Archives

Alpha Production – As We Get Better at Beta Measurement, Alpha Will Decline

A growing investment management theme over the last few years has been the incredible shrinking alpha. As investors gain more information on risk premia, there seems to be less alpha produced by managers. In reality, alpha production has likely not changed, but our measure of alpha has gotten more sophisticated so the skill associated with any manager seems to have declined or at least changed over the last decade. We can now tie what was previously thought of as alpha to specific risk factors. If alpha is tied to systematic risk factors, then it really is not alpha.

25 Years after Jegadeesh and Titman – The Momentum Revolution

Trend-following and momentum has always been an important part of hedge funds and alternative investing but it would be hard to say that trend-following was mainstream thinking prior to the early 90’s. This was the high water period of the market efficiency, but that thinking started to take a major change with the “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency”, published in the leading Journal of Finance. There were other papers that discussed similar topics and the behavioral finance paradigm shift had already begun, but this was the one paper that many academics started to quote with increasing frequency about momentum effects.

Where Do We Stand After the October Repricing?

The losses in October are well-known. Now the question is whether these down moves will continue across styles, sectors, country indices, and bonds. The answer with few exceptions is the same. Market trends are pointed down and volatility is higher. For equity styles, short, medium and long-term trends are all pointing down. For market sectors, the only positive trend is with consumer stables, utilities, and real estate; the more defensive sectors. For country equity indices, the only strong positive standout was Brazil in reaction to their presidential election. For bonds, short-term Treasuries offer some protection, but the longer-term trends are all down.

The Capital Appreciation Program: Spreads ‐ A Unique Approach to the Energy Sector

Corporate Summary Tyche Capital Advisors, LLC is a New York based registered commodity trading advisor currently offering trading programs to qualified investors. Through its trading programs, TCA will engage in speculative trading of futures and options contracts offered on the United States commodity exchanges and overseas futures exchanges. Tariq Zahir and Steve Marino are the […]

The October Repricing Causes Low Signal to Noise, Limited Trends

When markets reprice risk, it is not fun being a trend-follower. Long equity indices were a crowded trade and few made money when the early October reversal hit the markets. Fast traders were able to exploit the move, but a bounce off the lows hurt intermediate traders. Bonds were hit with the cross-currents of flight to safety against the continued threat of growth and Fed action. Currencies were hit with this repricing and not a place of profit able trends.

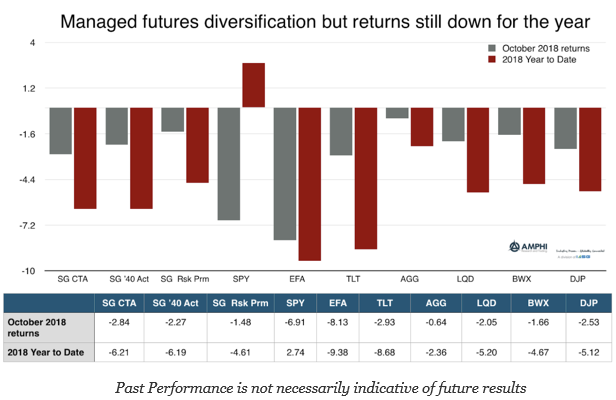

Managed Futures – No Crisis Alpha in the Short-Run

Market performance for October was sobering. Investors were complacent to volatility and the fact that markets correct. The speed of adjustment hurt the average managed futures manager who was not able to get out of markets, which repriced at the beginning of the month. Although the month ended with some improvement from return lows, there is little to celebrate.

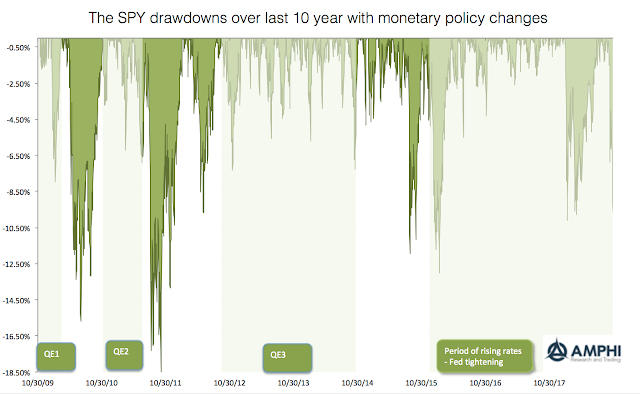

The Price of the Fed Not Providing New Liquidity – Larger Drawdowns

Our graph looks at the drawdowns for the equity benchmark SPY over the last ten years. While the current drawdown has come fast, there are have been a number of drawdowns that have been far worse albeit none that have reached the magic 20 percent market correction level. There is reason to be concerned, but investors need to have perspective.

Looking For Risk In All The Wrong Places….

…was lookin’ for risk in all the wrong places, Lookin’ for risk in too many faces, searchin’ their eyes and lookin’ for traces of what I’m dreamin’ of. -Lookin’ for Love, Johnny Lee Risk will surprise you. It is supposed to do this. While we always think of volatility as risk, the real measure of risk […]

Met Few Good Traders Who Thought Their Correct Decisions Were About Luck

Skill is what you have when things go right.

Luck is what you don’t have when things go wrong.

Probability does not have a personality.

Rising Interest Rates on Loans Current Numbers Don’t Show a Change in Standards

The channels of monetary policy are more important for any investigation of the macro economy. This is one of the key lessons from the Financial Crisis. Now that short-term rates are finally moving higher, the behavior of banks with respect to their lending activities becomes more critical. It is expected that as rates move higher, the demand for loans will be lower. Additionally, there may be a tightening of lending when rates move higher.

Emerging Markets Is A Place to Be In The Long Run

Emerging markets were talked about in many 2018 forecasts as the place to increase allocations both for bonds and stocks, yet that recommendation has been a performance disaster for many investors. For both the last year and for longer investment periods, EM has not matched the performance of DM equities or bonds. The current causes are many: trade wars scares, low commodity prices, a strong dollar and currency crises, over leverage, slower recent growth, and some strong geopolitical blow-ups. There are strong risks present, yet the arc of economic progress and convergence is still in place for those who think in the long run.

Hedge Funds – Mistakes, Pain, Competition, and Perhaps Not Enough Risk-Taking

“My mom always told me it’s okay to make mistakes, but she never worked at a hedge fund.”

― Turney Duff, The Buy Side: A Wall Street Trader’s Tale of Spectacular Excess

Decision-making will be filled with mistakes and failure. It is part of the process when making bets in an uncertain environment. No one is 100% certain and at your best, your track record will match your estimates for success. The objective of good investment decision-making is to get the process right, so failure or lack of success is not from lack of skill or outright ignorance. Nevertheless, even if the odds are in your favor, you will not get every decision right.

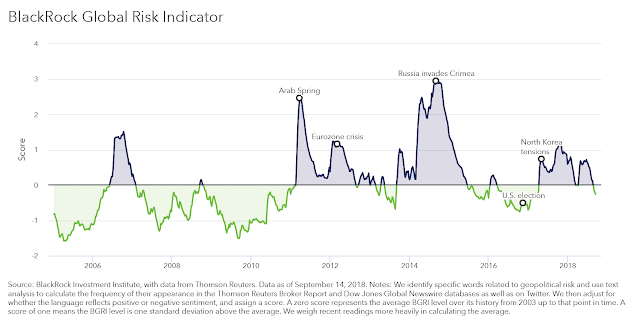

Geopolitical Risk Is Not the Driver of Any Market Decline

The BlackRock Global Risk Indicator is an interesting measure of uncertainty through looking at key work searches across a broad number of market news sources. I cannot say that this is a risk measure. Rather, the indicator is a measure of geopolitical negative news focus. It is a sentiment indicator that may lead to risk, as measured by negative market performance.