Archives

2021 Year in Review

The year of the pandemic led into another year of COVID but with a hefty dose of inflation. The Consumer Price Index (CPI) in the United States rose 7% in 2021, its highest level in nearly 40 years. The ramifications of this could impact every market going forward, especially as it affects central bank policy, […]

AG Capital December 2021 Investor Update

Commentary by AG Capital Management Partners, LP Steady outlook We ended the year much as we performed all year long – one step forward, and one step back. That’s OK. In a year where our ideas have not come to fruition in a timely fashion, our job is twofold: first to question our fundamental themes and […]

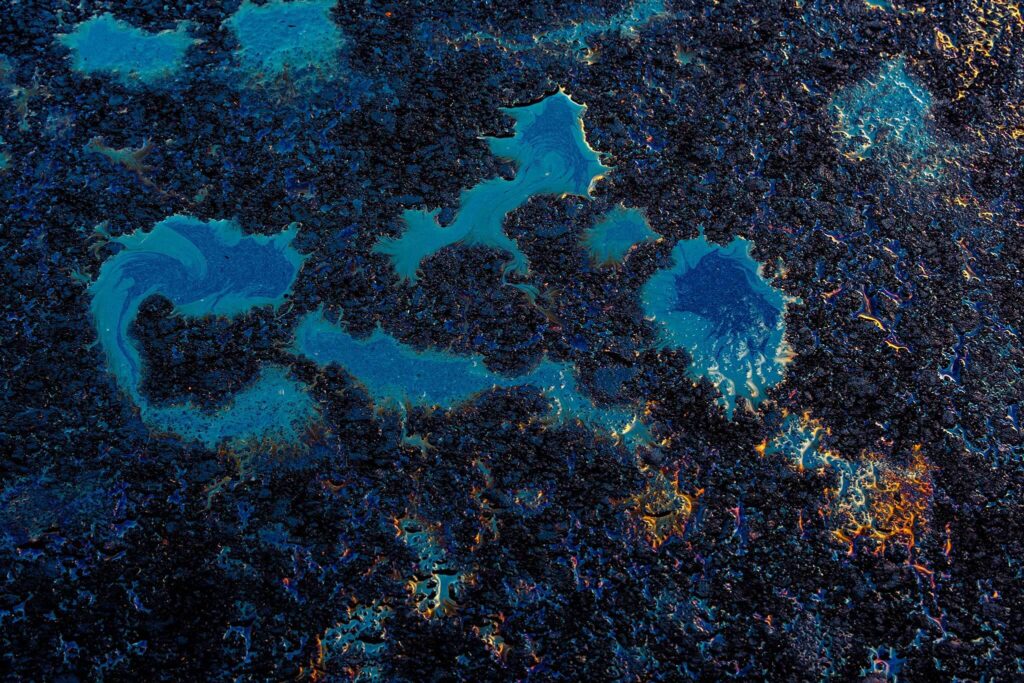

GZC Strategic Commodities Fund November 2021 Report

Commentary by GZC Investment Management November 2021 will be remembered as a month of abrupt volatility for oil, remembering September 2019, when the Saudi Aramco attack propelled oil prices $10 higher at the market open. On the 26th of November, it was not a gap open per se, but prices started diving on news that […]

Mitigating ‘attachment bias’

Investors generally feel the pain from losses twice as much as pleasure from gains. Investment judgment is skewed by initial information or experience, and investors assign excessive value to what they already own in their portfolios. These were the main findings by Nobel Prize winner Richard Thaler1 who used psychology to explore the cognitive biases […]

‘Twas The Taper Announcement Before Christmas

Investors held their collective breath as they waited on Jerome Powell to announce the newest Fed action the week before Christmas. Central bankers were unanimous in their decision to move to a less accommodative stance, and the market reaction was swift and fierce. The date, December 19th, 2018, when the Fed lifted the Fed funds […]

AG Capital November 2021 Investor Update

Commentary by AG Capital Management Partners, LP The Discretionary Global Macro Program generated a 9.3% return, net of fees, in November 2021, leaving YTD performance at -1.4%. Too late Although the Omicron variant of coronavirus is capturing current headlines, it’s not top of the list of things we care about from a macro perspective. Instead, a […]

Numberline Capital Partners November Performance Report and Market Summary

Commentary by John Knott of Numberline Capital Partners. The Numberline Macro Risk Program was down 4.36% net of all fees for November and is up 19.37% year to date. Additionally, the program has returned 14.85% over the previous 12 months. These numbers are compiled by Turnkey Trading Partners. We left off last month worried about the […]

Carbon Markets: Trading Government Policy and Corporate Commitments

What if I told you there was a futures sector that was not only driven by governments but explicitly designed to appreciate over time? Given the monetary policy of the past few years, many of us intuitively understand the influence that central banks can have on our economics. What if I told you that corporate […]

November 2021 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments As we close the month of November we are sad to report that COVID-19 has reclaimed the top spot as the single most important variable for the agricultural, and most other, markets. During the Thanksgiving break South African scientists announced that they had identified a new variant which was […]

Have you seen our updated website?

Come check out our new features! With a site used by thousands over its 25-year history, IASG works very hard to make sure we stay relevant with updated features and the most free information available in our space. Our industry-leading database is used by the largest fund managers down to the next generation of traders […]

Greatest Sale Ending

The greatest sale on IASG is coming to an end as Adalpha Asset Management is changing their fee structure for new investors from 0/30 management and incentive fee to 1/20 effective January 1st, 2021. Gary Polony quietly traded this program since 2003 alongside his proprietary business before customer assets took off in mid-2019. Despite spending immense […]

GZC Strategic Commodities Fund October 2021 Report

October was generally a strong month across the oil complex. Yet during that period gas and coal prices more or less halved. The interaction between fossil fuels continues with European gas prices ending their free fall at levels where oil prices were no longer competitive at substituting it. Spot crude oil balance tightness remained relatively […]

Warrington October 2021 Market Update

Commentary provided by Mark Adams of Warrington Asset Management After a choppy start to the month for the S&P 500 Index (“S&P”), the release of positive earnings reports sent the markets into an unabated upward trajectory with the indices quickly reaching new all-time highs. These strong gains were in the face of continued supply chain disruptions, […]