Archives

Challenge and Reality for Hedge Funds – Beating the Stock-Bond Blend

The key challenge for many global macro and managed futures managers (or any hedge fund combination) is showing their relevance during the post Financial Crisis period when the simple combination of stocks and bonds seem to have been enough to generate a very effective Sharpe ratio.

Hedge fund managers need to show their value-added in an environment where the negative correlation between stocks and bond has allowed the two-asset class blend to do an effective job of diversification.

Look for Firms with a Risk Advantage Not Just Risk Management – The Case within Money Management

There has always been a lot of talk about the competitive advantage of a firm. For money managers, it has been about their edge. However, there is a new focus by some consulting forms about a firm’s risk advantage. (See BCG’s Henderson Institute – “Taking Advantage of Risk” and the BCG’s Perspectives piece “From Risk Take to Risk Manager”). This strategy work has focused on a firm’s “risk advantage” as an alternative to competitive advantage. Firms that manage their strategic risk options can add value relative to those that look at risk management as a police function.

Exit Strategies and Quant Trading – Knowing How Firms Deal with Exits Is Critical

A panic only occurs if you are a late follower toward the exit. The panic occurs when you realize that the cost of exiting is higher than expected and liquidation is not moving as fast as expected. A trader can go through a mini-panic on a regular basis if an exit strategy is not planned correctly and there is a liquidity shortfall, Exit strategies are all about not panicking at those critical times, yet there are trade-offs between reducing panic and maximizing return. The control of exits as well as entries is a core issue with model building and drives incremental returns.

The Business of Hedge Funds – Dynamic Choice Beyond 2/20

The lifeblood of hedge funds as businesses is their performance pricing proposition through incentive fees, but the simple business model of 2% management fee and 20% incentive fees is fast becoming extinct. Pricing is coming down as well as becoming more complex with more pricing alternatives as the businesses become more competitive and investors become more sensitive to alpha production.

Drivers of commodities in the Medium Term – Global Growth and Dollar – Look Positive

If you wanted to focus on three longer-term macro factors that will drive overall commodity prices, it will be global growth, the dollar, and liquidity. The determination of long-only allocations in any asset allocation should focus on these three. Trading issues will be driven by volatility and market shocks.

Tetlock – Political Forecasting is a Loser’s Game… So Follow Trends?

The talking heads in the media spend significant time making political predictions. Even many Wall Street economists fall into the trap of giving political forecasting advice instead of digesting the economic data. The outcomes and impact of elections; pundits usually don’t know. The time of geopolitical risks and wars; pundits don’t know. The cultural changes that will impact markets; pundits don’t know. Unfortunately, the media does like the experts who are doubtful and equivocate. Pundits, however, are not often stupid. They provide significant amounts of information, background, and data. It is just that their ability to make good forecasts is poor. The advice from the forecasting expert Phillip Tetlock, the author of Superforecasters and Expert Political Judgment: How Good is It? How Can We Know? is very simple, “Don’t listen to them”. Their overconfidence will cause investor decisions to go awry. They place too high a probability on their views.

Research and Systematic Investing Can Overcome Motivated Cognition

Motivated cognition – we believe what we want to believe. We will also believe based on who we are and who we want to be. Our goals and needs shape our thinking. Facts do not change our goals when we have motivated cognition. Investors rationalize and filter evidence presented to support their views. Motivated reasoning will generate confirmation biases.

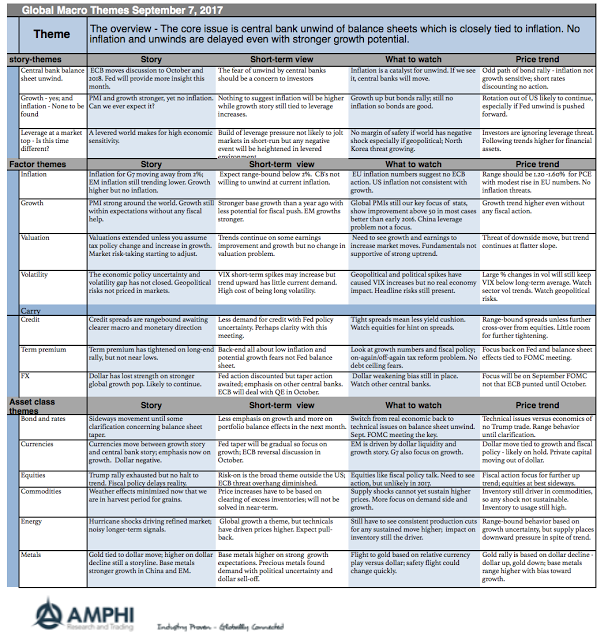

Global Macro in One Page – Where is that Inflation?

Where is that inflation? Central banks have this fixation on 2% inflation as both a goal and a signal. Policies have been structured for the magic 2% and signals for balance sheet action are based on the inflation hitting 2%, yet current inflation has not been able to reach this number. Growth expectations have been moved higher, yet there seems to be continued economic slack that will not allow product prices to push beyond 2%. Hence, central banks have held to current policies. (An exception was the Bank of Canada this month.) The result has been further asset price appreciation and more leverage. This combination will have to be adjusted, but not today. Nevertheless, markets are still hyper-sensitive to monetary policy musings.

Keeping it Simple with Explanations – An Investment Narrative needs to Answer Key Questions

There are two communication problems with global macro investing. First, the stories used to explain the global macro economy are confusing, contradictory, and haven’t proved to be true. This is an outgrowth of the poor forecasting of macroeconomics in general. Second, the stories used to explain the investment process especially for quants goes over the head of most investors. A discussion of techniques is not an explanation for how returns can be generated. Managers need to work on their narratives to ensure that investors understand what they do and why they make money.

AllianzGI Risk Monitor Survey – Geopolitical Risk on the Rise, Requires Special Thinking

If you tell me I have increased equity risk, I can adjust my asset allocation way from stocks and determine a good hedge strategy. If you tell me there is more interest rate risk, I can adjust my bond exposure and determine a hedge. But, if you tell me I have geopolitical risks, the choices or options become more complex. Geopolitical risks just don’t happen often so we don’t have a lot of countable events. Increased political risks will usually mean risk-off, but how this plays-out through a portfolio is less clear. It calls for more careful portfolio construction and diversification management.

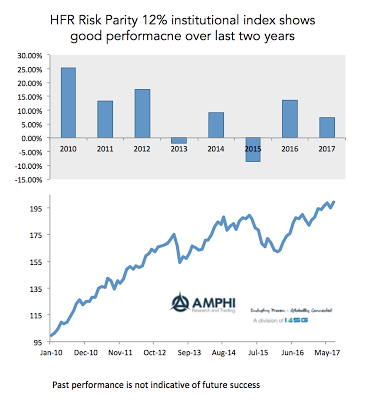

HFR Risk Parity Indices – A Systematic Alternative that is Returning

HFR has announced a new set of risk parity indices. The set of indices includes risk parity strategies at different volatility levels and for both institutional levels and smaller funds. These investable indices represent 25 different products with $110 billion in AUM. The risk parity portfolios are generally comprised of four sectors which are given equal risk weight: equities, credit, interest rates, and commodities.

Hedge Fund Performance – Growth, Macro, and EM Best Strategies

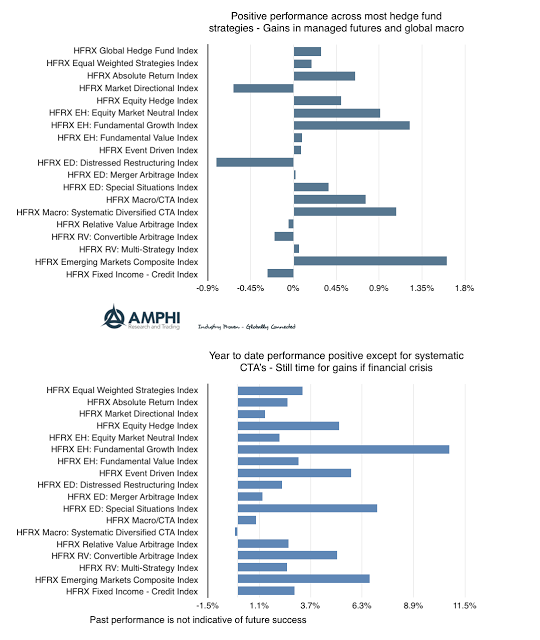

While stocks were mixed with performance down for the month in with growth, value, and small cap benchmarks, there was a general increase in hedge fund returns for August. Equity-focused hedge funds gained from the added dispersion in returns across sectors and individual stocks. Evidence suggests that active management relative performance increases when the correlation across stocks decline.

MiFID and Managers as Return Factories – For Whom is it an Issue

MiFID II is coming with less than four months to go until the start date in January 2018, yet money mangers and hedge funds are scrabbling to find the right regulatory structure and the right way to manage the costs of the business. MiFID requires an unbundling of brokerage from research costs. Asset managers will either have to pay for research or bill clients. Many managers have yet to make or disclose their intentions on how research costs will be handled. A topic that has not been fully covered is an understanding of the cost generating the investment returns based on the process employed.