Archives

AG Capital January 2022 Investor Update

Commentary by AG Capital Management Partners, LP Inflation It helps to go back to 10th-grade calculus class to understand inflation. Inflation is a rate of change (first derivative). For example, the latest headline number of 7% tells us that prices are rising on an annualized basis. What if inflation moves higher from here to 10% over […]

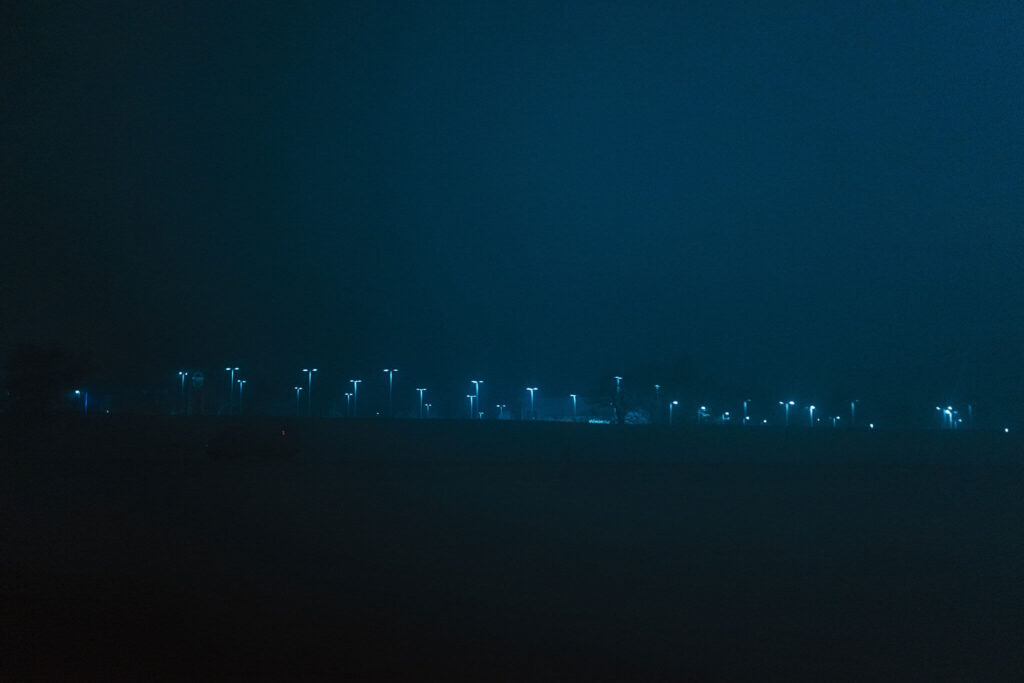

Is this the Season for Managed Futures?

“Winter is Coming” goes the famous line from Game of Thrones. In that context, it portended trouble ahead. Perhaps, it could also refer to the stock market to begin the year with the lowest January returns since 2008. A saying says that “As January goes, so goes the year.” The truth is that few are […]

January 2022 Market Letter

Commentary provided by Chad Burlet of Third Street AG Investments January was a month of extreme volatility for the agricultural markets. The two primary drivers of price were the weather in South America and the Russian military buildup along the Ukrainian border. Southern Brazil, Argentina, and Paraguay experienced several days of record heat on the heels of […]

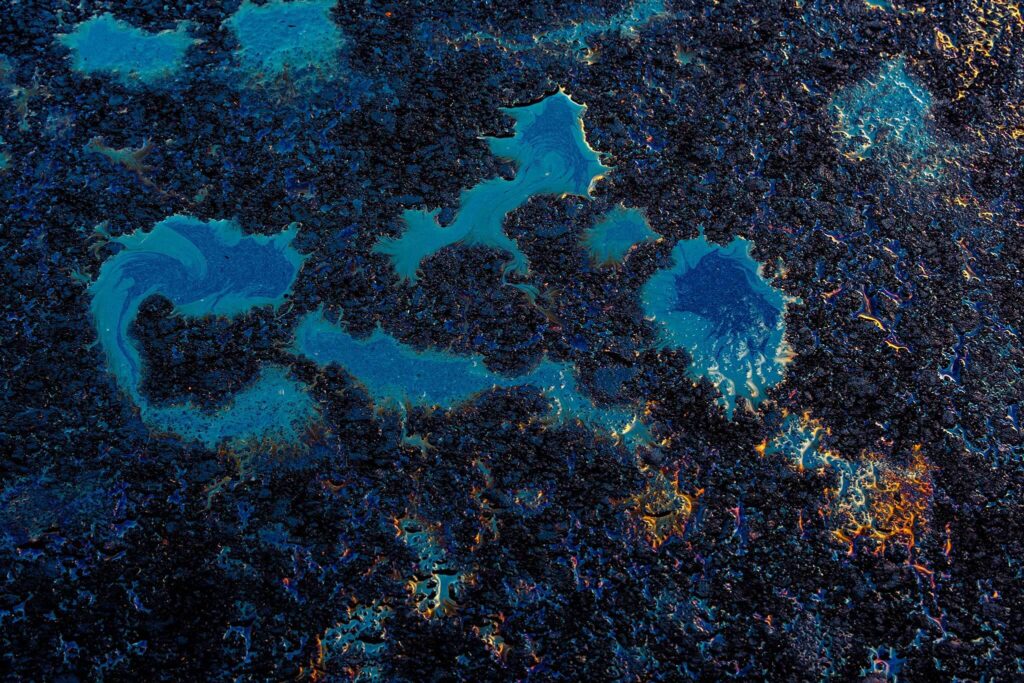

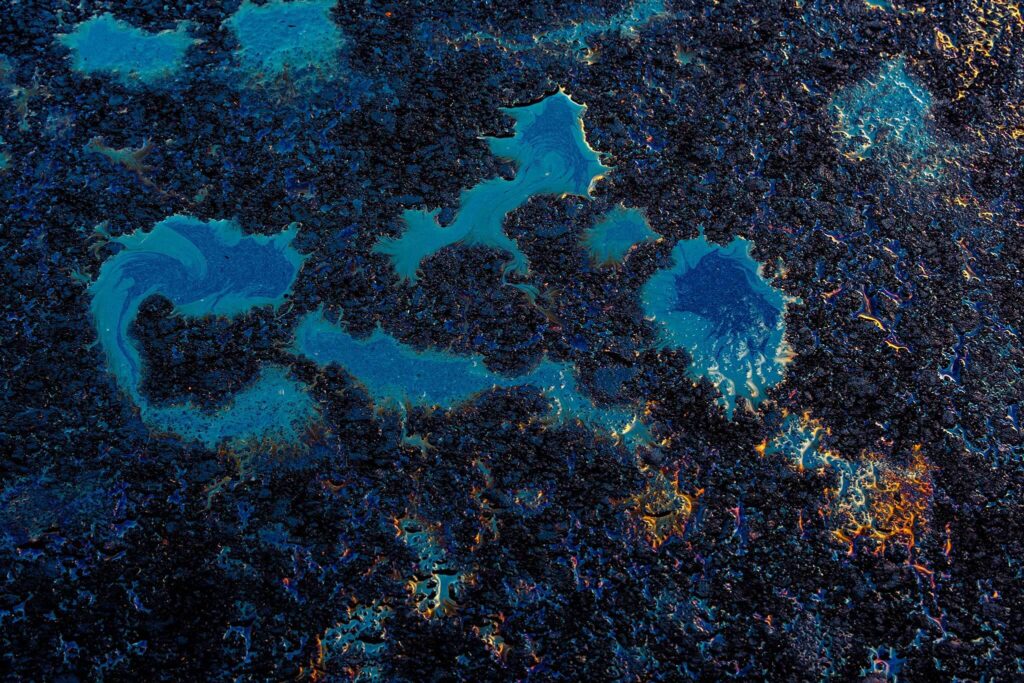

GZC Strategic Commodities Fund December 2021 Report

Commentary by GZC Investment Management Sell-side analysts and consultants remain extremely constructive, upgrading their oil price targets significantly for mid-year, and investor positioning has resumed in oil futures and options. At the end of Q3, the portfolio was positioned for upside risk as we entered the winter months; however, following further lockdowns due to Omicron […]

The Fed Pickle

I often think of an offhanded comment from the Chicago Fed Chairman Charlie Evans at a networking event shortly after the financial crisis. He said policymakers didn’t know what would happen after their extraordinary measures following the financial crisis. His point that much of what they did had never been tried before was true. I […]

Numberline Capital Partners December Performance Report and Market Summary

Commentary by John Knott of Numberline Capital Partners. As we look back on the year, the program satisfied all the benchmarks we have set for ourselves. Although past performance is not an indication of what is to come, we exceeded our 15% performance target. In addition, we kept our max drawdown under 5%. This year the […]

2021 Year in Review

The year of the pandemic led into another year of COVID but with a hefty dose of inflation. The Consumer Price Index (CPI) in the United States rose 7% in 2021, its highest level in nearly 40 years. The ramifications of this could impact every market going forward, especially as it affects central bank policy, […]

AG Capital December 2021 Investor Update

Commentary by AG Capital Management Partners, LP Steady outlook We ended the year much as we performed all year long – one step forward, and one step back. That’s OK. In a year where our ideas have not come to fruition in a timely fashion, our job is twofold: first to question our fundamental themes and […]

GZC Strategic Commodities Fund November 2021 Report

Commentary by GZC Investment Management November 2021 will be remembered as a month of abrupt volatility for oil, remembering September 2019, when the Saudi Aramco attack propelled oil prices $10 higher at the market open. On the 26th of November, it was not a gap open per se, but prices started diving on news that […]

Mitigating ‘attachment bias’

Investors generally feel the pain from losses twice as much as pleasure from gains. Investment judgment is skewed by initial information or experience, and investors assign excessive value to what they already own in their portfolios. These were the main findings by Nobel Prize winner Richard Thaler1 who used psychology to explore the cognitive biases […]

‘Twas The Taper Announcement Before Christmas

Investors held their collective breath as they waited on Jerome Powell to announce the newest Fed action the week before Christmas. Central bankers were unanimous in their decision to move to a less accommodative stance, and the market reaction was swift and fierce. The date, December 19th, 2018, when the Fed lifted the Fed funds […]

AG Capital November 2021 Investor Update

Commentary by AG Capital Management Partners, LP The Discretionary Global Macro Program generated a 9.3% return, net of fees, in November 2021, leaving YTD performance at -1.4%. Too late Although the Omicron variant of coronavirus is capturing current headlines, it’s not top of the list of things we care about from a macro perspective. Instead, a […]

Numberline Capital Partners November Performance Report and Market Summary

Commentary by John Knott of Numberline Capital Partners. The Numberline Macro Risk Program was down 4.36% net of all fees for November and is up 19.37% year to date. Additionally, the program has returned 14.85% over the previous 12 months. These numbers are compiled by Turnkey Trading Partners. We left off last month worried about the […]