Archives

Looking For Risk In All The Wrong Places….

…was lookin’ for risk in all the wrong places, Lookin’ for risk in too many faces, searchin’ their eyes and lookin’ for traces of what I’m dreamin’ of. -Lookin’ for Love, Johnny Lee Risk will surprise you. It is supposed to do this. While we always think of volatility as risk, the real measure of risk […]

Met Few Good Traders Who Thought Their Correct Decisions Were About Luck

Skill is what you have when things go right.

Luck is what you don’t have when things go wrong.

Probability does not have a personality.

Rising Interest Rates on Loans Current Numbers Don’t Show a Change in Standards

The channels of monetary policy are more important for any investigation of the macro economy. This is one of the key lessons from the Financial Crisis. Now that short-term rates are finally moving higher, the behavior of banks with respect to their lending activities becomes more critical. It is expected that as rates move higher, the demand for loans will be lower. Additionally, there may be a tightening of lending when rates move higher.

Emerging Markets Is A Place to Be In The Long Run

Emerging markets were talked about in many 2018 forecasts as the place to increase allocations both for bonds and stocks, yet that recommendation has been a performance disaster for many investors. For both the last year and for longer investment periods, EM has not matched the performance of DM equities or bonds. The current causes are many: trade wars scares, low commodity prices, a strong dollar and currency crises, over leverage, slower recent growth, and some strong geopolitical blow-ups. There are strong risks present, yet the arc of economic progress and convergence is still in place for those who think in the long run.

Hedge Funds – Mistakes, Pain, Competition, and Perhaps Not Enough Risk-Taking

“My mom always told me it’s okay to make mistakes, but she never worked at a hedge fund.”

― Turney Duff, The Buy Side: A Wall Street Trader’s Tale of Spectacular Excess

Decision-making will be filled with mistakes and failure. It is part of the process when making bets in an uncertain environment. No one is 100% certain and at your best, your track record will match your estimates for success. The objective of good investment decision-making is to get the process right, so failure or lack of success is not from lack of skill or outright ignorance. Nevertheless, even if the odds are in your favor, you will not get every decision right.

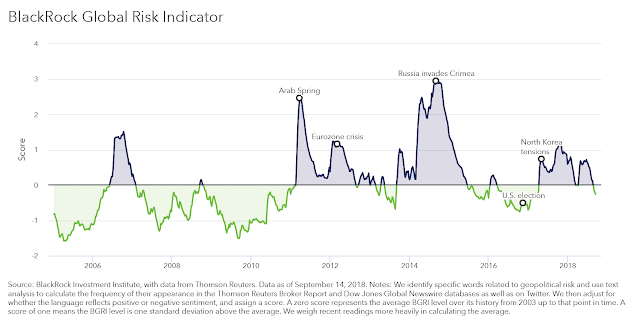

Geopolitical Risk Is Not the Driver of Any Market Decline

The BlackRock Global Risk Indicator is an interesting measure of uncertainty through looking at key work searches across a broad number of market news sources. I cannot say that this is a risk measure. Rather, the indicator is a measure of geopolitical negative news focus. It is a sentiment indicator that may lead to risk, as measured by negative market performance.

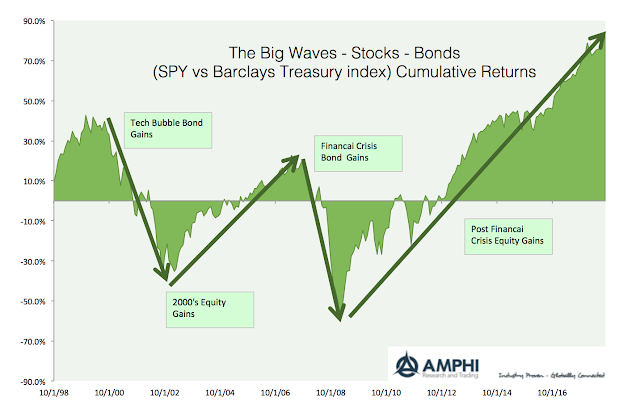

The Big Waves for Stocks, Bonds and Commodities – You Have to Exploit These Trends

Simple visuals can be very powerful at telling an effective investment story. I have compared equities, bonds, and commodity relative returns for the last twenty years to see the big wave cycles that investors needed to participate in to have a successful portfolio. The trends from these asset class cycles are long. An investor does not have to get in on the turning points, but they do need to hold the trends as long as possible. The secret to relative asset class success is commitment.

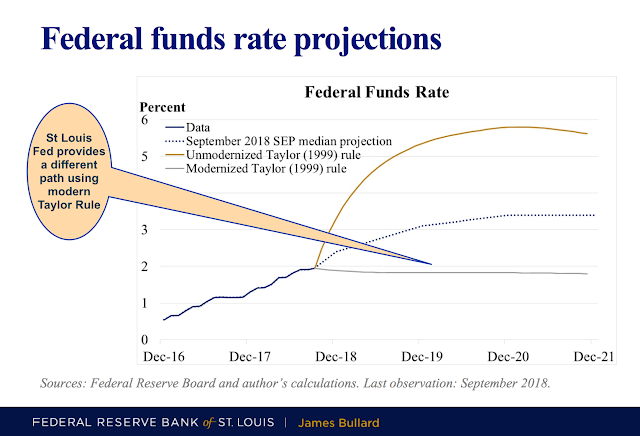

Mixed Signal from a Fed Official – A Modernized Taylor Rule Says Stop

Simple assumptions to some classic monetary models will produce very different policy views for the direction of Fed action. These significant policy divergences are the reason for the recent pick-up in bond trading. A dispersion of opinions on Fed action will lead to more volatility, trading, and potential rewards in these markets.

The Empirical Process Needs Narrative – Filling In the Space Between Data

The concept of investment narratives has been given a bad reputation especially by quants, yet these stories are often the glue that holds together data. Quants say, “Only look at the data”, yet the data may only be useful through words that extend meaning to the data.

Deglobalization and the Decline of the Liberal Order

The post-WWII period is special in political history. Instead of sovereign conflicts driven by self-interest, the world engaged in a successful experiment in multi-lateralism using world organizations to facilitate cooperation and resolve conflicts. This dominance of classic liberalism, albeit at times imperfect, was led by the United States that showed exceptionalism by furthering this global view and not normal imperialism.

Pew Charitable Trusts State Pension Review – No Good News Here

State pensions have changed their portfolio composition during the last ten years to increase their allocations to alternative investments, yet this adjustment has not helped them reach their targeted returns. This gloomy story was presented by the Pew Charitable Trusts State Public Pension Funds’ Practices and Performance Report.

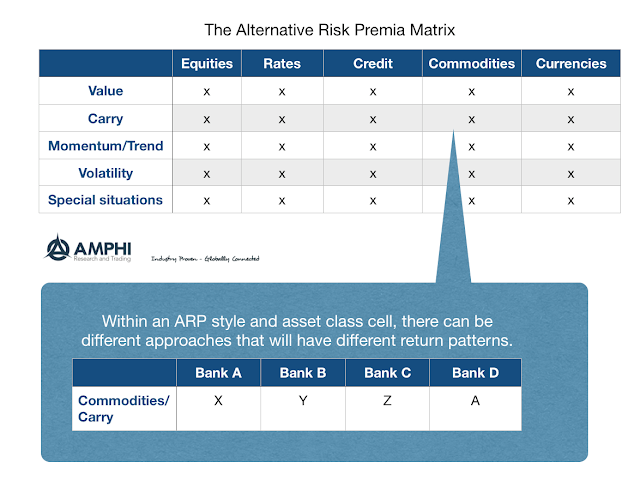

The Alternative Risk Premium Matrix – A Good Way to Jumpstart A Portfolio

An alternative risk premium (ARP) matrix is an effective way to start any portfolio construction exercise. A matrix divides risk premia through two criteria, asset class and style. We think in terms of a 5×5 style/asset class matrix. The asset classes include: equities, rates, credit, commodities and currencies. These asset classes have inherent differences that make them unique even when looking through an alternative risk premia lens. For alternative risk premia we include: value, carry, momentum/trend, volatility, and special situations. These styles are been well-defined and identify risk premia that can be exploited through forming long/short portfolios and are actively traded and structured through the bank swap market.

Corporate Debt Growth Has Exploded – The Added Macro Shock Sensitivity Creates Real Risks

There is no question that the explosion of corporate debt has caught the attention of many investors. This debt growth has been especially strong for BBB-rated companies which on the cusp between investment grade and high yield. Yet, like the boy who cries wolf or the doomsayer who is predicting the end of the world, warnings of a credit crisis do not seem to have affected investor activity. Corporate spreads are still tight and the reach for yield has continued almost unabated. Investors have not been given reasons to care about this debt issue today and have pushed any risks into the future.