Archives

Hedge Fund Performance Mixed, but some Bright Spots with Fundamental Growth and Systematic Macro

Hedge funds returns were mixed for November, but the fundamental growth and systematic macro strategies generated strong returns of over 1 percent. The fundamental growth strategy is the HFR leader for the year with a return profile at over 17%. The macro systematic strategy again generated a strong positive return. The HFR macro systematic index return was significantly higher than other systematic indices for November which suggest a high dispersion across managers in this category. The macro/ CTA which includes discretionary managers was actually down for the month. The absolute return, special situations, and emerging markets strategies were the biggest down strategies for the month, but all showed declines of less than one percent.

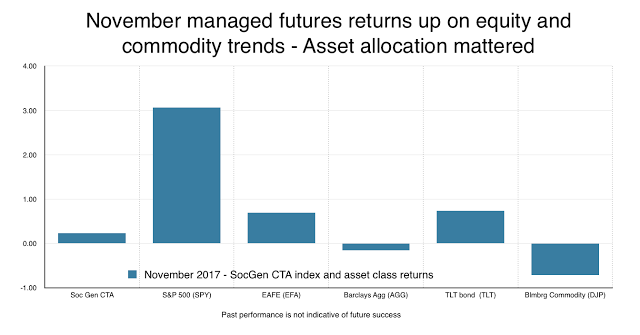

Managed Futures Slightly Positive in a Choppy Environment – Performance Driven by Asset Class Weights

Managed futures managers were, on average, positive for the month with returns beating commodities and the fixed income Barclay Aggregate index. Managed futures did not beat the strong equity performance but that should not be a surprise given that equity exposure will only be a small portion of the total risk exposure for managers. Most managers will cap the equity exposure within the program, so even if equities are trending higher, performance will lag a long-only index.

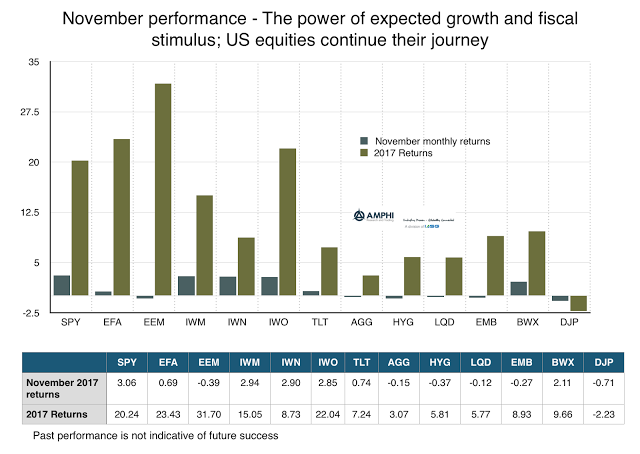

Sector Return Performance for Equities Strong across the Board – Hold Overweight in Equities

Equity style sectors were strong across the board with only emerging markets posting a negative November return; however, emerging markets have been the best performing sector year to date. The value index showed a strong gain although it still lags the growth index year-to-date. Trend indicators are all positive except for emerging markets and the short-term trend in the small cap index. Price indicators suggest that there is no reason to cut equity exposures.

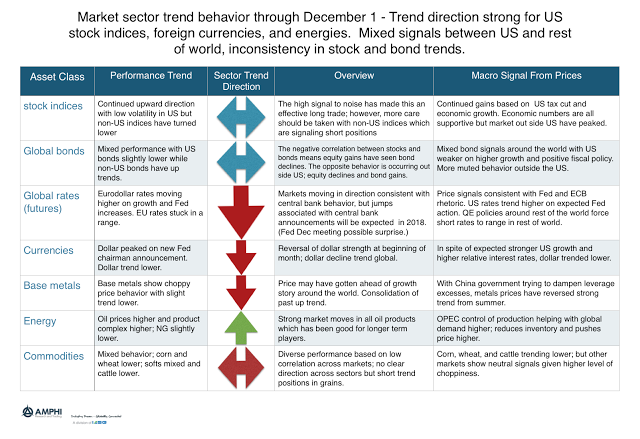

Trends Signals Still Mixed in Many Asset Classes – Long US Equity Indices Still Strongest Signal

Trend behavior last month was mixed for many CTA managers. The allocation weights had a significant impact on November performance. We believe there may again be significant dispersion in performance because trend dispersion is high. For example, US stock indices show strong up trend signals while non-US stock indices are showing clear short signals. The opposite is the case for bonds where US bond signals are for short positions while non-US bonds signals point to long positions.

Stocks Continue Their Strong Performance – Hard to Fight Equity Trends; The Opportunity Cost of not Following Trends is High

A combination of good economic growth news and a fiscal policy tailwind again drove US equity markets. The discounting of a US fiscal accelerant shows up in the positive US-global return differential for the November.

Active Cash Management for Managed Futures – A Simple Addition to a Fund’s Return Profile

Managed futures have unique features given that margin is only a small potion of the total investment. This allows for active collateral management in ways that are more impactful from other hedge funds. For most hedge funds that use a prime broker and make long/short equity investments, the focus of collateral management is with reducing the cost of borrowing. For futures, the leverage is not through borrowing but through the ability to increase notional funding based on the level of margin to equity. A good portion of funds given to any CTA is not managed efficiently but rather just held in cash.

Expected Yields and Returns for Bonds are Still Low – Go Get More Alternatives

The asset allocation decision concerning the addition of alternative investments, especially for diversification strategies, is actually quite straightforward. One, find strategies that have low and stable correlations with stocks and bonds. Two, find strategies that have a minimum acceptable return that will beat a traditional diversifier.

Normalcy for Stock Bond Correlation Says You Need Other Forms of Diversification

The bond diversification story is based on the strong negative correlation between stocks and bonds that has existed for over a decade, yet it is not a given that stocks and bond returns will move in opposite directions. A quick look at a very long history from a Wellington Management chart tells us that the negative correlation is the exception not the rule.

The Tale of the Tail – Focus on the Where, Why, and What is Wrong; Use Strategy Diversification as a Solution

Along with any discussion of asset bubbles, there is a complementary discussion concerning tail risk. If there is a bubble, there is likely to be a tail in the future. Bubbles and tails are tied together, yet tail events can occur even if there is no bubble.

Strategic Asset Allocation – Adding Value in a Low Returns Worlds

Strategic asset allocation as the name implies requires long-term return assumptions. There are often wide variations in the future forecasts. Many forecasts we have surveyed show positive expected returns, but the numbers are significantly lower than what investors have seen historically since the Financial Crisis. In general, Research Affiliates provides a good tool for analyzing the past and expected returns that we find helpful.

Holding Period Diversification – Investing with Hedge Fund Managers that have Different Trading Time-Frames Adds Value

Diversification can come in many forms. One that is not often discussed is holding period diversification or the time- frame used for making a trading decision. Some strategies are successful based on the expected holding period of the investment and not just the trading process employed. For example, there could be two price-based systematic managers who use similar models, yet they will get very different returns based the calibration of the holding period, short-term versus long-term. In the case of trend-followers, there are some trends that last only a short-time and can only be captured through trading a short time-frame versus other trends that can last for weeks, months, or quarters. These are captured differently based on the look-back or speed of the models.

Volatility Shock – A Concern That Is Real, but Should Be Tempered By VIX Dynamics

We believe that a volatility shock will generate a feedback loop that will force equity prices lower. High leverage tied to volatility targeted risk management will mean that any increase in volatility will lead to portfolio rebalancing and position cutting. This negatively correlated leverage effect between equity returns and change in the VIX is real, as measured by researchers at the New York Fed, see “The Low Volatility Puzzle: Are Investors Complacent?”.

Commodities – A Great Place to Play in Alternative Risk Premiums

Investors have shifted their focus to alternative risk premiums as a method for defining and allocating risk within a portfolio. The alternative risk premium framework can be employed in all asset classes but is especially useful in commodities given the large dispersion in markets and structural features that lend themselves to time varying risk premiums.