Archives

Emerging Markets – Bonds Beat Equities Which Beat Commodities – Will this Continue?

Emerging markets have been a tough place to invest especially in equities during the post Financial Crisis period. We include a stock index (EEM), and bond index (EMB) and a commodity index (DJP) for some simple comparisons of three ways to play emerging markets. After a strong rebound in 2009, emerging market equities have generated no returns for investors. Slower growth, poor commodity markets, and a stronger dollar have left equity holders with nothing to show for seven years. Emerging market bonds have told a different story with strong consistent gains since the Financial Crisis even with the strong dollar move over the last few years.

Sector Behavior Shows Stability After Large Moves at End of the Year

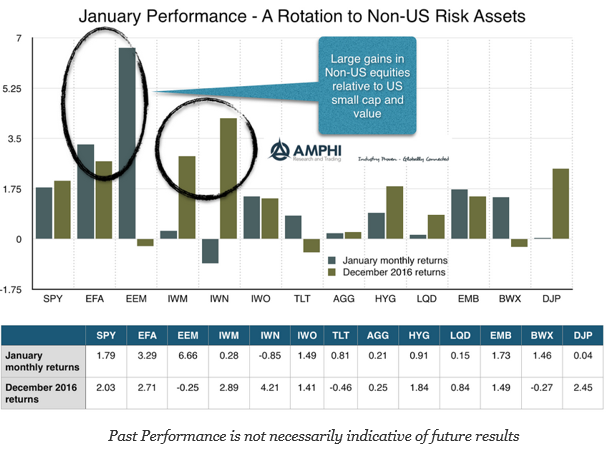

It was a positive month for risky assets, albeit more one of consolidation and than return break-out like what was seen last quester. Global markets outside of the US, especially emerging markets, showed large gains after a weak fourth quarter. The dollar gains post-election were partially reversed which added a tailwind to non-dollar investments of about 2%. After accounting for currency changes, developed non-dollar returns are back in-line with the US.

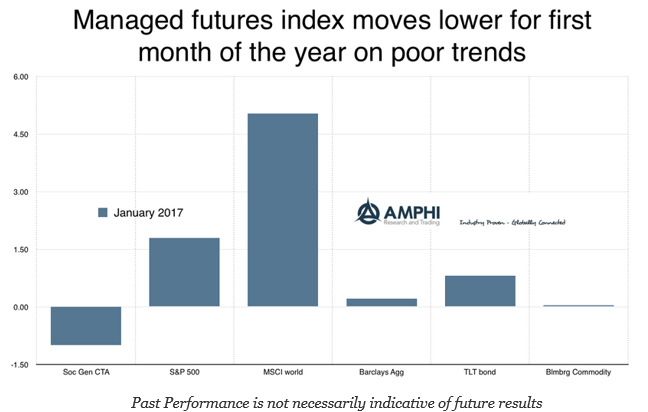

Managed Futures – No Trends to Exploit

The managed futures hedge fund style, as measured by the SocGen CTA index, declined by just under one percent for the month. There was limited movement in commodities and bonds and the largest gains for the month were in non-US equities where there is usually less exposure by futures managers. Going back over our sector trend measures, we were predicting a lackluster month since there were few strong directional trends going into January. The SocGen trend indicator index was down over 6 percent and the short-term trader index declined about 4 percent.

Banking and Speculation – All a Matter of Opinion?

“When as a young and unknown man I started to be successful I was referred to as a gambler. My operations increased in scope. Then I was a speculator. The sphere of my activities continued to expand and presently I was known as a banker. Actually I had been doing the same thing all the time.”

– attributed to Ernest Cassel by Bernard Baruch

The Switch – An Ascent in Non-US Returns

After the euphoria in small cap, value, and growth stocks post the Trump election, the markets have calmed and moved slightly upwards. Global equities and emerging markets stocks were the big winners for the month. These moves were a degree of catch-up to the outperformance in US stocks. Even with the poor print for fourth quarter GDP, equity investors are discounting better growth in 2017.

Bonds as Diversification Insurance – I Don’t Think So

Would you buy insurance where the value changes every day with market conditions? An “insurance contract” that may provide a hedge against equity risk today only to see the value of the hedge disappear tomorrow? Of course, the value can appear again, but investors may not have any guarantees. This is recent problem of investing in bonds as a diversification tool. The value of this diversification has become more variable.

Regression to the Mean, Luck and Picking Hedge Fund Managers

There are few statistical facts more interesting than regression to the mean for two reasons. First, people encounter it almost every day of their lives. Second, almost nobody understand it. The coupling of these two reasons makes regression to the mean one of the most fundamental sources of error in human judgment.

-Anonymous from What the Luck? The surprising Role of Chance in our Everyday Lives by Gary Smith

Speculation – It is Not Supposed to be Glamorous

The history of the bull speculation in cotton of 1903 will never be fully written because, though the men who influenced it are very interesting, their operations are interwoven with bloodless statistics and tiresome technicalities. -Edwin Lefevre Saturday Evening Post, August 29, 1903 from The Cotton Kings: Capitalism and Corruption in Turn-of-the-century New York and New […]

If it Works for Poker, it should Work for Investing…

More money is lost by players who know what the right thing to do is, but don’t do it, than for any other reason. Having a strategy, a game plan and the discipline to stick to it are, along with a sufficient bankroll, the four most important thing that a player needs to be a winner.

– Ken Warren poker writer on Texas Hold ‘Em

To Adjust or Not Adjust Volatility for Momentum Strategies

Risk management has taken the money management business by storm. If you run money, you have to say that you control volatility and manage the risk. It is the equivalent of saying, “I love my mother and apple pie.” If risk goes up, you have to cut position exposure or at least that is what many will say is the path to good returns. Nevertheless, the empirical testing of this truism could be improved. A recent paper in the Journal of Alternative Investments called, “Volatility Weighting Applied to Momentum Strategies” looks at this important question in detail and concludes that it does help at improving the return to risk.

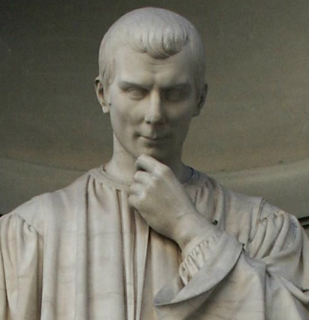

Machiavelli Could Have Been a Trend-Follower

Whoever wishes to foresee the future must consult the past; for human events ever resemble those of preceding times. This arises from the fact that they are produced by men who have been, and ever will be, animated by the same passions. The result is that the same problems always exist in every era.

– Niccolo Machiavelli

Downside Risk – Maybe You Should Be an Insurer?

No investor wants to bear downside risk. Well, perhaps more precisely, no one wants to bear downside risk without extra return compensation. Strong asymmetric risk preferences create the reason for a volatility risk premium – the empirical fact that implied volatility is higher than realized volatility. What the volatility risk premium states is that if you buy an option you will pay more in terms of volatility than what the market will give you in actual volatility. In a very simple but elegant paper in the Journal of Alternative Investments called “Embracing Downside Risk”, some practitioners look at the compensation toward downside risk through a decomposition of returns by strategy.

2017 – Living in a Bimodal World

Most investors like to think of financial market risks as measured through a normal distribution. In reality, we know that it is not the case. However, how we incorporate and discuss fat-tails is not always clear. One thing that is clear is that fat-tails can be created when there is a mixed distribution or a combination of distributions that represent different regimes. A simple example will be the mixing of growth versus recession or good versus bad states of the world. This has been our theme for 2017 with a new year post. The potential for two different economic regimes will create fat tails in the return distribution of financial assets.