Archives

Is it Worth Trading Both Euro STOXX 50 and 600? Country and Capitalization Plays

Is it worth trading two highly correlated equity indices? The correlation between the Euro STOXX 50 and 600 is generally above .95, so most would argue that the two are interchangeable. There is a significant difference in the volume of each futures contract, so liquidity may not be the same. Hence, some would argue that it is reasonable to choose one, but a closer look will show that there are spread opportunities across the two indices no different than the equity spread opportunities in the US based on size or industry mix. Spread trades in index futures offer a way to increase the opportunity set of returns in ways that are often uncorrelated with traditional directional bets.

A Simple Taxonomy of Diversification – All Diversifiers are not Alike

When I hear about diversification across funds or strategies, I, like most investors, will immediately focus on the correlation matrix versus other alternatives and asset classes. However, investors should be thinking beyond the simple historical numbers and focus on forward expectations for correlations. There should be views of how diversification may change through time or behave under different scenarios. To form diversification or correlation forecasts, investors should have a classification scheme for diversification. All diversification is not alike and a classification scheme may help with determining how correlation may move.

Managed Futures in a Drawdown – How Bad Is It? – Take a Look

As measured by a well-watched peer group index, the managed futures hedge fund strategy is in a significant drawdown. Despite this, money is still flowing as investors have taken a forward-looking view of what this strategy will do if there is a sell-off in major asset classes like equities. Of course, indices do not represent […]

Cost of Liquidity – The Hidden Management Fee that needs to be Calculated

Investors are looking closely at the fees being charged, but the hidden fee of liquidity may be the most significant cost that is often not talked about. Large firms that are charging less may have higher costs associated with liquidity than small firms. As the size of the firm grows, the cost of entering and exiting may be higher. Additionally, some markets that may offer opportunities are avoided because the cost of trading when liquidity is lower is higher.

It’s an Electronic Futures World – Now What Do We Do? The Changing Role of Brokerage

Automated execution is taking over futures markets. Actually, the battle is over. Voice (non-electronic) and manual execution are reserved for illiquid products, old school firms, smaller traders, those who may be undertaking spreads, complex legged or option strategies, roll strategies, and some block trade. However, the use of electronic trading can vary by market and sector. Technically, we are referring to manual (MAN) versus automated (ATS) trade execution where automated is generated and/or routed without human intervention. Non-electronic would be a separate category. By far, automated to automated trades dominate most markets even in many commodities. The high frequency automated traders are the new market scalpers. Financials have a higher percentage of automated trading over commodity markets.

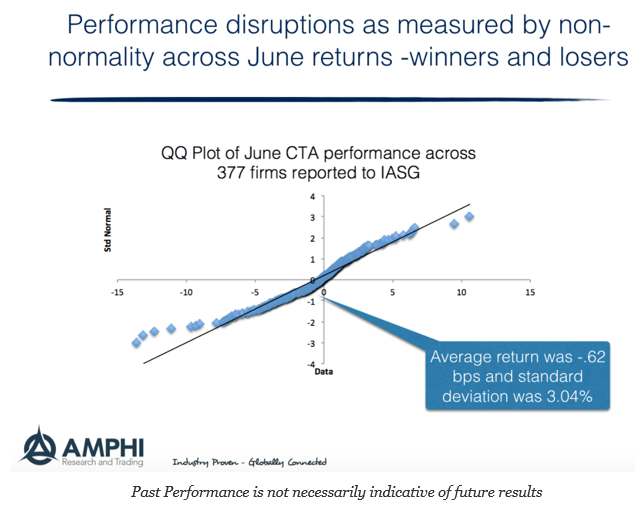

When Markets Disrupt, So Does Performance – June Managed Futures and Outliers

What kind of month was June for CTA’s? Well, you can look at the distribution plot of returns for the month to get an idea of the extremes. We created the QQ plot for the 377 firms that reported to the IASG database for June as of last week. This can be done for smaller more specialized samples, but we took the maximum set of data reported to IASG.

Using Hedge Fund Pricing as a Weapon – The Firms with Scale Will Squeeze Smaller Firms

The idea that hedge funds are getting 2/20 for management fees is becoming a myth. Dynamic pricing is being used more aggressively by hedge funds with a wide range of management and incentive fee options. For example, in the managed futures space, there seems to be a willingness to offer beta products as low-cost alternatives as well as traditional alpha plus beta products. The low cost products are being marketed as trend-following beta at low cost while higher priced products are being offered as alpha generators relative to trend-following beta. Of course, there is not a clear definition for what is trend-following beta so there is something more going on with this pricing. (The beta may be associated with a peer index, so the beta firms offer a low cost product to match a bundle of competitors.) This approach is being used by a number of larger firms.

Suffering from Regret in the Hedge Fund World – A Problem for all Investors

We have learned from behavior finance that one of the key thing that investors do not want to suffer from is regret. From prospect theory, there is a desire to sell winners and hang onto losers in order to avoid regret not suffer from loss aversion. Loss aversion tied everywhere to the decisions we make. Picking the wrong manager. Picking the wrong strategy. Picking the wrong time to enter or exit a trade. Investors do want to make a decision only to find out that ex post it was a poor one.

AUM Growth as a Signal of Quality – Is the Herd Right?

It is hard to determine whether one manager is better than another when looking at performance numbers. The sample sizes are often too small to distinguish return differences, so investors often looking for other signals that can be used to suggests one manager is better. One that is often used is growth of AUM. Call it the “wisdom of crowds” signal. If an investor cannot distinguish the return performance between two managers, he will place weight on the dollar opinion of others. If the herd is investing in manager X, perhaps they know something that others don’t. The investor will free ride on the due diligence of others and invest with the manager who is growing faster.

Trend-Following – A Century of Data Suggests There Is Value

Consistency is critical for any investment style or factor, and it seems that trend-following seems to show it better than most other alternative strategies. It is now almost amusing that when efficient markets ran supreme as the paradigm of choice for market behavior no one was able to find these results, but now that there […]

Is “Directional Volatility” Needed for Trend Followers?

What is needed is volatility coupled with price trends, which Ivarsson refers to as “directional volatility”. “What we at RPM look for is ‘directional volatility’, meaning volatility that drives markets in a certain direction”. – RPM’s executive Vice President Per Ivarsson

The concept of directional volatility is elusive. It combines two concepts, the path of prices with the price spread away from the average. The quote is focused on the critical need for a trend with volatility for trend-follower to profit. Volatility is necessary but not sufficient for strong trend-following profits. It is necessary to have prices move across a range in a discernible path, but a wide price range can still be without trends. Trends may occur if there is low volatility but the level of profits will be smaller and the trends will be harder to identify.

The depiction of trend following as a look-back straddle is based on volatility and the ability of the trend follow to capture the range. The look-back option is the potential max that a trend follower may achieve for a single trade within a time span. Nevertheless, if we think of a stochastic process for a price series, we want a mean change plus wide dispersion. It is not enough to just have volatility, the journey expressed in the volatility is critical.

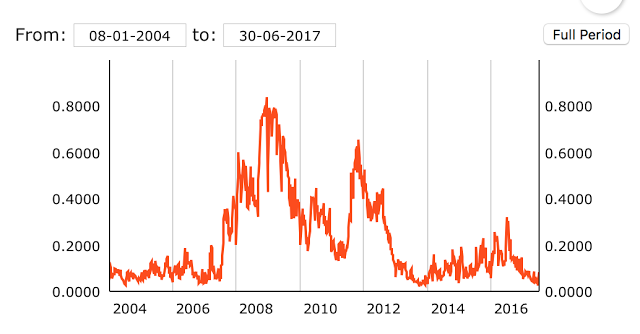

ECB CISS Index; There is No Trend in Stress – Be Happy

Don’t worry, be happy and without stress. The ECB Composite Index of Systematic Stress (CISS) measures declining stress in the EU. While there is a big disclaimer with the ECB risk dashboard that this is not an early warning system, the declining trend tells a story of stability. This index serves as a European equivalent […]

Global Macro on One-Page – All about Central Bank Balance Sheet Issues

What will be the key driver for global macro portfolios in the year’s second half? I hate to say it, but it will again be central bank behavior. I thought there was a switch to focus on the real economy with the Fed starting to raise rates and react to the macro environment. Still, markets […]