Archives

AG Capital: Fade to Famous

There’s something about being quoted in the Wall Street Journal or making it onto Bloomberg TV that often leads to terribly inaccurate judgement calls (at least in the short-term). A classic example of this is Ray Dalio’s famous interview from Davos in early 2018, where he declared that “If you’re holding cash, you’re going to feel pretty stupid” just before the market cratered -12% and potentially may have begun a topping process for the entire bull market run from 2009.

Analyzing the performance table

Disclosure documents include performance summaries for managed futures investments. Find out how to decipher the different pieces of information these summaries provide. Upon receiving a Commodity Trading Advisor (CTA) disclosure document, the first thing investors usually do is turn to the performance table found in the Past Performance section of the document. This is where […]

The Basics of Managed Futures: Understanding the Role of Commodity Trading Advisors

Managed futures are operated by licensed Commodity Trading Advisors, or CTAs, regulated in the United States by the Commodity Futures Trading Commission and the National Futures Association. Commodity trading advisors (CTAs) are asset managers who follow systematic investment strategies. Essentially, they are the operators of managed futures accounts and are directly responsible for the actual […]

Third Street Ag – How low can they go?

This summer’s theme could well have been: How low can they go? The “they” was supply and demand. Unfortunately, the competition looked more like a cage match than a limbo contest. In that analogy the heavyweight match was certainly Prevent Plant (PP) versus African Swine Fever (ASF).

Breakout Funds – Toxicity

Last night was a great chance to opportunistically be long of risk, short the long end of the curve. We got some incrementally positive news on the China front on the Europe open and, risk pushed higher, and steepeners were put out. Bears were sent scrambling to wait for the grownups to come back from vacation.

Adalpha Asset Management – Seeking Volatility

“What just happened?” is becoming an all too common phrase for market watchers over the past few weeks. Whether it be the Fed Chairman giving a talk, interest rate behavior, or a short tweet from the President, markets have been responding aggressively. Over long periods of time all of these things could often be put on the category of “noise” but in the meantime anyone watching their portfolio can get an ulcer.

Coloma Capital – Trade War Tempest or Just a Squall?

Trade War Tempest or Just a Squall? As the July 31st Fed interest rate cut was quickly overrun by the trade war tit-for-tat, we need to gain some perspective on expected impact of the US/China interaction in early August without the hype too often seen in the media. On August 1st, Trump stated that he intends to place a 10% tariff on the remaining $300 billion-ish in Chinese exports to the US as of September 1st. The prior statements were a 25% tariff (notably higher) and at an indeterminate date (easily ignored by the markets). A lower tariff that can possibly be fully absorbed by Chinese firms may ruffle some feathers but would not be a crisis. The Chinese response of cancelling nebulously-defined agricultural sales (note that pork shipments are full speed ahead, despite the existing Chinese tariff) would be partially matched off with lower US grain production from the poor spring weather. There are also some reports that the Chinese tempered their Brazilian soy purchases which implied intrinsically lower Chinese grain demand. In other words, this first response was justification for something they wanted to do anyway.

AG Capital – Volatility Expansions and Contractions

We had an interesting conversation with an extremely sophisticated allocator recently. He asked, given that you have had a good run with a long gold position this year, with large open profits, how much will you lose if it reverses hard and you are stopped out at lower levels?”. It’s a question that gets to the heart of trading, and ultimately deals with the difference between what’s known as open equity and closed equity.

Warrington Asset Management – Looking back on July

The S&P 500 continued to climb steadily up to the last trading day of the month even though market participants knew that day could bring volatility, as the U.S. Federal Reserve (the “Fed”) was scheduled to announce their latest monetary policy update on July 31st. Speculation about their intentions to lower interest rates for the first time in ten years had been a market focus for months. Fed Funds futures pricing is often used to estimate the probability of pending Fed interest rate changes, and had signaled the most likely decrease to be between 25 and 50 basis points. However, when Charmain Powell announced the 25 basis point cut he also implied it might be a “one and done” scenario rather than a prolonged rate cutting cycle favored by market participants, causing an immediate decline in stock prices. The selling in the S&P was strong, sending the Index to its largest intraday decline since early May. In fact, prior to that drop, the S&P had not had a 1% daily gain or loss in the previous 36 consecutive trading days, the longest streak since early October 2018.

JTM Capital Management – Major Factors Affecting Agriculture

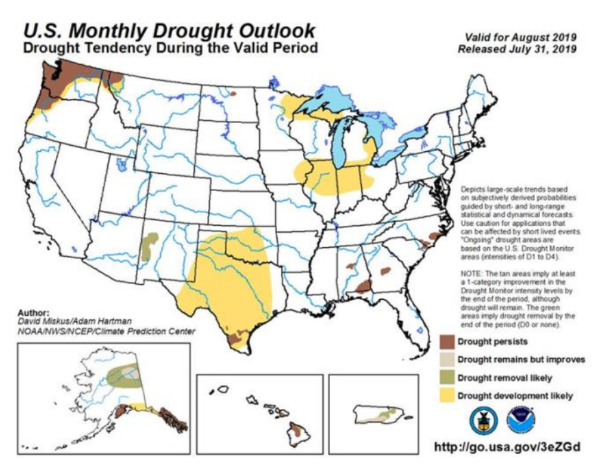

Following up on last month’s commentary, July featured lower than average rainfall and higher than average temperatures across most of the US’s primary growing regions. Interestingly enough these results were quite different than the NOAA long-range forecasts issued for the month. Specifically, most of the Corn Belt experienced maximum temperatures that averaged 2-4 degrees (F) above normal. As you can see on the left even with this year’s extremely wet spring, drought conditions are expected to develop in key growing regions of IA, IL, and IN. This is definitely something to keep an eye on as near perfect conditions will be needed to substantially increase row crop yields at this point.

Third Street AG July Commentary

Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither IASG or Third Street Ag Investments LLC nor any of their data or information providers shall be liable for any errors or delays in the data or information, or for any actions taken in reliance thereon. We do […]

Breakout Funds – Interesting days ahead

What a wild past 27 hours across Macro. Yesterday was one of the most anticipated Fed meetings in memory. Markets were looking for a cut of 25 and hoping for more – either yesterday or in the near future. What we got was 25 and a bumbling press conference where Powell seemed to have no clue what was driving Fed policy at this point. The best we could take away was further trade uncertainty may result in those much begged for rate cuts. But this was just a guess, and that’s the point.

Managing Money: It’s basically all noise, with a few exceptions

Noise and an overwhelming amount of data is the biggest challenge in managing money in 2019 (or anytime in the past decade). In the 1960s, 1970s, and even the 1980s, delivering alpha came down to having access to information others didn’t have – the process of obtaining data was a value-add. Today, we have the complete opposite problem. In 2019 we have too much information, and delivering alpha comes down to paring things back to their essence, stripping away unnecessary garbage.