Archives

The dispersion in hedge fund returns – Differences in style matter

All hedge funds are not created equal as the return box chart shows for the post Financial Crisis period. There is a significant amount of dispersion across hedge fund styles. Over the period 2009-2018, the difference between the best and worst hedge fund category is almost 7 percent after we account for global equities and bonds.

The Desire For Private Equity – Return And Yield; But Time May Be Running Out

The attraction to private equity and other less liquid alternatives is clear from the Guide to Alternatives by JP Morgan Asset Management. The return profile is much higher for private equity and debt funds than more liquid alternatives and global bonds; however, the dispersion in returns is multiples higher than what can be expected from other public categories.

Where are you getting diversification within alternatives?

All alternative investments and hedge funds are not created the same. There is significant dispersion in their correlations with global bonds and equities. Some are better at diversification and others are good for adding returns. A recent Guide to Alternatives from JP Morgan Asset Management provides long-term correlations for alternatives and hedge funds for the post Financial Crisis period.

Risk premia versus hedge funds – Worth a look

As we better understand the return generation process, we are able to dissect any set of money manager or hedge fund returns into its component parts. At a high level, any money manager can be divided into a set of risk factors or premia and alpha or skill. As a general conclusion, researchers have found that as investors get better at identifying risk factors, the size of alpha declines. We are able to attribute more returns to specific risks so the amount that is leftover as skill declines.

Why Probability Matters More than Direction: Insights for Traders and Investors

One of the critical problems with decision-making is that it is often simplified into either/or choices. “Yes/no,” and “Go/No-Go” is how we often focus our attention and make decisions. Life is easy when problems are framed as either black or white. For example, the Fed will either tighten or not tighten. Employment will either increase […]

Naturalistic decision-making permeates investment world

Gary Klein is one of the great researchers in practical decision-making; however, he has been overshadowed by the behavioral bias revolution and the more popular work of Nobel prize winner Dan Kahneman. That is unfortunate and should be rectified. Klein focuses on naturalistic decision-making; the fact that decision-making in real life is significantly different than anything in a controlled environment.

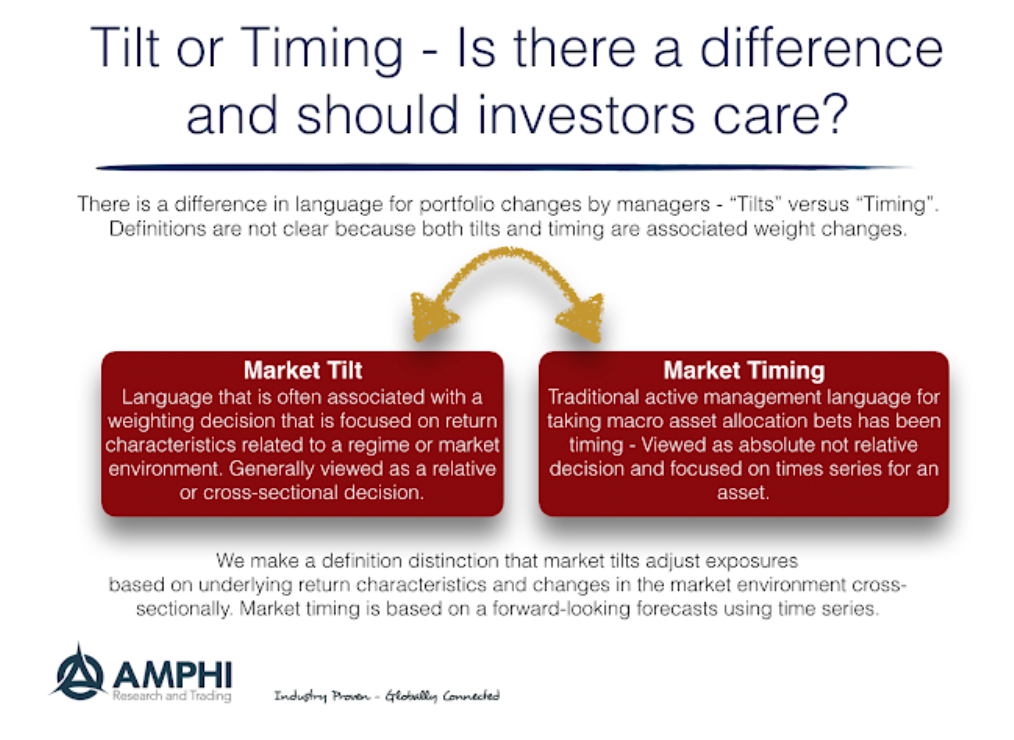

Market Tilt or Timing – Is there a difference in forecasting?

At a recent conference, I heard a large money manager say the following, “We do not market time, but we do take market tilts.” Unfortunately, no one was able to ask the manager to clarify the difference between tilts and timing. Aren’t they both forecasts?

Premortem for decision-making – Better than waiting for the decision postmortem

All investors and traders want to get better as decision-makers. They are open to learning and improvement, and a natural way to gain this improvement is through reviewing their actions after the fact. The old adage is that we will learn from our mistakes. If you have a thorough review process, you can form an effective feedback loop to ensure future decisions will not be driven by the mistakes of the past.

Non-normal distributions – Assume tail risks are higher than normal measurements

If you assume a normal asset return distribution world and it does not exist, you will be surprised with return performance especially in the tails and unlikely for the better. Of course, when in doubt, the rule of thumb for any sample of return data is to assume normality. Using the central limit theorem is a good starting proposition for any discussion, but it is not where the return discussion should end. The distribution assumptions are a place for danger with decision-making.

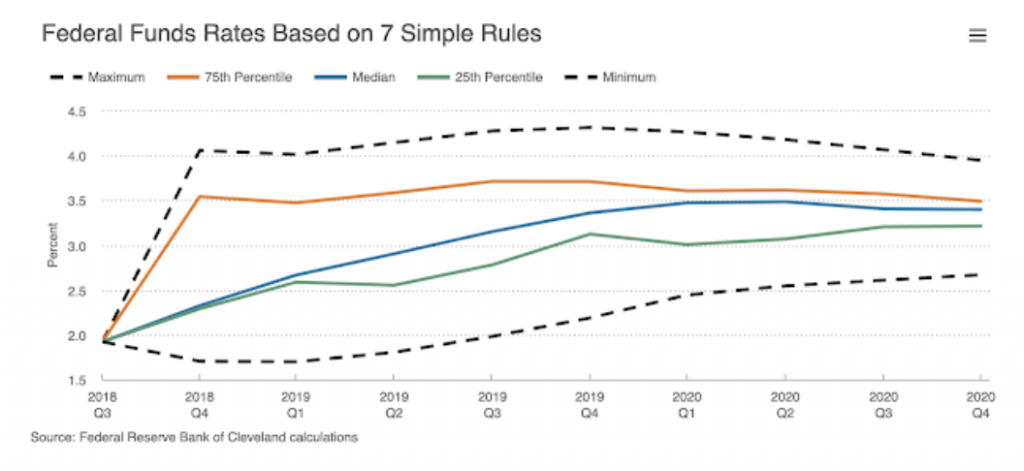

Bracketing Fed Funds rates through a known set of model – Getting good probabilistic estimates

An ensemble approach to modeling can be an effective way to get a good idea of the consensus and differences in forecasts on futures moves in the Fed funds. This is an effective alternative to looking at Fed funds futures and options as a market estimate.

Trend-following is not the same as following the herd of opinions

Investors may be viewed as trend-follower because they chase performance, only picks recent winners, and sort on performance. However, trend-following professionals often exploit this undisciplined, casual, and unsystematic approach to trends through the investment scaling of chasers. Investor behavior driven by tracking the opinion of peers is a form of trend following and may create price trends; however, it is not the same as a disciplined approach to finding trade opportunities through rules-based behavior.

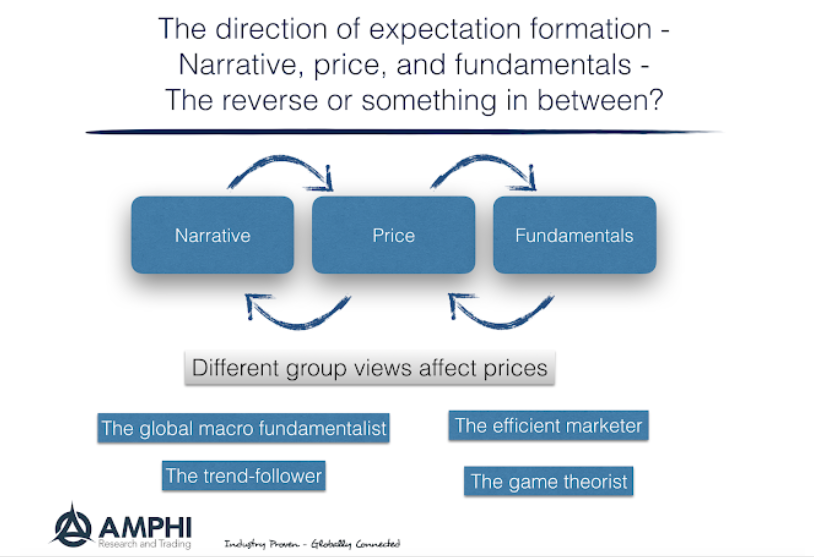

Mastering Market Philosophy: How Your Investment Strategy Shapes Your Profits

Any investor needs to know two things: what is the philosophy that drives his decisions; what is the philosophy that is driving the market as a whole. Are you price, fundamental, efficiency or narrative driven? Is the market currently price, fundamental, or narrative driven? Know your expectation mechanics.

WYSIWYG, Hedge Funds, and Alternative Risk Premia – The Business of Product Marketing

WYSIWYG – “What You See Is What You Get”. This is a phase that has been applied in computing to describe the standard that what is on a computer screen should translate to what is on a printed page.