Archives

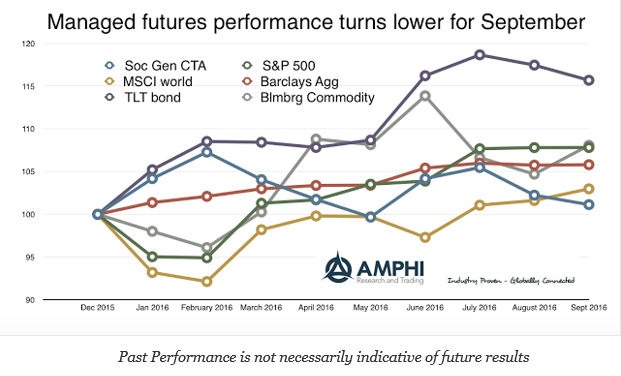

Managed Futures – A Month of Giveback

The performance of the SocGen Managed futures index fell short this month relative to major asset classes except for the long bond. Its year to date performance is now below all of the major asset classes. While many traditional long-only traders were able to take advantage of the risk-on environment, managed futures was not able to exploit opportunities surrounding the Fed announcement.

Minksy, Volatility, and Skew

The Financial Crisis resurrected the thinking of Hyman Minsky and his “financial instability hypothesis”. With the crisis, there was coined the term Minsky Moment, the time when financial markets collapse after a period of prosperity from the excessive speculation on financial assets. Unfortunately, his insightful views on financial instability never received the attention it deserved before the crisis. It was not structured in the current economic orthodoxy of formal mathematical modeling.

Messy Markets, Mixed Distributions, and Skew – Thinking About Downside Risk

We often only think about markets in terms of risk and return where risk is measured by the standard deviation of returns. It is easy to calculate and update. Unfortunately, the changing nature of markets makes for messy calculations and analysis. Assuming a normal distribution is just too simple for measuring risk. Investors have to be aware of skew in return distributions. More specifically, investors have to account for negative skew because the unexpected extra downside risk is what really hurts portfolio returns.

TED Spread Warning – Not What You Think

The TED spread has been used as financial market warning signal for decades although it has moved in and out of favor over time. Market participants have turned to other measure of financial risk, but when this old measure jumps, it is worth taking a closer peek.

Momentum in Futures Not Spot – Hidden in the Basis?

Momentum strategies work with commodity futures, but a closer examination shows that the same momentum strategies are ineffective with commodity spot prices. This result, that the cash price action is not mirrored in the futures prices, seems odd. Of course, the futures are expectational markets, but the cross-sectional behavior in the spot should be represented […]

The Clearinghouse, FCM’s, and the New DFP’s

The clearinghouse is the truly special feature of any futures exchange because it allows buyers and sellers to comfortably come together to trade with only limited credit risk. Traders know that they do not have to worry about the specific risk of their trade counter-party because their risk is with the clearinghouse. We know that the actual structures in place are more complex than this simple story. The mechanics make all the difference so changes should be looked at closely.

Risk and Return

Risk and return. The drumbeat that return is received in exchange for taking on risk as measured by volatility is relentlessly driven into the minds of all investors, but what if this trade-off is not as strong as the rhetoric? New research focuses on skew as one of the key risks. In particular the downside risk of negative skew may be more important at explaining excess returns than volatility which can lead to either upside or downside.

Quant and System Developers – There is a Distinction

Thinking about the analysis of systematic global macro and managed futures managers, I asked a simple question, is there a difference between a quant and system developer. A portfolio system is a complete integrated approach for making market predictions and investment decisions including sizing, entry, exit, and risk management. Is it possible for a manager to be less well-trained as many newly minted engineering quants, but still be talented at building portfolio systems?

The Advice of Mr. Jaggers, “Follow the Evidence.”

“Take nothing on its looks; take everything on evidence. There’s no better rule.” — Mr. Jaggers, Pip’s guardian in Great Expectations by Charles Dickens.

If we had Mr. Jaggers as our guardian and mentor, we would likely be better analysts. A recurring theme this month has been about finding the truth through a focus on data, not commentary. Look to the data and not what is being said. If there is no supporting evidence, discount. If no supporting evidence is provided, then find your own. Markets may be driven by sentiment or perception but ultimately it will discount and respond the evidence.

The Deeper Dimensions of Economic and Financial Globalization: A Paradigm Shift in Investing

Economic and financial globalization is not just about trade. It is about trade only to the extent that trade includes goods, services, capital, labor, information, and culture. Globalization concerns the positioning of the firm and the individual in the world, not just the positioning within the nation-state or local economy. While globalization affects everyone, the […]

Forgetfulness and Financial Analysis – Is More Memory Always Better?

Big historical events, especially tragedies, are committed to memory so we will not forget, yet is it really good to remember everything? Put differently, is forgetfulness useful? Would we be better off if some memories disappeared?

Financial Analysis and “Truthiness” – Follow Data, Not the Talk

If I were being polite, I would not argue that we are in an age of lies by politicians, businessmen, or leaders, but what The Economist has called a “post-truth world”. Stephen Colbert described the current environment as one of different levels of “truthiness”. At best, clarity by leaders and spokespeople is in short supply. Most commentary is done for spin.

The Paradox of Skill – Why Competitive Markets are Left to Luck

The paradox of skill is an important concept to understand for any investor or trader. Managers will often talk about wanting to prove their skills in a competitive environment against the best in the world. Forget that nonsense. You want to be the best in an uncompetitive or less competitive environment. You want to have a strategy that others do not follow. Being in a competitive space may seem like a good thing, but it will be harder to beat others. If there is a fixed amount of alpha, everyone will be fighting for that same alpha and it will be harder to win your share when the market is more competitive.