Archives

Bull Market with Higher Risk – Looking into 2018

2017 will go down as one of the most remarkable years for the US Stock market on record. The Dow Jones closed with 71 record highs which is a record in itself. The Dow posted a record high almost every three days. The S&P 500 posted gains of 19.4% with near-record low volatility while enduring geopolitical tensions, massive natural disasters, political turmoil in Washington and a tightening of monetary policy. In fact, the market currently has the calmest price fluctuation in 50 years, with the S&P 500’s average (daily up-or-down moves) a mere 0.30%. As a comparison, this is over half the move last year and almost a sixth (1/6) of the average daily move in 2008. It’s the smallest absolute daily move average since 1965; we had to trace back to 1964 when S&P 500 average daily move went below 0.3%. (Figure 1).

60/40 Global Blend Tells a Similar Story to US – 2017 Was Exceptional – A Normal Year May be Closer to 1/2 of the Return

The 60/40 stock/bond combination generated an exceptional year for many investors. Although a 60/40 combination is a simplified version for the portfolio that many investors hold, it is a good representation of the general asset class mix without any accounting for alpha and manager selection. For international investors, we ran a similar 60/40 combination of the MSCI World and Citi WBIG index of world sovereign bonds.

Managed Futures Up for Month and Positive for the Year Even in a Risk-On World

Much has been made about the value of managed futures during periods of market crisis, but there are also some other regularities that have been found for this strategy that can help with understanding performance.

A Dollar-Funding Problem? – Cross-Currency Basis Swaps Signal Temporary Dollar Shortage

Global macro traders look for outliers. The good ones have a disciplined approach to review and process lots of cross-market relationships looking for the few that may be out of place. These are the relationships that need capital and for those that can provide the funds, there is a reward.

Do You Really Want to Live With a 60/40 Allocation in 2018? – Follow the Numbers and You Will Likely Underperform

Numbers and statistics are a funny thing. They usually don’t lie and are not fake. You can misinterpret them, but numbers tell a story and it is the job of the investor to either accept the story or come up with an alternative.

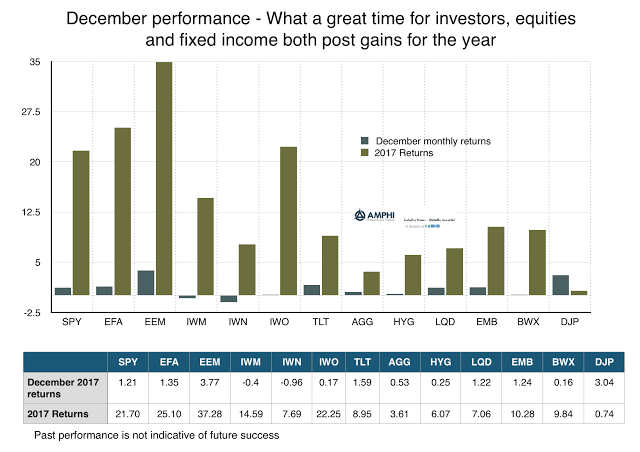

This Investing is Easy! Everything Positive for 2017, But Unfortunately We are Starting a New Year

Many pension and endowments are going to post double-digit returns for 2017. Most have exceeded their actuarial expect return assumptions of 7%. Family offices and general investors have also posted good returns for the year.

Forget About Overvalued Equities – Forecast Survey Expects 6% – Optimism Still Exists

Perhaps the market analysts making 2018 forecasts for the S&P500 did not get the memo on valuation. The equity markets are overvalued by most any measure, yet the median forecast is still expecting a 6% total return in the year-end Bloomberg survey.

Add Mental Models for the New Year – Broadening Your Thinking Process Will Improve your Productivity

Most New Year’s resolutions focus on the physical, “I will exercise more, eat less.” A better resolution should focus on mental muscles like, “I will add some mental models to my thinking.” This may help better manage time and effort and allows you to undertaken tasks more efficiently.

Slicing the Pie for Better Allocations Using Managed Futures

At the end of the year, investors will review their asset allocation decisions. Often investors will think about their pie chart exposures to different asset classes and strategies. Too often the focus is on asset class allocations and not enough on strategy differences. The problem with asset classes is that correlations may change significantly in a crisis with the usual problem being a movement to one. Diversification is not present when you need it.

Mean Reversion Is Not the Same as Contrary Thinking. A Big Confusion for Many Managers

Disagreeing with the consensus or trend is not always contrary thinking or mean-reversion thinking. It is sometimes being different for the sake of being different.

What We Look for with Trend-Following Beta – A Simple Set of Rules

Trend-following, as applied to managed futures, has been around for decades. Yet, there is no universal agreement on what is or should be a trend-following benchmark that can serve as the strategy beta or as a trend-following strategy factor. A trend-following benchmark can be used to measure the factor-beta of any manager. I can be […]

Is a Bond Bust More Likely Than an Equity Sell-Off? Look For Alternatives

The major drumbeat of asset class overvaluation has focused on equities, but perhaps a scarier place to invest is holding long duration bonds. Both asset classes may be overvalued, but a close look at the economic fundamentals may suggest that greater concern should be with bonds.

Looking at Commodities from Both a Macro and Micro Perspective – Different Stories

The narrative for holding an allocation to commodities by looking through a macro factor lens may generate different conclusions than taking a micro market-specific perspective. While the macro perspective is good for setting longer-term strategic allocations, the micro perspective helps with tactical decisions on where or how to put money to work in commodities.