Archives

Why does momentum investing work?

Conventional wisdom says that it should be doomed once any stock-picking strategy nears “sure thing” status. If everyone knows the secret to vast riches, how could the strategy possibly work anymore? But there is a successful strategy that has been followed — and widely discussed — for decades, yet somehow persists as a relatively reliable […]

What does it mean for an investment strategy to be “robust”?

In the business of managing money, there is a key word that often comes up but is easily misunderstood: robustness. What does it mean for an investment strategy to be “robust”? What does a robust strategy look like? Is it something that most investors find palatable? Look at the following returns for two different managers, Mr. low vol and Miss robust.

Sortino: A Sharper Ratio

Many traders and investment managers have the desire to measure and compare CTA managers and / or trading systems. Risk-adjusted returns are one of the most important measures to consider since, given the inherent / free leverage of the futures markets, more return can always be earned by taking more risk. The most common risk-adjusted […]

Trading Palladium: A Classic Macro Approach

Disclaimer: While investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and, in fact, result in further losses in a portfolio. In addition, studies conducted on managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies […]

Changing the dynamics of enhanced cash – Switch from credit to alternative risk premia

Investors are always looking for ways to enhance cash returns – higher yield with liquidity and limited principal risk. The timing for using different enhanced cash techniques changes with market conditions. Widening the choice set through investing in alternative risk premia may be a way to meet enhanced cash goals without significantly increasing risk.

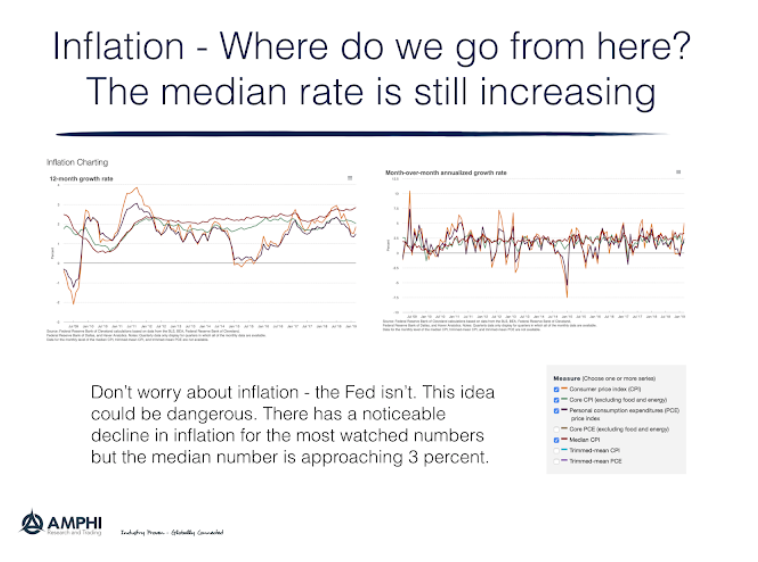

Inflation – Where do we go from here?

Don’t worry about inflation – the Fed isn’t. Or, the Fed believes there is no value is trying to get ahead of any inflation increase given the relatively tight range for inflation. The market penalized any fixed income investor that acted on inflation fears. Any Fed objective function has a higher weight on growth.

Mike Lombardi, football coaching and investing

I am not a football fanatic, but I picked up this book on a recommendation and was amazed by Lombardi’s insights on leadership and management. Mike Lombardi is long-time football executive and media analyst. The book focuses on Bill Belichick and the New England Patriots, but his conclusions could apply to any money management firm. A good money management firm is successful because it acts like a well-disciplined organization with a common purpose. That is no different than a competitively run sports organization. Lombardi finishes his book with five key recommendations for firm success that are worth presenting in bold.

“The Emeril Lagasse Theory” – Practical knowledge and culture is not often transferable

After hundreds of discussions with hedge fund managers, I am still surprised that there is a fear of revealing investment processes under the assumption that someone will steal their ideas and intellectual capital. There are few investment styles that are truly unique and special. What is special is still strategy execution – the practical process of delivering returns. Skill is with the decision-making execution of information and strategy.

From Hedge Funds to Passive Investing: The Need for a Paradigm Shift in Endowments

Endowments are supposed to be the smart money, yet if you review the recent exhaustive paper on return performance, you will get a different impression. Large endowments do better than small endowments, but when you compare with a simple 60/40 stock bond balanced fund, there is not a lot of alpha generated. See “Investment Returns and […]

Time-varying correlation – Diversification benefits are dynamic

What is the correlation between two assets? The correlation is critical because it is the driver for any diversification decision. The better question is, “What is the correlation now, and what can it be in the future?”. Correlations are often time varying and regime specific. In bad times, correlations rise, so the diversification expected is not present when you need it. This phenomenon requires more thinking about tail risks and how to best address them.

Behavioral economics – Is an atheoretical approach harmful?

Behavioral economics research has been path breaking and has truly impacted the thinking of most investors. Psychology is fundamental to human decision-making and our knowledge and understanding of economic agents has been enhanced through the large body of research in this area. Through finding exceptions and breaking down conventional utility maximization theory and wisdom, behavioral economic has advanced science, yet this work is not completely fulfilling. Our knowledge is filled with behavioral exceptions and leaves us with the impression that our decision-making skills are psychological damaged, but there is no unifying framework for how the range of biases fits within utility maximization, consumer behavior, market efficiency, and general decision-making.

Diverse ARP return pattern consistent with macro environment

A comparison of ARPs across asset classes and styles from the HFR indices shows consistency with the macro environment. We equalized the HFR ARP indices to a ten percent volatility for ease of discussion. April monthly returns are in grey while year to date returns are in red. The returns were generally lower than the market exposures, which were expected. The HFR numbers are averages and have shown significant dispersion. The low correlation across ARPs will create opportunities to improve the return to risk ratios through portfolio blending.

Microcosm versus Macrocosm – The impact of your mental model in decision-making

Every investor has a mental model of how the world works. Some may call this their philosophy. Other will call this their belief system. These mental models form their rational expectations or rational beliefs. They are rational because they are consistent with the mental model being employed. These beliefs should be unbiased. If they are not, it requires the investor to adjust their model to eliminate the bias.