Archives

CTAs Stung by Low Volatility in August

Following a flat July, CTAs struggled in August. A concomitance of low volatility, range bound markets, lack of follow through on existing trends, as well as an emergence of new trends, resulted in negative performance for several managers. The extremely low volatility environment was challenging for most systematic managers as their strategies had little to work with. This absence of any meaningful follow through resulted in a portion of previously accrued gains being absorbed back into the markets.

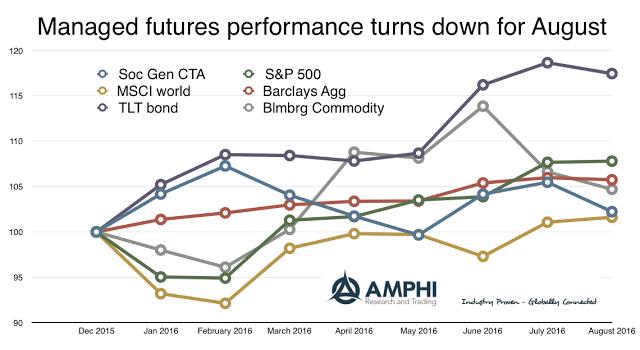

Managed Futures August Performance – Negative Chop

A rule of thumb for managed futures performance is that if there is little movement in the underlying asset classes, there will be negative performance for the average managed futures manager. While it does not apply to all managers, certainly trend-followers need trends, and a measure of trend is the longer-term volatility or spread in prices.

Wider Dispersion in Sectors, Styles and Countries in August

We have described August as the dog days of summer given the limited movement in major asset classes; nevertheless, we were seeing more dispersion within equity and bond sectors, styles, and country indices. Moving averages are flattening and there are less clear signals within our sector groupings. It is unclear how long range-bound behavior will last given that the Fall season for financial markets, when trading activity picks-up, starts next week.

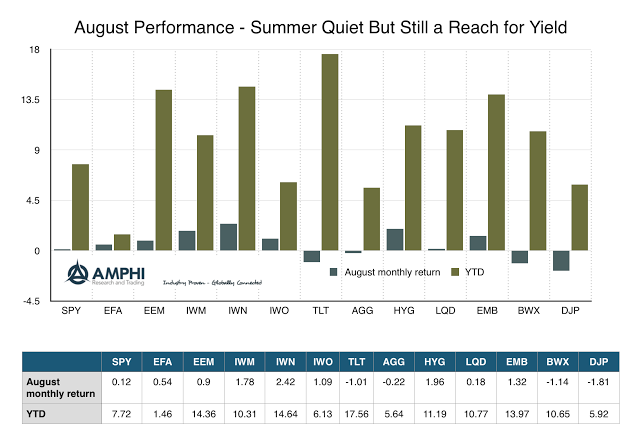

Review of Asset Classes

For many it was a hot August. Time to slowdown, go on holiday, and not worry about financial markets. Of course, there is a lot to worry about, but August performance across most asset classes showed general range-bound behavior with a continued reach for yield within the equity and fixed income asset classes. The tight range was linked to no substantive news to change expectations. After weeks of hype, the comments of Fed Chairman Yellen at the Jackson Hole conference did not serve up anything new. The data driven Fed may raise rates or not based on further confirmation of data that seems stuck in a range.

Beware, Sharpe Ratios are Time-Varying

“What is your Sharpe?” This is one of the first questions that is always asked of managers. The mangers will firmly reply, “My Sharpe ratio is X.” The conversation then moves onto the next question as if this one number serves to address the performance issue, yet the Sharpe ratio is dynamic. In a drawdown, no one wants to even see that number. When things are going well, the Sharpe ratio is king. Investors have to accept that this is a variable number because the underlying assets bought by funds have variable Sharpe ratios.

The Elegance of Simplicity in Investment Management

Some people believe that if you want to show how smart you are, you should tell people how complex your investment process is relative to others. Wow investors with your skill and mental agility, this will win you new money. Be and act like the most intelligent person in the room. The Power of Simplicity […]

Getting Ready for a Liquidity Event Through Using Index Futures

Liquidity is never present when you need it. This truism is especially the case when there is a financial crisis. A crisis become a liquidity event if sellers cannot find buyers at a fair price or at extreme any price. If the security is more specialized or complex, it will be even harder for the seller to find buyers. There will have to be a greater price decline from fair value before a buyer is found.

Scenario Analysis – Because There is More Than One Path to the Future

Investors do not know the impact of different alternatives in history. In fact, history is subject to discovery and this process of historical discovery is subject to biases as we try to sift through facts.

CTAs Set to Thrive at End of QE Era

In the midst of any foggy economic phenomenon, it’s difficult for an industry to really assess how it’s being affected. But with time comes clarity, and it’s now possible to look back on the past eight years of Fed policy and draw broad conclusions about how Quantitative Easing actions created headwinds for investors in the managed futures space. Crucially, these conclusions give us a reason to feel optimistic looking toward 2017 and the return to a world of abundant, varied trading opportunities.

Kottke Commodities – U.S. Crops, World Demand Both Probable Records

July is the make-or-break month for U.S. corn, as well as immediately ahead of the counterpart period for soybeans. After burgeoning world demand stripped the big South American soybean crop bare in only five months, and Brazil’s corn production shrank, the consequences of a merely modest problem in the U.S. harvest would have been extremely serious. Widespread publicity of “La Nina,” an unusual eastward shift of warm water in the Pacific Ocean associated with poor growing conditions inNorth America, had the world food market particularly on edge. Prices of both corn and soybeans rose sharply in June in apprehension of widely-forecast hot and dry weather during the crucial months to come.

Looking for a Turn in Both Government Bonds and the Japanese Yen

In quite a few ways, recent weeks have been anything but boring. Trying to filter out important events from random noise in markets today feels like a bit of a mugs game, but that shouldn’t stop us from trying if we think that we can add some value to our investors. We would like to pick up on a couple of areas that are gaining our attention, and we’re certainly not alone, so here goes with our version of events.

Managed Futures Prospers from BREXIT Blues

The IASG Trend-Following Strategy Index posted an estimated net return of +4.59% for June. The dominant theme in June was the UK referendum on EU membership, or ‘Brexit’ and the attendant surge in volatility that resulted in positive performance for CTAs. Trading conditions for systematic diversified managers were conducive due in large part to an […]

Kottke Commodities – Soybean-Corn Supply Imbalance to Continue

The world grain trade has been shocked in 2016 by the speed with which the entire exportable surplus from a large Brazilian soybean crop was consumed. While statisticians’ opinions differ, the more astute extrapolated early on from the pace of vessel loading that importers would not only come with equal alacrity for the U.S. crop next fall, they’d even need to tap more U.S. supplies yet this crop year. In short, demand for soy meal, a high-quality, high-protein feed ingredient key in efficient meat production, is beyond anything anticipated.