Archives

Trend-Following – A Century of Data Suggests There Is Value

Consistency is critical for any investment style or factor, and it seems that trend-following seems to show it better than most other alternative strategies. It is now almost amusing that when efficient markets ran supreme as the paradigm of choice for market behavior no one was able to find these results, but now that there […]

Is “Directional Volatility” Needed for Trend Followers?

What is needed is volatility coupled with price trends, which Ivarsson refers to as “directional volatility”. “What we at RPM look for is ‘directional volatility’, meaning volatility that drives markets in a certain direction”. – RPM’s executive Vice President Per Ivarsson

The concept of directional volatility is elusive. It combines two concepts, the path of prices with the price spread away from the average. The quote is focused on the critical need for a trend with volatility for trend-follower to profit. Volatility is necessary but not sufficient for strong trend-following profits. It is necessary to have prices move across a range in a discernible path, but a wide price range can still be without trends. Trends may occur if there is low volatility but the level of profits will be smaller and the trends will be harder to identify.

The depiction of trend following as a look-back straddle is based on volatility and the ability of the trend follow to capture the range. The look-back option is the potential max that a trend follower may achieve for a single trade within a time span. Nevertheless, if we think of a stochastic process for a price series, we want a mean change plus wide dispersion. It is not enough to just have volatility, the journey expressed in the volatility is critical.

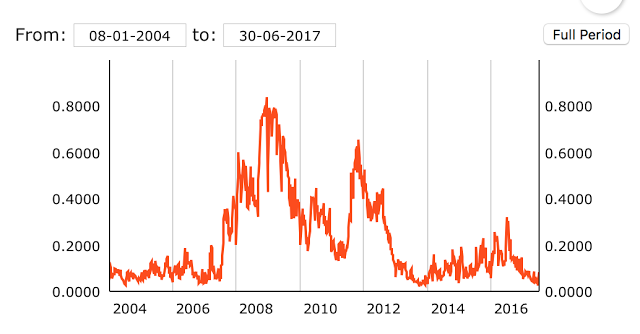

ECB CISS Index; There is No Trend in Stress – Be Happy

Don’t worry, be happy and without stress. The ECB Composite Index of Systematic Stress (CISS) measures declining stress in the EU. While there is a big disclaimer with the ECB risk dashboard that this is not an early warning system, the declining trend tells a story of stability. This index serves as a European equivalent […]

Global Macro on One-Page – All about Central Bank Balance Sheet Issues

What will be the key driver for global macro portfolios in the year’s second half? I hate to say it, but it will again be central bank behavior. I thought there was a switch to focus on the real economy with the Fed starting to raise rates and react to the macro environment. Still, markets […]

Most Stocks are Losers – Median and Skew Tell an Important Story

Most stocks do not do well over their lifetime. If you randomly pick a stock or set of stocks there is a high likelihood you will not do better than T-bills and you will likely not survive for a long time. This should be well-known, but a new research paper really present some stark conclusions. This is a paper that is insightful and sobering for most investors. See “Do stocks Outperform Treasury Bills” by Hendrik Bessembinder.

The Icarus Trade: A Testable Concept or False Narrative?

We have heard the term “Icarus Trade” recently popping up in market discussions several times. In Greek mythology, Icarus creates wings to fly, but his overconfidence took him too close to the sun, where his wings burned, and he fell back to earth. In investment terms, the overconfidence of some investors will take them to […]

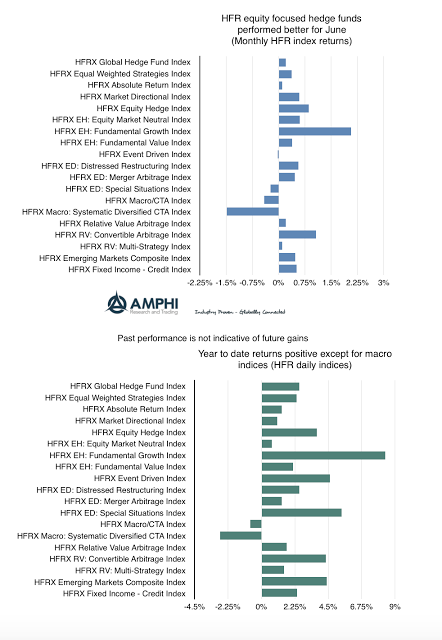

Hedge Fund Performance – Mixed from End of Month Volatility

The equity focused HFR hedge fund indices produced positive returns for the month of June while those indices focused on broad-based macro trades declined. Equity focused hedge fund managers will often do better when there is more dispersion across industry sectors and when there is stronger performance in broader-based indices like the Russell 2000. The market saw strong gains in both growth and value indices and less emphasis on large cap names. The fall in tech stocks which have been at elevated levels may also have been a contributor to some hedge fund gains.

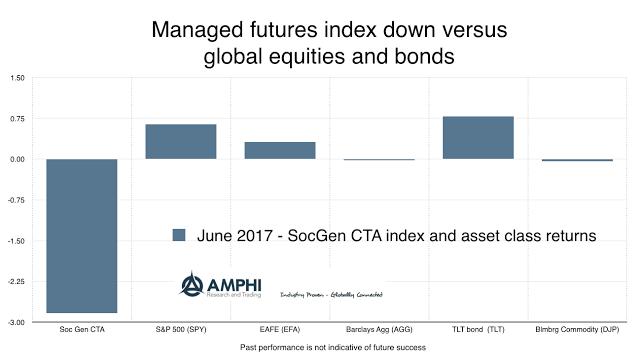

Managed Futures Hit with Trend Reversals, but Opportunity Potential in July

The managed futures index from SocGen was down over 2% for the month with price declines in many major financial markets over the last week. Similar performance has been found with other indices; however, those managers with more commodity diversification have fared better.

Trend Environment Looking Stronger – Loses in June May Lead to Profits in July

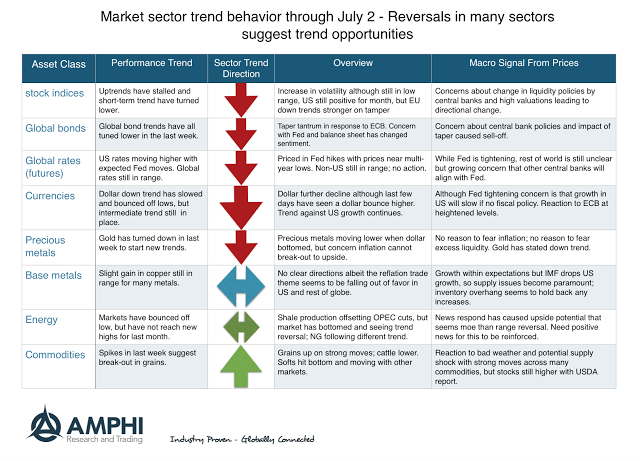

Trend traders were hit with a number of significant reversals in major asset classes near the end of the month. Bonds were rocked with a possible ECB “taper tantrum” albeit it is early to say that this will be like what was seen in the US. No two market tantrums will ever be the same. Equities are in a trend decline in Europe and the US has started to trend lower although the month still generated positive gains for many investors. There is an equity rotation away from large cap indices, but it is hard to take advantage of in futures. The dollar also trended lower near the end of the month only to see some gains in the last two trading sessions. Many commodities moved higher on weaker supply reports and oil products has bounced off the declines from the past few weeks. Last week was the major reversal period.

Sector Performance Mixed with Potential Roll-Over of Trends

2017 has been a risk-on year. It started with a risk-on sentiment for the US with the Trump trade and moved to a global phenomenon; however, as we end the first half of the year there is a growing level of concern across many market sectors. Short-term moving averages and break-out indicators have turned negative for a number of styles indices in June. While all major sectors except for value are positive for the year, there is the view that uncertainty and volatility may start to swamp the risk-on euphoria. Fears of over-valuation may be a topic of discussion, but money flows and price action over the last six months have told a different story.

Central Bank Communication and the “Cool Hand Luke” Effect

” What we’ve got here is failure to communicate. Some men you just can’t reach. So you get what we had here last week, which is the way he wants it. . . well, he gets it. I don’t like it any more than you men.” – Cool Hand Luke (1967) – The Captain’s speech

The last week was tough on both bond and equity markets around the globe because central bankers were trying to provide “forward guidance” to the market. Central bankers speak and the market will listen and react.

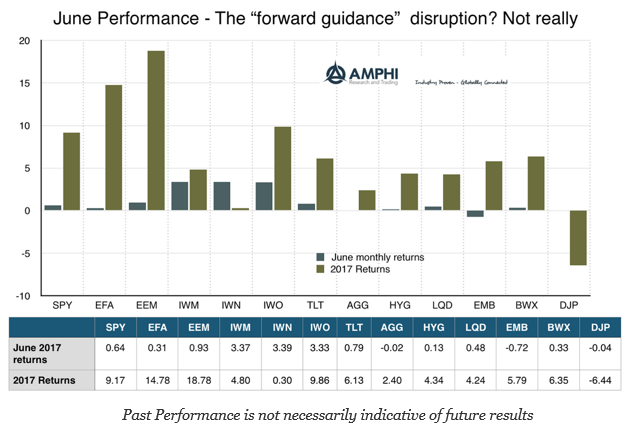

End of Month Disruption Did Not Offset Gains for Month – The Upward Path on Holiday

In spite of the market anxiety during the last week of the month, most major indices generated positive returns for June. The only exceptions were the emerging market bond index (EMB), the Bloomberg commodities index (DJP) and the Barclays Aggregate index (AGG). It was surprising that small cap, value and growth all posted strong gains after falling behind global and large cap equities. Bonds were generally positive even with the turbulence in the last week.

Diversification without Some Pain is not Diversification

“No one likes losing money, but if something in your portfolio isn’t giving you heartburn, you’re probably not diversified.” – John Lindner, PCA Consulting

How many times have you recently heard, “My hedge funds are not generating enough performance relative to my equity portfolio. Why am I holding this stuff?”

The answer is simple. It provides diversification. This diversification can be across markets, time-frames, factor sensitivities, and styles of return generation. Diversification by its very nature means that there will be performance differences and return gaps. A well-diversified portfolio will have assets that do not move together, so it should not be surprising that if an asset is added to generate diversification it will not match the core performance of equities and bonds. If performance across portfolio exposures is similar, diversification was not achieved.