Archives

Dan Fuss’s 4 “P’s” for Global Fixed Income – Watch Out If You Are a Bond Holder

Dan Fuss, the Loomis Sayles bond guru, has been working in fixed income for decades. He has developed a set of four “P’s” with central bank behavior for looking at the macro fixed income environment and his read is suggesting that caution should be applied to any forecast that believes bonds are safe.

Are You Honest With Your Investment Intellect? Avoid Biases and Follow the Data

And not only the pride of intellect, but the stupidity of intellect. And, above all, the dishonesty, yes, the dishonesty of intellect. Yes, indeed, the dishonesty and trickery of intellect.

-Leo Tolstoy

Spider Chart Tells Managed Futures Story Differently

The spider chart is an alternative way of displaying data that may be useful at showing the strong diversification benefits versus different asset classes and alternatives. Correlations are looked at through a matrix form but the spider or radar graph may better display the most relevant information. Each node on the web may represent a different asset class and show the correlation of each to a single strategy.

Will Hedging, Not Speculation Be The Driver of a Financial Disaster? Is VaR Hedging Like Portfolio Insurance?

Unlike earlier financial disasters, this one will emerge not because of too much speculation, but because of the inverse – too much hedging.

-William Silber on stock market in August 1987

Could this be the problem we are facing with the next financial crisis? There has a significant amount of talk about over-valuation in equities and the reach for yield in fixed income, but there has been less focus on how a financial crisis will evolve. It may not be from speculators changing their views on the market although this could be a catalyst. Selling could be driven by investors who are trying to hedge or mitigate their risk exposures.

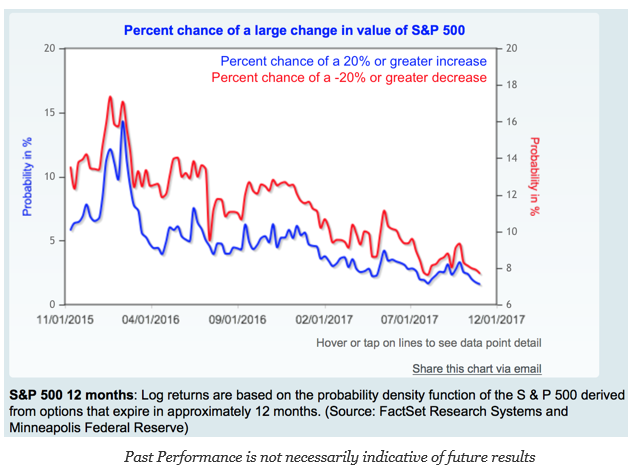

The Upside-Downside Risk Embedded in Options –Lower, But Less Balanced Than Earlier in the Year

From the Minneapolis Fed we have market-based probabilities of a large up or down market move embedded in 12-month options. This is a good market-based view of a large up or down stock market move.

Why Now Might Be the Best Time to Invest in Managed Futures

Managed futures have been in a significant drawdown with poor Sharpe ratios over the last two years, albeit October has been a good performance month. Many investors have discussed throwing in the towel and getting out of this hedge fund strategy. New investors have focused on other strategies and not wasted time with CTA’s. A […]

How Many Biases Dragged Down Your Performance Last Month?

The behavioral finance revolution has been well noted by both academics and practitioners. Multiple Nobel Prizes have gone to economists who have studied in this area, yet investment decision-makers still make the same behavioral mistakes. We have noted our biases but often we have not changed our behavior. Perhaps it is too ingrained, but good has to be reinforced.

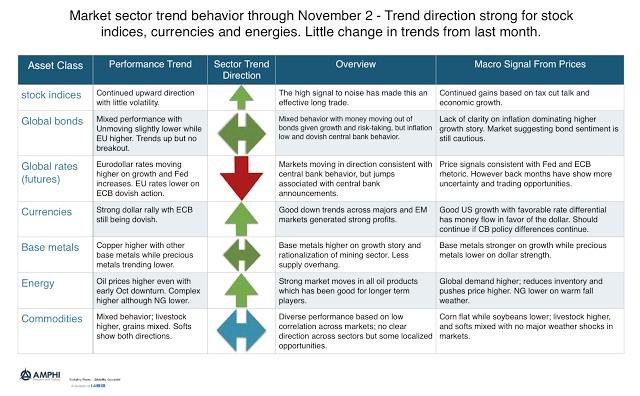

Trend Continuation in Currencies, Energy, and Equities Will Be Good For Managed Futures

You could call it the second reflation trade. Based on economic data trends which suggest stronger global growth coupled with tax reform/cut talk, we are seeing major sectors show increasing trends and opportunities. The good October trends seem to be carrying over to November. The reflation trades has driven stock indices, energy, and base metals prices higher. The differential between monetary policy in the US and the rest of the world also suggests dollar strengthening. The rate differential is in favor of the dollar. This dollar strength places downward pressure on precious metals. Bond price behavior has been a little surprising with some recent gains in spite of the strong growth story.

October Hedge Fund Performance Led by CTAs – All Hedge Fund Strategies Positive for the Year

CTAs showed their strongest performance of the year in October. Only the fundamental growth strategy came close to generating the returns seen in managed futures for the month. Some strategies actually posted losses for October even with the continued increase in equity returns.

Thoughts of Managed Futures Death Were Premature

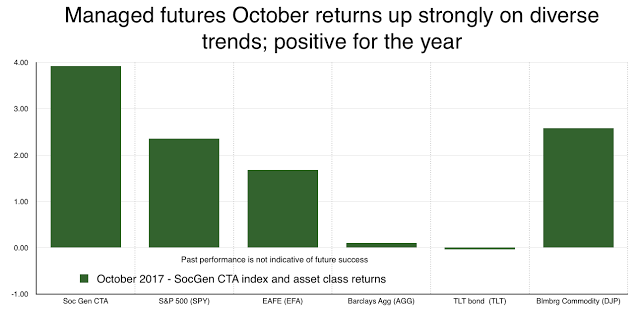

Managed futures returns exploded to the upside with index returns showing big gains relative to alternative asset classes. The positive skew for some managers was even more surprising. We saw some October returns as large as 14%. Every major index we track was close to 3% or higher. For example, the October return using the Morningstar managed futures category was positive 3.45 and the year to date return was up 1.85 percent.

Natural Gas Market – Elasticities Are Changing and That Means More Volatility

Natural gas has always been a volatile market and subject to weather shocks; however, over the last few years the volatility and weather shocks have been dampened because of the high storage inventory levels. Monthly volatility has declined by at least 1/3 over the last three years as inventories remained high.

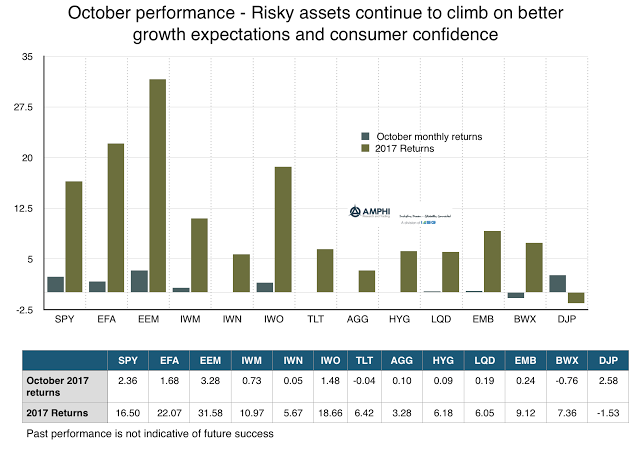

Risky Assets Up and Safe Assets Flat – Investors Look Beyond Any Political Rhetoric

Talk of tax cuts floating through the halls of Congress coupled with stronger consumer confidence allowed risky assets to continue marching higher. Warnings of overvalued equities, concerns over leverage, and higher geopolitical risks, have not stopped stocks from stronger gains around the globe. For US companies in the third quarter, 76% have shown positive earnings surprises and 67% have had positive sales surprises. The earnings growth rate is 4.7% for the third quarter according to Factset. Positive economics, good company performance, and low volatility all contributed to this continued rally.

Get To Know the Types of Diversification Because it Matters for Long-Term Performance

A simple explanation for looking at a portfolio as a bundle of diversifiable risks is presented nicely in the new book, Rational Investing; The subtleties of asset management by Hugues Langlois and Jacques Lussier, two excellent researchers and money managers.