Archives

A look back at the Grain Markets

Wheat made new lows led by Matif, and corn and beans worked towards low end of the ranges. There were no real weather scares in SAm and both corn and bean prod’n ideas are getting bigger. For the month, corn lost 19-20 cents and beans were down 27. Meal was down $11.00 and oil down 25 points. Chgo was the biggest loser – down 35 cents with KC down 27 and Mpls down 16. Matif wheat was down $14.75 euros/tonne – 44 cents. French wheat is $20-25/ton below SRW and thus continues to bring Chgo down.

Paradigm Shift

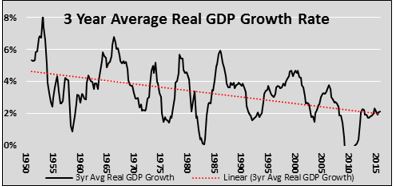

The Absolute Return (AR) series of articles provides a primer on alternative investment styles to which few investors have access. Global markets and economies appear to be at the precipice of a paradigm shift making the timing of the AR series of unique value. In the 7 years since the financial crisis, most asset prices have experienced significant appreciation allowing for even the most inexperienced investor to increase his or her wealth. As the saying goes, “a rising tide lifts all boats”. For investors, understanding the tide of financial momentum is extremely important. Accordingly, we summarize 4 primary drivers of past returns to help gauge whether the tide can continue to rise or if retreat is more likely.

Narrow Ranges Reflect Ample World Supply

The amplitude of grains and oilseed prices last month was extraordinarily narrow. Soybeans were the most-contained, with a high-to-low closing price range of just 28c in the March contract, narrowest for January since 1998. It’s even more remarkable considering that on the 12th, USDA surprised the trade by reducing the 2015-16 U.S. crop by 50 million bushels. The reason that such stable matching of supply and demand rarely persists for a month is the constant fresh assessments of risks to production of crops in the field and the next to be planted. Today, such is the adequacy of supply and geographic diversification of growing areas that the market judges risk to be lowest in decades.

Interviews of Absolute Return Managers

In the three prior articles we discussed the goals of absolute return (AR) investors, defined strategies typically used by AR investors and most recently stressed why limiting loses, a key goal for any AR investor, is vital to growing wealth in the long run. This article reiterates many of those concepts through the interviews of 2 highly respected Global Macro CTA’s. As you read their respective comments note the consistent emphasis of risk, losses and cross asset correlations.

Bank of Japan Surprise Move

Thoughts on today’s Bank of Japan action and Global Equity Markets The Bank of Japan surprised markets overnight by becoming the most recent central bank to move rates into negative territory, albeit only on new excess reserves created by additional QE, and this time with a razor thin 5-4 vote. This comes on the heels of continued weak economic data, and again (their 3rd time in a year) they postponed the deadline for achieving their 2% inflation target an additional 6 months to early 2017. The Yen weakened dramatically (~2%) overnight as the market was surprised by this seemingly aggressive action in light of recent commentary that additional easing wasn’t necessary.

The Importance of Limiting Losses in Absolute Return Strategies

Absolute return strategies aim to generate positive returns irrespective of market direction. A more accurate and appropriate definition is that absolute return, or active investment management, always seeks to minimize losses. We mentioned this as a core attribute of an absolute return strategy in “Why an Absolute Return Strategy,” but this simple concept is worth […]

Alternatives to Long Only Passive Strategies

As we discussed in “Why an Absolute Return Strategy”, most investors, knowingly or not, rely on long-only passive strategies. These investors may shift between stocks, bonds and cash at various intervals, but generally their portfolio returns mimic those of well-known stock and bond indices. Alternatively, active or absolute return investors rely on many different strategies that are not dependent upon a positive market direction to generate positive returns. To continually build wealth through good and bad markets, absolute return investors require a diverse, alternative set of strategic tools. This article describes a number of strategies used by absolute return investors to help them achieve their goals.

Building Wealth: The Power of Absolute Return Strategies

The first goal of investing is to increase wealth or, to put it differently, to increase purchasing power. Warren Buffet says, “Rule 1 of investing is never losing money. Rule number 2 is never forget rule number 1.” The hidden message in these seemingly obvious statements is that building wealth depends much more on preventing […]

NFA Elections – Position Paper

It is time for another NFA Board of Directors election. If it seems like we just asked you for your

vote, it’s because we did as you elected us to two-year terms less than a year ago. However, due to

changes to the Board’s composition, we currently find ourselves up for election yet again in the only

two contested races on the whole Board. We know that the constant stream of elections may seem

unimportant, but as someone who makes their living subject to ever-increasing regulation, taking the

time to vote for effective Board representation directly benefits your business.

One of the unique things about NFA is that it is chartered as a democratic, Member-run self-regulatory

organization. This carries with it substantial responsibilities for both Members and Management to

balance maintaining the rights of Members with protecting customers and avoiding regulatory capture

whereby the organization could be run for the benefit of a select few. For the organization to be

successful, Members need to take an active role in its governance, by educating themselves on often

complex regulatory issues, speaking out on proposed regulations, and electing Directors who put those

goals above their own personal benefit. We think that we have done the latter to the best of our

abilities and would be honored to continue serving you on the Board.

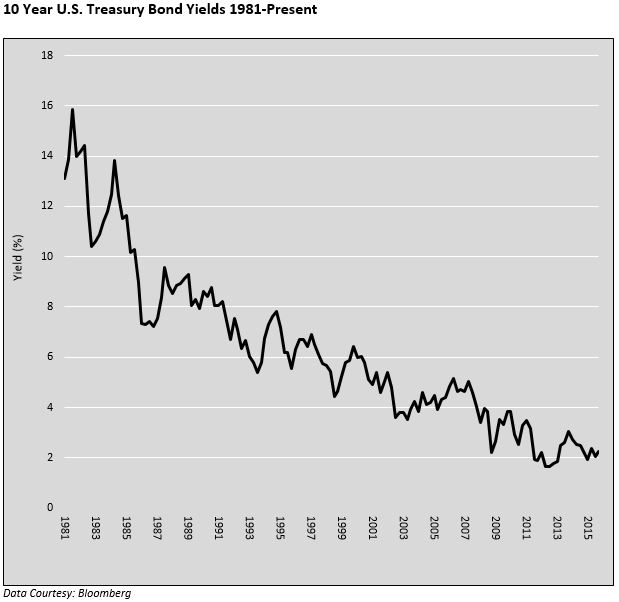

Bonds – What Drives Investors

Part 2 of our series on bonds “Bonds – Is Credit Growth Hitting its Limits?” discussed the likelihood that the demand to borrow could stay weak, keeping the demand curve from shifting right and therefore playing an important role in keeping a lid on higher interest rates. In this final article of the series we focus on factors that investors should consider to help gauge demand for bonds.

Bonds – Is Credit Growth Hitting its Limits?

In “Bonds – More Than Meets the Eye”, we proposed that despite historically low interest rates there may be opportunities in Treasury Bonds to earn total returns well in excess of their current low yields. In this article, the second installment of a three part series, we analyze some important factors which help determine where interest rates might be headed in the near term. This article focuses on the demand side of the supply/demand curve to understand pricing pressures. Part 3 of this series will emphasize the supply side of the curve and key determinants of interest rates including economic growth and inflation.

Bonds – More Than Meets the Eye

When buying equities, some investors plan for a short holding period, seeking to capitalize on short-term price fluctuations – “a trade”. Others plan on a longer holding period based on economic or fundamental analysis – “a long-term strategic investment”. Regardless of which tactic is employed, few schedule a specific day, month or even year for divestiture. Contrast this with the bond investor’s strategy, whereby many bondholders seek to hold their investment to its maturity date. Those bond investors possessing this predilection are likely unaware of potential opportunities that trading bonds offers. In this era of historically low yields the opportunity for outsized returns may be significantly larger than current yields advertise if one considers selling a bond prior to its maturity.

Commodity Prices and the U.S. Dollar

The chart above plots the performance of the Commodity Research Bureau (CRB) index, a benchmark measuring the prices of 19 diverse commodities. The legend is purposefully omitted so that we may pose the following question: If the lines represent one indicator, why are there 3 lines? The answer lies not in the commodity prices underlying the index, but in the currency used to express the prices. The blue line represents the CRB index as it is commonly expressed, in U.S. dollars (USD). The green line is denominated in euros and the black line in Brazilian reals. This graph highlights that the currency in which a commodity is denominated can have a meaningful effect on prices.