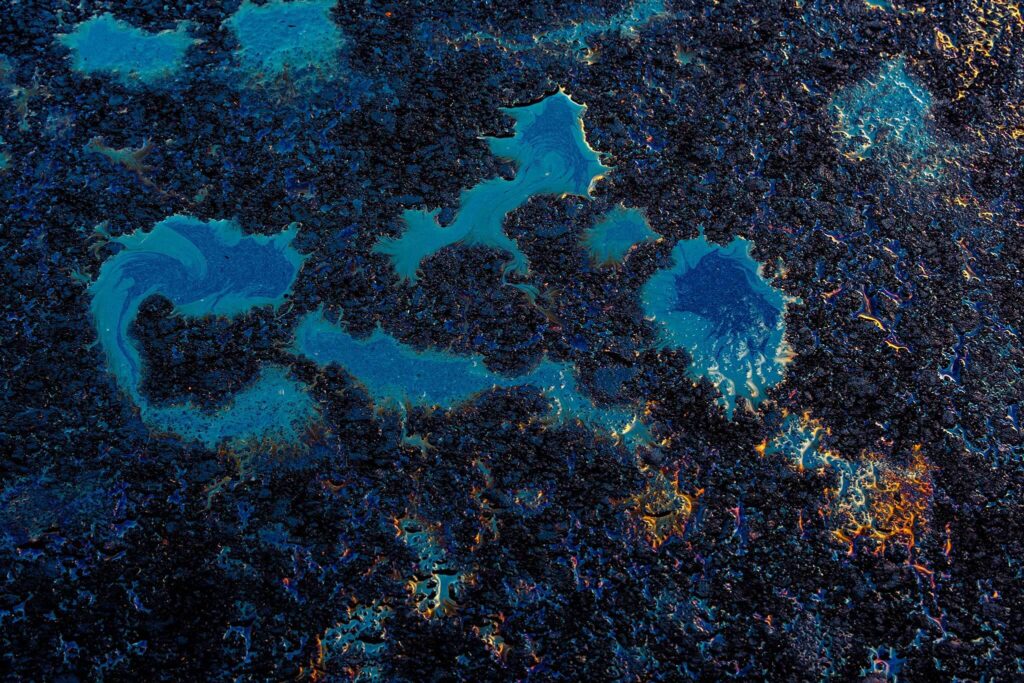

A Nickel for Wild Ride

While the world focuses on oil prices, a little paid attention to commodity was a big story last week that mostly went unnoticed. The price of Nickel skyrocketed 250%, which caused the LME exchange to suspend trading and put a big Chinese bank in a huge hole. Not surprisingly, Russia produces a significant quantity of […]

Biggest Weekly Commodities Gain since 1960

The war in Ukraine is pushing commodity prices well beyond their recent inflation-induced highs, and it appears things may get worse. Bank of America says that commodity prices have seen their strongest start since 1915. Here are some highlights for the week (to confirm these are changes for the week, not the year). Oil prices […]

Russian Sanctions Already Traded: GZC Strategic Commodities Fund January 2022 Report

Commentary by GZC Investment Management In January, global energy demand was on the strong side of expectations, with oil storage in OECD drawing significantly. However, global crude oil balances suggest it is likely to ease for the coming months despite a strong backwardation in oil curves and limitation in US stocks building instrumented by Saudi […]

Gamma Q January 2022 Market Update

Commentary provided by Todd Delay of Gamma Q Breckhurst Commodity Fund (onshore) was up a net estimate of 1.29% for January, and Breckhurst Commodity Fund (Cayman) was up a net estimate of 1.25%. The risk loss in trading futures and options can be substantial. Past performance is not necessarily indicative of future results. A long […]

War on Low Energy Prices

“Energy independence is our greatest geopolitical and economic tool and we cannot lose sight of that as instability rises around the globe.” – Joe Manchin on February 17, 2022 It seems that despite this warning and others, this message seems to be getting lost, and we may see real consequences shortly as Russia sits on […]

The Rush to Decarbonize

With COP26 underway, the discussion returns to how close each polluting nation can get to net-zero emissions (NZE) by 2050. This, the climate scientists suggest, is the only way to limit the pace of global warming to 1.5°C above pre-industrial levels this century. Not everyone is fully committed, but the general thrust is in this […]

Cayler Capital January 2022 Commentary

Commentary provided by Brent Belote of Cayler Capital We first turned bullish oil in April 2020, and I’m slowly starting to feel like it has run its course. We are still holding long positions, and prices will likely overshoot on the high side, but for the first time since the pandemic, we are starting to […]

AG Capital January 2022 Investor Update

Commentary by AG Capital Management Partners, LP Inflation It helps to go back to 10th-grade calculus class to understand inflation. Inflation is a rate of change (first derivative). For example, the latest headline number of 7% tells us that prices are rising on an annualized basis. What if inflation moves higher from here to 10% over […]

Is this the Season for Managed Futures?

“Winter is Coming” goes the famous line from Game of Thrones. In that context, it portended trouble ahead. Perhaps, it could also refer to the stock market to begin the year with the lowest January returns since 2008. A saying says that “As January goes, so goes the year.” The truth is that few are […]

January 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments January was a month of extreme volatility for the agricultural markets. The two primary drivers of price were the weather in South America and the Russian military buildup along the Ukrainian border. Southern Brazil, Argentina, and Paraguay experienced several days of record heat on the heels of […]

GZC Strategic Commodities Fund December 2021 Report

Commentary by GZC Investment Management Sell-side analysts and consultants remain extremely constructive, upgrading their oil price targets significantly for mid-year, and investor positioning has resumed in oil futures and options. At the end of Q3, the portfolio was positioned for upside risk as we entered the winter months; however, following further lockdowns due to Omicron […]

The Fed Pickle

I often think of an offhanded comment from the Chicago Fed Chairman Charlie Evans at a networking event shortly after the financial crisis. He said policymakers didn’t know what would happen after their extraordinary measures following the financial crisis. His point that much of what they did had never been tried before was true. I […]