Archives

Strong trends across most market sectors

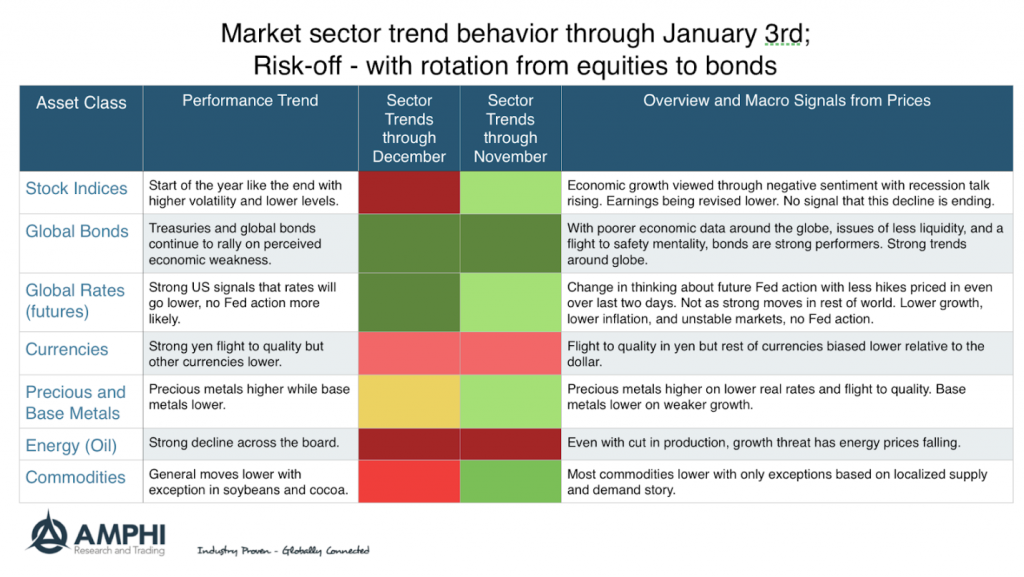

December was a great trend environment for those focused on intermediate to long-term timeframes. There were profitable opportunities in both equity indices and global bonds. Equity index trends flipped early in December and have accelerated albeit with greater intraday volatility. Bond trends continue on slower macroeconomic growth numbers and the perception of a more dovish Fed. Strong signals exist for short, intermediate and long-term timeframes.

If it keeps on rainin’ levee’s goin’ to break

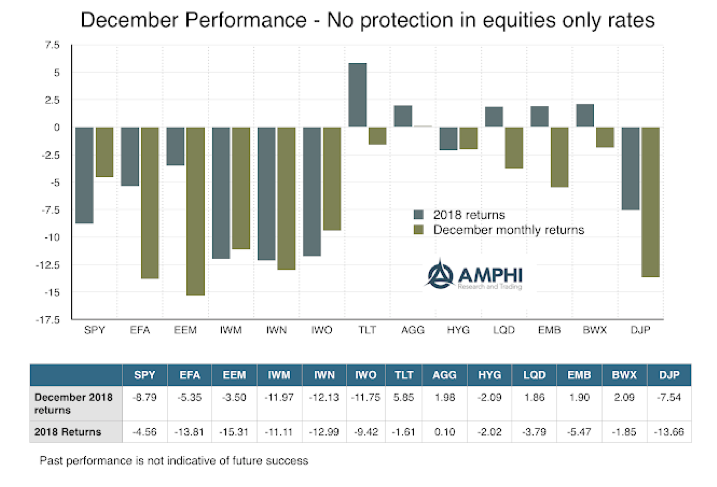

The levee broke in December with heavy selling of equities. Long duration Treasury bonds offered protection through its negative correlation with stock but there was little to make investors happy for the year. In some cases, the entire year’s return was swiped out in one month. Some analysts have suggested that this is the first time where almost all asset sectors and categories generated negative returns.

When Facing Ambiguity, Be a Skeptic

“On the road from the City of Skepticism, I had to pass through the Valley of Ambiguity.” Adam Smith

Most of finance focuses on measurable risk. Less focus is uncertainty or events that cannot be give an objective probability of occurring. Those events that are hard to measure provide the greatest opportunity.

Alternative Risk Premium versus Multi-Strategy Hedged Funds – A Process of Creative Destruction

There is growing competition with how investors access returns for different investment strategies. For example, hedge funds have developed multi-strategy approaches to investing. The multi-strategy approach has replaced fund of funds as a good means for accessing diversified hedge fund return exposures. On the other hand, there are the bundled offerings of alternative risk premia through banks who are now effectively competing in the multi-strategy hedge fund space.

Time Varying Alternative Risk Premia – Do You Want To Be Active Or Passive?

A big issue with building an alternative risk premia portfolio is whether you believe that it should be actively managed or whether it should just be a passive diversified portfolio. This is a variation of the old issue of whether there is investment skill with predicting returns. Investment skill is not just isolated to security selection but also can be applied to style rotation just like asset allocation decisions.

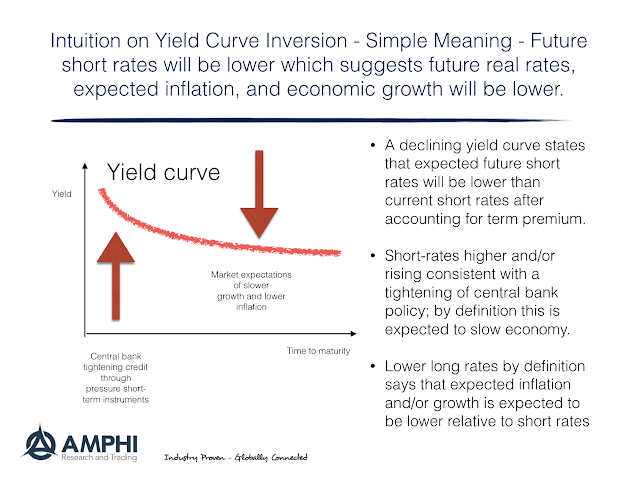

Yield Curve Inversion Hysteria – Give It a Rest

Everything you have heard about yield curve inversion is true; nevertheless, everything that is true may not harm your investments. Yield curve inversion is a good predictor of recession, and there is a link between this inversion, recession prediction, and equity declines. However, being the first to react to flattening or inversion may not win you portfolio success.

Bear Markets – Not Unusual, But Hard to Predict, so Stay Diversified

Everyone talks about bear markets; however, it is surprising that this downturn definition is so arbitrary. Commentators are somewhat cavalier with their discussion of bear markets. It is a down move of 20% from a high price point. A correction is a down move of 10%. A bear definition could be applied to a individual asset, a sector, or an asset class.

Are Risk Factors and Risk Premia the Same Thing?

There is a difference between risk factors and risk premia. This may be viewed as a subtle distinction, but it is important to think about the differences. Factors explain the return attributes of an asset. Those attributes may be either style or macroeconomic factors. Factors provide a description of what drives returns. A risk premium is what an investor receives for taking-on the risk associated with a factor. A risk premium is compensation for non-diversified risk which can come in the form of a style or a macro factor. A factor is a measurement of a characteristic. A premium is compensation for holding a characteristic. Investors want to be paid a premium for a persistent repeatable factor.

Yield Curve Impact on Asset Prices – Evidence Does Not Provide Simple Answers

Let’s just make things clear. There have not been many yield curve inversions, so analysts who want to study the behavior of asset prices during inversions have limited data. Yield curves may signal recessions which may also signal a decline in equities associated with slower growth, but the timing links are highly variable. The risk differs depending on how the question is asked.

Central Bankers as a Tribe of Technocrats – Outside the Mainstream?

Are you a technocrats or a politician? If you listen to central banks, they will say they are just technocrats or experts who do not engage in politics. To discuss political implications of policy or have politicians involved in the discussion is an infringement on a central banker’s cherished independence. Only through independence and limited oversight can central banks do their sacred technical work.

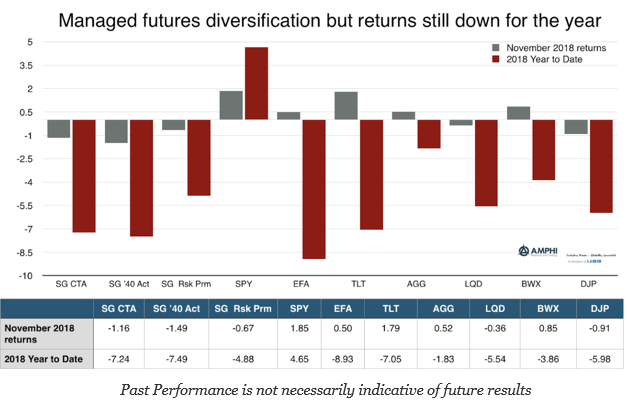

Managed Futures Funds Not Able To Find Trends

This was a negative month for managed futures funds as measured by peer indices for a simple reason, range bound behavior in equities and a reversal in bonds. Equity indices have started to trend higher, but longer-term trend followers were not able to effectively exploit these moves in the second half of the month. Global bonds have trended higher for most of the month but smaller position sizes based on higher volatility limited gains. Oil prices offered strong gains, but the size of positions may not have large enough to make an overall impact on fund returns. Commodity trades are generally a small portion of the total risk exposure for large funds.

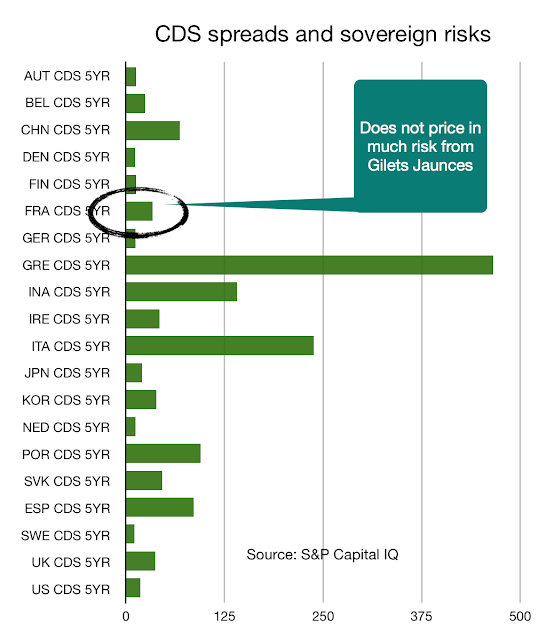

French Political Uncertainty Not Priced Effectively

The cost of being wrong with political uncertainty is significant and the impact will be felt across many markets. The yellow jacket “uprising” has already shifted French economic policy and will also affect the direction of government. We may not be extremists but the fundamental pact between the governed and government is broken which is not good for any investments.

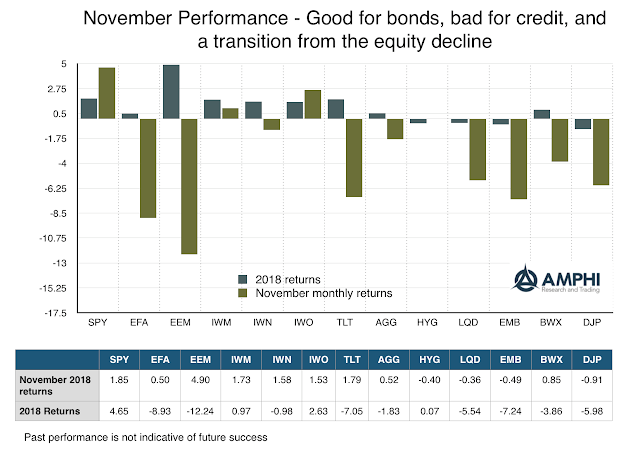

November Performance – Bonds Say Environment Is Negative, Equities Don’t Agree

Last month nothing worked with all asset classes generating negative returns. October saw a shift in market sentiment toward risk-off behavior. Investors started to take loses and adjust to more defensive portfolios. Momentum was clearly negative early in November, but monthly returns are sending different signals with both US and global equities higher. Nevertheless, it is too early to make any statement that risk-taking is back on. Equity markets have come off lows but are not showing any trends. Credit ETFs declined sharply relative to Treasuries and long duration bonds gained on new fears of economic slowdown. Commodities declined on a sharp fall in energy prices.