Archives

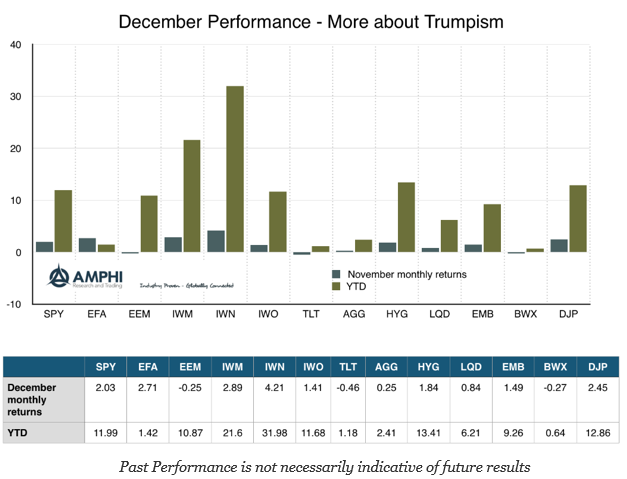

Did Asset Class Performance Reflect the Political Upheavals of 2016?

Show me the performance for the year and I should be able to tell you something about the economic and political events for the year. I may not be able to tell you the specifics, but I should tell you whether it was a “good” or “bad” year in terms of economic growth, uncertainty, risk, and confidence. Looking back over 2016, you would not know that it was a year of political upheaval.

Divergence in Bank Performance between US and EU – So What?

The one take-away from the Great Financial Crisis has been the importance of financial intermediation, banking. When banking is disrupted, lending will not happen. There will be a cutback in credit which stalls the economy. Additionally, if capital is not available for banking, there will be a cap on lending especially if there is a constraint on leverage. Funding will become scarce. If bank capital falls, lending will be disrupted. This lending channel is amplified with the swings in the business cycle.

Listen Up Hedge Funds – You Don’t Perform, You Die

The latest hedge fund asset flow report published by EVESTMENT tells a tale of an industry that has become more competitive and is in a period of consolidation. The easy money of being a hedge fund manager is over. Now, you have to earn your AUM through offering a better product. The year to date outflows for 2016 have been $83 billion which is small on a $3 trillion base, but suggests that investors are getting more particular in what they expect from hedge funds. Couple these outflows with the higher level of fund closing and we see a competitive market place which is unforgiving to managers. It does not matter whether you think you have investment skill; poor performance will relegate you to obscurity.

Financial Stress Down, Policy Uncertainty Up

Don’t try and call the direction of the markets with some forecast which will most likely not come true. Decide the environment that we live in and determine what will be the best portfolio to take advantage of it, or as I say often, “You cannot tell where you are going until you know where you are.” A key for knowing your economic location is through determining whether there is financial stress in the economy. Stress leads to change. When stress increases or falls, investors will become more risk averse or risk seeking. It is a driver of volatility.

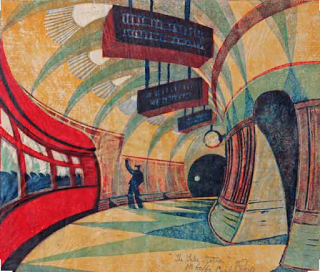

The Art of Money Management: Balancing Skill and Authenticity

Money management has been compared to art. There is a technical skill component to generating returns but there is also an artistic component with how information is weaved together to produce a successful portfolio. Money management can be like art because it may have uniqueness that transcends rules. You can have all of the rules, read all of the books on how to do it, and still not get the results that are expected. Now, we believe that artistic uncertainty can be minimized through good checklists, but we accept that for many, money management as art is real.

The Phillips Curve – Isn’t that an Old Relationship that Does Not Apply Anymore?

Anyone with grey hair is likely to remember studying the Philips Curve in his or her macroeconomics class, yet if you started to talk about the unemployment inflation trade-off today, you would be viewed as some “old school” thinker who is out of touch with reality. The Phillips Curve is an artifact of economic history. Is the Phillips Curve dead, another zombie model that walks around with no useful purpose? No

Visualization of Connectedness and Networks – Moving Beyond Correlation

Everyone uses correlation to tell a story, but some cutting edge work takes this to another level when it is connected to concepts on networks and topology of mapping connections. Network research is on the cutting edge of understanding systemic risk and how capital and information flows across the globe. It can also be used to help visualize data. The idea that all markets will react together is a just a simplification that can lead to poor thinking about markets. A network approach can help show how markets interact.

Foreign Exchange Trading – Adding another Dimension to Alpha Creation

The dollar and FX trading is back in hearts and minds of investors. For many, it never went away, but during the Post-Crisis period, there was a fall-out in performance and interest in trading currencies as an alpha source. With limited trends and carry that was squeezed down to zero there were limited opportunities for profit. If all central banks are behaving the same and growth differentials small, there will just be limited trade opportunities except for periodic short-term dislocations. That dearth of opportunities has changed in 2016 and may continue in 2017 for a simple reason. Economic differentials across countries are back.

Fake News, Old News, Wrong News, or Just Plain Old Prices

The world has been abuzz with talk of fake news as if this was a new concept. Fake news has been around as long as newspapers have been printed and before. It has been called gossip, bias, or yellow journalism. Fake news has taken countries to war, ruined reputations, and swindled readers. Like all technological change, it is coming faster and in more forms.

Paid Less for Less Protection – Your Credit Markets for 2017

One of the best performing sectors for 2016 was high yield credit which saw a large reversal in spreads with the improvement in the oil market. Credit funding for shale oil exploration and production was in jeopardy with the low oil prices, but the duel conditions of higher oil prices and an improvement in economic prospects have brought spreads to former tight levels last seen in 2014. Of course, there are other issuers in the high yield market but this move was associated with the risky oil credits.

Momentum and Mean-Reversion (divergence/convergence) Research Shows Combo Works

We have often stated that the market move in two modes or regimes, divergence and convergence. Another way to describe this market behavior is through momentum and mean-reversion. Yet, these regimes should not be viewed as independent. They can actually be negatively correlated, but because they have different time horizons, they can co-exist. An older paper looks at combining these two strategies with global equity returns and finds that a combination can lead to excess returns. (See Balvers and Wu in “Momentum and Mean Reversion Across National Equity Markets”.)

The Most Important Chart for 2017 – Embrace the Current Uncertainty

There is the foundational view that increased uncertainty will and should lead to changes in our economic behavior. There should be an increased desire for caution. Investments in the future should be smaller or deferred. There should be an increase in the holding of cash versus any risky investment. Actions may be scaled or averaged to reduce potential regret. Risk aversion will impact the return needed to offset the risks faced. Uncertainty should be avoided or at least approached with caution.

Ideas and Work… Focus on the Details of Doing

Often what passes for an idea is, on closer inspection, really propaganda – someone wants something, wants to promote something. The hard part is finding a form. The most convincing works tends to be those in which the thinking is inseparable from the doing.

The big-idea people will always be among us…. Nothing wrong with big ideas, but they aren’t especially relevant to figuring out how something works – or doesn’t.

– from 2. to 1. How 3. See by David Salle