Archives

Zhou Xiaochuan – The Central Banker Even Quants Should Have Known. But Who Will Come Next?

You have heard of Yellen (Fed), Draghi (ECB), Kuroda (BoJ), and Carney (BOE), but most cannot name any China central banker, yet the moves of this bank may be more important than the four when thinking about the future of world currency hegemony. Zhou Xiaochuan has been in the news just before the Chinese Congress with a strong appeal for financial reform. This is reform for further ascent of China as a major financial player. He has followed this path across his central banking career, but he is set to retire in January.

Diversification Beyond 60/40: A Path to Improved Portfolio Performance

“Enough with this diversification talk, I’ve got my 60/40 and I am happy!” The 60/40 stock/bond portfolio mix has become a standard reference or benchmark for many investors, yet its performance versus a truly diversified portfolio is mixed.

Richard Thaler – Nobel Prize Winner – The Economist Who Provides a Foundation for Rules-Based Managed Futures

We congratulate Richard Thaler on winning this year’s Nobel Prize in Economics. His relentless research on the failings of rational behavior in human decision-making has had a significant impact in finance and economics. His prolific work is the foundation for all of what we call behavioral economic and finance. Prior to Thaler, economist focused on Homo Economicus, the rational man that does not make mistakes or misjudgments. Thaler showed through test after test that we make mistakes and have biases. He did this albeit radical work not as an outsider to finance like Dan Kahneman but as a economist steeped in the neoclassical tradition.

Back to Basics on Managed Futures with AIMA – Answering the Question for Why This Strategy Should be Held

There are many works on managed futures that explain the basics of this hedge fund strategy, but the characteristics need to be reinforced especially at current times when the strategy is underperforming other hedge fund strategies. The core reason for holding managed futures is that it provides useful diversification. This diversification is not available from other strategies and this diversification will be especially present during ‘bad times” of a equity decline. Don’t forget that those strategies that have more systematic risk will need to generate higher returns. Investors will be paid to hold them. On the flip-side, there will be a “payment” for managed futures which does well in “bad times”.

Is there a difference between smart and intelligent with hedge fund management?

An investor can ask, “Find me the most intelligent hedge fund manager. Someone else may say, “I want the smartest manager in the hedge fund space”. Saying that you want an intelligent manager may not be the same as saying you want a smart manager. There is a difference between intelligence and smarts, so says, Heather Butler in the recent Scientific American article, “Why do smart do dumb things, Intelligence is not the same as critical thinking and the difference matters”.

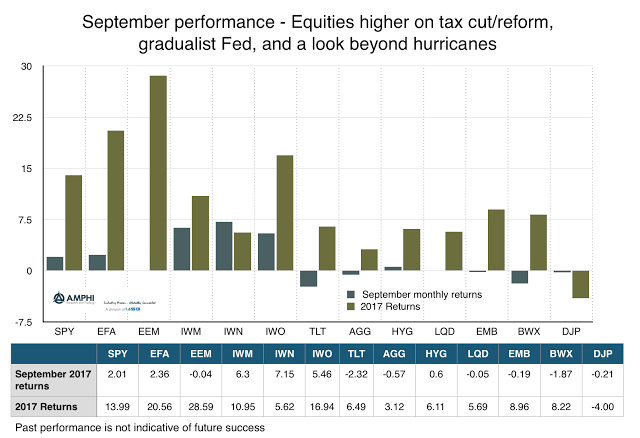

Return Rotation to Higher Risk Premium Equities Relative to Bonds

September was a month of transition for many styles, sectors, and class returns. In the style sector, small cap, growth, and value benchmarks generated strong performance under higher expectations for the reflation trade. There was a rotation from safer fixed income to higher risk premium styles. We are a long way from tax reform or a cut, but the fiscal issue is back on the table and in the minds of investors who want to get ahead of any changes.

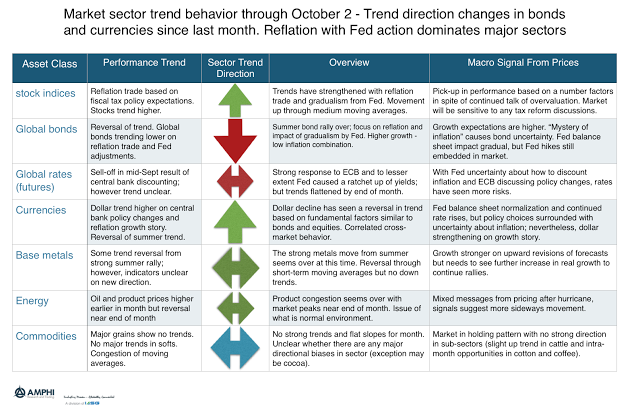

Change in Sector Trend Direction – Problems of September May Be Opportunity for October

The trend story for September was an end to the summer bond rally, a pick-up in equity trends, and a new interest in buying dollars. Without major strong trend opportunities in commodities, the reversal in bonds and currencies hurt many managed futures traders.

Bond Quality Down Further – Reason to Switch to Global Macro

Corporate spreads are tight and there is little room for further reduction given the absolute level of spreads. The reach for yield may be at an extreme. The bond spread is the compensation given bondholders for taking on the risk of corporate debt; consequently, it should become a concern when the quality of bond covenants or protections declines with spreads. Of course, if risk is declining, this is not the case, but at this point in the credit cycle it is hard to make that argument. An inverse relationship between spreads and covenant weakness means you are getting less compensation and less protection for the same risk, all things equal.

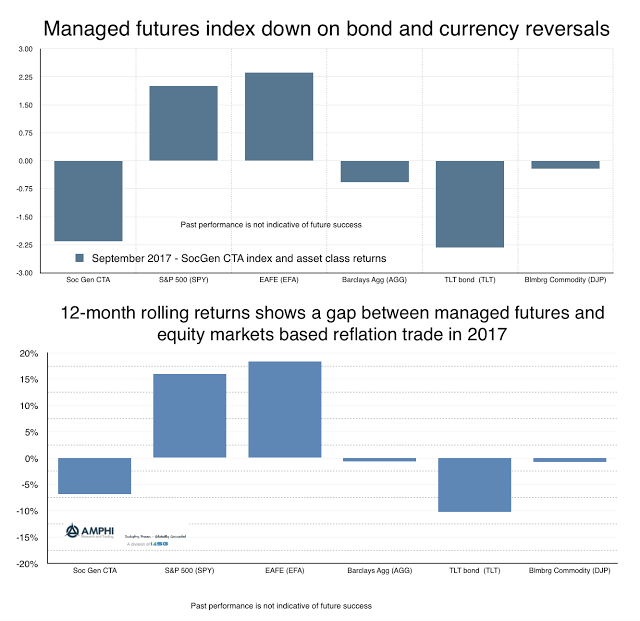

Managed Futures Turn Negative on the Renewed Interest in the “Reflation Trade”

Managed futures returns across CTA’s were down on average for September based on reversals in currency and bond trends. The weakening dollar and the strong bond returns during the summer made for good performance in July and August, but the combination of renewed interest in the Trump reflation trade and uncertainty concerning the direction of interest rates changed the trend opportunities.

No “Inflation Mystery” with Equities but Bonds More Uncertain

Regardless of the speculative warnings or the beware signs in fundamentals equity markets continue to move higher. Who says there isn’t inflation? It is just a matter of definition between real goods and financial goods.

Asset Allocation dispersion Risk – The Cost of Wrong Allocation Picks is Significant, So You Need Macro Gamma

There is no question that research shows that asset allocation matters. It matters more than stock selection and it matter more than manager selection. But, it is sometimes hard to visualize what is the impact of different asset allocation choices. The following table from Fidelity’s Market Snacks is enlightening. The table of average annual return is completely expected. If you increase risk through more aggressive asset allocations, return goes up. The movement from conservative to aggressive over the long-run is linear; nothing new here.

Deloitte CFO Survey – Overvaluation and Less Optimism – Beware

The Deloitte CFO quarterly survey should give any investor pause for concern. The numbers for this quarter show that 83 percent of those surveyed believe the equity market is overvalued. The number is at all time highs but has been around 80% all year, in spite of the market continuing to go up. Perhaps the CFO’s forecasts are wrong; however, I have more concern from the economic sentiment and expectations.

Challenge and Reality for Hedge Funds – Beating the Stock-Bond Blend

The key challenge for many global macro and managed futures managers (or any hedge fund combination) is showing their relevance during the post Financial Crisis period when the simple combination of stocks and bonds seem to have been enough to generate a very effective Sharpe ratio.

Hedge fund managers need to show their value-added in an environment where the negative correlation between stocks and bond has allowed the two-asset class blend to do an effective job of diversification.