Archives

Risk Should Not Be Determined by Feelings of a Past Experience – Block the Perceptions and Focus on Some Numbers

Risk perception is often about pain and not probabilities. It is about the experience of risk not the mathematical chance or size of loss. I would like to say that everything about risk management is measurable and can be reviewed dispassionately, but that is not the case. There is often a difference between fear and facts and this is the perception gap which often leads to bad judgment. You may be a dispassionate risk assessor, but the market’s perception of risk may be driven by its weighted perception of the risk.

The Power Law, 80/20 Rule, and Concentration of Returns – What It Means for Money Managers

The power law has been become a strong fascination to me. We have been trained to generally think about the normal distribution. The law of large numbers has been pounded into our psyche since our first class in statistics but as you look more closely, the more relevant the power law becomes. Now, a normal distribution will produce extreme values. However, in a power law the extremes follow certain characteristics such that the “top few” are unbundled or more likely to have an extreme, (as opposed to a normal distribution where the “top few” are exponential and bounded).

Ride the Trend, but Remember What Is Possible

“I am not an optimist. I am a very serious possibilist.” – late statistician Hans Rosling.

“I am a trend-follower for both price and fundamentals. I am also a very serious scenario realist.”

How do investors reconcile potential storm clouds with optimistic trends in markets. There is ongoing information of long-term economic problems from a wide variety of sources today, yet many markets have continued to move higher and followed trends. There often seems to be disconnects between long-term peril or risks and shorter-term optimism. Some says this is the essence of a bubble market, a disconnect between price and fundamentals, yet avoiding trends based on yet to be realized threats can easily cause investors to avoid profitable opportunities.

Active Management Should Work Because Active Managers Work Hard – You Are Committing a Fallacy

Which is more likely? A manager who has successful returns, or a manager who has successful returns and gets up early, works hard all day, and spends half the night reading current research. Which one will you choose to run your money?

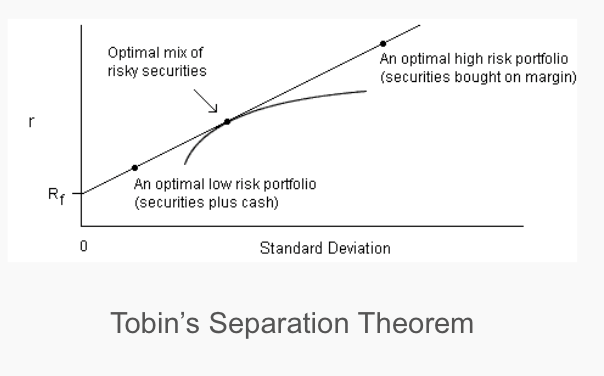

Tobin’s Separation Theorem – It Can Be Applied Anywhere

One of the greater principles of investment finance is Tobin’s separation theorem which is a powerful simple tool that can be used for any investment portfolio, but is especially useful when thinking about managed futures and alternative risk premiums. (Robin Powell reminded me of Tobin’s contribution in his essay, Can you really stomach the risk you’re taking?) There is a tremendous amount of useful investment advice through just applying the simplest of concepts.

Commodity Returns Over the Long-Run – A Good Diversifier, So Get Back in with an Asset Allocation

Commodity index investing has not been very successful for investors as measured by leading index total returns since the Great Financial Crisis. The end of the super-cycle has been tough on most investors and only recently has there been a period of extended positive returns based on the rise in oil prices. Is there any relief for investors?

Decision Noise Reduction – This is the One Thing Investment Managers Should Get Right

“There’s a lot of noise when making a decision. Not in the decision itself, but in the making of the decision. It is possible that an algorithm, and even an unsophisticated algorithm, will do better because the main characteristic of algorithms is they’re noise-free. You give them the same problem twice, you get the same result. People don’t.”

– Daniel Kahneman keynote at the Morningstar Investment Conference in Chicago 2018

The “Hedgehog and the Fox” Revisited – Have Managers with Big Ideas, But Diversify

The Greek poet Archilochus wrote, “The fox knows many things, but the hedgehog knows one big thing.”

Go Back to Basics with the Efficient Market Hypothesis – Think of it as a Base or Prior

The Efficient Market Hypothesis… has two components that I like to refer to with the terms No Free Lunch and The Price Is Right. The No Free Lunch component says that it is impossible to predict future stock prices and earn excess returns except by bearing more risk. The Price Is Right component says that asset prices are equal to their “intrinsic value,” somehow defined.

– Richard Thaler, “From Cashews to Nudges:The Evolution of Behavioral Economics”, American Economic Review 2018

Risk Preferences are not Stable – The Major Take-Aways

An important problem in finance is trying to properly incorporate risk preferences when forming portfolios. This is especially true if risk preferences are not stable. Yet, we have increasing evidence that risk preferences do change over time. (See article “Are risk preferences stable?” by Hannah Schildberg-Horisch in the Journal of Economic Perspectives Spring 2018 and illustration below.)

The Power Law and Hedge Funds – Power Law in Size May Not Equal Power Law in Returns

The four biggest hedge fund launches of 2018 have attracted more than $17bn, according to figures compiled by the FT. That compares with the $13.7bn investors have put in existing funds, according to data from eVestment. from FT Hedge fund stars rake in billions for new funds

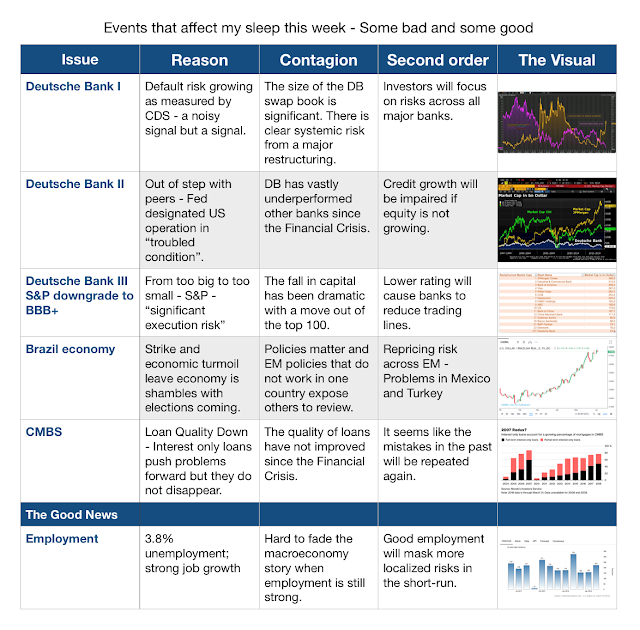

What Affects My Sleep This Week – DB, Brazil, and CMBS

Historian Deirdre McCloskey says, “For reasons I have never understood, people like to hear that the world is going to hell.”

John Stuart Mill wrote in the 1840s: “I have observed that not the man who hopes when others despair, but the man who despairs when others hope, is admired by a large class of persons as a sage.” from Morgan Housel “The Psychology of Money”

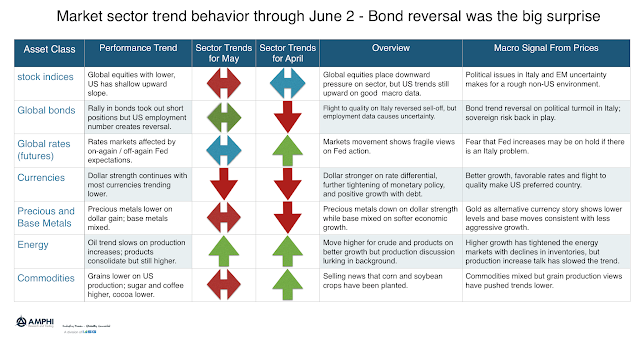

Trends Dominated by Bond Reversal, But Not Clear the Shock Rally Will Continue

I have always thought that the simple physics analogy that a market at rest will stay at rest and a market in motion will stay in motion is apt for trend-following. Trends will change when there is a shock or catalyst that will change the underlying fundamentals. Trend-following does not require knowing all of the reasons for why a trend is happening or why it may stop. Trend-following only requires that a signal is extracted and followed until price dynamics tell you otherwise. The success with trend-following is driven by the fact that trends last longer than expected. They last longer because most new information is trend reinforcing. Fundamentals do not generally change quickly. Nevertheless, loses will occur when new information causes an expectations reversal. Expectations may change more frequently than fundamentals.