Archives

Ideas and Work… Focus on the Details of Doing

Often what passes for an idea is, on closer inspection, really propaganda – someone wants something, wants to promote something. The hard part is finding a form. The most convincing works tends to be those in which the thinking is inseparable from the doing.

The big-idea people will always be among us…. Nothing wrong with big ideas, but they aren’t especially relevant to figuring out how something works – or doesn’t.

– from 2. to 1. How 3. See by David Salle

Risk Factors Change – Do You?

From ETF Trends comes an interesting chart on the relative performance of different risk factors for US large cap equities. Factor analysis and building portfolios based on specific factor risks has become all the rage in investing. We think this is useful and significant advancement to portfolio management, but there is still a lot to learn about the dynamic behavior of factors.

Focus – Study on Diseconomies of Scope Demonstrates the Key to Success

We know the answer to success. If you want to get good at something you have to focus and do the work. Is this focus measurable in money management? Similarly, can we say something about manager focus through time? An interesting piece of new research looks at this problem in the paper, Diseconomies of scope and Mutual Fund Manager Performance.

The Buzz with Pension Clients 50-30-20

The rule of thumb used by many investors as a base portfolio allocation has been a 60%/40% stock/bond mix. When in doubt, investors are supposed to go with a standard 60/40 allocation as a safe base case. If you are going to change the allocation, measure the change against the base 60/40 mix. Investors can perhaps add international equity or international bonds or maybe a dash of commodities, but if there is more uncertainty, the safe action is to move back to 60/40. Many advisors may suggest something different, but then show why it would be better than the baseline 60/40 as the reason for its efficacy.

Where do advisers want active management?

There has been a strong move to passive investing tied to benchmarks by investors. The reasons for this movement are threefold. One, passive benchmark investing is cheaper than active management. Two, active management has often underperformed benchmarks. Three, passive investing provides transparency on what will be in the portfolio. Nevertheless, a survey of defined benefit consultants suggest that the choice between active and passive management is not obvious and actually asset class specific. There are some areas where consultants view that active management is important while other areas the focus is for passive investing.

Fidelity Survey – Expect Asset Allocation Changes

A recently published Fidelity Global Institutional Investor survey suggests that more asset allocation changes will be made in the next one to two years than shown in their last two surveys in 2012 and 2014. This survey anticipates what we are all thinking – it is a new investment world with a Fed becoming more aggressive and the politics of populism sweeping many countries. The post-crisis investment world of boundless liquidity and asset performance catch-up has ended. We are entering a new period of two-way market views. There is more uncertainty on market direction so we are likely to see more divergences in asset allocation.

When asked about the top concerns for investing in their portfolios, the three top answers were all boar performance; what is past performance of an asset class, what is the expected return from an asset class, and where has there been success and failure with investments. Perhaps performance is always the top issue in the minds of managers, but the survey highlights particular focus during this period of transition.

Asset Classes, Styles and Sectors Show Dispersion

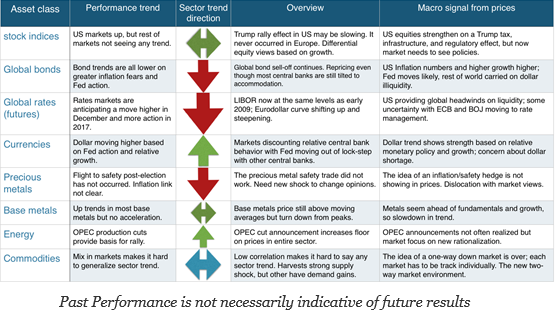

A review of all sectors shows some clear themes across asset classes. Bonds are out of favor and US equities are preferred. International equities and bonds reflect repricing of rates and currencies while still showing lower global growth.

Trends for December – Dispersion Across Sectors

Key financial market trends show continuation as we enter December. Down trends in bonds and rates may show some weakening after the strong moves in November, but there are few signs of reversals. Dollar strengthening is linked to the bond moves based on expectation of increased US growth and Fed action. Energy markets show a strong uptrend on announced OPEC production cuts. The US equity rally post-election is slowing. This stock rally never occurred in global markets. There are limited trend opportunities in precious metals and slowing trends in base metals. Commodity markets are mixed based on large dispersion in supply and demand conditions.

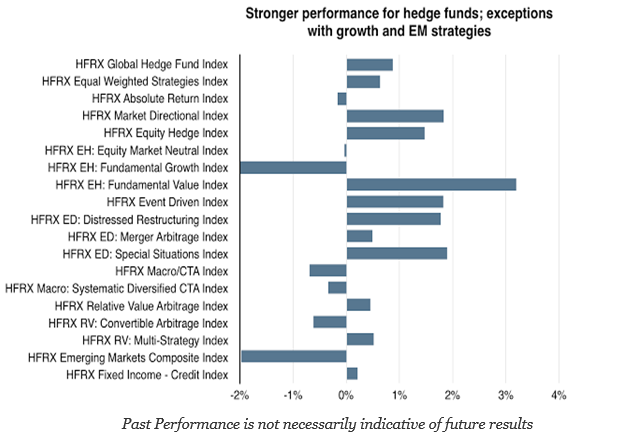

Hedge Fund Performance Stronger but Not Enough to Make a Good Year

A US equity rally after the election and a major bond sell-off highlighted the month for traditional assets. Many hedge fund strategies were able to exploit these moves and generated gains especially in fundamental value, market directional and relative value strategies. The big losers were fundamental growth and emerging markets. Global macro and CTA strategies also generated loses for the month.

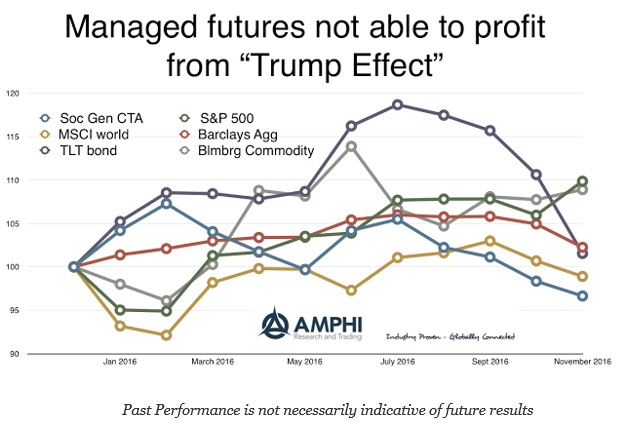

CTA Performance – On Average, Could Not Take Advantage of “Trump Effect”

A large sell-offs in bonds both domestically and around the world, a strong US equity move, and a strong dollar trend that changed perceptions on currencies, did not create an environment where managed futures were able to generate positive returns. I don’t want to be accused of hindsight bias, but a review of price trends in bonds and the dollar going into the election suggested that post-election moves, while extended, were not inconsistent with longer-term trends. Still, an early review suggests that there have been some major winners in this space who will end the year with strong positive gains. Careful CTA manager selection has meant the difference between success and failure in 2016.

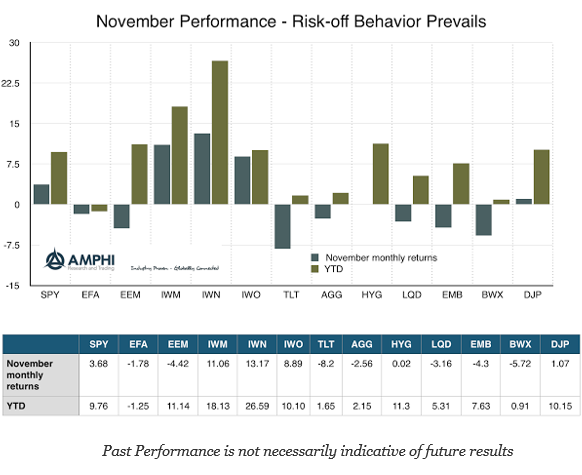

The Big Bond Break and Equity Revival – November Performance

For those who had a “safe” portfolio skewed to bonds before the election, it was a disaster month. For those who were stock-pickers in value and small cap, it was a dream market. The return differential between bonds (TLT) and value (IWN) was more than 20% in one month. Call it a “Trump Rally / Trump Bond Sell-off”, but the financial world changed beyond politics. This sound bite story may be getting old, but there is a lot going on in markets beyond being long stocks and short bonds.

CTAs – What is going on with size?

CTA Intelligence reported the top 50 CTA’s as of September 2016 and provided some good graphics on the names and the changes over the last year. Taking a closer look at the data from the perspective of market structure and industrial organization provides some additional insights on the managed futures industry. We will focus the discussion on the top 50 managers because these are the ones that will receive the most interest from institutional investors. We can call this the relevant market.

Exits as Important as Entry Points? A Critical Issue

“I made my fortune by selling too early”, a quote from Baron Rothschild used for an investment game by John Hussman. John Hussman has invented a game called “Baron Rothschild” as a teaching tool which is based on a simple process of drawing returns from a set of cards The sequence of cards can generate a performance record. Think of this as a form of Monet Carlo simulation from a return distribution. The player can call stop after any number of picks or he can continue to pull return cards to compound his performance.