Archives

Commodities – A Great Place to Play in Alternative Risk Premiums

Investors have shifted their focus to alternative risk premiums as a method for defining and allocating risk within a portfolio. The alternative risk premium framework can be employed in all asset classes but is especially useful in commodities given the large dispersion in markets and structural features that lend themselves to time varying risk premiums.

Changing the Risk Profile from Credit to Macro – Take Away Liquidity Risk and Switch Alternative Risk Premiums

Investors should have a growing concern with the reach for yield in the current market. The reach for yield has pushed investors into illiquid issues where the risk profile has changed from credit/carry to credit/carry/illiqudity. Investors will generally receive a higher premium if an asset is illiquid. Unfortunately, illiquidity premiums are hard to measure; consequently, the traditional credit betas will not be properly measured and there could be the mistaken view that there is greater alpha from managers who hold these types of assets.

Ivy League Performance – Competing With Top Tier Endowments Can Be Done

The latest performance numbers for Ivy League endowments have been nicely displayed in the chart below along with the 60/40 stock/bond portfolio. Since the development of the “endowment” model associated with Yale and the attention on Harvard, the largest endowment, there has been an unusual focus on these funds. There is a fair amount of dispersion between the best and worst managers in the group.

Being Short Volatility is Risky in a Crisis – Do You Know Your Volatility Premium Exposure?

Implied volatility is usually higher than realized volatility so there is a positive volatility risk premium, except when there is a crisis or volatility spike at which time the volatility premium turns negative. A recent CBOE seminar presented a chart on the volatility premium to illustrate the risk.

The Growing Danger from a Market that is Complacent of Risk – A Variation on Minksy

Investors should be concerned about the unintended behavior from low volatility. Low volatility will lead to higher volatility in the future when investors become complacent about risk, the “Volatility Paradox”. This paradox has been discussed by Richard Bookstaber as early as 2011 and recently referred to in a post on his blog, Our low risk (low volatility) world.

Dan Fuss’s 4 “P’s” for Global Fixed Income – Watch Out If You Are a Bond Holder

Dan Fuss, the Loomis Sayles bond guru, has been working in fixed income for decades. He has developed a set of four “P’s” with central bank behavior for looking at the macro fixed income environment and his read is suggesting that caution should be applied to any forecast that believes bonds are safe.

Are You Honest With Your Investment Intellect? Avoid Biases and Follow the Data

And not only the pride of intellect, but the stupidity of intellect. And, above all, the dishonesty, yes, the dishonesty of intellect. Yes, indeed, the dishonesty and trickery of intellect.

-Leo Tolstoy

Spider Chart Tells Managed Futures Story Differently

The spider chart is an alternative way of displaying data that may be useful at showing the strong diversification benefits versus different asset classes and alternatives. Correlations are looked at through a matrix form but the spider or radar graph may better display the most relevant information. Each node on the web may represent a different asset class and show the correlation of each to a single strategy.

Will Hedging, Not Speculation Be The Driver of a Financial Disaster? Is VaR Hedging Like Portfolio Insurance?

Unlike earlier financial disasters, this one will emerge not because of too much speculation, but because of the inverse – too much hedging.

-William Silber on stock market in August 1987

Could this be the problem we are facing with the next financial crisis? There has a significant amount of talk about over-valuation in equities and the reach for yield in fixed income, but there has been less focus on how a financial crisis will evolve. It may not be from speculators changing their views on the market although this could be a catalyst. Selling could be driven by investors who are trying to hedge or mitigate their risk exposures.

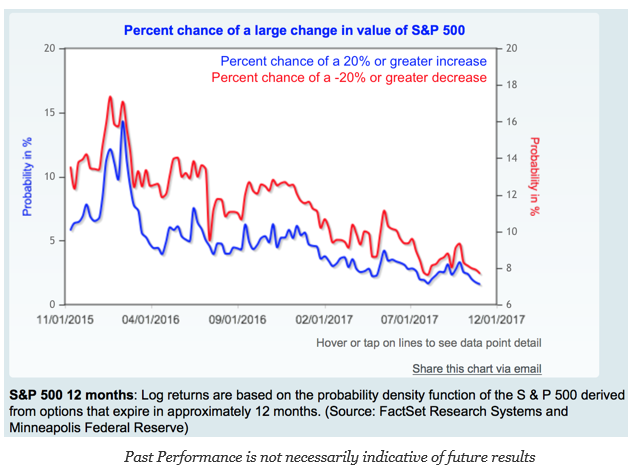

The Upside-Downside Risk Embedded in Options –Lower, But Less Balanced Than Earlier in the Year

From the Minneapolis Fed we have market-based probabilities of a large up or down market move embedded in 12-month options. This is a good market-based view of a large up or down stock market move.

Why Now Might Be the Best Time to Invest in Managed Futures

Managed futures have been in a significant drawdown with poor Sharpe ratios over the last two years, albeit October has been a good performance month. Many investors have discussed throwing in the towel and getting out of this hedge fund strategy. New investors have focused on other strategies and not wasted time with CTA’s. A […]

How Many Biases Dragged Down Your Performance Last Month?

The behavioral finance revolution has been well noted by both academics and practitioners. Multiple Nobel Prizes have gone to economists who have studied in this area, yet investment decision-makers still make the same behavioral mistakes. We have noted our biases but often we have not changed our behavior. Perhaps it is too ingrained, but good has to be reinforced.

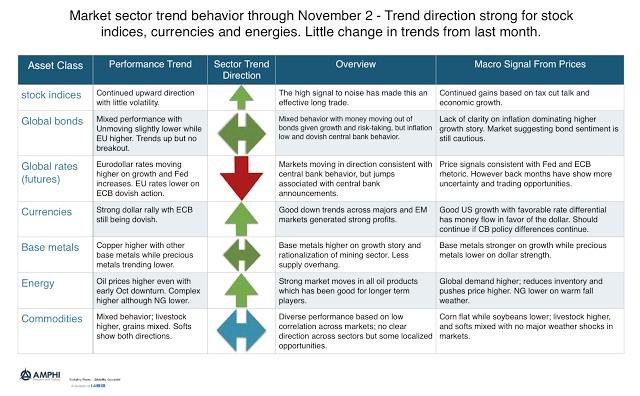

Trend Continuation in Currencies, Energy, and Equities Will Be Good For Managed Futures

You could call it the second reflation trade. Based on economic data trends which suggest stronger global growth coupled with tax reform/cut talk, we are seeing major sectors show increasing trends and opportunities. The good October trends seem to be carrying over to November. The reflation trades has driven stock indices, energy, and base metals prices higher. The differential between monetary policy in the US and the rest of the world also suggests dollar strengthening. The rate differential is in favor of the dollar. This dollar strength places downward pressure on precious metals. Bond price behavior has been a little surprising with some recent gains in spite of the strong growth story.