Archives

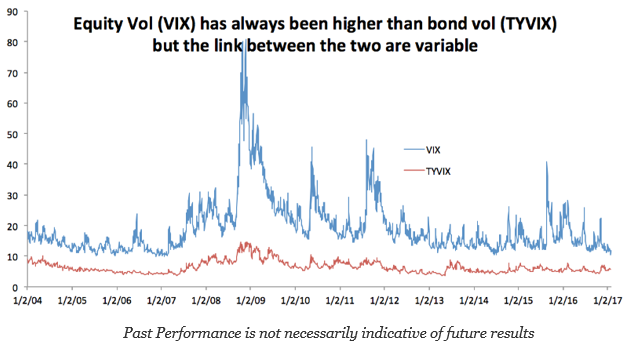

Equity and Bond Volatility are Different – The Need for Broader Thinking

A key issue with asset allocation and risk parity is the changes in volatility across asset classes. The foundation for risk parity is based on equal weighing of asset classes volatility as opposed to setting dollar weighting. Hence, knowing the relative differences in volatility and how they move through time is critical. We can describe some of the key issues associated with any volatility matching or equalization strategy by taking at a quick look at the CBOE VIX index for equity volatility and the TYVIX for Treasury bond volatility. The simple case of comparing these two major assets classes helps to describe the problem of volatility matching.

Bond and Equity Flows -Who is Underwater?

Asset allocation changes are often associated with the pain faced by investors. When there is financial pain through loses, allocations change, so it is important to know where are the pain points. Pain points can be associated with book value loses. Look at when money flowed into an asset class and the price associated with that flow.

BlackRock Survey – Investors Will Pour Into Real Assets

Earlier this month, BlackRock reported their institutional investor survey findings taken from late last year. The results are not that surprising if you believe that inflation may be rising and there is still a need for yield. Cash levels are expected to decline along with fixed income, but real estate will see a large boost. Investors will reduce public equity exposure, but increase their exposure to private equity. There is a bias to less liquid higher risky assets. What may catch some by surprise is the large increase in allocations to real assets which includes timber, commodities, infrastructure, and farmland.

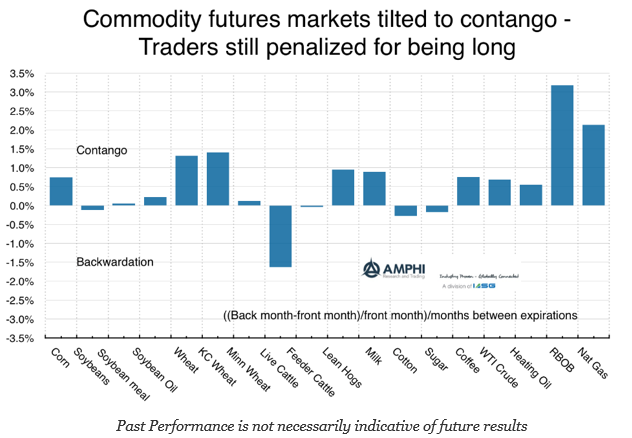

Contango Still Dominates the Commodity Markets

There has been increased interest in commodities and real assets with the increase in inflation. Commodity price as measured by the Bloomberg commodity are off the lows since February of last year, but he markets are still digesting the adjustments in demand and supply since the Great Financial Crisis. Most markets are still in contango because of high inventory levels. These contango levels have fallen over the last year, but are not like the long periods of backwardation during the 90’s and commodity super cycle. This places a significant roll drag on performance for pension funds that may choose to buy an index.

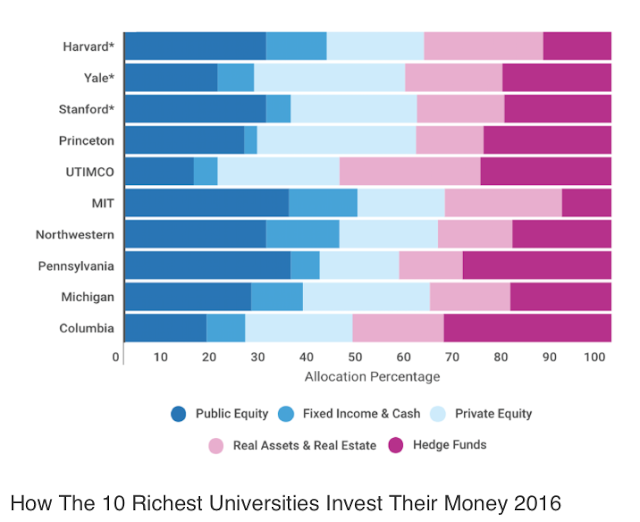

Endowment Models – Bogle Simplicity a Winner

Everyone likes to follow what endowments are doing because there is the assumption that they represent smart money. If universities are where the smart people are, then it stands to reason that their money managers are also smart. The return numbers suggest that endowments don’t have a lock on good performance. In fact, simple allocations have proven to be more effective at generating return. The Bogle model which is a simple variation on the classic 60/40 stock/bond mix is a perfect example. This asset allocation in made up of 40% US equities (total US stock index), 20% international equities (total international stock index) and 40% bonds (total bond index). The Bogle allocation works when compared with endowment allocation which have been tilted to alternatives and away from equities.

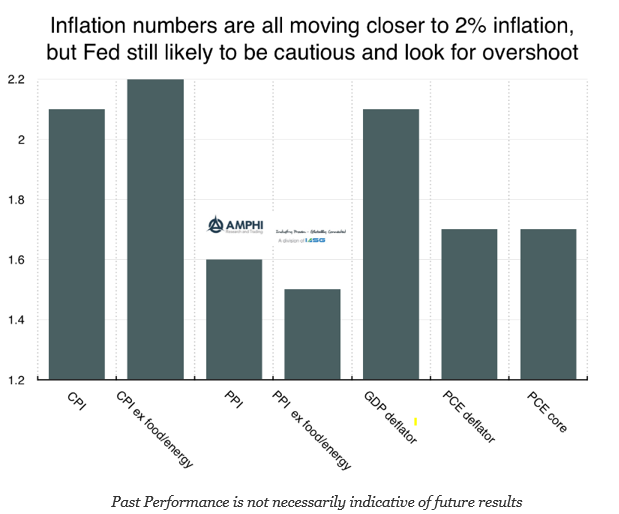

Inflation Closing in on Magic 2% or Bouncing Back

Current inflation numbers are all moving closer to 2%, but there is no special policy action from hitting or exceeding this rate. In fact, a cautious Fed is more likely with the most aggressive forecast being 2-3 rate moves. The Fed has not followed a mechanistic policy even though they have stated they are “data driven”. The most likely forecast will be to fade the earlier musings of the Fed.

Hedge Fund Performance Starts Well for January

The markets were generally calm for January even with the upheaval and uncertainty from the new Trump Administration. The surprise for many investors is the continued low volatility in the markets which seems inconsistent with the political uncertainty faced. While hedge funds generally did well for the month, there were some negative stand-outs, the macro and CTA strategies.

Commodity Exposure – Off the Lows and Worth Considering

From the high in June 2008, the Bloomberg Commodity index (formerly the DJ-UBS index) is still down from its high by 61.6%. The index is off the all-time lows since the crisis which was reached last February 2016 by about 16.5%, but the index is nowhere near old highs.

What are Endowments Doing with Their Allocations?

This above chart from thetrustedinsight.com provides an interesting tale about asset allocation for large endowments. Forgot about the traditional 60/40 stock/bond mix. Forget about the 50/30/20 stock/bond/alternatives mix. If you don’t need liquidity, as is the case for the endowment portfolio allocations, a mix between liquid and illiquid is a better base framework. Hold private equity and real estate as core allocations. This core is for long-term appreciation and cash flow greater than bonds, but is generally illiquid. Take money from fixed income and cash. Take funds from public equities and use hedge funds, which may have mixed liquidity, as an additional return enhancer. The public equity and bond/cash portion of portfolios is between 25 and 50%, while hedge funds are from 7.5 to 32.5% for these key endowments. The majority of their allocations are not with traditional equity and bond beta.

A Falling Correlation with Equities Makes for Greater Commodity Value

Commodities were supposed to be the great portfolio diversifier, a real asset that protects against inflation, offered positive roll yield, and gains from a super cycle. The reality over the last eight years has been much different. The roll yield disappeared as markets turned in many cases from backwardation to contango. Investors were penalized with negative roll. The super cycle ended with the Great Financial Crisis with a market decline over 75%. The markets have been digesting an excess supply/demand imbalance for years. The final kicker for investors was the financialization of commodities. Correlations with equities rose so investors did not get the diversification free lunch that was expected from looking at historical data. Now times are different, so throw out the old thinking.

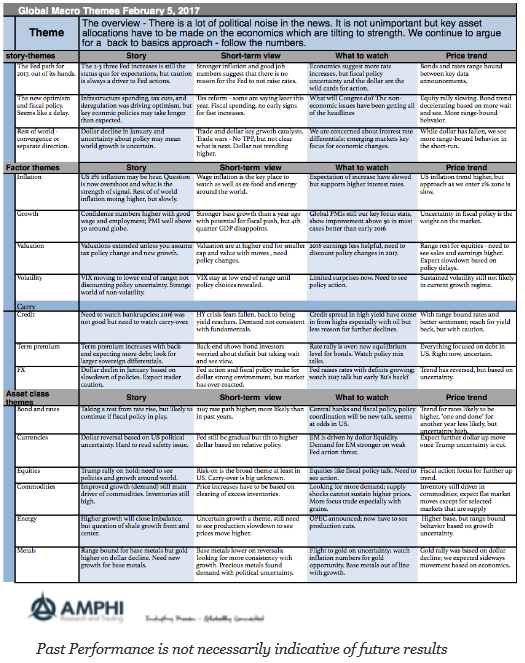

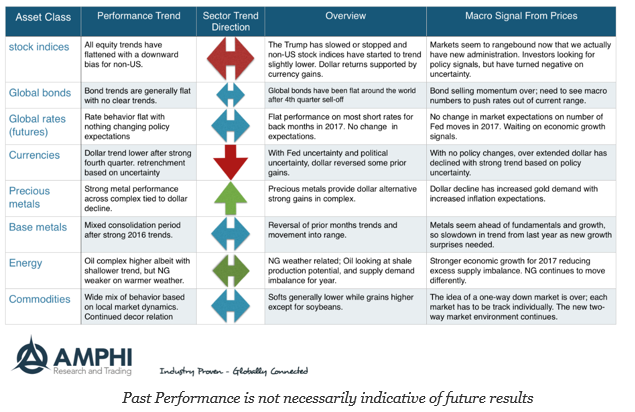

Global Macro on One Page – More of the Same

Just because there is the passage of time does not mean that market themes will change. The big issues could be unresolved with no information that will change expectations. We are at one of those times.

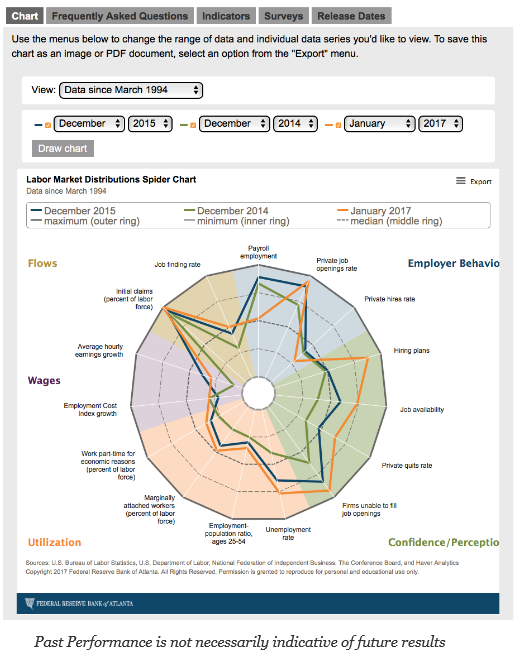

Labor Spider Shows the Key Issues – Utilization

There are a lot of labor statistics to analyze to measure what may happen with fed policy and interest rates. One of the key problems is trying to place all of this information on a single page or in a visual format that can do proper comparison with the past and provide analysis of the present. The Atlanta Fed has achieved that goal with their new labor spider graph.

Trendless Markets as We Move into February

Our sector indicators have all pointed to more trendless behavior for the major asset classes. The only major trend was a decline in the dollar for January and stronger moves higher for precious metals. With higher inflation expectations, and policy uncertainty, there are fundamental reasons for these moves.