Archives

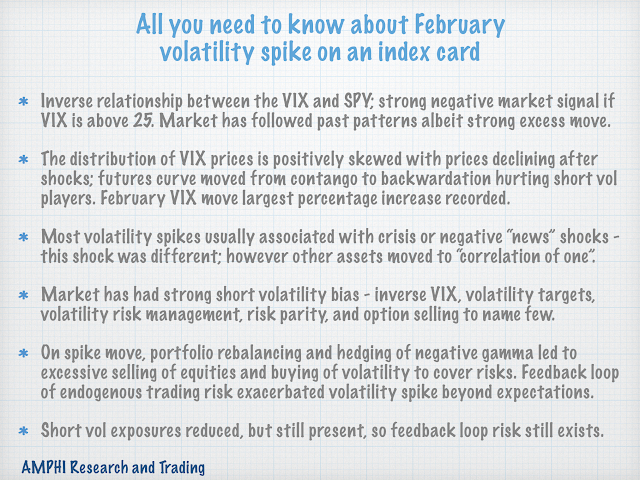

The “3 by 5 Index Card” on What You Need to Know About the February VIX Spike

University of Chicago professor Harold Pollack in an interview a few years ago mentioned that the best money advice can fit on a three-by-five inch index card. He was then challenged to write the card. His financial advice went viral. We follow this tradition by focusing on a simple “three-by-five index card” on the VIX volatility spike earlier the month.

What Is Your Focus? Schwerpunkt – The Center Of Gravity For Your Investment Efforts

Schwerpundt is a German word meaning main focus, center of gravity, or focal point. The term came from Von Clausewitz’s “On War” and refers to the strategic objective or goal of any military campaign or battle. It is the place of greatest importance against an adversary.

Psychopaths Are Not Good Hedge Fund Managers, Neither Are Narcissists – Who Would Have Thought?

Wall Street is filled with characters and “personality”. I have met my share, but a key question is whether some of these personality extremes actually lead to better returns. I have written about this in my posting The Wisdom of Psychopaths and Trading. Some have suggested that the characteristics of psychopaths if directed toward good goals may lead to successful outcomes. The core idea is that a lack of empathy or emotion found in psychopaths is actually good for some jobs. Certainly, there is a strong strain of thinking that trading should be without emotion. Hence, personality characteristics such as less emotion or empathy may be good for return generation. You just may not want to have them as your boss.

Generating Tilts Around Core Bonds – Changing The Correlation, Yield, And Risk Exposures To Bond Sectors Offers Opportunities For Portfolio Refinements

Some may say, “A bond is a bond, is a bond”. Investors may place risky assets in one category and then have bonds in a less risky category. This dichotomy does not focus on the important distinctions between bond groups and the roles that different bond categories may play nor does it present the possible trade-offs between return, risk, and correlation within a portfolio from different bonds.

Time For Commodities, But What Is The Right Choice? Think In Terms Of Risk Premiums

Inflation is a growing concern with many investors. Additionally, there is the perception that financial assets are overvalued. There is a need for diversification across other asset classes given the potential for stock-bond correlation rising in an inflationary environment.

Taking A Second Look At Gold During A Financial Crisis

What would have protected investors during the turmoil of last week? With all of the major asset classes falling, not much. Declines were a just a matter of degree. There were some selected instruments that did well, but the “correlation to one” effect, albeit not absolutely true, kicked-in for many assets that were supposed to provide strong diversification. However, there was a protection instrument that did provide safety, gold. Although slightly under bond returns for the Barclay Aggregate index through the first twelve days of the month, it has generated gains for the year and certainty beat long-term Treasury bonds.

If Dollar Is Down, Investors Want To Look Toward Commodities

The dollar may be trending down, but investors should also look at the second order effects of what will happen to other markets. For example, a declining dollar is good for long commodity exposure. The long commodity argument is twofold, one, a decline in the dollar makes commodities denominated in dollars cheaper to foreign buyers which will increase demand; two, a decline in the dollar associated with global growth will increase global commodity demand. There are both substitution and income effects.

“Bond Vigilantes” – They Were Corralled But Never Disbanded

We have not heard from the “bond vigilantes” in quite some time. The origin of the word vigilante is Spanish for watchman, alert, or guard, and like a watchman they have been out there waiting for the long combination of events. The definition of bond vigilantes is a broad term for bond market participants who impose discipline on the market through focusing on negative fundamentals. Their form of discipline is selling duration or not buying at current levels.

Yes, The Stock-Bond Correlation is Rising, But Let’s Have Some Perspective

Many commentator have talked about the fact that stocks and bonds moved together during the current market sell-off as if this is big news, highly unusual and signal of market change. A positive correlation is not the normal relationship we have seen in the post Financial Crisis period, but it may be a little early to say there is a sea-change in market behavior.

Risk Parity – When volatility goes up across asset classes, the result is painful. But perhaps not as bad as some alternatives.

Risk parity has had good performance over the last two years with double digit returns after stumbling in 2015, yet the diversification strategy of equal weighting of four major asset classes has been painful this year. Diversification based on weighting risks offers some protection but is not cure for a volatility revaluation.

Has SPY – VIX Sensitivity Changed in the Last Week?

The talk of the markets is the significant spike in the VIX index and the large decline in equities over the same period. An important question is whether the relationship between the stock and volatility has changed with this move. A quick answer is no.

What to Do in a Market Sell-Off – Don’t Sell, Rebalance and Restructure

When asked for money, WC Fields once said, “Sorry good man, all my money is tied up in cash.”

What Does Systematic Decision-Making do? Debias Your Portfolio Decisions

McKinsey and Company published an interesting paper on the use of AI in asset management called, “An analytics approach to debiasing asset management decisions”. (Hat tip to Tom Brakke for mentioning the article in his newsletter.) This paper shows the powerful use of analytical tools to extract hidden biases in investment management decision-making. Employing large data sets of manager decisions, companies are finding a wide set of behavioral biases identified in economics present with their decision-making.