Archives

Worth Thinking About For The Week – Volatility, Uncertainty, And Contagion

Volatility has fallen since the February vol-shock, but the vol-of-vol shock paints a deeper picture of the calm that has overtaken the equity markets. This same behavior is seen in other asset classes. Given the combination of geopolitical risks, economic uncertainty, and policy changes, should we expect this level of calm? It seems unlikely.

Alternative Risk Premium Versus Bonds – A Choice Of Factor Risks And Diversification

Investors want diversification from their equity exposure. This desire for diversification increases with uncertainty and with expectations of an equity decline. The big question is how or where are you going to get this diversification. The diversification winner for the post Financial Crisis period has been simple, US bonds. Bonds have been an asset that generated a good rate of return with lower volatility and a negative correlation with equities. You could not ask for a better diversifier. Unfortunately, the investment environment is changing and the benefits from bonds may no longer be available, so there is an increased desire to find new diversifiers.

Prophets Of Doom Continue With Negativity – Now What?

Ben Bernanke, former chair of the Federal Reserve. “In 2020, Wile E. Coyote is going to go off the cliff and look down.”

Alan Greenspan, also former head of the Fed. “There are two bubbles: a stock market bubble and a bond market bubble.”

Scott Minerd, Guggenheim Partners chief investment officer. The market “is on a collision course with disaster” and the catastrophe will hit in late 2019, with stocks losing 40%.

Jim Rogers, founder of the Quantum Fund. “When we have a bear market, and we are going to have a bear market, it will be the worst in our lifetime.”

From Forbes 4 Financial Savants Warn About The Great Crash Of 2020 Larry Light

These four experts are telling us doom is ahead. Call it Wile E. Coyote moments, double bubbles, bear of bears or a collision course with disaster, the prediction is the same – wealth destruction is coming. These are the usual doomsday stories. They may be right but there seems to be a natural bias to the dark side. We seem to like it and pundits keep feeding us these narratives.

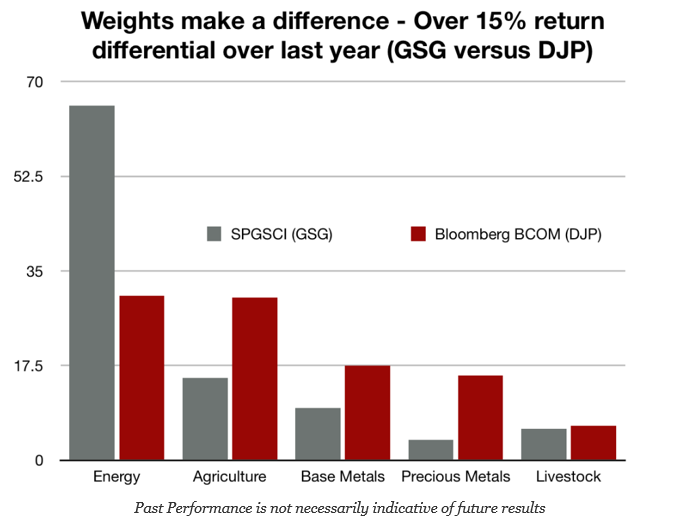

Commodity Gains Existed Over The Last Year, But It Depended On The Index Used

Commodities, as an asset class, have had exciting performance year; well maybe, if you had the right index. A quick look at returns over the last year shows that if you held the SPGSCI index through the GSG ETF, you would have gained a very attractive 19 percent return. If you held the broader-based Bloomberg commodity index (BCOMM) (DJP ETF) you would have received only 3.2%. Both are well-defined indices, but the performance difference would have been in the double digits. This is all based on the weighting of the index. SPGSCI has a 2/3rds weighting in energy while the BCOMM only has a 30 percent energy weighting. If you liked energy, you would have been a star. If you preferred diversity, you would have been made only a slightly positive gain.

Charts That Give Me Fear and Calm This Week

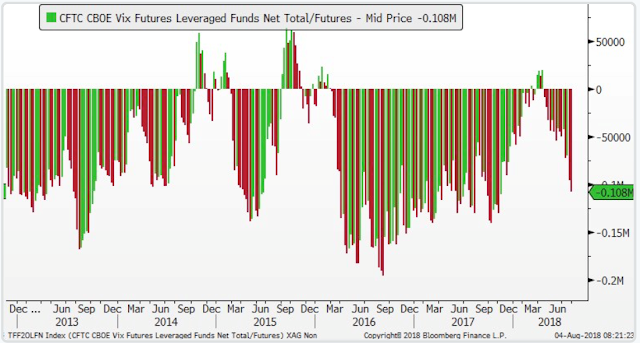

What did we learn from the February volatility shock? Volatility has trended lower and the same trades are being put into play; short volatility. Looks like the market has a short memory.

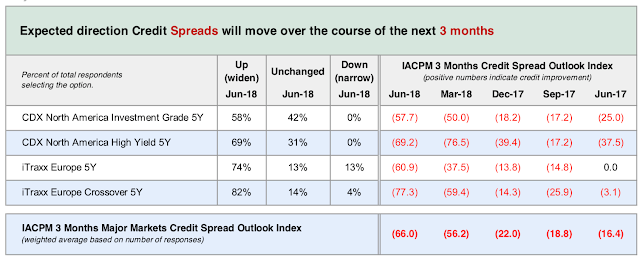

What A Difference A Year Makes – Credit Spread Sentiment Is Moving Negative

The survey from the International Association of Credit Portfolio Managers shows a significant change in the sentiment of credit managers on the direction of credit spreads. The diffusion index which ranges between 100 and -100 shows that the increase in negative sentiment has moved significantly downward. This decline is occurring even with corporate and high yield indices showing some tightening this last month. The survey was conducted in June, but the tilt is strong. This bias should be included in any portfolio adjustments.

“Think Outside The Box” or “Look More Closely Inside The Box” – Start Inside The Box

“We need to embrace the fact that we don’t know what the next bad outcome is. We need to think outside the box.”

“The world is continuing to change, and we need to constantly reinvent ourselves in this revolving world.”

-John Williams, President NYFRB

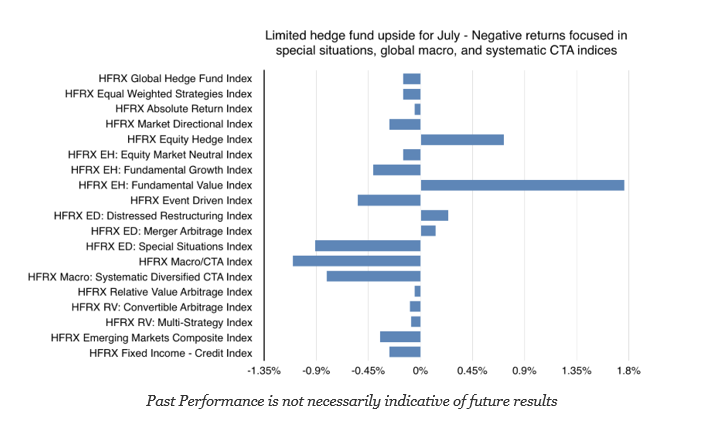

Hedge Fund Performance Mixed for July

Hedge fund returns for July were generally negative with the only exceptions being equity hedge and fundamental value strategy indices. The class of uncorrelated hedge funds styles, event driven and special situations, under performed. Defensive styles like systematic CTA and global macro also posted negative returns.

Switch To Risk-On But Dispersion In Return Shows Mixed Opportunities

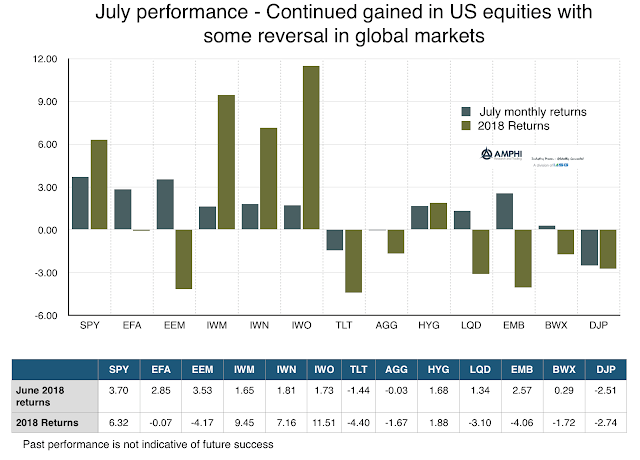

All equity style sectors generated gains for July. The EM index ETF is the only major style down for the year. Global markets outperformed more localized US markets as measured by mid and small cap indices. Growth has been the best style index this year with returns exceeding 11 percent. While performing well this month, global equities have still lagged for the year based on growth and earnings differentials versus the US. Nevertheless, there are some concerns about short-term trends in smaller cap indices as well as growth and value indices.

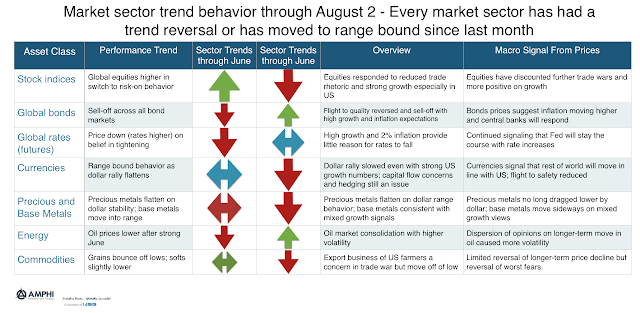

Sector Trends Show Significant Changes Over Last Month

Our tracking models for the end of July show that there have been changes in direction for all major sectors. This would usually suggest significant loses for trend managers but the relatively mild volatility and the slow reversals allowed for adjustment of signals to mitigate loses.

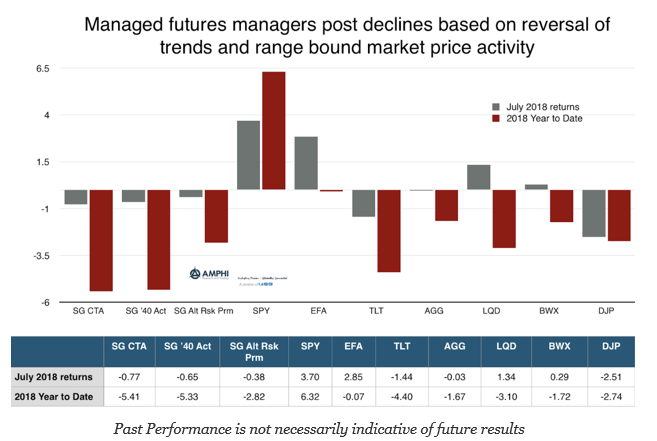

If There Are No Trends, There Will Be No Gains – Managed Futures Slightly Negative On Range Bound Market Behavior

July proved to be a classic reversal from less risk appetite to risk-on behavior. Global equities, which were weak in June, reversed on the expectations of stronger growth and earnings. This was bad news for trend-followers positioned for further market declines. The switch in risk appetite caused bonds to move lower. The strong growth, higher inflation, expected larger supplies, and expectations for continued Fed QT placed added pressure on Treasuries. Credit markets moved in-line with equities. The range bound currencies helped international assets but did not allow for trading gains. Commodities were mixed with energy prices moving lower and grains seeing some buying pressure after large declines last month. All of these reversals did not help intermediate trend traders.

July Performance Shows Risk-On Appetite

First look at the data to see what weighted market opinion is telling us. July marks a reversal to more risk-on behavior with strong gains in large cap US stocks as well as international and emerging market equities. While small cap, growth, and value indices all did well, the broader international concerns affecting risk behavior have abated. This positive global view was also seen in the international bond markets. The dollar rise from a desire for safety was contained and more range bound. Along with international bonds, credit markets improved with tightening spreads. The only losers for the bond sector were long-duration Treasuries and commodities.

The Correlation within the Financial Cycle – Not Good for Those Looking for International Diversification

One of the core strategies for portfolio diversification is increasing exposure to international stocks and bonds. This risk reduction strategy is easy to achieve, yet the value of this asset class diversification has diminished over the last few years. The financial cycle has more commonality as measured through times series analysis, and it is harder […]