Archives

WYSIWYG, Hedge Funds, and Alternative Risk Premia – The Business of Product Marketing

WYSIWYG – “What You See Is What You Get”. This is a phase that has been applied in computing to describe the standard that what is on a computer screen should translate to what is on a printed page.

That’s crisis not correction alpha, you fool! Trend-following value is in simplicity

I discovered from reading an informative piece on managed futures and CTA’s from HedgeNordic magazine that trend-followers will produce “crisis alpha” but not “correction alpha”. A crisis is defined as a significant and extended downturn while a correction is short-term drawdown. Unfortunately, one man’s correction is another man’s crisis. All crises start and end as corrections.

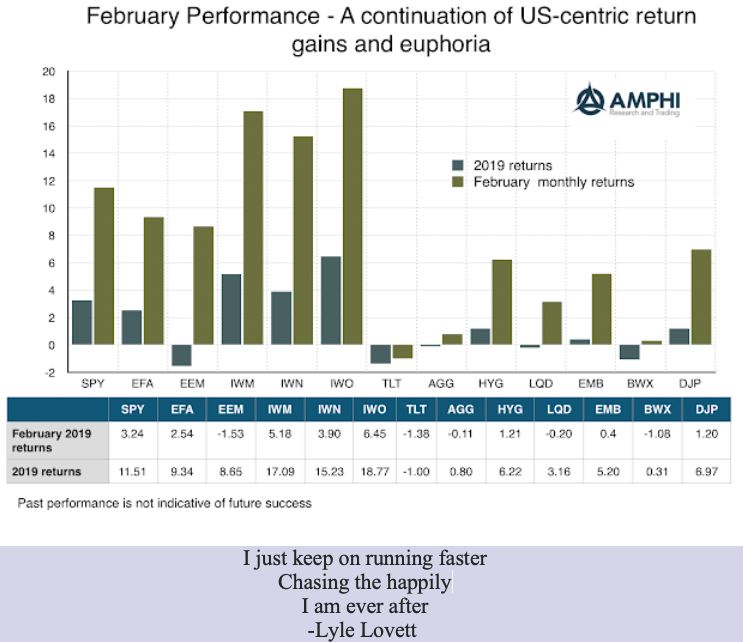

Risk-on with trends – Hard to take the opposite side regardless of fundamentals

The trend is with risky US assets which is not what we saw in the fourth quarter of last year. The reasoning for risk-on is sound; equity volatility has been reversed and financial stress has fallen. These effects have dominated the US market and have had a stronger impact on riskier assets.

The limits of investment stories – Better to have a sample of data

I have an anecdote, but not an antidote, for whatever ails you; that is the problem. Stories or tales of past economic events do not solve investment problems. Investment tales may persuade as a device for action. They may provide useful background information, but they do not provide the basis for an effective solution.

Are you prepared for a tail event? – Investing for extremes

Everyone is expecting a big negative credit event. Leverage is high. Overall debt is high. Growth is still low. Loose monetary policy continues at extremes through quantitative easing that has supported the extension of the global credit cycle. Nevertheless, the knowledge of a large downside tail event does not mean that investors are prepared with an action plan for when the downturn arrives. Investors can still be unprepared for what they will do with their portfolio when the time comes.

Follow police procedure when investment modeling – Use independent models as witnesses

“To derive the most useful information from multiple sources of information, you should always try to make these sources independent of each other. This rule is part of good police procedures. When there are multiple witnesses to an event, they are not allowed to discuss it before giving testimony. The goal is not only to present collusion by hostile witnesses, it is also to prevent unbiased witnesses from influencing each other.” – Daniel Kahneman – from Farsighted Steve Johnson

Follow Howard Marks – Know where you are in the business cycle

Farago provides a useful framework for describing the great short book Mastering the Markets by Howard Marks. The Marks approach is simple but often not given enough attention. Know where you are in the business and credit cycle and you will make better decisions and miss blow-ups.

Gell-Mann Amnesia – Be an investment skeptic and do your own research

The Gell-Mann amnesia effect may seem to be an interesting behavioral novelty for cocktail conversation, yet it provides an important lesson for doing research in any financial markets.

It is a good story, but you will not find it in any behavioral finance discussion. There is no actual research on this effect. Crichton wrote about it years ago in a posting “Why Speculate?”. He actually stated in the article, “I refer to it by this name because I once discussed it with Murray Gell-Mann, and by dropping a famous name I imply greater importance to myself, and to the effect, than it would otherwise have.”

Thinking about skew – Alternative skew measures

I was having a discussion about the merits of managed futures relative to other hedge fund styles. Managed futures funds will often have positive skew versus other hedge fund styles. The measurement of skew is tricky and is not present with all managers but for trend-followers who allow profits to accrue, it is more likely. The argument for positive skew is embedded in the behavior of the managers.

Managed futures trend-following performance – It is not volatility but the stress that matters

“Crisis alpha” is used as a quick description of managed futures trend-following, but there has been very little work to explain what the term means. A generic definition is that a crisis is when equity markets have a significant decline, but that definition tells us nothing about what will be the conditions for a crisis or when a crisis will occur.

FX intervention – Analysis says central bank activity works

Many have held the view that central bank FX intervention is ineffective. It can be disruptive and have some temporary impact, but central banks cannot make currency markets do what they don’t want to do. Research using public data, a limited sample and mainly focused on floating exchange rate regimes, shows, at best, mixed value […]

Alternative risk premia overreaction in 2018 – Don’t fall for recency bias

What happened to alternative risk premia returns in 2018? This was a major discussion topic at a UBS risk premia conference last week. It was a difficult year. In fact, it was the worst performance year since 2008, and the decline for many strategies was a multiple standard deviation event. Yet, there is a good opportunity for investors who focus on the longer-run. Since the performance for many risk premia seemed unrelated to macro factors, there is strong potential for mean reversion to longer-term strong positive performance. To extrapolate recent performance as representative of history would be to fall into a recency bias.

Risk premia performance generally positive for January

It is a new year and the underperformance of many alternative risk premia strategies in 2018 is now an old memory. Good performance heals past return wounds. While well-constructed alternative risk premia should not be highly correlated to market beta, they will be related to the investment regime. Risk premia are time varying.