Archives

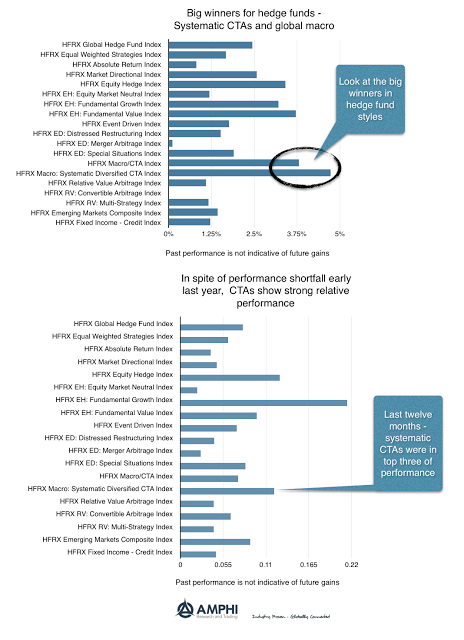

Hedge Fund Performance Strong in January, Especially for CTAs and Global Macro

Hedge fund performance, as measured by the HFR indices, showed strong performance in January especially for global macro and systematic CTAs. Systematic CTAs also generated returns that were in the top three categories for the last twelve months.

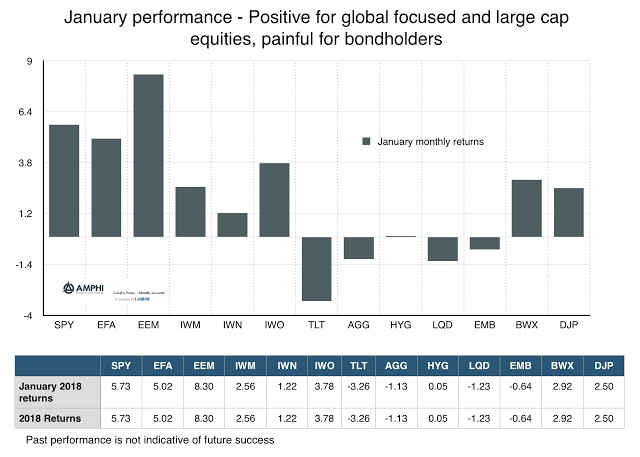

January Sector Performance Strong for Style, Sector, and Sovereign ETFs and Poor for Bond ETFs

Equities started the year with strong performance across style, sector, and country groupings; however, there were some exceptions to these gains and also some signs of potential for performance declines. Bond ETF returns were all negative except for international bonds which gained from the dollar decline. These returns are consistent the fundamental story of strong growth and expected higher inflation. There will be peak and valley in return even with the clear story, but the general direction is still risk-on for equities and avoidance of duration for bonds.

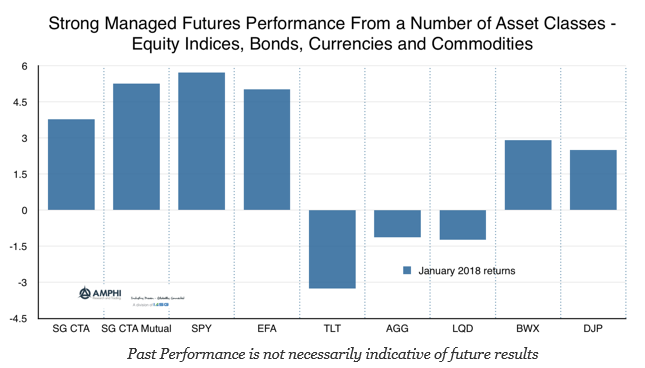

Strong Managed Futures Returns from Multiple Asset Classes – Consistent with Fundamentals

Managed futures showed strong performance in January from a variety of asset classes. Many managers were able to continue to take advantage of the trend in US equities, albeit with a giveback of some profits at the end of the month. Global bonds generated gains from short positions as a significant sell-off accelerated through the month. The dollar decline made trading currencies also profitable. The trend in oil and refined products also continued although a surprise inventory increase at the end of month added volatility. Selective trading in precious and base metals also added to performance. There were also commodity opportunities from newly formed trends.

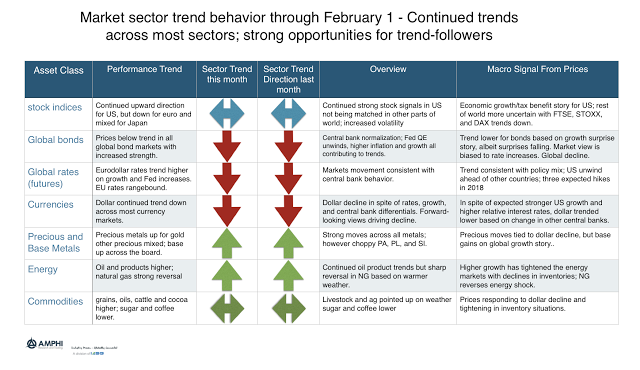

Trend in Markets – Short Bonds and Dollar, Long US Equities – Strength Continues going into New Month

January performance was a good start to the year for many trend-followers. Our sector trend measures suggest a good performance month that looks to continue into February. The fundamental themes concerning growth and inflation at the beginning of the year continue although with different levels of intensity.

Definitions and Formulas

Arbitrage: Several sub-strategies fall under arbitrage. The most prevalent in the managed futures industry is statistical arbitrage. A simple example is simultaneously buying gold on one exchange (for a lower price) and selling gold on another exchange (for a higher price). This strategy looks to profit from the price difference. Average Commission: This represents the […]

January Market Performance – An Extension of Growth and Inflation Themes

With continued euphoria about global growth and growing fears of inflation, the large cap and international stock investors saw strong gains while bondholders were hit with loses. Markets in January saw extremes in what were identified as the core themes for the year, growth plus inflation. Now, there may be stagflation holdouts, but growth indicators are still strongly positive albeit there are signs that the trends in positive economic surprises last quarter will be more tempered.

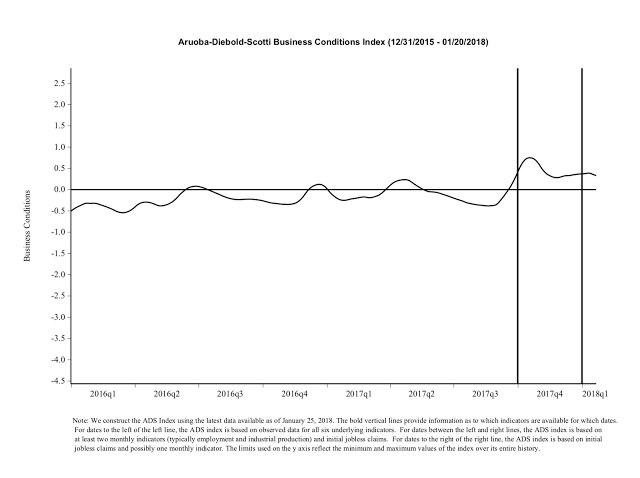

Philly Fed Business Conditions Index – Consistent With a Robust Market

The relationship between growth and equity market returns is not always direct. Equities can move higher because of an increase in earnings growth or from an increase in valuation. Market earnings should increase with economic activity but they may vary across the cycle. Similarly, the relationship between growth and nominal yields also can be variable albeit generally positive. Higher growth may lead to higher real rates, higher expected inflation or a change in monetary policy. The problem is that actual economic growth often has reporting delays so the link with market prices is mixed. The link between prices and fundamentals should focus on leading or forward-looking indicators.

Volatility and Price Bubbles – What You Need to Know Hard to Say There is a Strong Relationship, But Too Quiet is Not Good

No one wants to be the holding a bubble asset when the market breaks. It is not pretty given the potential for sharp corrections, but it is hard to say when it is time to leave the party. You could just say you don’t want to play the game, but the opportunity cost can be high because the time between bubbles begin and the market reverses can be measured in years. Additionally, with bubble language surrounding equity and bond markets as well as some real estate markets, the world could either be filled with bubbles or the term is being used so loosely that it does not have meaning.

Call Option on Weather Shocks Through Agricultural Managed Futures Managers

There is the potential for a major agricultural price dislocation if a strong La Nina effect lasts through the summer. It is unclear whether the current La Nina effects will continue, and current expectations are that it will dissipate in the spring, but history suggests that ENSO effects can disrupt many major commodity prices including corn, soybeans, wheat, coffee, and sugar. So how can investors take advantage of this uncertain opportunity?

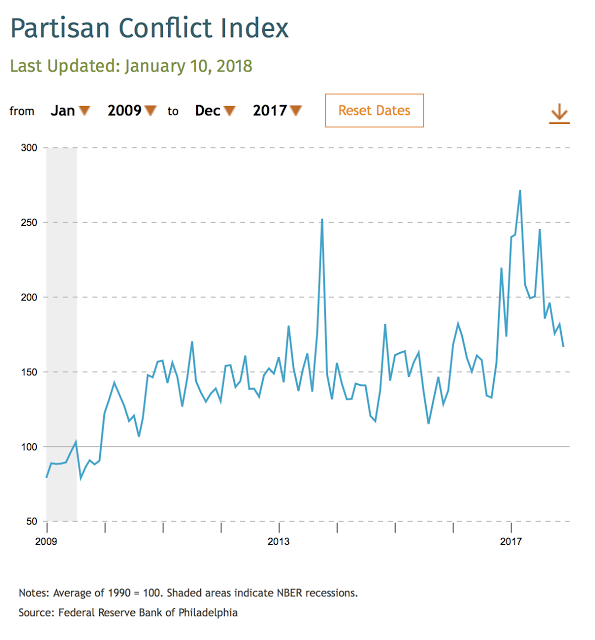

Philly Fed Partisan Conflict Index is Actually Down – Normalization May Be Good for Markets

As someone who is biased toward quantitative work, it has been difficult to judge the impact of political rhetoric and conflict on market behavior. Market uncertainty should increase when there are more partisan conflicts which should translate into higher market risk premiums. Nevertheless, if there is no measure of conflict, this idea cannot be put to a test.

The “New Global Macro” Thinking – It is About Your Ability to See and Exploit Networks

What has been the biggest change in thinking about global macro investing in the last ten years? Some could say it is the “anything is possible” view toward central banks. There is now nothing like normal central bank behavior. Others could say that it just the change in macro relationships which has made looking at old price relationship suspect.

Commodity Return Dispersion Very Large – The Opportunity and Risk in This Sector

Volatility in commodities as measured by their dispersion in returns is high, so it is hard to characterize the behavior of the commodity sector. The periodic table of annual returns highlights the varied behavior of these markets. This list does not even include softs, tropicals, or livestock commodities and is tilted to the base metals; however, the story would still be the same.

Who Makes a Good Hedge Fund Manager? Judgment – The Combination of Assessment, Action, and Feedback

Knowledge is the Treasure, but Judgment is the Treasurer of a Wise Man. He that has more knowledge than Judgment, is made for another Man’s use more than his own.

-William Penn

My father used to tell me that brains are like muscles: they can be hired by the hour. It is character and judgment that are not for sale.

-Antonin Scalia