Archives

Long-Term Growth Pessimism From Fidelity Investments – What Should You Do?

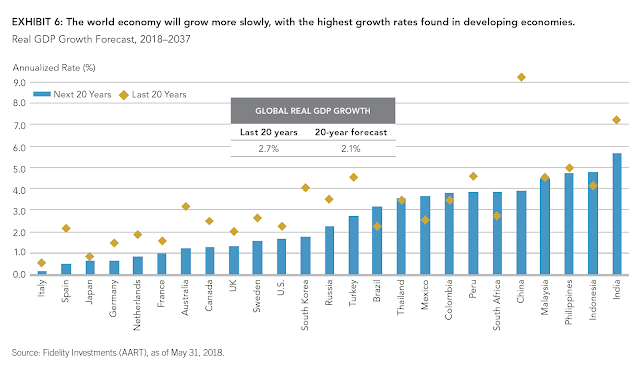

Fidelity Investments as come out with their long-term secular global growth prospects and it sobering tale of lower growth. (See Secular Outlook for Growth: The Next 20 Years.) With few exceptions, the growth for each of the countries studied will be lower. The exceptions are based on catch-up, the idea that very low productivity countries will increase productivity as they move closer to the rest of the world. These forecasts are not based on any exogenous events that will cause economic growth disruptions. They are only focused on demographics and productivity. Populations will be aging, growth rates will be slowing, and productivity is not expected to see any increases over current trends.

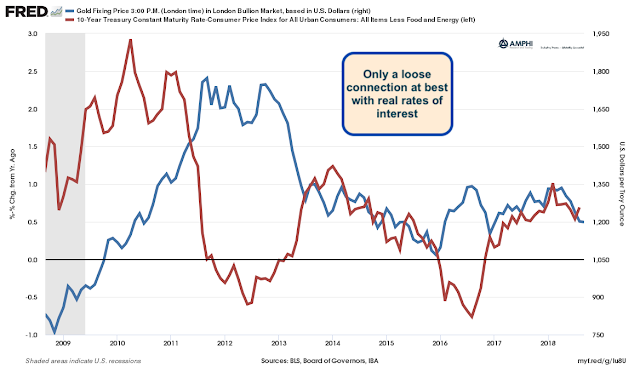

Gold – Not Be A Strong Link To Inflation Nor A Strong Relationship With Real Rates

We have written about the surprising lack of gold price gains with the surge in inflation. A reader has commented that it is the real rate of interest that is important, not inflation. Unfortunately, the data does not seem to show a close relationship.

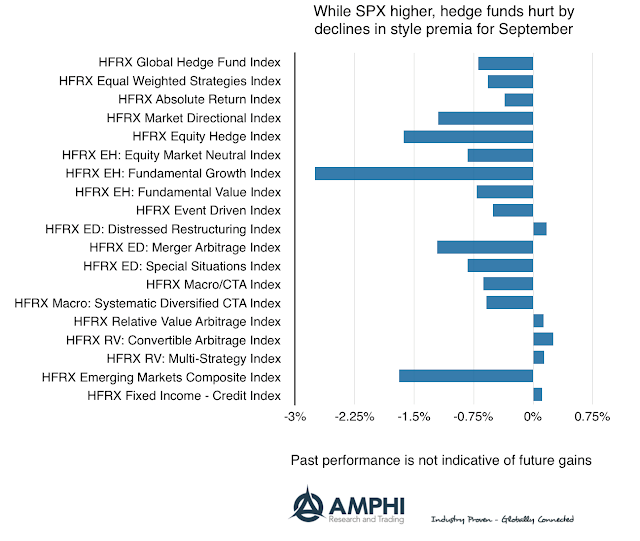

Hedge Fund Styles Underperform – More Risk-Taking Will Be Required To Make Positive Returns

You would not think some hedge funds would be down so significantly for September returns given that the major stock index (SPX) moved higher, but upheaval in small cap, value and growth harmed the average equity hedge fund. There were some positive gains in relative value managers, but it was a generally a tough month for those trying to actively find returns.

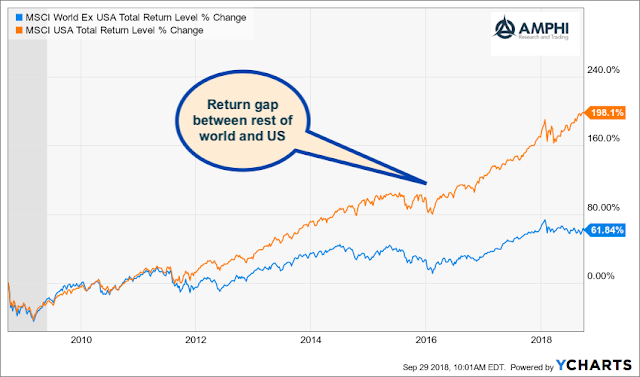

The Big Equity Return Gap – Should We Expect the “Great Convergence Trade”?

There is a large return gap in equities. The US and the rest of the world are living in two parallel equity investment universes. For the US, strong economic growth, loose monetary policy even with the current tightening, and pro-cyclical fiscal policies have proved to be a successful investment elixir. The rest of the world is facing slower growth, debt without gains, and an environment that has been filled with uncertainty. We are not arguing that the differential is unjustified. However, we are surprised by the length and size of the gap given the interconnectedness across markets especially in the developed world. This is not the equity diversification that investors expected or desired.

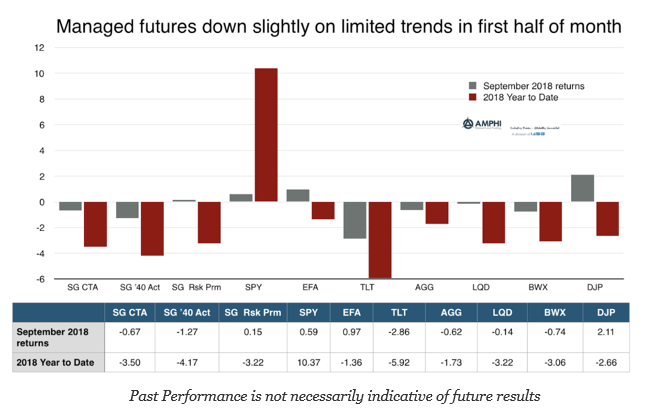

Managed Futures Down for Month but Within the Range of Performance for Other Asset Classes

Managed futures, as measured by the SocGen CTA index, showed a slight decline in return for the month, but this performance within the range of most asset classes with the exception of equities. Being long market beta is still king for the year with little absolute performance value from diversification.

Strong Directional Trends in Bond, Rates, and Energy Sectors

September was a slightly down return month for many trend-followers as the first half of the month was range bound. Our sector indicators showed most markets not having clear trends with only some slight directional tilts. During the month, the markets became more directional for bonds, rates and energy. The price action in these markets aligned with economic fundamentals. A combination of continued good economic news, higher inflation, and another Fed increase all point to negative fixed income markets not just in the US but across all developed markets. Equity market signals were less clear-cut as the combination of higher rates and strong economic growth generated crosscurrents that were less clear. Cash flows should be higher, but the discount rates are also higher.

The Most Diverse Asset Class – The Uniqueness of Commodities

Each asset class is special but have some defining characteristics that make them an asset class. Each also has dispersion in returns within the members in the classification. Commodities are an asset class with a very diverse collection of members which may give very conflicting macro/micro signals.

10 Years After the Financial Crisis: What Have We Learned?

We spend a great deal of time studying history, which, let’s face it, is mostly the history of stupidity.”

-Stephen Hawking

“We learn from history that we learn nothing from history.”

-George Bernard Shaw

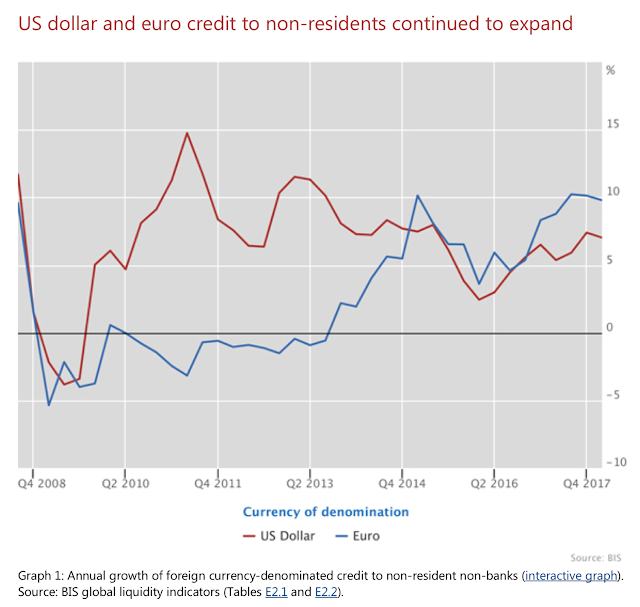

I don’t want to sound pessimistic, but it cannot be helped when reviewing what lessons have been learned since the Financial Crisis. It has been a decade since the Financial Crisis; however, some of the same problems that led to the crisis seems to still exist. Yes, there are differences; subprime loans, mortgage excesses, and bank leverage will not be the problems. Some of the structures have changed and our knowledge of financial channel dynamics on the real economy has improved, but the meta-issues of credit, leverage, and liquidity still seem to exist with limited solutions and discussions.

Trade Matters but Capital Flows Matter More – The Dollar as a Global Risk Factor

Global markets has been focused on trade, trade wars, and tariffs. News has been dominated by discussions on trade and less often about dollar currency changes and capital flows, yet capital flows often dominate trade. An increasing dollar is supposed to be emerging market positive through the trade channel, but in reality, a dollar appreciation will increase financial risks and impact EM investments.

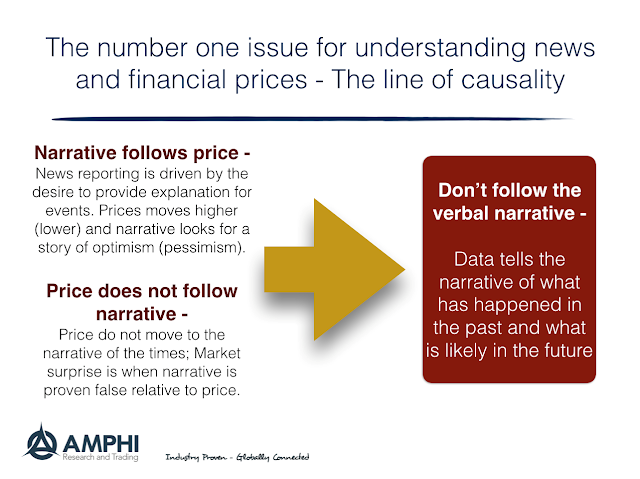

Narrative and Price – Know the Line of Causality

With all of the discussion on news, “fake news”, misinformation, and opinion, it is important to focus on some first principles for investing and narrative as news. The narrative is not the facts from an announcement, but the story surrounding the price move coupled with facts. For any investor, it is important to realize that narrative generally follows prices, and prices do not follow narrative.

Rates Are Now Higher Than Dividend Yields – Should Investors Care?

Short-term interest rates are now above dividend yields for the first time since the Financial Crisis. This could be a big deal. Investors can now hold short-term bonds and receive a higher carry return than holding dividend-paying stocks. The cost of holding cash is now less than holding dividend stocks.

Alternative Risk Premiums across Asset Classes Are Not Alike – What Has Worked and What Has Not Worked

There are now hundreds of alternative risk premia that are available from banks. This is a business outgrowth of the alternative risk premia work that has been done by academics. Yet, it is difficult to argue that there is any one return or risk profit that can describe the performance of risk premia. There are structural risk premiums which may not vary much over time and as well as risk premia that are cyclical in nature and be related to macro economic factors.

Carry – What to Watch With This Alternative Risk Premium

One of the core issues with alternative risk premia is not just determining whether they exist but how they will move through time. If alternative risk premia are time varying and associated with specific macro factors, it may be possible to tilt exposures based on current or future market conditions or avoid carry risk premia during those periods when expected returns will be lower.