Archives

Using Economic Growth as a Predictor for Managed Futures Returns

Another simple test to determine whether managed futures returns will do better than average is by looking at economic growth. We know that bonds and other defensive assets like managed futures will do better in “bad times,” such as a recession, but there are not many recessions. The cost of being defensive can be very […]

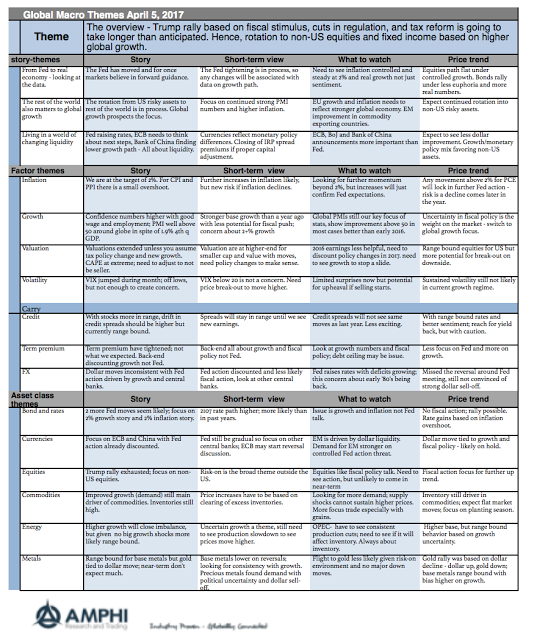

Global Macro in One Page – Rotation to Non-Dollar Assets Continuing

March was a tough month for making any economic judgments. The Trump rally in equities was expected to continue, but reality has been a switch to non-US risky assets. A bond sell-off was expected given Fed action combined with more fiscal policy revelations. It did not happen. The dollar was expected to continue its rally based on further confirmation of the Fed being out of step with other central banks. It did not happen.

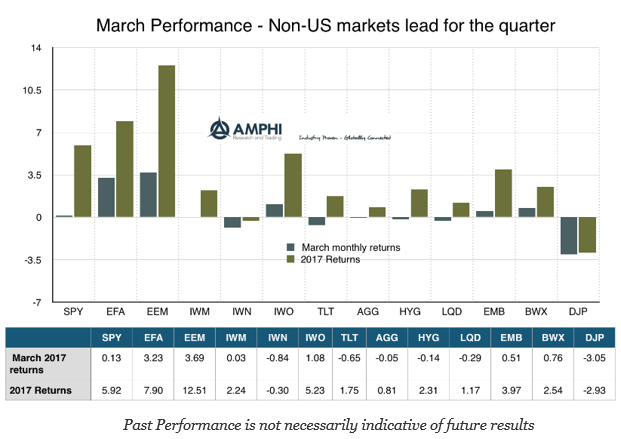

March Showed a Rotation in Return Performance

March saw a significant rotation in return performance from US equities to global and emerging markets and from value to growth. Our indicators show prices are starting to break to the downside albeit trends are currently flat. March was a transition month from euphoria to reality concerning US government policies. Future price direction will be determined by the real economy and not policy expectations.

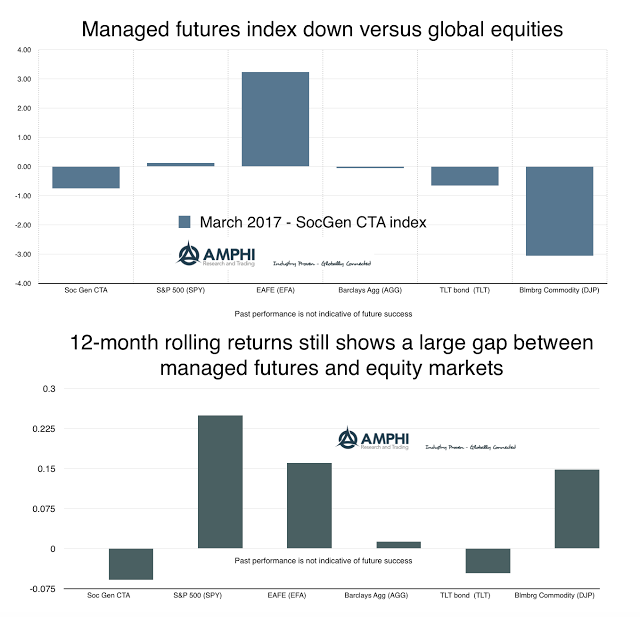

Managed Futures Cannot Find Returns on Market Reversals

Managed futures declined on market reveals from the Fed FOMC announcement of a 25 bps rate hike. While the move seemed to have been baked into market thinking before the announcement, key asset classes revised trend direction after the 15th. The SPX, which was already flattening in trend, turned lower. Bond returns, (long duration), actually turned higher on a perceived more aggressive Fed. The dollar strength reversed and commodities moved higher after declining for the last month. You get the picture on the change. Trend-followers saw a reversal in performance which added to a lower overall return.

LMEprecious – Joining the Futures World?

Any managed futures trader will tell you that trading metals on the LME is much more difficult than other “futures” contracts. Structural differences make for a more challenging environment from monitoring and capital usage to transaction costs. The continuous forward contracts of the LME are just more difficult to trade than the focused discrete delivery dates of futures because market liquidity is spread over a wider set of dates. Even if liquidity is centered at a three month prompt, the liquidity on exit before expiration may be more difficult to find.

Managed Futures vs. Tight Financial Conditions: Who Wins in the Battle of Investment Strategies?

Financial conditions can inform us about periods when thises and market dislocations will occur. The graph above shows the time series for the Chicago Fed adjusted financial conditions index. The index measures liquidity, risk, leverage in money, debt, and equity markets, and traditional and shadowing banking measures. If the index is positive (negative), financial conditions […]

Strong Non-US Returns for the Quarter – End of the Trump Effect?

The capital flows and returns for the month and quarter tell a risk-on story for global markets. This is not the case for the US where equity returns were at best flat and bonds showed negative returns in March. The dollar sold off for the month by slightly less than one percent as measured by the DXY dollar index. Even if we account for the dollar tailwind for international stocks, global equities did better than the US by well over 2% for March. Emerging markets have seen the best quarter in years with double-digit returns. Adjusting for the dollar would have placed international and emerging market bonds in-line with US bond returns.

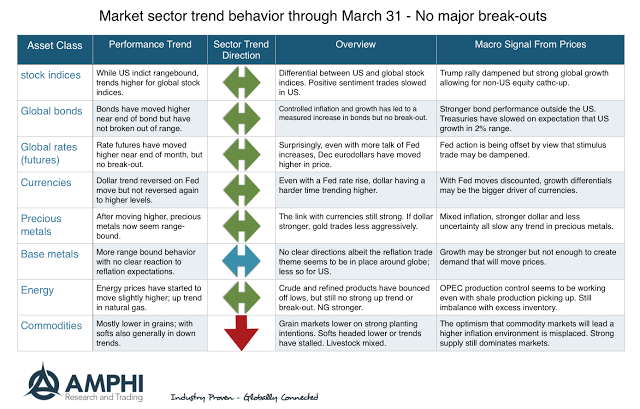

Trends and Break-Outs – No Strong Directions for any Sectors

For most managed futures managers, the modeling task is simple, look for trends or break-outs. Managers are not predictive but reactive to what market prices are doing. Looking at the current price data across the major sectors provide little evidence of strong trends or break-outs. Trends that seem to be currently developing are not strong enough to move beyond recent highs, so our trend sector matrix is showing sideways to a slight up moves across most sectors with the only strong trends in commodity markets.

Golden Rule of Forecasting – Be Conservative

One of the leading experts on forecasting is J Scott Armstrong, from the Wharton School. He has produced numerous papers and books on forecasting but has encapsulated all of his decades of thinking with his paper, The Golden Rule of Forecasting. There is a right and a wrong way to do forecasting and Armstrong walks through the key issues, whether it is through an econometric model or a judgmental forecast. His golden insight is that when in doubt be conservative. More deeply, his comment is that the forecaster must seek out and use all knowledge relevant to the problem, including knowledge of methods validated for the situation.

Trend-Following, Portfolio Insurance, and Market Selling Pressure

A recent FT article, “Rise in the new form of ‘portfolio insurance’ sparks fear – Popularity of trend-following funds – and their promises – carry echoes for some of 1987 crash” focused on the threat of trend-following to create selling pressure on equity markets. This speculative topic has been a recurring theme for decades and has been extensively researched. The empirical question is very straight forward. Do futures prices lead cash prices and are futures prices driven by systematic trend-followers? That is, is there a positive feedback loop whereby the selling of equity futures by some strategies will lead to more selling and a price crash? The research on the impact of speculators has generally shown that this is not an issue.

What Kind of Model to Choose?

Approaches to modeling go through fads and fashions. What was learned yesterday by MBA’s will be the model of choice tomorrow. Certain approaches are employed because that is the approach the modeler wants or likes. The same applies to strategies. A value investor will not likely to turn into a growth investor. He likes that sort of thing. A quant will not become a discretionary storyteller. He likes the precision of the model.

Dollar Variations – The Two Main Levels of Uncertainty

What makes currency forecasting so difficult are two levels of uncertainty. This uncertainty is playing out today with the dollar declining on the Fed raising interest rates.

Drawdowns – Worth a Closer Look as a Risk Measure

While there is a strong interest in short-term return performance and volatility of hedge funds, drawdown is still the risk where most investors have placed their focus. Maximum drawdown, as a risk measure, can be formalized as the conditional expected drawdown or the measure of the tail mean of a maximum drawdown distribution. The figure below shows what that distribution will look like. What makes this risk measure especially useful is that it can be employed in any optimization and has a linear attribution to factors. Maximum drawdown can have traded off against return or specific risk factors. It can be compared or related to the marginal contribution of risk measure which has gained popularity with many investors.