Archives

Diverse ARP return pattern consistent with macro environment

A comparison of ARPs across asset classes and styles from the HFR indices shows consistency with the macro environment. We equalized the HFR ARP indices to a ten percent volatility for ease of discussion. April monthly returns are in grey while year to date returns are in red. The returns were generally lower than the market exposures, which were expected. The HFR numbers are averages and have shown significant dispersion. The low correlation across ARPs will create opportunities to improve the return to risk ratios through portfolio blending.

Microcosm versus Macrocosm – The impact of your mental model in decision-making

Every investor has a mental model of how the world works. Some may call this their philosophy. Other will call this their belief system. These mental models form their rational expectations or rational beliefs. They are rational because they are consistent with the mental model being employed. These beliefs should be unbiased. If they are not, it requires the investor to adjust their model to eliminate the bias.

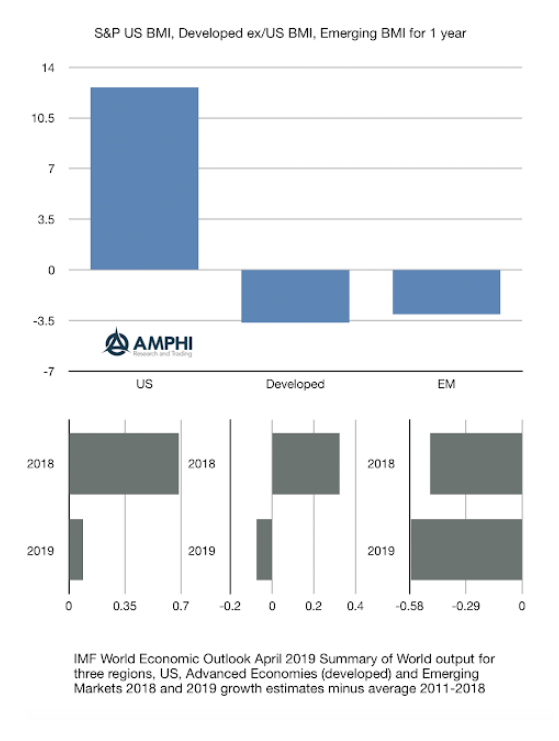

Global Macro Rationality and Equity Returns – Consistent With Growth Story

While some question the rationality of markets over the last few quarters, we believe equity markets are global macro consistent. This consistency can be seen in the return pattern for the US, developed markets, and emerging markets. As a simple surprise number, looked at the difference between the average growth rates for three macro categories from the IMF WEO from 2011-2018 against 2018 growth and expected 2019 growth.

A “Playbook” versus “Rulebook” and reaction to uncertainty

How do you deal with uncertainty? Some will suggest following rules. Disciplined and systematic investing is the best way to deal with the unknown because there is specific action regardless of the environment. Others argue for flexibility. Unknown or surprise events require special action. When faced with uncertainty, it may be best to adapt and adjust to the specific situation. Arguments can be made for both.

Credit risk – Profitability more important than leverage

There should be concerns about the amount of corporate leverage in the economy, but if there is no catalyst credit event, current risk is limited. We are not downplaying potential credit risk, but there needs to be focus on the right issues that will drive corporate bonds spreads higher.

Bending the return curve with rebalancing using trend-following

Rebalancing has become an essential tool for portfolio management. Nevertheless, market return patterns will affect the return impact of rebalancing. Regular rebalancing is a mean-reverting strategy. For example, suppose there is a simple 60/40 stock/bond portfolio. In that case, stronger stock performance will cause the allocation to deviate from the strategic allocation and lead to […]

How many animals should be in the factor zoo?

Investment factor growth has exploded to the point that are now close to 400 identified through research published leading finance journals. This factor explosion has been called the factor zoo and it is overcrowded. A careful review of the statistical testing procedures will tell us that it is highly unlikely that all of these identified factors will be true. Many are statistically significant only by chance given multiple testing problems. Additionally, if we impose transaction costs on these factors, their profitability will be diminished and in many cases not useful.

Factor Investing – Not as easy as many expect

Investors can form exaggerated expectations on what can be the potential return performance from factors. Some have described a “zoo” of factors. There are now hundreds of factors that have been analyzed and reported in the academic literature. Nevertheless, many have been hard to replicate, show performance return declines after being researched, and have failed when tested out of sample under realistic market conditions. These poor results may be from data mining, not accounting for transaction costs, data mining, poor design, and potential crowding. There are successful factors that have stood the test of time, yet even their performance has been time varying and may be less successful factor after accounting for all costs. Don’t be disappointed if actual returns are less than what is reported in academic studies.

Risk Management – Controlling what you have not thought of

If you have an asset that has some market risk but a large portion that is unexplained, the risks you face are different. You still can either leave the market risk exposed or hedged, but the majority of the risk cannot be explained. Hence, it cannot be truly hedged. You can conduct further analysis to measure the risks from other factors but you may still be left with a high percentage unexplained. You may have thought of everything with respect to your risks, but there is a lot leftover.

Cognitive Priming and Trend-following – Not a Bad Thing

Cognitive priming is a real effect that has often not been discussed with investment decisions and behavioral finance. Suggestions can be used to steer the behavior of investors. Priming is the use of stimulus to create a memory effect or create a temporary increase in accessibility of thoughts and ideas. It is the non-conscious use of memory. It could be used to increase both positive and negative thoughts, ideas, and behavior. Businesses have constantly used priming in advertising to help steer or suggest positive memories. Psychologists have tested priming for years and find that the power of suggestion or linkage is real and extensive. At the extreme, think of Christopher Nolan’s movie Inception on the idea of implanting ideas in memory.

Liquidity Risk: Why Every Investor Needs an Exit Strategy

If there is an adverse market move and you want to change portfolio allocations and sell some securities, will you get a fair price? Any downside situations that investors will face will face a liquidity shortage. This is different than thinking about illiquid investments, where the knowledge concerning illiquidity is known. The IMF Global Financial […]

Be a Coach Belichick 5-tool Investment Leader

He (Bill Belichick) is a five-tool leader, adept at strategy, tactics, preparation, execution, and what you might call situational intuition, the rare ability to know which among the first four is required and when.

The Growing Impact of Industry Domination on Futures Markets

Few will disagree that competition through a diverse set of independent traders is good for futures markets trading. Still, this issue should be broadened to the subtle impact of general competition across firms in the economy, not just the futures markets themselves. A growing set of recent research suggests that the US is becoming less […]