Archives

Mutual Funds Versus ETF Liquidations – Their Market Impact May Not Be The Same

There has been a significant capital switch from mutual fund investing to ETFs, from active to passive investing. This has been a significant positive for many investors because there are many “active” managers who are closet indexers and active managers who do not show skill.

Decomposition of Credit Markets – Simple but Important Conclusions

Should investors be worried about credit spread return expectations or expectations of credit default losses in the current environment? Before we answer the credit questions about the current environment, investors may need a framework for weighting the types of risks in the credit markets. This is the fundamental question concerning holding any credit exposure, and an exhaustive research using variance decomposition of a large dataset shows that you should be worried about both. See “What Drives the Cross‐Section of Credit Spreads?: A Variance Decomposition Approach”, by Yoshiio Nozawa in the October 2017 Journal of Finance.

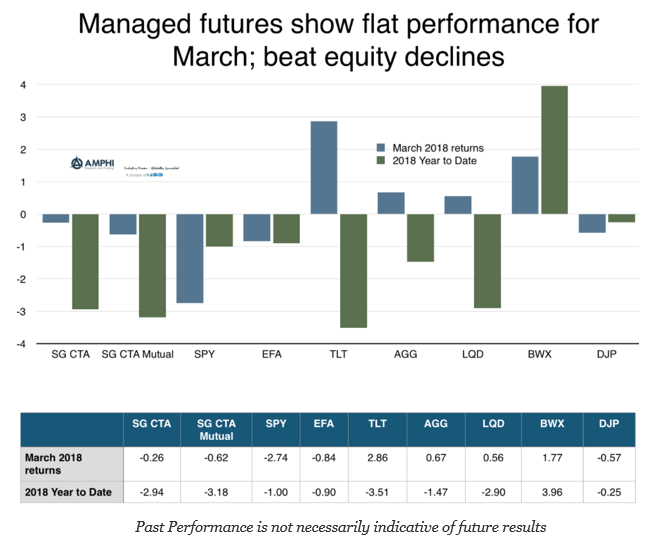

Managed Futures Slightly Down for Month – Better than Equites

Managed futures index returns were slightly negative for the month with the SocGen CTA index down 26 bps and the SocGen CTA mutual fund index down 62 bps. The BTOP 50 index gained 26 bps for the month. This compared favorably against many equity indices, but was less than the fixed income indices. Trend-following managers were not able to catch the early rotations from equities to bonds during the second half of the month.

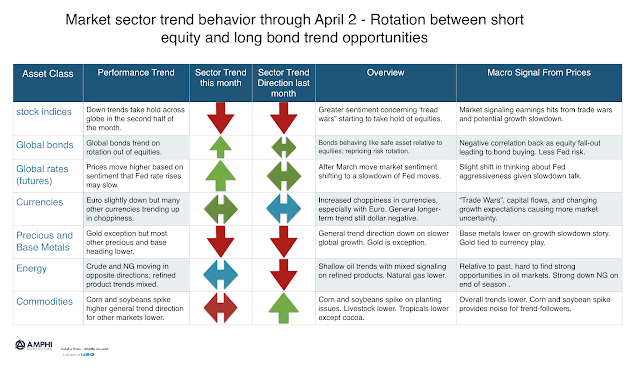

Trends Tilt to Bonds Over Equities

Global equity index signals suggest short positions while bonds are showing stronger long trend signals. The repricing of risk usually is associated with movement from more risky to less risky assets. Short rates suggest more uncertainty on Fed making good on rate rise promises. Metals are signaling a growth slowdown. The general tenor is that trends in most liquid markets more likely.

Sector Differences Increased During Month – Rotation to Bonds from Equities

2018 has surprised many investors with a change in focus from economic growth and increased earnings from tax cuts to an emphasis on volatility repricing. Most equity factor and sector styles generated negative returns for the first quarter with the only exception being emerging markets and growth. The only positive price-based signals are within the growth sector.

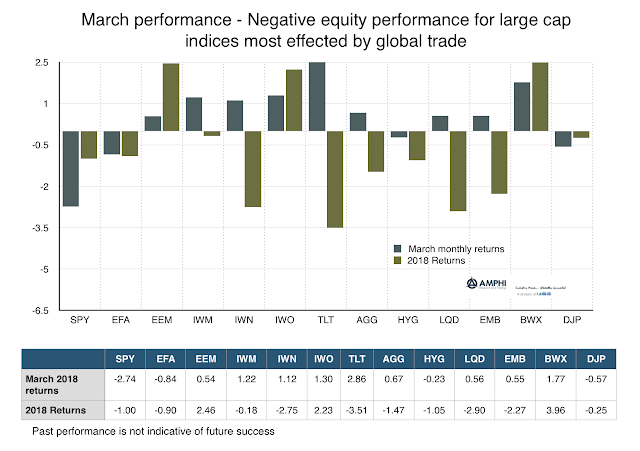

Change in Mood Reflected in Asset Markets

Markets have seen a significant change in economic sentiment over the first quarter of 2018. Market views have moved from euphoria concerning tax cuts and global growth, to the fear of a volatility shock, to a revised view of growth, and finally to growth fears under the concern that a trade war is around the corner. Overall, major assets, both equities and fixed income were negative for the quarter. Large cap firms that engage in global trade were hurt in March while bonds rallied as the safe asset. US small cap equities did better given their focus on domestic growth. Emerging markets gained on the dollar decline and the continued belief that EM markets have room for independent growth.

Failures with Information Usage – Competing Models and a Solution

Investors do not always use all the information that is available to them; however this is a not a unique problem to finance but an issue that runs the gamut for all consumer decisions. The explanations for the problem of information usage or non-usage has fallen into two major camps or models of behavior and described nicely in a recent Journal of Economic Perspective article, “Frictions or Mental Gaps: What’s Behind the Information We (Don’t) Use and When Do We Care?” by Benjamin Handel and Joshua Schwartzstein. We present their framework with our view on how the problem can be solved.

Portfolio Trust in Mean Reversion Not Momentum – The Contradiction of Investing in Trend-Followers

Most trend-follower will say that they are “non-predictive”. While I think this is true in the sense they do not form forecasts or expectations, trend-following is also based on the prediction that the price direction through some set of price weighting from yesterdays and today will continue into tomorrow. Trend-followers do not try and forecast expected returns rather they extract signals from past data under the assumption that price moves will have memory of at least direction. These managers find trends across a large diverse set of markets and then invest long or short based on these trends. If the markets are moving higher, they are a buyers, and if price move lower they are sellers. Buy high under the assumption that prices will move higher and sell low under the view that prices will move lower.

Stock-Bond Correlation – An Inflation Regime Change Will Push It Higher

A recurring global macro theme has been how investors should think about stock bond correlation. The negative correlation between stocks and bonds has been the single best diversification provider for any portfolio. There are very few alternative investments that have offered the same amount of diversification and provided a significant amount of alpha. This simple diversification is why variations on the 60/40 stock/bond portfolio mix have been such winners since the Financial Crisis. But times change, or more specifically, regimes change.

Oh My Bonds

“Oh my god, the unemployment rate is below the natural rates, sell your bonds!”

This has been the usual bond market reaction for the last few decades, but the world has changed. There may be good reasons to sell bonds, but a low unemployment rate may not be the main driver. Investors need to kill off the idea of the natural rate of unemployment or at least modify their views. That does not mean that bonds will not react to low unemployment rates, but the current sensitivity is significantly different than what we have seen in the past.

If You Want to Understand Overall Credit Spreads, You Have to Have Both a Macro and Micro View

If you want to understand overall credit spreads you have to have both a macro and a micro view. The macro view looks at the business cycle and the chance of default for risky assets based on economic growth. The micro view looks at the credit supply coming to market, the demand for loanable funds at any time, and the structure of deals. The macro focuses on credit risk expectations and the micro will be more centered on the flow of funds. A macro-micro framework helps focus our interest in actual and perceived credit dislocations.

Expressing Trend Bets Through Futures or Option – The Problem of More Moving Parts

The choice between using futures versus employing options for a trend-following program is worth reviewing after the recent market events. Would trend-followers who used options have done better than those who expressed their directional bets with futures? The key to this answer is whether the trend-follower had a view on volatility.

Quants and Uncertainty – Post-February Thinking

As far as the laws of mathematics refer to reality, they are not certain; and as far as they are certain, they do not refer to reality. -Albert Einstein