Archives

The Effectiveness of Managed Futures: Exploring Trend-Following Strategies

Why is managed futures or, more precisely, trend-following an effective investment strategy? Many managed futures programs have been successful by keeping it simple and using heuristics like following the price trend and not always using all the available information about a market. Disciplined and systematic decision-making seems to be a robust means of dealing with […]

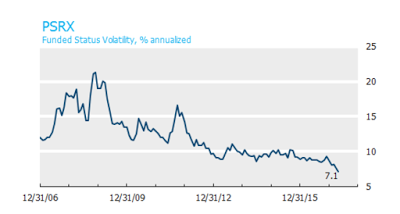

Pension Surplus Risk at all Time Lows

The Funded Status Volatility index (PSRX) from NISA is a useful tool for understanding pension risk exposures. It is an aggregate of the risks for pension based on the combination of assets and liabilities associated average allocations for the 100 largest pension funds as measured through public information and 10-k filings. The index, which represents $1 trillion in AUM, will move up and down with the volatility of all asset classes. Hence, falling equity and bond volatility as well as changes in the discount rates will translate into a falling PSRX index.

Volatility and Managed Futures – Is There a Relationship with the VIX?

Many believe that managed futures is a long volatility strategy because the strategy is like being long a look-back straddle. We believe there is a more nuanced story associated with long gamma exposure, but let’s use the prevailing wisdom of long volatility as a starting point for a discussion.

How Many Managers Should You Review Before You Pick One?

Choices, choices, choices. There are just so many managers to choose for a portfolio. Look at the major database; hundreds of managers of all sizes, styles, and skills. Using some simple criteria, the list can be reduced significantly. Minimum size, minimum track record, max drawdown, and max volatility could be just a few ways of […]

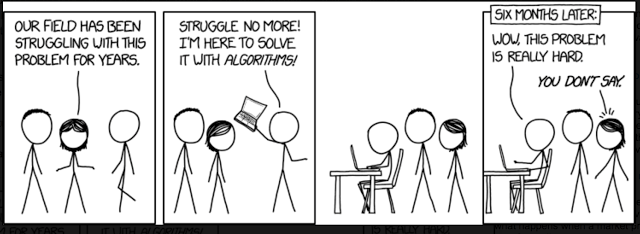

Quant Research and Managed Futures – Key Areas of Focus

Managed futures research is hard. This is especially the case in the quantitative area. There always are new models being tested by almost all managers, but finding a truly new model or process that adds value is truly difficult. Data mining is an issue.

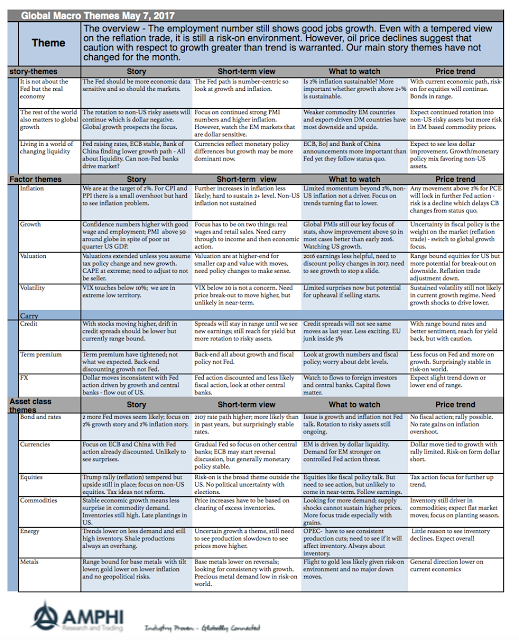

Global Macro on One Page – May 2017

The Fed and other central banks are not that important in the current thinking of investors. The focus is not on the policy musings of bankers but the real economic data. All that matters is whether growth has a strong chance to be above trend and whether global DM inflation has a chance of reaching and sustaining 2%. We are skeptics of both occurring.

The Importance of Liquidity in Metals Exchange and Futures Contracts

There should not be a lengthy discussion on what investors want from a metals exchange or futures contract—liquidity, liquidity, and liquidity. We use the word three times for each liquidity form that attracts trading. It does not matter if you are a hedger or speculator; the demand is the same; deep liquidity, so the cost […]

VIX and What to Expect – The Odds Against the Big Jump

The VIX index, the most widely watched measure of market volatility, is at extended lows with a jump lower after the French presidential first round election results. The uncertainty and risk premium from this election has been taken out of the market. Economic uncertainty has also fallen since the US election although it is still elevated since the earlier last fall.

Commodity Investing – What is it all About?

What is commodity investing all about: 1. The curves and carry – backwardation/contango (inventory). Given the cash market for commodities is often not available for investing, the primary market for investors in commodities is the futures. Consequently, the shape and dynamics of the futures curve is a dominant factor for longer-term investing. Investors cannot think […]

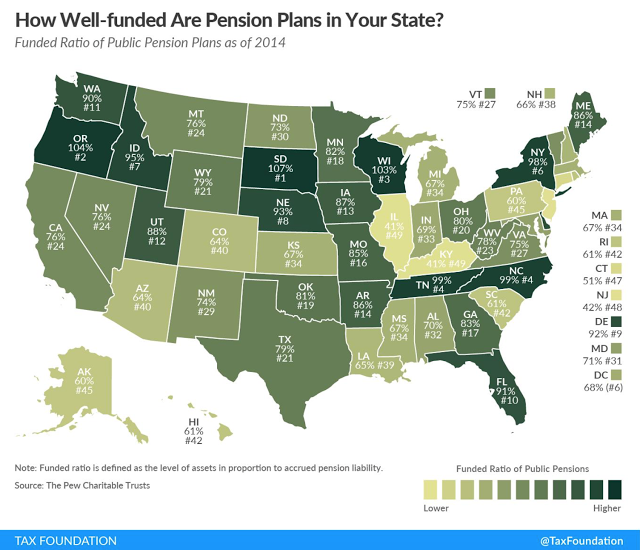

Who Needs Alternatives Like Managed Futures the Most? Underfunded State Pensions

The Tax Foundation map of state funding ratios for public pensions is very sobering. The amount of state under-funding is significant. These numbers are determined by the discounted expected liabilities relative to the assets held. To stay even with these ratios and assuming there is no surprise increase in liabilities, the states have to return the discount rate. These discount rates or expected returns seem unrealistically high.

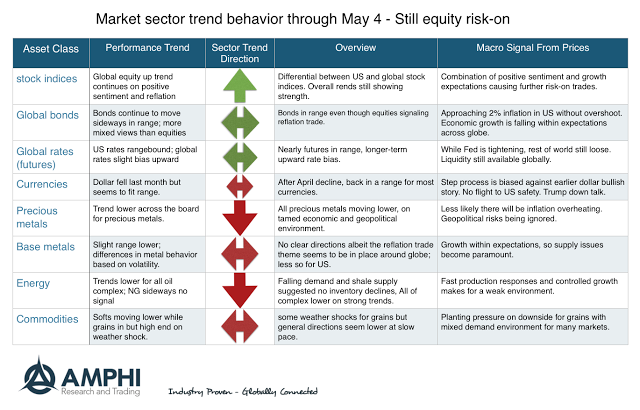

Market Trends for May – Some Developing Strength

Going into the month, there are good up trends in place with global equities and down trends in oil, precious metals, and selected commodities. What is interesting is the inconsistency across some markets sectors. The reflation risk-on trade is still apparent in the global equity indices, but we are not seeing strong evidence of bond sell-off or rally. Oil prices suggest both supply strength and demand weakness. Gold and precious metals are out of favor with long-only investors. The idea that we will have a dollar rally on Fed hikes seems misplaced and there is less risk-on demand for the US relative to the rest of the world.

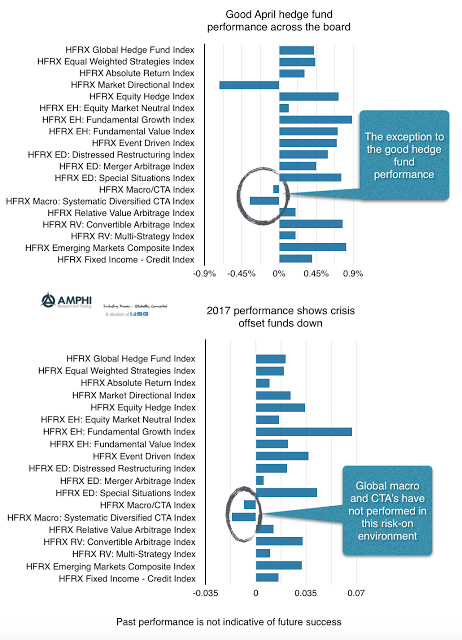

Hedge Fund Performance Consistent with Environment

No hedge fund strategy will make money all of the time. As the market and economic environment changes, the performance of different strategies will also change. Hedge fund factor exposures will be different based on the strategy employed by the manager. If you cannot predict the environment factor exposures, there is value with holding a diversified portfolio of hedge funds. April performance clearly shows the difference in strategy behavior.

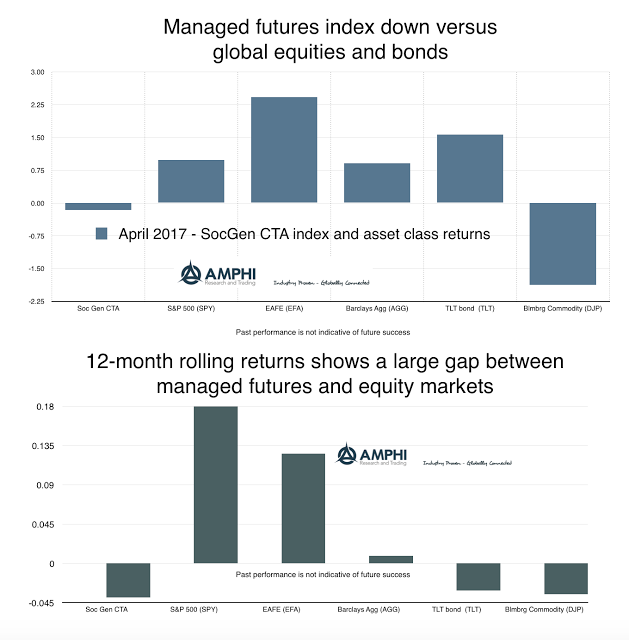

Managed Futures Flat for Month of April

The SocGen CTA index was essentially flat for the month which is not surprising given three major factors. One, we are in a global risk-on environment which generally is not attractive for trend-followers. It is not that there are no trends, but there were limited gains from diversification across asset classes relative to a risk-on portfolio. Two, there were few strong trends going into the beginning of the month. Given the usual time-frame for effective trend-following which is weeks not days, there has to be continuity of trends to have a good performance month. The strong gains in foreign markets may not have been given enough exposure to generate good portfolio returns. Three, the focus on financials especially fixed income and currencies by large managers was a drag on performance relative to equities and short commodities trends. Four, volatility is at extreme lows. We have looked at market volatility through the VIX index and current levels are above the 98th percentile for the lowest since 1990. Divergent strategies based on taking advantage of the spread in prices through time will be limited in their return potential in this type of environment.